How to Incorporate Geographic Expansion Opportunities Into Valuations?

International expansion is a key chapter in any organization’s story. It carries benefits such as greater geographical diversification and scaling of operations. At the same time, it is also a significant financial commitment that carries substantial risks. Given its potential impact on long-term success, such a move demands thorough evaluation and planning.

While contemplating such an expansion, you will encounter challenges such as fluctuating foreign exchange rates, indiscernible opportunity size, and various biases.

To help you make an informed decision, in this article, we will explain how you should value an international expansion opportunity. Later, through examples, we will explore two valuation methods that are most relevant in this context. Read on to know more!

Key considerations for international expansion valuation modeling

By incorporating the following considerations, you can avoid pitfalls such as overestimating the value of expansion opportunities and overlooking key risks.

Market size

You must value your expansion opportunity based on the part of the market you can realistically hope to capture, not the entire market. Due to limitations of your business model, product characteristics, and market competition, you cannot realistically assume that you would capture the entire market as soon as you enter.

To identify the size of your expansion opportunity, you must invest in market research that informs you about the following metrics:

- Total addressable market (TAM) – The TAM is the total market demand for your product and represents your maximum potential revenue.

- Serviceable addressable market (SAM) – The SAM is the total demand generated by your target audience. It is the section of the TAM that you could capture based on your business model and product characteristics.

- Serviceable obtainable market (SOM) – The SOM is the portion of the SAM that you could capture given the competitive landscape.

The gaps between TAM, SAM, and SOM can help you estimate your potential growth rate post-expansion.

Ramp-up curve

When your company expands into a new region, it will take some time to reach maximum productivity. In the first year of expansion, your company may not break even due to low demand, supply chain issues, and poor unit economics. Resolving these issues may take time. But eventually, your target audience would see the value in your product. Over time, your team may establish a more robust supply chain that minimizes the costs.

Your cash flow projections must reflect these challenges in ramping up operations in a new region. To do so, you must coordinate with your operations team and build realistic expectations about how your expansion opportunity would play out.

Risk adjustment

When you expand into a new country, you would be exposed to risks such as:

- Fluctuations in foreign exchange rates impacting profit margins

- Changes in regulations and the trade environment limiting the scale of operations

- Inability to adapt to the new country’s culture, resulting in a loss of demand

Furthermore, when expanding into a less developed country, investors demand higher return to compensate for the risk associated with greater economic uncertainty in the region. This expectation is represented as the country’s risk premium.

To improve the accuracy of your valuation, you must conduct scenario analysis where different foreign exchange rates and regulatory and trade environments are considered. You should also adjust your revenue projections based on the time required to adapt to the new country’s culture. Additionally, you must increase the discount rate by the country risk premium to fairly reward your investors.

How to value international expansion opportunities using the discounted cash flow (DCF) method?

The discounted cash flows (DCF) method can be used for valuing international expansion opportunities when significant research has been conducted. To truly leverage this valuation method, you must build reasonable foreign exchange rate estimates. Furthermore, you must also estimate the impact of different regulatory and trade environment conditions on your cash flows.

Let us understand this through an example.

Suppose your company is considering a $6 million investment to expand into Europe. The expansion is planned to span five years, during which foreign exchange rates between the euro and the US Dollar are expected to follow the trends outlined below:

Expected euro to US dollar foreign exchange rates:

| Scenario | 2025 | 2026 | 2027 | 2028 | 2029 |

|---|---|---|---|---|---|

| Optimistic | 1.2 | 1.22 | 1.15 | 1.18 | 1.18 |

| Neutral | 1.12 | 1.15 | 1.1 | 1.12 | 1.14 |

| Pessimistic | 1 | 1.1 | 1.05 | 1.06 | 1.1 |

We will assume that changes in the regulatory and trade environment only affect the EBITDA figures, while tax rate, working capital, depreciation, amortization, and capital expenditures remain unaffected.

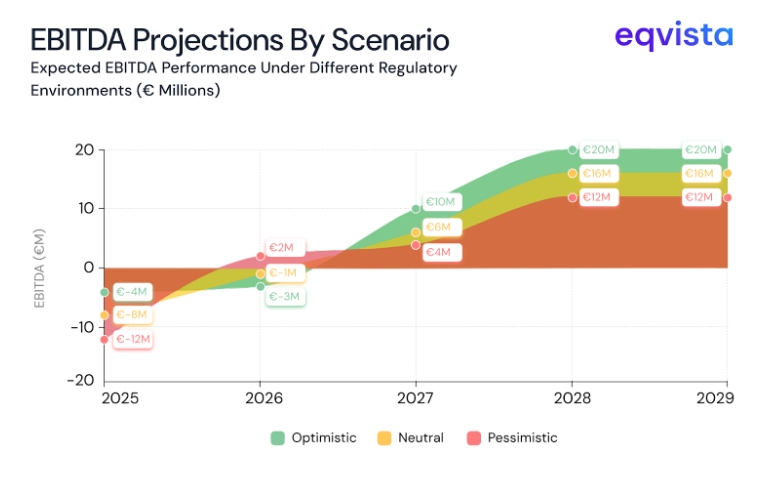

The projected EBITDA under each regulatory and trade environment scenario over the five-year period is as follows:

| Scenario | 2025 | 2026 | 2027 | 2028 | 2029 |

|---|---|---|---|---|---|

| Optimistic | -€4,000,000 | -€3,000,000 | €10,000,000 | €20,000,000 | €20,000,000 |

| Neutral | -€8,000,000 | -€1,000,000 | €6,000,000 | €16,000,000 | €16,000,000 |

| Pessimistic | -€12,000,000 | €2,000,000 | €4,000,000 | €12,000,000 | €12,000,000 |

