Exercising Stock Options

You have come to the right place if you would like to learn more about exercising stock options, early exercising, and the tax implications of exercising stock options.

It is true that exercising stock options might seem complicated to most and lead to drastic financial consequences if not planned right. Hence, it is wise to prepare yourself and carefully when exercising your stock options. It is also important to be privy to all of the tax implications of exercising stock options, so that you do not end up in the crosshairs of an IRS agent.

Stock Option

You need to understand the basic elements of stock options before you familiarize yourself with exercising stock options. At the very least, you ought to know what a stock option is and what its types are.

What is a Stock Option?

A stock option is an official contract between two parties. This contract provides the purchaser the right to sell or buy underlying stocks at a specific price and within a particular time frame.

In the stock option landscape, people call a stock option seller an option writer. The seller receives a premium amount from the official contract bought by the purchaser.

Types of Stock Option

Essentially, there are two stock options types that you need to be privy to:

- Call Option – A stock call option gives the buyer the right to purchase stock. The buyer, however, does not have an obligation to do so. A stock call option will go up in value when the price of the underlying stock increases.

- Put Option – A stock put option gives the purchaser the right to short-sell the stock. A stock put option will go up in value when the price of the underlying stock comes down.

In the public market investors normally take advantage of different combinations of call and put options to optimize their investment strategy or hedge their portfolio of securities. However its a bit different in the private market.

Private Company’s Stock Options with Stock Option Agreement

A private company’s stock options are stock call options. These provide the stockholders the right to buy the company stock shares at a particular price.

A key reason a private company issues stock options is these are not regarded as business costs on the official books. Small-sized establishments like private companies usually lack the financial resources to provide high-performing or high potential employees paychecks that equally correspond with their publicly traded and large corporate peers.

They keep and attract workers via other strategies, such as providing them more responsibility, visibility, and flexibility. Another way is by providing stock options. Private companies and entities might also utilize stock options to pay consultants and vendors.

The most common private stock options types include:

- Unexercised Incentive Stock Options: This is an option to purchase stock at a reduced rate for workers with no standard monthly income tax at exercise.

- Long-Term Capital Gain: You should hold these for at least 1 year. This stock option type is subject to wash sale rules and realized capital losses or capital gains taxes.

Exercising Stock Options

Now we come to the crux of this article- exercising stock options. So what do exercising stock options really mean? When is it best to exercise these options, and how you should go about doing it? We will be covering all of these things. Let us first look into the basic definition of exercising stock options.

What does Exercising Stock Options Mean?

When a private organization provides you stock options, they give you the right to purchase company stock shares at a particular price. The company does not give you stock shares outright. This specific price is your exercise price, strike price, or grant price. It is often the standard market value of the private company shares at the time you get your options. The expectation here is that the share values will climb, and then you can sell them for a considerably greater amount than what you paid initially.

It is vital to have a tactic revolving around exercising options. Here, it is not simply exercising and hoping that they are worth something eventually. That is because exercising can have a considerably large and real effect on your taxes.

When should I Exercise Stock Options?

Private companies often will not give you the green light for exercising your stock options immediately. Instead, companies usually have this policy where you might have to continue working for them for a particular time period (this period is often 1 year) or/and hit a certain milestone. This is often referred to as a cliff period.

The procedure of earning the exercising right is what experts call vesting. Usually, you only have the freedom to exercise vested stock options. After you reach your vesting threshold (this is the waiting time period you read about earlier), you can exercise your vested stock options whenever you please. However, keep in mind that to do this, you have to stay with the organization. You might still be able to exercise your stock options for a certain time post leaving the company. This depends on the exercise period (post-termination) of your company.

Some of the private companies will let you early exercise your stock options prior to your options’ vesting. If your organization allows this, you may exercise your stock options immediately after receiving your option grant. However, they will carry on vesting in accordance with the initial schedule.

How do I Exercise Stock Options?

So how do you effectively exercise stock options? Let us walk through an example so that you can gain a better understanding of what you can expect when you are exercising stock options.

The private organization where you work has provided you the right to buy 2,000 stock options at $20 for each share. And you have the time until January 1st, 2026, to buy.

