EBITDA Multiples by Industry (2026)

Last Updated: December, 2025

Company valuation is one thing that every entrepreneur must bear in mind at every stage of a business. No significant decision can be taken without estimating the market value of a company at any given point. Factors called valuation multiples are important indicators in this process. Investors and company managements alike use these valuation multiples by industry as a guide in funding and budgeting decisions. EBITDA multiples by industries are a subset of a wider group of these financial tools known as the valuation multiples.

EBITDA Multiples for Various Industries

‘Multiple’ as such means a factor of one value to another. In the context of company valuation, valuation multiples represent one finance metric as a ratio of another. These multiples are widely categorized into three types – equity multiples, enterprise value multiples, and revenue multiples. This article focuses on EBITDA multiples valuation which is a type of enterprise value multiple.

What is EBITDA Multiple?

EBITDA stands for Earnings Before Interest Taxes Depreciation and Amortization. EBITDA multiples are a ratio of the Enterprise Value of a company to its EBITDA. These multiples are very useful to estimate the market value of a company based on a set of standard factors and simultaneously compare them to other companies in the industry with similar credentials. They are especially beneficial to compare companies within the industry but vary in aspects such as their capital structure, asset ownership, taxation, etc.

Usually in the initial stages of a business, revenue multiples are used. As the company begins to mature and profit potential becomes a determining factor for investors and market valuation, EBITDA multiples by industry are used to understand the profit potential of a company. A higher value indicates a higher profit possibility and vice versa. However, as a good practice, these multiples are not used as a single point of reference. Experienced analysts always refer to the value from two or more valuation multiples to arrive at a realistic valuation of a business.

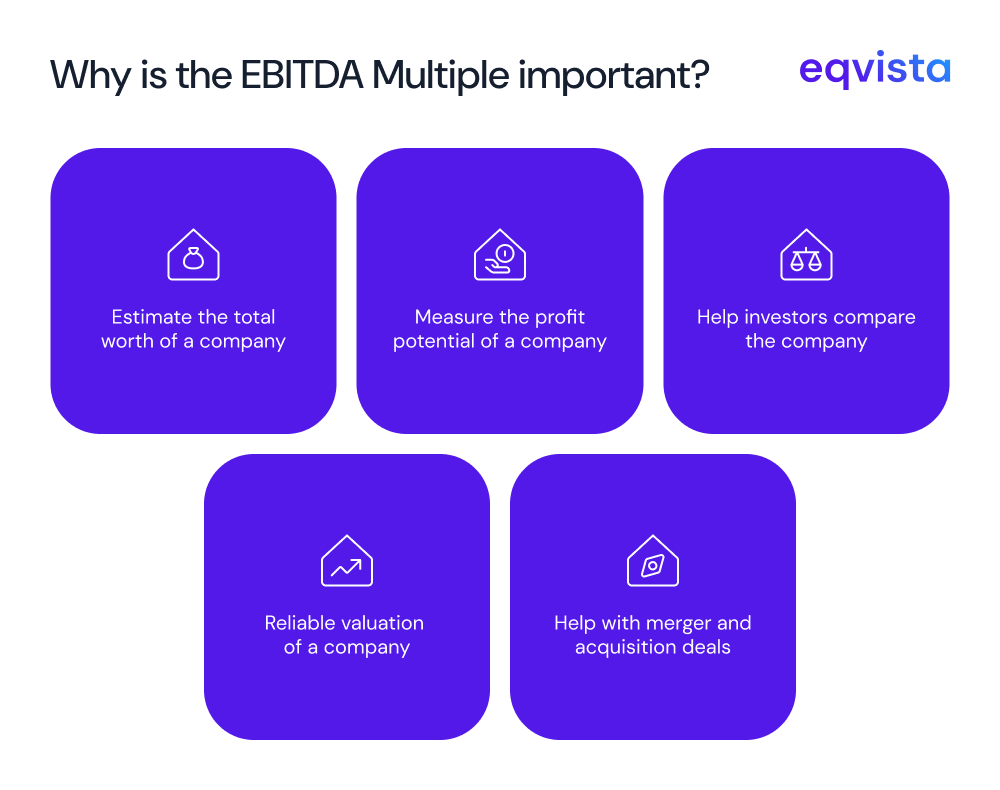

Why is the EBITDA Multiple important?

