Do Revenue Multiples Still Work for AI Startup Valuations in 2025?

The British mathematician, Alan Turing, in 1947, famously said, “What we want is a machine that can learn from experience”. Turing never named his idea anything. Fast forward eight decades, and what he envisioned is finally shaping up.

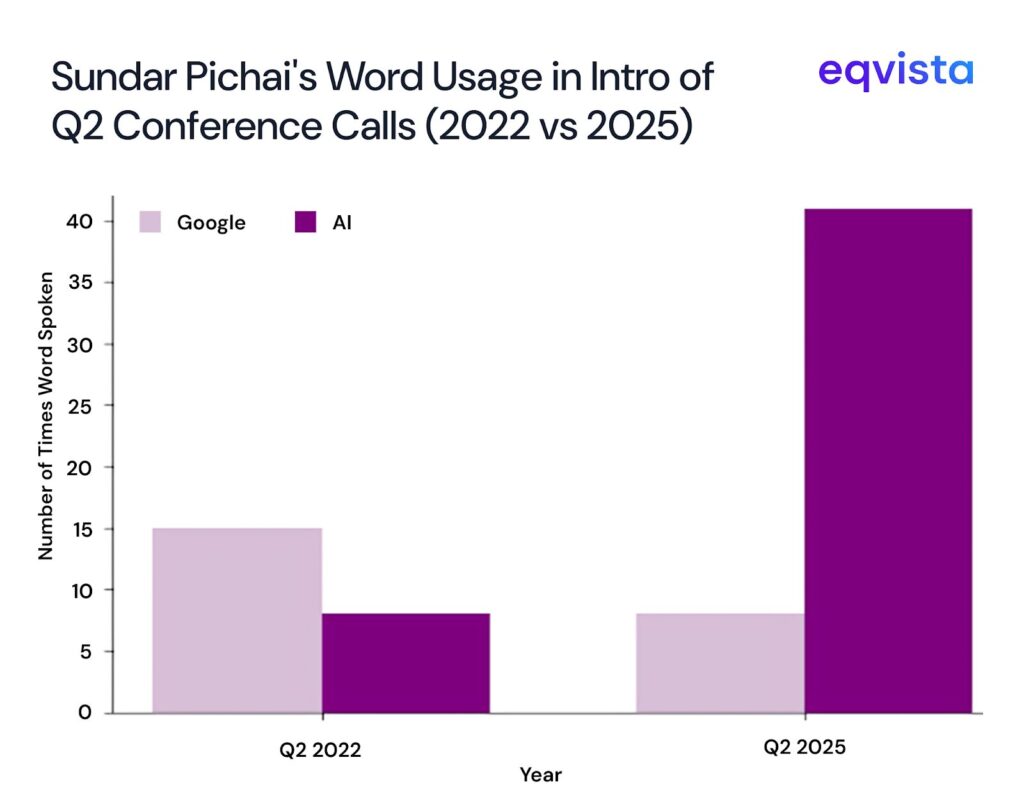

AI is now the buzzword in the financial markets and the defining theme in the big technology names. Evidence of this can be seen in the words of industry leaders.Recently, during the Q2 2025 earnings call, Google’s CEO, Sundar Pichai, mentioned the word “AI” approximately five times more often than the term “Google”.

Interestingly, his usage of the word “Google” has fallen by about half compared to three years ago, whereas the term “AI” has increased by more than five times.

Graph 1: Highlights Sundar Pichai’s word usage of “AI” and “Google” in the earnings call beginning (before Q&A)