You opt to hang on to the stock option for a certain time until your company’s stock reaches up to $35 dollars per share on December 1st, 2021. This is the time you make the decision to exercise your stock options.

When you are exercising your stock options, you will purchase the 2,000 company shares for $40,000 (as per the $20 per share rate the company granted you). Then, with an existing price of $35 for each company share, you may sell these shares for a staggering $70,000. That puts a $30,000 profit in your pocket, which is rather good!

That said, you would have to set aside adequate funds for short-term capital gain taxes. This can be as much as 15-37% contingent on your current salary tax bracket. Bear in mind that this can substantially affect the profit amount you have left with you to fulfill your financial objectives. Hence, it is of paramount importance to do your thorough research before you exercise your stock options.

Early Exercising Stock Options

Now, let us look into early exercising stock options and what these entail. Keep in mind that early exercising is different from normal exercising of stock options. You will also learn how the 83(b) election plays a role in early exercising.

What does Early Exercising of Stock Options Mean?

Early exercising stock options is the right that you have to exercise your options before their vesting. Your option grant ought to mention whether you may do early exercising.

Early exercising stock options can be an advantage to you in some crucial ways:

- If you early exercise your stock options as soon as your private company grants them to you, you probably will not owe any extra taxes (at the exercising time) since you are purchasing them at standard market value. It is important to note that you have to file an 83(b) election (more on this later) within one month of exercising to reap the benefits of this advantageous tax treatment. Also, be aware that there can be serious consequences if you manage to miss this deadline.

- If you have Incentive Stock Options, early exercising these stocks can help you qualify for their desirable tax treatment. To qualify, you should hold on to your shares for two years at least post the grant date and 1-year post exercising. Similarly, if you have non-qualified stock options, early exercising helps start your stock holding period sooner. In this way, you might pay the lower capital gain tax when you finally sell the stocks.

It is wise to exercise early in the following two scenarios:

- You are early in your company tenure.

- Once you are very confident that your private company will thrive and taste a lot of success, you also need to have sufficient savings and be ready to risk them.

83(b) Election

There is no doubt that 83(b) election can have substantial value for you when it comes to early exercising your stock options. Although the stock option holder does not need to file a Section 83(b) election when early exercising, most of the early exercise tax benefits depend on Section 83(b) election filing.

You will not owe any taxes at the exercise time if you are exercising your options when their standard market value is the same as their exercise cost, and you file a Section 83(b) election form timely. When you file this election form, you (the stock option holder) agree to instantly include in your gross income any “spread” linked with the stock option exercise. That depends on the market value of the stock on the exercise date, instead of later as the stocks vest. In order for the Section 83(b) elections to be effective, it is imperative that you file it within a month post the exercise date.

Taxation in Exercising Stock Options

Are you wondering what the tax implications of exercising stock options are? There are critical tax implications to take into consideration at any time when an individual stands to profit from the stock options they have.

Stock options of employees do not have any instant tax-related implications. That is because they do not provide your workers any interest in company ownership until they exercise their stock options. Ownership in an official capacity happens when the stock option owners exercise their options.

When a certain employee in a private company sells off their stock options, the tax-related implications become very vital to consider. After their stock sale, employees have to report capital gains or losses depending on the discrepancy between the amount they receive from the sale and their tax basis.

Every employee is liable for standard income tax on the discrepancy between the standard market value and purchase price with non-statutory stock options. These options are taxable for employment and income tax. However, non-statutory stock options are not subject to AMT (a shadow tax). These stock options are withholding tax.

The procedure is more complicated when it comes to incentive stock options. The government imposes AMT (Alternate Minimum Tax) apart from the standard income tax. AMT is applicable to particular individuals, trusts, estates, and employee stock option sales. The employee receives the advantage of adjusted taxes when he or she exercises their stock options.

Exercising Stock Options on Eqvista

You can exercise your stock options on the Eqvista app, and record all the details of the exercise all online. This will help you easily store the information in one place and share the details with other users without having to go through endless emails.

Once you have the details of the stock option exercise, follow these steps on the app.

