Which Equity Compensation Is Best: Options, RSU, RSA, Phantom Stock or SAR?

Receiving equity compensation is a great benefit for a lot of employees, but most don’t know which equity compensation plan is the best for them. Stock options, restricted stock and restricted stock units, stock appreciation rights, phantom stock, and employee stock purchase plans are the five primary types of individual equity compensation programs. There are various types of employee compensation plans which help the employees to get special consideration in terms of pricing or conditions under each type of plan. The best employee equity compensation plans always help the employees. In this article, we will discuss each equity compensation program to help you decide which one is the best for you.

Equity Compensation Plans

Many companies, especially startup companies, provide equity compensation to their employees. By doing so, the company can conserve their cash and attract highly talented individuals who can help the business in the long run. Options, restricted stock, and performance shares are examples of equity compensation; these investment vehicles indicate employee participation in the company. Employees can partake in the company’s profits through appreciation, encouraging retention, especially if vesting restrictions are in place. A below-market pay may be accompanied by equity compensation at times. Options, restricted stock, and performance shares are examples of equity compensation; each investment vehicle represents a stake in the company.

What is equity compensation?

Equity compensation is a form of non-cash compensation that a company can offer its employees in exchange for a share of its ownership. Stock options, performance shares, and restricted stock are just a few examples of equity remuneration. Employees who are paid in stock may be able to participate in the company’s earnings through appreciation.

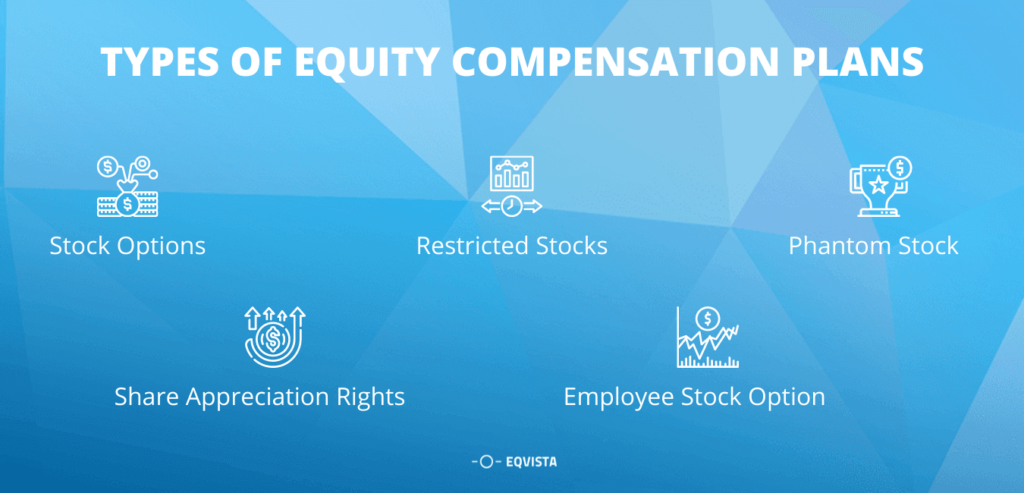

Types of equity compensation plans

There are five types of equity compensation plans which are most commonly used in business terms and finance. A shareholder and company must be aware of its functions and know the difference between all five types. The types of compensation plans are as follows :

Stock Options

A stock option plan promises equity at a fixed price on a future date, usually if certain conditions are met. It offers the holder, usually an employee, the right to buy a particular number of shares at a predetermined price at some point in the future (the “exercise price”). This right is frequently linked to the option-promise holder’s staying with the company for a set amount of time. Stock option plans are particularly appealing to startups that often lack the financial resources to attract and retain top talent (such as employees, directors, consultants, and advisors) who can help the company grow.

Restricted Stocks

Instead of actual shares, participants in an RSU Plan are given notional units called “restricted share units (RSUs)”. The RSU value fluctuates with the rise and decline in the awarding corporation’s common shares market value. After meeting specific requirements, such as staying with the company for a certain period, the plan member receives the shares underlying the RSUs on a vesting schedule.

SAR (Share Appreciation Rights)

The corporation gives plan participants share appreciation rights (SAR) under SAR Plans. Participants in each SAR are entitled to receive the net value of the rise in the market value of the corporation’s share between the grant date and the vesting date when the SAR vest. In some aspects, SAR Plans are comparable to stock option plans, and in others, they are similar to RSU plans.

Phantom Stock

A phantom stock plan is a type of deferred compensation plan in which the employee receives an award based on the company’s common shares value. The reward, however, does not convey equity ownership in the corporation, unlike actual shares. In other words, the employee does not receive any genuine claims.

Employee Stock Purchase Plan (ESPP)

An employee stock purchase plan (ESPP) is a company-run program through which employees can buy company stock at a reduced price. The corporation uses the employee’s accrued cash to buy stock in the company on behalf of the participating employees on the purchase date.