To understand the importance of EBITDA multiples, one must begin by questioning the relevance of the two factors used in the calculation – the EV (enterprise value) and the EBITDA of the company. Enterprise value estimates the total worth of a company in the market, while EBITDA measures the profit potential of the same business. When these two are calculated as a factor of one to another, the resulting multiple provides a realistic estimate of the true merit of the company as an investment option. Investors can compare the multiples of various companies and estimate how much they really need to pay to acquire this company.

As a practice, it is seen that the lower the value of the EBITDA multiplies by industry, the cheaper is the acquisition cost of the company. Usually, any value below 10 is considered good. Thus with an EBITDA multiple, investors planning on the acquisition can estimate the following:

- Company A is trading for example at 5x

- Company B, C, D, and E are trading at 7x, 6.5x, 3x, and 9x respectively

- Company D with an EBITDA multiple of 3x seems to be the best choice for acquisition

Investors find EBITDA multiples valuation reliable while considering companies within the same industry for mergers and acquisitions. However, it is important to know that investors will always try to pitch for a lower valuation and make the necessary adjustments to the EBITDA multiple while a seller will try the opposite. An expert analyst should always keep a lookout for wrong estimations arising from these factors.

EBITDA Multiple formula

As discussed, EBITDA multiple by industry is derived from two financial metrics – the enterprise value and the EBITDA of a company. The formula looks like this:

Let’s discuss each component one at a time.

What is EV?

EV or the Enterprise value is the first thing investors look at during mergers and acquisitions. As such, there are many factors beyond internal financial metrics that contribute to the true valuation of a company. However, funding decisions can’t be based on vague estimations. To ensure solidity in company valuations, enterprise value is used as a common reference. Though it is a theoretical value of takeover, private equity firms have evolved to rely heavily on this metric. Enterprise value indicates the amount of money needed to acquire a business.

Enterprise Value is calculated in two ways. The simplest one is:

And the elaborate version of this formula is:

Another variation of EV calculation could be:

As seen in the formula, enterprise value does not depend on the capital structure of a company. Thus, it can be safely used to compare companies with varying cap structures for a takeover. As a result, being part of the EBITDA multiple valuations, the enterprise value as an entity lends this character to the multiple as well. An EBITDA multiple is thus a reliable valuation tool while comparing companies with varying cap structures.

What is EBITDA?

Earnings Before Interest Taxes Depreciation and Amortization or EBITDA is used by investors to solely estimate a company’s profitability excluding the non-operating and non-controllable assets. This metric is easily derived from the financial reports maintained by a company. Analysts do not need to use complicated calculations to derive this value. It is simple and straightforward. EBITDA formula is as follows:

EBITDA points at the current financial health of a company. Based on this value, analysts estimate the future profit-making potential of the company. Thus, EBITDA as a part of EBITDA multiples by industry contributes as the metric that determines the profitability of companies being considered for a potential takeover.