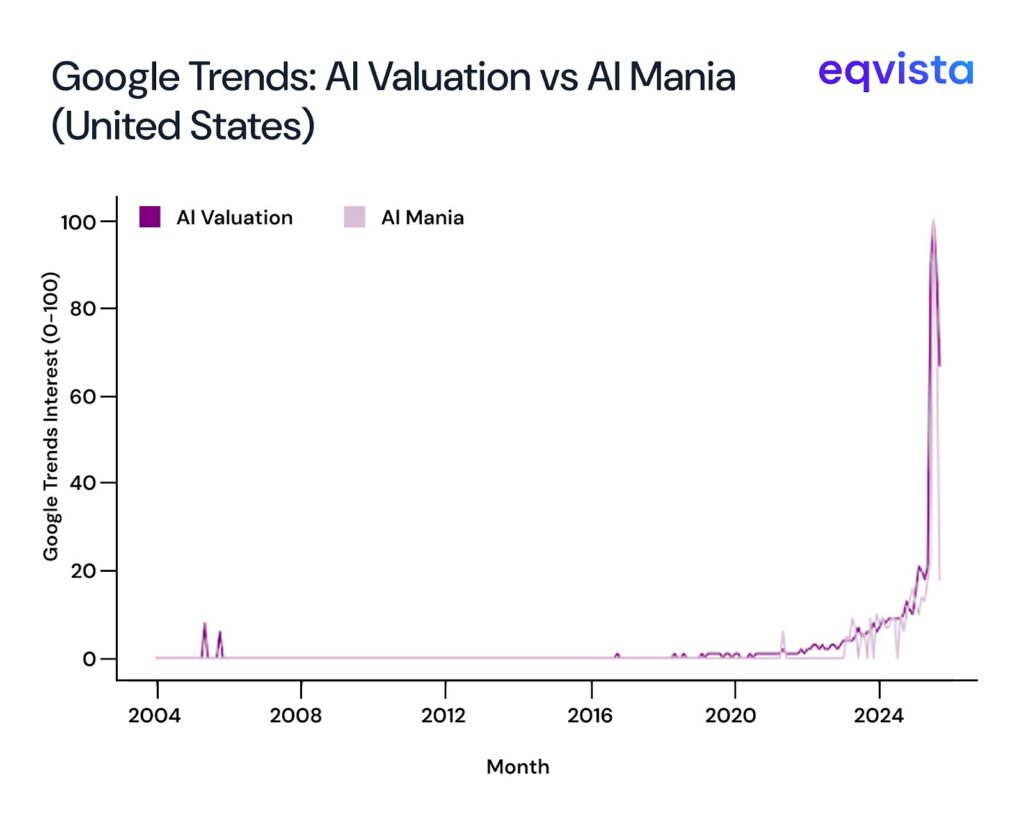

Google Trends also holds an interesting insight:

Graph 2: Google trend search results of the terms “AI Valuation” and “AI Mania”

The above graph,sourced from Google Trends- a tool that tracks the popularity of search terms, shows unprecedented interest in the terms “AI Valuation” and “AI Mania” in the US.

As these companies command unprecedented valuations, investors are questioning whether revenue multiples—the traditional benchmark for startup valuation—remain relevant in this new paradigm.

In fact, most prominent money managers and hedge funds attribute the current stock market rise to the influence of AI. The frequent mentions of AI in Google searches and industry leaders suggest that it is the driving theme in the current market. It generates a mixture of worry, confusion, and awe in the world.

Naturally, this brings about the question: how to value these startup companies- both private and public? And more specifically, can we rely on historical traditional multiples to value the same?

Historically, investors relied on revenue multiples as a straightforward valuation metric. However, AI startups are challenging this conventional wisdom. When companies trade at 100x or even 225x their revenue multiples, as seen with Sierra AI, traditional frameworks may no longer apply.

Valuation Methodologies of AI startup Valuation

The value of any business is nothing but the present value of its future free cash flows.

What becomes important in this equation is understanding the future cash flows of a business. This, in turn, implies that anyone who has specialized knowledge of a domain (better forecasting ability) would be in a better position to understand what the intrinsic value of the business would be in that specific domain area.

In businesses that operate in industries, which are currently inventing their business model, this becomes challenging and introduces the need for heavy continuous research.

This confluence of uncertainty in business models and rapid innovation can often lead to errors in judgment.

To account for the unique nature of AI startup valuation (high growth, rapid changes in business model, and innovation), different valuation models can be formulated that are derived from the traditional models but incorporate these specific dynamics.

Multi-Factor Models

Factor models can be created by an analyst to adjust a base multiple to incorporate specific factors that the business has.

For AI startup valuation, this would translate into bifurcating them based on key differences and applying a premium or discount in valuation based on the same.

For example, Tempus AI operates in the heavily regulated sector of healthcare AI, vs Github / OpenAI, which operate in a low-regulation environment. High regulation can be perceived as both a risk and an opportunity. If regulation bars people from entering the industry, it can act as a moat, but if it turns against the business model or a company fails to comply with the regulation, it would be a problem.

Similarly, a data moat showcases whether the AI company is using proprietary data or publicly available data. Data that is hard to get (proprietary) would be valued more richly. By adjusting discounts for factors like regulation, data, business model, and others, analysts can adjust valuations with appropriate premiums or discounts.

A general multi-factor model looks like this:

Ri = αi + βi1·F1 + βi2·F2 + … + βiK·FK + εi

where Ri: Return of asset i; αi: Intercept (alpha, idiosyncratic return/abnormal performance); βik: Sensitivity (factor loading or beta) of asset i to factor k; Fk: Value of factor k; K: Total number of factors; εi: Error term (asset-specific risk).