How does Equity compensation work?

A corporation that provides equity remuneration to its employees gives them ownership of private or public stock in addition to a salary. In most situations, employees must stay with the company for a specific amount of time in order to become fully vested in the shares, which means they own the stock outright. Employees who have completely vested can sell their stock for cash on private or public markets, depending on whether the company is privately or publicly held. For a variety of reasons, an employer may offer potential employees equity pay. They may include the following:

- Correcting the “principal/agent” problem – This occurs when employees do not have the same incentives as their boss to constantly act in the company’s best interests. Employees can become part-owners in the firm by offering equity-based remuneration, which aligns their interests with those of the company’s leaders and owners.

- To reduce cash requirements – Businesses can save money on immediate payroll costs by giving their employees stock in the company. This is particularly common among companies with a tight financial flow.

- To inspire employees, companies will provide equity-based remuneration in addition to their regular wages.

- Hiring and retention – Because equity compensation creates financial ties to the organization, it can help attract top talent and keep critical personnel.

Importance of having equity compensation in an organization

Many public firms and some private organizations, particularly startups, offer equity remuneration as a bonus. Due to a paucity of funds or a desire to invest cash flow into growth projects, equity pay is a viable choice for attracting high-quality staff. Employees in technology companies in both the start-up and mature stages have traditionally been rewarded with equity remuneration.

There is never a guarantee that your equity ownership will pay off with equity compensation. Being paid a salary, as opposed to equity pay (or in combination with equity compensation), can be advantageous because you know exactly what you’re getting. Your equity compensation might be influenced by a number of factors. Staff can partake in the company’s profits through appreciation, which can help retain employees, especially if there are vesting restrictions.

Employee Stock Option (ESO)

Employee stock options are a type of equity remuneration given to employees and executives by firms. Rather than issuing actual stock shares, the corporation instead offers derivative stock options. Regular call options provide the employee the right to buy the company’s stock at a certain price for a set period of time.

What is an employee stock option?

Employee stock options are a type of financial equity remuneration issued by companies to their employees and executives. The stock options available are ordinary call options, usually offered as a discounted price, which allow an employee or executive to acquire their company’s stock at a predetermined price and time. An employee stock option agreement is used to negotiate and sign off on the terms and conditions of the stock option before it is finalized.

The importance of employee stock options

It serves as a motivator for employees since once they own stock, they feel responsible for its performance because it determines the value of its stocks. It assists the employer in retaining the firm and ensuring a high level of work performance.

Pros and cons of employee stock options

There are several advantages and disadvantages of the employee stock option that should be kept in mind before considering these compensation plans. Each investor, company owner must be aware of the pros and cons, which are as follows:

Pros

- Stock options for employees make compensation packages more appealing.

- They are a low-cost business benefit.

- Employee retention is improved.

- Provides employees with a sense of “ownership” in the company, helping them to feel more linked to the entire organization.

- Employees are encouraged to work longer hours. When a company’s financial situation improves, so does the stock of its employees.

- Potential tax advantages.

Cons

- Employees face complicated tax consequences.

- It might be challenging to determine the value of stock options.

- Individual employees rely on their coworkers’ efforts to achieve organizational success, which can lead to conflict.

- Even if the company is underperforming financially, stock options can result in substantial remuneration for leaders.

- Dilution can be exceedingly costly to shareholders in the long run.

Restricted Stock (RSA and RSU)

The corporation issues shares to plan members at no cost under Restricted Share Plans and Deferred Share Plans. The shares are conditionally awarded and will only be released to the participant after any conditions are met. The conditions could be time-based, performance-based, or a combination of the two. Employees might be given restricted stock units (RSUs) or restricted stock awards (RSA) as a mechanism for their employer to give them company shares. The award is “restricted” because it is subject to a vesting schedule, which might be based on the length of service or performance goals, as well as any transfer or sale restrictions imposed by your firm.

What are Restricted Stocks?

The commitment of a firm to pay shares depending on a vesting schedule is represented by restricted stock units (RSU). While this is advantageous to the corporation, it does not provide employees with ownership rights until the shares are earned and issued.

Importance of RSU

Restricted stocks have an imperative role to play when it comes to equity compensation plans. They help in making better decisions in stock, lowers the potential tax. There is less risk in the restricted stocks. It helps in taking ownership of the store along with reducing deferred tax.

Pros and cons of Restricted Stock

Restricted Stocks have their own benefits, which help the companies in a lot of ways, but there are also disadvantages. It is important to keep in mind the pros and cons, which are as follows :

Pros

- Employees get the whole value of a stock equivalent with no exercise price (making is free).

- Companies concerned with reporting earnings should expect a more predictable blow to earnings than if they used options.

- Companies have a good sense of how to allocate resources evenly among employees who arrive at different times.

