ESPP or Employee Stock Purchase Plan

Employee Stock Purchase Plan or ESPP is an equity compensation scheme that is offered by publicly traded companies.

To be a stockholder in your company is a matter of pride and ownership. A phenomenon that was once a privilege reserved for only the top management has today become a powerful recruitment and retention tool. Employees feel an entitlement to the company’s profits in exchange for their hard work. Equity compensation is also a proven method to retain employees for the long term.

Employee Stock Purchase Plan

Companies normally grant equity benefits governed by vesting schedules. On completion of set conditions or milestones, an employee becomes eligible to purchase stocks granted to them at a predetermined price. Sometimes this process proves cumbersome as the employees have to purchase the stocks in bulk. This draws considerable tax implications as well. However, an employee stock purchase plan is a scheme that provides a breather to this process. Let’s see how.

What is an Employee Stock Purchase Plan or ESPP?

Employee Stock Purchase Plan or ESPP is an equity compensation scheme that is offered by publicly traded companies. This allows employees to purchase company stock at a discounted price. However, not all employees are eligible for this scheme. An ESPP is carefully granted with pre-requisite milestones. An employee becomes eligible for this scheme only on completion of these set benchmarks.

An employee stock purchase plan is a trusted tax-efficient method of providing equity benefits to employees. Employees are not required to purchase stocks directly. Rather they contribute to ESPP through automatic payroll deductions. These deductions are usually done every month. However, the IRS limits payroll contributions to $25,000 for one year.

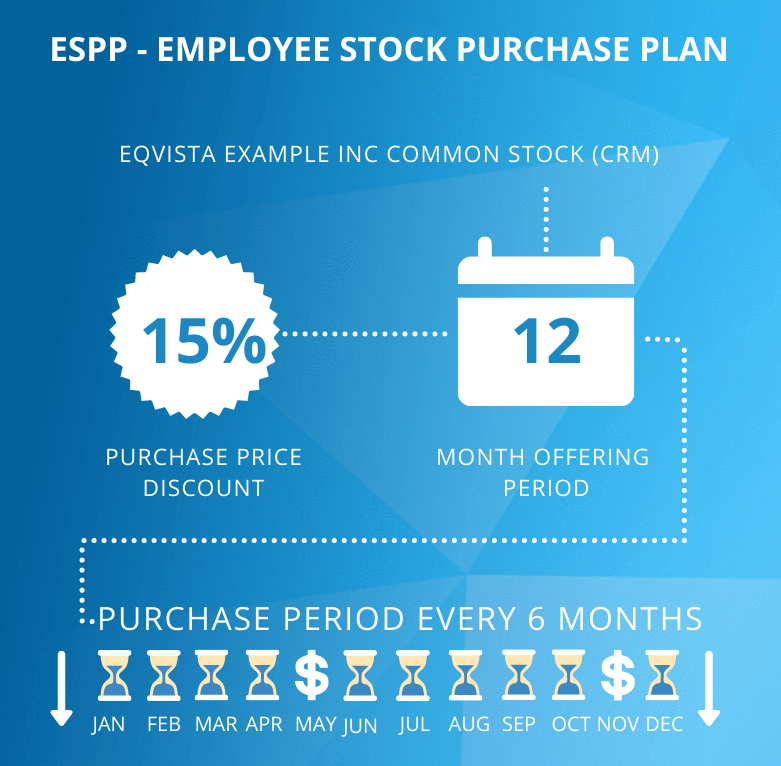

An employee stock purchase plan offers another important feature. Eligible employees can receive discounts as high as 15% on stock purchase through an ESPP scheme. Since ESPP schemes are spread over a certain period, the lowest stock price between the start and end period is considered as the base price. For example, if the stock price at the start of an ESPP scheme is $100 and this falls to $80 by the end of the term, the base price of the stock is taken to be $80. Now if a maximum discount of 15% is applied, employees will be eligible to purchase the same stock at $68.

But certain factors affect ESPP eligibility. They are:

- An employee must have completed at least 1 – 2 years of service in the company.

- An employee stock purchase plan is a benefit of choice. It is offered to all eligible employees. However, all employees are not obligated to participate in it.

- An employee already holding more than 5% of company stocks is not eligible to participate in an ESPP.

Benefits of ESPP

Overtly an employee stock purchase plan may feel like a lot to take in, but in the long term, this scheme benefits both the company and the employees. Here is a snapshot into some of the advantages of ESPP:

Stock purchase below market value: This is the best benefit of ESPP. Normally when a company offers equity benefits to employees, stocks are purchased at fair market value. But ESPP allows two distinct benefits that allow stock purchase below the fair market value:

- Discount – An interesting aspect of how ESPP works is that it allows a discount of almost 15% on the fair market value of stocks. This is a unique advantage as normally the best price a company offers for stock purchase during equity grants is the fair market value on the purchase date.

- Look-back provision – This is another unique aspect of the employee stock purchase plan. An ESPP scheme is spread over a certain time span known as the ‘offering period’. In simple terms, this is the length of time when deductions happen from the employee’s salary account towards this scheme. Thus it is natural for stock prices to fluctuate between the start and end date of the offering period. The ‘look-back provision’ enables ESPP to purchase shares of stock at the lowest of the two prices between the start and end date of the offering period. This is an advantage in two ways:

- If the stock price increases between the purchase date and offer date, the employee is expected to pay only the lower grant price.

- If the stock price falls between the purchase date and the offer date, the employee pays the price on the purchase date.

Both these features are great as standalone benefits. However, the best situation is when the ESPP scheme offers these benefits together. When an employee stock purchase scheme offers a discount as well as a look-back option together with the same benefit, these features can be stacked. This means a discount is offered on the look-back price.