Pros and Cons of EBITDA Multiple Valuation

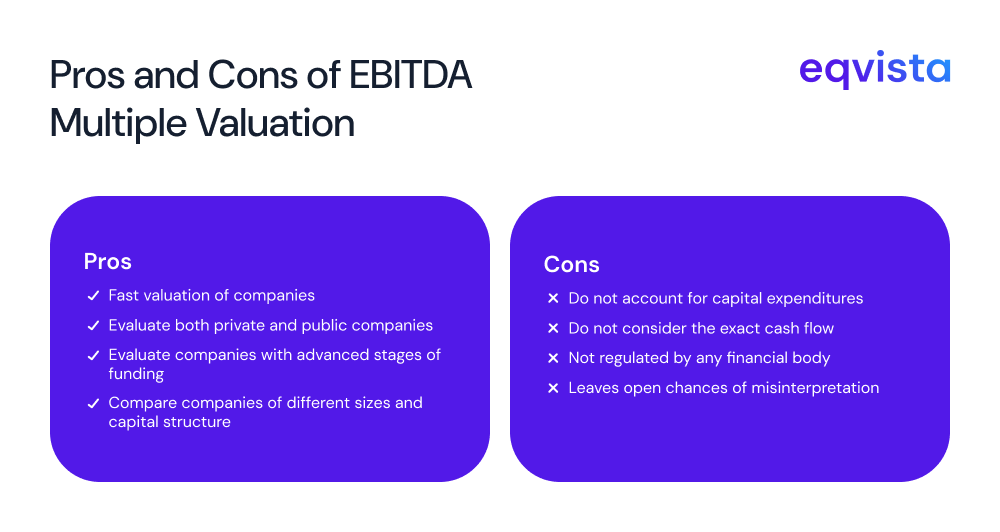

EBITDA multiples valuation is a go-to technique for most investors and financial analysts dealing with high-profit mergers and acquisitions. Using this category of valuation multiple indeed has its merits; however, it is also important to note the loopholes as well. Here is a brief about the pros and cons of EBITDA multiples:

Pros of EBITDA multiples

- It can be used to evaluate various types of businesses, private as well as public. But using this multiple for public company valuations is the easiest as all financial information for such companies are readily available.

- They are best used to evaluate companies entering advanced stages of funding such as Series-B onwards. The profitability of a company is a crucial factor at this stage. The use of enterprise value as well as EBITDA together in a ratio provides investors sufficient clarity about the future profit potential of an expanding business.

- They have proven to be very useful to evaluate as well as compare companies of different sizes and capital structures. This flexibility allows a wide range of comparisons for investors to play within an industry.

- They help to evaluate companies faster in comparison to valuation multiples based on financial metrics that use cash flow and other income-generating sources.

Cons of EBITDA multiples

- They do not account for capital expenditures. Thus if a business has high capital spends, those do not feature in the multiple and might lead to skewed valuations.

- They do not consider exact cash flows as well. This again might not represent the actual financial situation of a company leading to wrong estimations.

- EBITDA multiples valuation is not regulated by any financial body. This leaves a wide berth for variations in calculations across industries. It is mostly left to the company valuation professionals and the investors involved in the takeover negotiations.

- Due to this non-regulatory aspect, it leaves open chances of misinterpretations.

EBITDA Multiples by Industry

Here is a compilation of EBITDA multiples across industries. To study this table, a couple of aspects are worth considering. Firstly, EBITDA multiples for small business or startups will be lower, in the range of 4x. Secondly, these multiples will be at a higher range for large, publicly traded companies. And lastly, since EBITDA multiples are not regulated by any federal body, fair play is expected as a good practice in business.