Cons

- When an RSU vests, it is always taxed at the high regular income tax rates. Filing an IRS 83(i) election for a 5-year deferral is an exception. The RSU value will still be subject to ordinary income tax, but any subsequent rises in value will be eligible for capital gains treatment.

- They don’t vest until liquidity is achieved, and you have no control over the IPO or M&A event date. RSUs, on the other hand, usually expire after 5 to 7 years, and corporations are not required to reissue them.

- While the company is still private, an RSU cannot be sold or transferred.

- RSUs cannot be used to file an 83(b) at the time of award to lock in reduced taxes.

- Even if you aren’t ready to sell your RSUs, an IPO triggers taxes.

Phantom Stock and SAR

A Stock Appreciation Right (SAR) is an award that allows the bearer to profit from the increase in value of a specified number of shares of company stock over a specified time period. A stock appreciation right is valued in the same way that a stock option is valued: the employee benefits from any increases in the stock price above the award price. Unlike options, however, the employee is not forced to pay an exercise price to exercise them; instead, depending on the plan rules, the employee receives the net amount of the gain in the stock price in cash or shares of company stock.

What is phantom stock or SAR?

Phantom stock plans and stock appreciation rights (SARs) are two stock plans that don’t really use shares but pay employees based on the company’s stock performance.

A Phantom Stock Option is a performance-based incentive plan that gives an employee the opportunity to receive cash payments after a set period or when certain conditions are met and is closely related to the company’s share price valuation and appreciation.

Stock Appreciation Rights are similar to Stock Options in that they are given at a fixed price and have a vesting term and an expiration date. An employee can exercise a SAR at any time before it expires once it vests. Depending on the rules of an employee’s plan, the proceeds will be paid in cash, shares, or a combination of cash and shares. If you get funds in the form of shares, you can treat them like any other stock in your brokerage account.

Importance of phantom stock and SAR

Employers can use phantom stock and SARs to give equity-linked pay to their employees without diluting their shares considerably. Even though these programs have significant drawbacks, industry experts expect that both types of plans will grow more common in the future.

Because these “pseudo shares” are not actual shares before an exit event, the beneficiary is usually exempt from paying taxes. The beneficiary would generally receive a sum equivalent to the cash they would earn if they held the actual stock at the time of exit. Some programs provide for a dividend in the form of common or other types of equity rather than cash. Typically, the incentive is conditional on the recipient sticking with the company until the triggering event occurs.

Pros and cons of phantom stock and SAR

Employee stock awards have been proved to have several advantages for both employees and employers. Phantom stock plans and stock appreciation rights (SARs) are two forms of stock plans that don’t use shares but pay employees based on the company’s performance. We list out the pros and cons below:

Pros

- SARs make it simple for employees to exercise their rights and compute their gains.

- Unlike traditional stock option grants, they do not need to place a sale order at exercise to cover the amount of their basis.

- Employers prefer SARs because the accounting regulations for them have improved significantly in recent years; they now receive fixed accounting treatment rather than variable accounting treatment and are treated similarly to traditional stock options.

- Employers can use them to compensate staff without handing over a piece of the company’s ownership.

- Phantom stock plans can increase employee motivation and tenure and deter key personnel from leaving the company, thanks to a “golden handcuff” feature.

Cons

- SARs do not pay dividends and do not grant investors voting rights.

- Phantom Stock are not applicable to some companies.

- Every organization uses them as they might be an expensive approach.

Comparing Stock Option, Restricted Stocks, Phantom Stock, and SAR

| Stock Options | Restricted Stocks | Phantom Stocks and SAR | |

|---|---|---|---|

| What is it? | The right to purchase shares in the future at a price specified on the date of grant. | Shares granted are subject to certain restrictions. | Units giving the right to receive shares subject to certain restrictions. |

| Value | Depends on the increase above the exercise price. | Depends on the stock price at vesting. | Depends on the stock price at vesting. |

| Payment | Payment of exercise price | No payment to receive shares | No payment to receive shares |

| Tax | Taxable at exercise for NSO And ISOS(AMT) and to share sale for ISOS. | Taxable at vesting | Taxable at vesting |

| Voting Rights/ Dividend | Upon exercise | Yes, during the vesting time | No, but can choose to give div-equivalent |

| Mostly seen in | Early Stage, High Growth Startup | Co-founder arrangements | More mature companies, later startups, those with liquid stocks |

Issue and Manage Equity Compensation Plans with Eqvista

Sometimes managing equity compensation plans can be difficult for organizations, and it’s a complex process to understand the entire plans and work on them. We at Eqvista provide you with an application where you can keep track of your equity compensation plans. A user can register an account and fill the sign-up form, and get started with our services. You can also book a demo to understand our application. We also offer full 409a valuations for finding your exercise price of your options.