To illustrate how such multi-factor models can be applied in AI startup valuation, consider Tempus AI: the company raised $410.7 million via its IPO at an implied valuation of $6.1 billion. This valuation demonstrated a multi-factor valuation approach. It has access to proprietary multimodal healthcare data (data moat). The hybrid core-and-integrated AI model, strong revenue growth (89.6% YoY in August 2025), and predictive capabilities further boosted value.

The revenue of the business has grown from $693.4M in 2024 and is projected to be $1.2B by the end of this year. This gives the current value to be 12.5x over this year’s full-year revenue.

This multiple is higher than the average SaaS business (typically on an average trade at a 6-8x multiple), but its current multiple reflects weighted contributions from business model, AI capabilities, regulatory alignment, deployment, and market factors.

While this 12.5x revenue multiple exceeds typical SaaS benchmarks of 6-8x, it reflects the premium investors place on AI-specific factors in AI startup valuation. Pure revenue multiples alone cannot capture the value of proprietary data moats, regulatory advantages, or AI capabilities—hence the need for multi-factor adjustments.

Strategic Exit Valuation

Strategic Exit is a valuation approach method that estimates what the company might be worth based on the likelihood of a future buyout or IPO. In AI startup valuation traditional revenue multiples become particularly inadequate for strategic exit scenarios.

Essentially, the Investor/ Fund would estimate: What will this company be worth to a strategic acquirer or in an IPO down the line?

The Modelling Process:

- Strategic Acquirer Analysis: What would Apple/Google/Microsoft/Meta pay to acquire this business?

- IPO Comparable Projections: If the business becomes the “Google of AI search” or “Microsoft of AI infrastructure,” what would it be valued at?

- Platform Value at Maturity: What’s the exit multiple for a mature AI platform company?

An example of this: Perplexity is a research agentic assistant with application classification. It has recently also launched its browser, Comet. It can be a good target for investors to estimate at what valuation perplexity can be sold down the line to a search engine player like Google (which also owns a browser, Google Chrome), or if Perplexity becomes the Google of AI search, how would it be valued?

Hence, such AI startup valuations can defy traditional metrics and would not be easily explainable by traditional valuation methods like Revenue multiples.

Probability Weighted Outcome Modelling

As previously noted, it is challenging to pinpoint the future of businesses in areas of rapid disruption. This makes scenario analysis a useful tool for conducting AI startup valuation.

In the AI Industry, this would mean the areas that are easier to evaluate (likely to succeed) would be valued at a greater premium.

For instance, in May 2025, Harvard researchers published research showcasing that AI helped human customer support and reduced their time spent by 20%. In fact, other researchers suggest that it can significantly reduce the need for human agents in this domain. This visibility showcases that AI businesses operating in this niche region of customer service might get a more attractive valuation than AI operating in less promising / more uncertain areas.

This trend is visible in the private markets as well: Sierra AI, a B2B customer support AI, is one of the most highly valued AI companies. It was valued at 225x its revenue in 2024, and a recent round would give it 100x ARR value.

Essentially, the probability of success would determine the value of the business. Hence, an AI company with both a high probability of success and high revenue impact would be valued at a premium to one with either lower probability of success or lower impact.

Probability weighted outcome modelling can be expressed mathematically as:

Probability Weighted Valuation=i=1∑n(Outcome Valuei× Probabilityi)

Another example of this approach can be in ascertaining the value of OpenAI.

Revenue Displacement Model:

- Estimated Knowledge GDP in 2030 (LLM+ Gen AI+ Autonomous AI+ Conversational AI): ~$600B

- Probability of 15% market capture: 30%

- Probability of 10% market capture: 50%

- Probability of 5% market capture: 20%

- Weighted Outcome: Estimated revenue in 2030 of $63B

The current valuation of OpenAI, estimated at $500B, would be 8x 2030 estimated earnings.

In probability weighted valuation, scenario modelling can be used to justify the valuation of businesses.