| SECTOR | INDUSTRY | EV to EBITDA as of Dec 2025 |

|---|---|---|

| Communication Services | 13.09 | |

| Advertising | 10.79 | |

| Alternative Carriers | 10.84 | |

| Broadcasting | 8.841 | |

| Cable & Satellite | 6.077 | |

| Integrated Telecommunication Services | 6.393 | |

| Interactive Home Entertainment | 23.24 | |

| Interactive Media & Services | 21.34 | |

| Movies & Entertainment | 15.49 | |

| Publishing | 13.2 | |

| Wireless Telecommunication Services | 9.586 | |

| Consumer Discretionary | 14.32 | |

| Apparel Retail | 17.09 | |

| Apparel, Accessories & Luxury Goods | 12.37 | |

| Automobile Manufacturers | 13.54 | |

| Automotive Parts & Equipment | 6.973 | |

| Automotive Retail | 15.86 | |

| Broadline Retail | 19.12 | |

| Casinos & Gaming | 12.23 | |

| Computer & Electronics Retail | 9.825 | |

| Consumer Electronics | 10.13 | |

| Distributors | 9.989 | |

| Education Services | 11.98 | |

| Footwear | 19.27 | |

| Home Furnishings | 11.34 | |

| Home Improvement Retail | 15.24 | |

| Homebuilding | 10.35 | |

| Homefurnishing Retail | 13.82 | |

| Hotels, Resorts & Cruise Lines | 13.68 | |

| Household Appliances | 9.154 | |

| Housewares & Specialties | 8.469 | |

| Leisure Facilities | 12.49 | |

| Leisure Products | 11.55 | |

| Motorcycle Manufacturers | 6.134 | |

| Other Specialty Retail | 13.16 | |

| Restaurants | 17.65 | |

| Specialized Consumer Services | 7.792 | |

| Textiles | 5.864 | |

| Tires & Rubber | 6.029 | |

| Consumer Staples | 13.52 | |

| Agricultural Products & Services | 12.42 | |

| Brewers | 7.65 | |

| Consumer Staples Merchandise Retail | 20.5 | |

| Distillers & Vintners | 9.29 | |

| Drug Retail | 9.629 | |

| Food Distributors | 10.92 | |

| Food Retail | 9.324 | |

| Household Products | 13.56 | |

| Packaged Foods & Meats | 10.12 | |

| Personal Care Products | 14.18 | |

| Soft Drinks & Non-alcoholic Beverages | 16.81 | |

| Tobacco | 12.2 | |

| Energy | 6.644 | |

| Coal & Consumable Fuels | 9.192 | |

| Integrated Oil & Gas | 5.456 | |

| Oil & Gas Drilling | 5.401 | |

| Oil & Gas Equipment & Services | 8.234 | |

| Oil & Gas Exploration & Production | 5.088 | |

| Oil & Gas Refining & Marketing | 8.431 | |

| Oil & Gas Storage & Transportation | 12.11 | |

| Financials | 20.04 | |

| Asset Management & Custody Banks | 17.64 | |

| Commercial & Residential Mortgage Finance | 28.35 | |

| Consumer Finance | 10.93 | |

| Diversified Banks | - | |

| Diversified Capital Markets | -2.415 | |

| Diversified Financial Services | 10.55 | |

| Financial Exchanges & Data | 19.85 | |

| Insurance Brokers | 16.59 | |

| Investment Banking & Brokerage | 14.12 | |

| Life & Health Insurance | - | |

| Mortgage REITs | 10.66 | |

| Multi-line Insurance | - | |

| Multi-Sector Holdings | 16.07 | |

| Property & Casualty Insurance | 74.35 | |

| Regional Banks | - | |

| Reinsurance | - | |

| Specialized Finance | 15.75 | |

| Transaction & Payment Processing Services | 17.53 | |

| Health Care | 14.57 | |

| Biotechnology | 16.17 | |

| Health Care Distributors | 14.12 | |

| Health Care Equipment | 19.9 | |

| Health Care Facilities | 10.22 | |

| Health Care Services | 10.83 | |

| Health Care Supplies | 15.88 | |

| Health Care Technology | 23.43 | |

| Life Sciences Tools & Services | 21.13 | |

| Managed Health Care | 19 | |

| Pharmaceuticals | 12.63 | |

| Industrials | 14.01 | |

| Aerospace & Defense | 22.61 | |

| Agricultural & Farm Machinery | 12.88 | |

| Air Freight & Logistics | 9.68 | |

| Airport Services | 11.24 | |

| Building Products | 12.69 | |

| Cargo Ground Transportation | 10.62 | |

| Commercial Printing | 9.473 | |