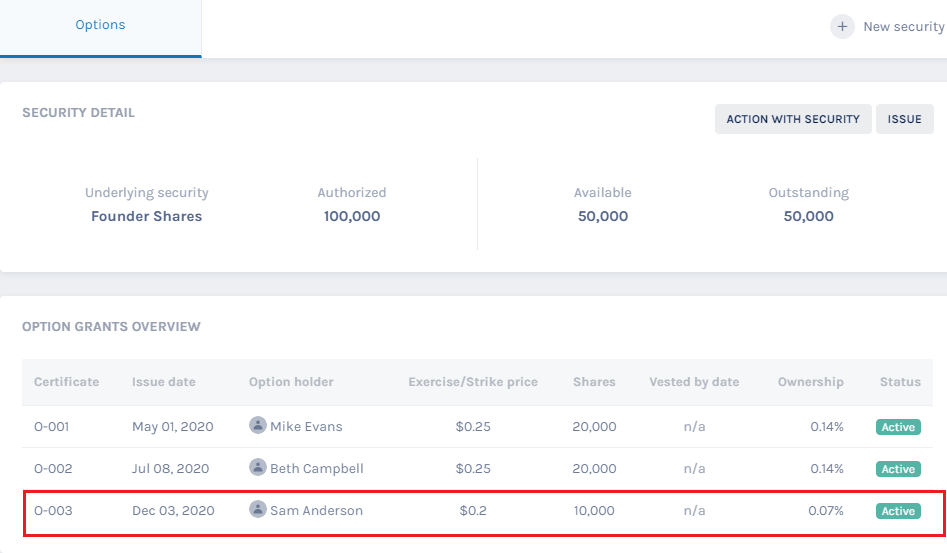

From the Option pool page, choose which option you would like to exercise.

Once you have clicked into the Stock Option Grant, go to the action bar and click on “exercise to equity”, which will bring you to this page.

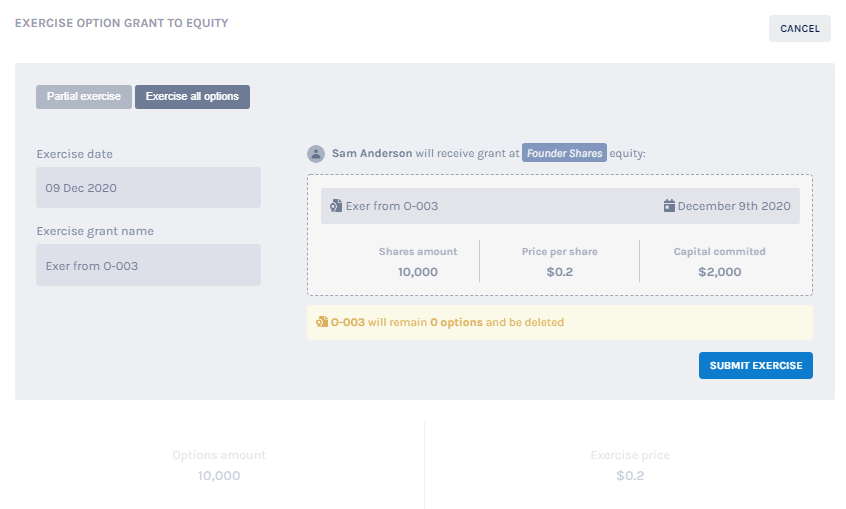

You can choose to have a partial exercise or full exercise, along with the exercise date and new share grant name.