Other important advantages

Apart from these two important features of employee stock purchase plan, some of the other common benefits are:

- It is very easy to enroll. Once a company offers an ESPP scheme to an employee, it is just a matter of completing a few documents that determine how much money will be deducted from their remuneration and the discount on the purchase of stocks.

- An efficient ESPP scheme that allows the selling of shares just after purchase is an efficient method to increase the overall income. Since the shares are purchased at a discount, the employee will profit from selling these at market value if not more.

Types of ESPP

Employee stock purchase plans can be categorized into qualified and non-qualified plans. This distinction is broadly based on how shareholders react to each of these plans. Here is how it works:

- Qualified plan – This type of ESPP needs shareholder approval before being issued by the company. All participants in this type of plan have equal rights and the offering period cannot exceed more than 3 years. Besides, there is a cap on the maximum discount offered.

- Non-Qualified plan – On the contrary, this type of ESPP does not require shareholder approval. Moreover, they entail fewer limitations when compared to qualified ESPP plans.

What to consider before enrolling in ESPP

Entering an ESPP scheme is an easy task for an employee. It is just a matter of completing some documents. However, whether or not it turns out to be a profit depends on the events that unfold during the stock sale. From an employee perspective, participating in an ESPP scheme is most profitable in the long run. However, one must understand what one is signing up for. Some of the important aspects one must consider before enrolment are:

- the right time to enroll

- the amount an employee agrees on as monthly deductions

- the timely decision to sell shares

- the intricacies involved in the ESPP tax rules

How does an ESPP work?

To understand how ESPP works, one must look at it as a systematic investment plan. This simply means that deductions happen in a period manner instead of in bulk. Once the employee agrees to enroll in ESPP, monthly deductions are made from their salary until there are sufficient funds to purchase stocks. A typical ESPP agreement includes the following terms. A basic understanding of these terms is important to grasp the full extent of ESPP benefits:

- Enrollment period – A time frame granted to employees to decide their enrollment option. They can choose to opt-in or opt-out.

- Offering date – The date on which payroll deductions begin for the employee opting into ESPP.

- Offering period – The time frame during which regular deductions continue from the benefitting employee’s salary account. This can extend to a maximum of 27 months.

- Purchase period – This is the schedule that determines the periodic deductions from an employee’s monthly remuneration. This is planned at equal intervals during the entire offering period.

- Purchase date – It is the last date of every purchase period on which stocks are purchased with the employee’s accumulated funds.

ESPP contribution limits

It is true that if done right an ESPP scheme is an all-out profitable one. That is why just like all other regulations, there is a cap on the total amount. The IRS regulates ESPP deductions to $25,000 per employee annually. But this cap is on the pre-tax income. Thus, if a maximum of 15% discount is applied, the total cap stands at $21,250 annually. Besides, a company can also impose restrictions on the annual cap beyond the prescribed IRS slab.

Let’s break this process down with an example

Let’s assume Rose joins a company and enrolls in the November ESPP cycle. Naturally, the offering date is set to a day in December for a 24 months offering period. This means that Rose’s purchase period is 6 months. Thus her first purchase date would fall in June the following year.

Let’s say that on the enrollment day, the fair market value of the company stock was $500 per share. Rose is offered this employee stock purchase plan at a 10% discount. When the look-back feature is applied to this scheme, this is how it plays out:

- When stock prices accelerate – Let’s say that the stock prices shot up by $20 per share between the offering date in November and the first purchase date in June the following year. The new stock price on the purchase date is now $520. But due to the 10% discount, Rose will purchase shares of stock @ $450 per share. Rose gains $70 on each share as it is.

- When stock prices plummet – In case the opposite happens and share prices drop to $450 on the first purchase date, the look-back option allows her to purchase stocks at a 10% discount on the lowest stock price between the offering date and purchase date. In this case, Rose will purchase stocks @ $405. Even though stock prices crashed, Rose still stands to profit. This is the beauty of ESPP schemes.

ESPP Taxation

ESPP taxation happens in two stages. The first point of tax incidence is during the allotment of shares. Second tax incidence happens while selling these shares. Hence a company issuing ESPP schemes must be aware of these two basic points:

- The “discount” parameter of an ESPP scheme is counted as the “perquisite”. An employee must declare the perquisite in the company’s tax return and claim credit of the TDS. This component is taxed as “income from salary”.

- On the other hand, when shares are sold, based on the holding period, this will be taxed as capital gains. In the case of publicly traded stocks, for a holding period of less than 1 year, capital gains are around 15%. When the holding period is more than 1 year, capital gains tax is around 10%.

Keeping these two phenomena as the base, let’s take a look at how ESPP taxation works differently for qualified and non-qualified plans.

- Taxation for a qualified ESPP plan – Qualified employee stock purchase plan requires shareholder approvals and is limited to an offering period of 3 years. In terms of taxation for such plans, employees are liable to pay any taxes at the time of share purchase through ESPP. But the time of sale is considered as a taxable event and must be reported while filing returns.

- Taxation for a non-qualified ESPP plan – A non-qualified employee stock purchase plan behaves differently. They do not have as many restrictions as the qualified plan, but the entire gain is taxed at ordinary income tax rates.

Issue and Manage Employee Equity on Eqvista

Offering equity benefits is trending as an attractive option to hire and retain talent. Companies with an efficient equity compensation scheme are preferred by top talent. To manually issue and manage the equity in a small company with a handful of employees is a practical thing to do. But in an expanding business with varying stakeholders, automating this process is the best way forward. Eqvista is one of the leading specialists in equity management software. We provide end-to-end solutions for all your equity needs. These articles outline our comprehensive services. For further information reach us today.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!