| Construction & Engineering | 13.71 | |

| Construction Machinery & Heavy Transportation Equipment | 14.09 | |

| Data Processing & Outsourced Services | 11.77 | |

| Diversified Support Services | 16.73 | |

| Electrical Components & Equipment | 18.22 | |

| Environmental & Facilities Services | 15.28 | |

| Heavy Electrical Equipment | 28.59 | |

| Highways & Railtracks | 12.27 | |

| Human Resource & Employment Services | 14.64 | |

| Industrial Conglomerates | 13.49 | |

| Industrial Machinery & Supplies & Components | 15.34 | |

| Marine Ports & Services | 9.302 | |

| Marine Transportation | 6.432 | |

| Office Services & Supplies | 9.169 | |

| Passenger Airlines | 7.121 | |

| Passenger Ground Transportation | 17.23 | |

| Rail Transportation | 12.26 | |

| Research & Consulting Services | 15.09 | |

| Security & Alarm Services | 8.438 | |

| Trading Companies & Distributors | 14.13 | |

| Information Technology | 24.33 | |

| Application Software | 26.7 | |

| Communications Equipment | 21.97 | |

| Electronic Components | 17.62 | |

| Electronic Equipment & Instruments | 17.67 | |

| Electronic Manufacturing Services | 14.75 | |

| Internet Services & Infrastructure | 48.21 | |

| IT Consulting & Other Services | 14.85 | |

| Semiconductor Materials & Equipment | 26.21 | |

| Semiconductors | 30.65 | |

| Systems Software | 21.83 | |

| Technology Distributors | 10.2 | |

| Technology Hardware, Storage & Peripherals | 21.68 | |

| Materials | 10.26 | |

| Aluminum | 7.852 | |

| Commodity Chemicals | 8.726 | |

| Construction Materials | 11.97 | |

| Copper | 11.29 | |

| Diversified Chemicals | 7.583 | |

| Diversified Metals & Mining | 9.609 | |

| Fertilizers & Agricultural Chemicals | 7.118 | |

| Forest Products | 16.76 | |

| Gold | 11.06 | |

| Industrial Gases | 15.04 | |

| Metal, Glass & Plastic Containers | 8.597 | |

| Paper & Plastic Packaging Products & Materials | 9.756 | |

| Paper Products | 9.276 | |

| Precious Metals & Minerals | 8.788 | |

| Silver | 17.68 | |

| Specialty Chemicals | 12.63 | |

| Steel | 8.29 | |

| Real Estate | 18.67 | |

| Data Center REITs | 30.88 | |

| Diversified Real Estate Activities | 13.69 | |

| Diversified REITs | 15.61 | |

| Health Care REITs | 23.96 | |

| Hotel & Resort REITs | 12.04 | |

| Industrial REITs | 21.58 | |

| Multi-Family Residential REITs | 17.33 | |

| Office REITs | 15.7 | |

| Other Specialized REITs | 15 | |

| Real Estate Development | 12.22 | |

| Real Estate Operating Companies | 21.99 | |

| Real Estate Services | 25.18 | |

| Retail REITs | 17.21 | |

| Self-Storage REITs | 18.24 | |

| Single-Family Residential REITs | 18.06 | |

| Telecom Tower REITs | 19.91 | |

| Timber REITs | 16.14 | |

| Utilities | 10.86 | |

| Electric Utilities | 10.1 | |

| Gas Utilities | 10.33 | |

| Independent Power Producers & Energy Traders | 11.52 | |

| Multi-Utilities | 12.07 | |

| Renewable Electricity | 15.8 | |

| Water Utilities | 11.65 |

Data Source: ycharts.com, data for the United States on December 16, 2025

Get Your Business Valuation From Certified Valuation Experts

Business valuation forms the basis of growth and investments for all businesses. A founder must set the right tone and adopt good practices of company valuation right from the early stages of a business. Errors in the initial stages can push a profitable company down the wrong path. It is best to trust professionals to avoid such errors. The expert team at Eqvista is made up of experienced valuation analysts, able to find your company value with our 409a valuation services. Checkout our price list or contact us today!