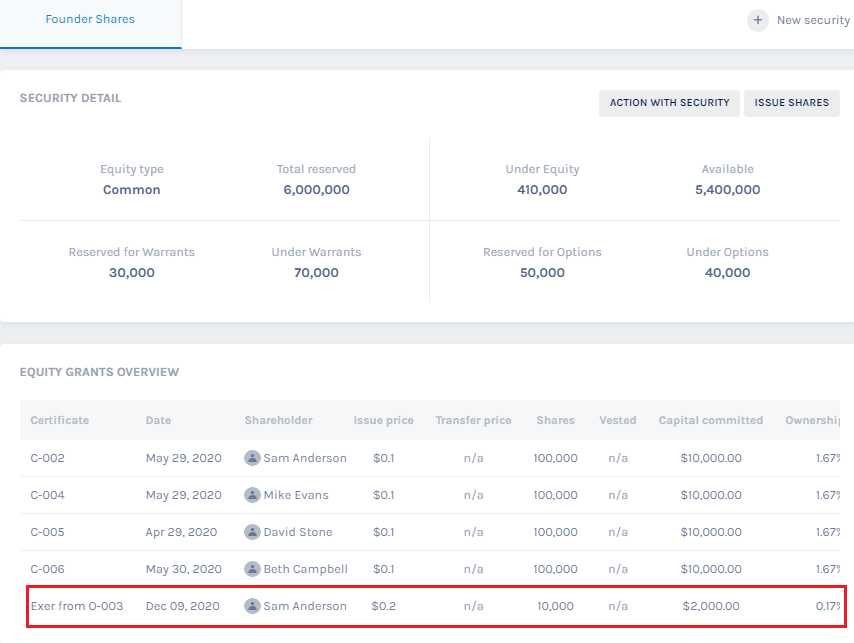

After exercising the grant, you can see the new shares on the app in the share class.

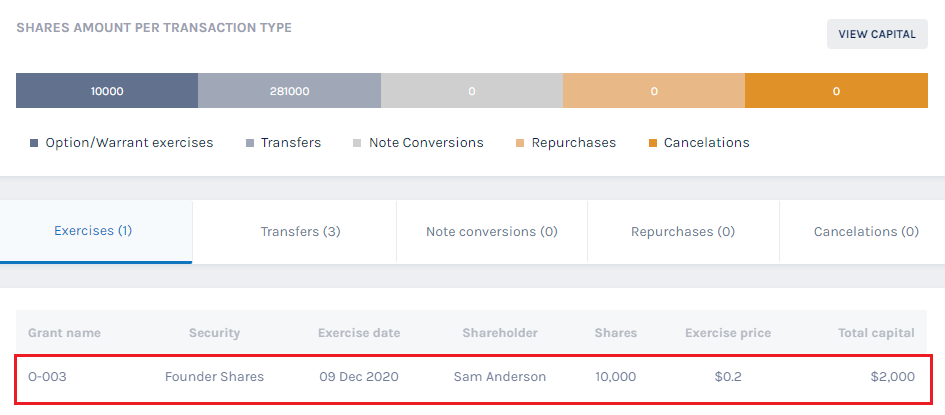

It’s also important to record the details of the stock option exercise in the Secondary Transaction list for use later. Here you can see the information of this under the “exercise” tab in the Secondary Transaction list.

And just like that you can easily exercise your company stock options and store the details of this all through the app.

Conclusion

To summarize, it is in your best interest to do your thorough research first before you decide to exercise your stock options. A hasty decision here can have unpleasant financial consequences in the future. In addition, it would be a good idea to consult a professional who can guide you regarding the best exercising stock strategies to employ.

Eqvista is an advanced Cap Table software that can manage and record all your stock options exercises. Our Cap Table also helps companies issue and track their company share grants and organize different types of shareholders.

FAQs

What happens when you exercise stock options?

When an option holder exercises stock options, it basically means that the holder is actually purchasing the shares at the given strike price. After the stock options are exercised, the holder will be entitled to become a shareholder and as per the option contract, a specified number of shares will be issued to the option holder.

Is it better to exercise stock options or sell them?

Well, exercising and selling options are two different things. Before the stock options are exercised, the holder will not be able to sell shares due to the fact that the shares are yet to be issued. When the holder exercises stock options and becomes entitled to the shares, then they can begin to sell their shares. It is important to note that in privately held companies, selling shares are restricted, however, some private companies may provide a tender offer which is a process wherein the employees can sell their shares to investors.

Why should you exercise stock options early?

Usually, options holders are not allowed to exercise stock options early. However, some companies allow the option holders to exercise stock options early provided that certain conditions are met. In such cases, it is recommended to exercise stock options as soon as the options are granted because exercising stock options early means that the option holders will be able to receive benefits from the shares such as dividend payments and voting rights. Although the original vesting schedule of the options is not modified.

Do I need to pay taxes when I exercise a stock option?

Yes, when you exercise stock options, you will have to pay taxes. If it is ISOs or Incentive Stock Option, then you will have to pay an alternative minimum tax (AMT). While in the case of NSOs or Non-Qualified Stock Options, then you will be subject to ordinary income tax. It is essential to consult your tax advisor in order to avoid penalties.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!