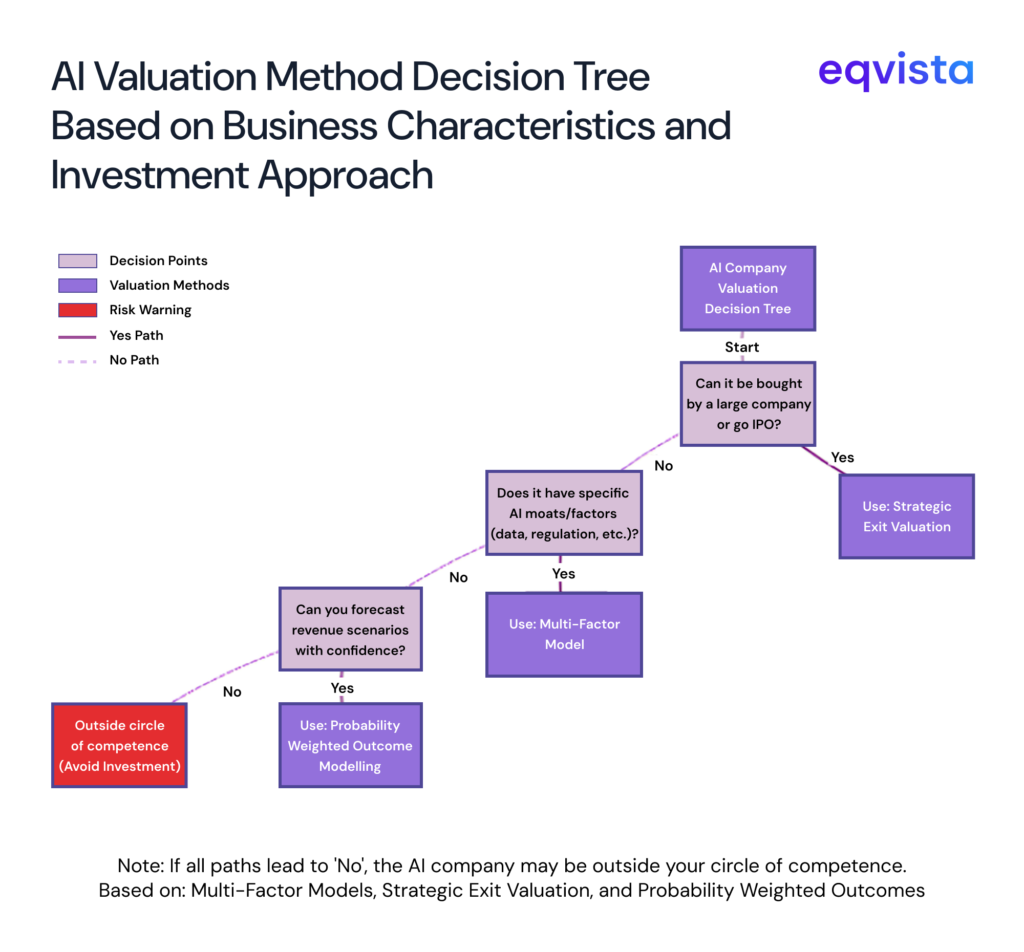

Figure 1: Decision tree chart for selecting the valuation model

If an investor/ fund house cannot ascertain any of the following-whether the company is a good acquiring candidate, how it would be valued at IPO , whether it has any niche or not, what its revenue would look like in coming years (under different scenarios)-then it simply means the business is outside of their circle of competence. Attempting AI startup valuation for such business using traditional revenue multiples would expose them to significant risk of error in judgement.

What History Tells Us About Revenue Multiples and Valuations?

In the essay, “The Unreachables”, psychoanalyst Theodor Reik wrote, “There are recurring cycles, ups and downs, but the course of events is essentially the same, with small variations. It has been said that history repeats itself. This is perhaps not quite correct; it merely rhymes.”

Modern history bears this out: two events are never the same, but they do have some pattern of resemblance.

The dotcom period witnessed many companies disappearing in the subsequent decade as the industry consolidated, and a few businesses survived. For example, Amazon kept growing even after the peak of the dot-com period, while Pet.com failed.

Studies estimate the five-year failure rate of IPOs during the dot-com period was between 50%-66%. This highlights in a new industry that is rapidly growing, very few players are left as time progresses.

Today’s AI boom demonstrates similar characteristics:

- Winner Takes All Dynamics: Network effects and data moats push for extreme outcomes.

- Technical Risk: An early breakthrough in AGI could upend the market situation.

- Compute Cost Complex: With economies of scale, cost typically falls, but AI model complexity is pushing up the price. Greater AI model complexity requires significant investment to scale, and this higher compute cost can eventually lead to overinvestment and elevated risks of losses.

Taken together, these factors highlight that AI startups face higher failure probabilities than companies in established industries.

The Future of Revenue Multiples In AI Startup Valuation

Accordingly, the valuation process of modern AI startups requires sophisticated, multidimensional frameworks that factor in both existential risk and strategic upside. In an industry that is evolving rapidly, regular research is vital to alter intrinsic valuation to incorporate recent data.

Every forecast carries the risk of missteps, and in an industry that grows at a relentless pace, traditional revenue multiples have become relics of a quieter age—useful as starting points, but insufficient as standalone valuation tools for AI’s complex reality.

Contact our valuation experts today to discuss how we can support your AI startup valuation needs with multidimensional analysis that goes beyond traditional revenue multiples.