The expected tax rate, working capital changes, depreciation, amortization, and capital expenditures over the five-year period are as follows:

| Particulars | 2025 | 2026 | 2027 | 2028 | 2029 |

|---|---|---|---|---|---|

| Tax rate | 30% | 30% | 30% | 30% | 30% |

| Depreciation and amortization | €2,000,000 | €2,000,000 | €2,000,000 | €2,000,000 | €2,000,000 |

| Capital expenditures | €1,000,000 | € - | €1,000,000 | € - | € - |

| Increase in net working capital | €100,000 | €120,000 | €200,000 | € - | € - |

Assuming a discount rate of 20%, we can make the following projections for the optimistic regulatory and trade environment scenario.

| Particulars | 2025 | 2026 | 2027 | 2028 | 2029 |

|---|---|---|---|---|---|

| EBITDA | -€4,000,000 | -€3,000,000 | €10,000,000 | €20,000,000 | €20,000,000 |

| Depreciation and amortization (D&A) | €2,000,000 | €2,000,000 | €2,000,000 | €2,000,000 | €2,000,000 |

| EBIT | -€6,000,000 | -€5,000,000 | €8,000,000 | €18,000,000 | €18,000,000 |

| Tax rate | 30% | 30% | 30% | 30% | 30% |

| Tax | € - | € - | €2,400,000 | €5,400,000 | €5,400,000 |

| Earnings before interest (EBIT - T) | -€6,000,000 | -€5,000,000 | €5,600,000 | €12,600,000 | €12,600,000 |

| Depreciation and amortization (D&A) | €2,000,000 | €2,000,000 | €2,000,000 | €2,000,000 | €2,000,000 |

| Net working capital | €100,000 | €120,000 | €200,000 | € - | € - |

| Capital expenditures | €1,000,000 | € - | €1,000,000 | € - | € - |

| Unlevered free cash flows (UFCF) | -€5,100,000 | -€3,120,000 | €6,400,000 | €14,600,000 | €14,600,000 |

| Present value of cash flows | -€4,250,000 | -€2,166,667 | €3,703,704 | €7,040,895 | €5,867,413 |

| Euro-to-US dollar conversion | |||||

| Optimistic conversion | -$5,100,000 | -$2,643,333 | $4,259,259 | $8,308,256 | $6,923,547 |

| Neutral conversion | -$4,760,000 | -$2,491,667 | $4,074,074 | $7,885,802 | $6,688,850 |

| Pessimistic conversion | -$4,250,000 | -$2,383,333 | $3,888,889 | $7,463,349 | $6,454,154 |

The maximum value of this opportunity is the sum of all optimistic euro-to-US dollar conversions of present values in the optimistic regulatory and trade environment scenario. This equates to approximately $11,747,729.

In a similar manner, we can generate valuation projections for all scenarios.

| Conversion↓\Regulatory and trade environment→ | Optimistic | Neutral | Pessimistic |

|---|---|---|---|

| Optimistic | $11,747,729 | $4,657,580 | -$653,634 |

| Neutral | $11,397,060 | $4,683,403 | -$340,440 |

| Pessimistic | $11,173,058 | $4,997,004 | $435,532 |

In this example, we can observe that the expansion yields positive results only in an optimistic regulatory and trade environment scenario. In all other scenarios, the valuation of the expansion is below the initial investment amount of $6 million.

If we assume that each scenario is equally probable, this opportunity should be foregone on account of high regulatory and trade environment risks.

How to value international expansion opportunities using the real options method?

When your company is still contemplating whether to expand or not, you can get valuable insights through the real options valuation method. This method effectively captures the uncertainties involved in international expansion with a limited set of inputs. Here, the expansion is treated as a call option.

In our example, we will use the Black-Scholes formula for call option pricing. The key inputs in this formula are:

- Strike price (K) – The investment amount is chosen as the strike price since it is a price to be paid for the opportunity.

- Current price (S) – The present value of expected cash flows is chosen as the current price since it represents the underlying value of the opportunity.

- Time to maturity (T) – In this context, we will choose the anticipated duration of international expansion as the time to maturity.

- Risk-free interest rate (r) – We will assume the present Federal Funds target rate of 4.5% as the risk-free interest rate.

- Volatility (V) – In this context, volatility represents the uncertainty or variability in the cash flows from the expansion opportunity.

The Black-Scholes formula for call option pricing is:

Call option = S × N(d1) – Ke-rT × N(d2)

In this formula, N refers to the normal distribution and:

- d1=ln SK+(r+V22)×T /V√T

- d2=d1-V√T

Let us assume that your company needs to invest $10 million in an international expansion. So, our strike price (K) is $10 million. This expansion is expected to generate cash flows whose present value is $30 million. So, $30 million is our current price (S). We also know that:

- Anticipated duration of international expansion = 5 years

- Volatility = 30%

When we plug in these values in the Black-Scholes formula for call option pricing, we arrive at $22,105,468.92 or approximately $22.11 million. Thus, we have estimated that the present value of this opportunity is $22.11 million.

Eqvista- Accurate valuations for informed decisions!

In today’s extremely globalized economy, opportunities for international expansion are surprisingly within reach and abundant. However, when faced with an abundance of choices, staying ahead of the competition demands accurately assessing each expansion opportunity. To make an informed decision, you would require analytical rigor and expertise to evaluate financial viability, strategic alignment, and potential risks.

By delivering accurate, data-driven insights, Eqvista’s valuation experts can empower startups to seize high-potential opportunities and maintain their competitive edge. Contact us to learn more about our services!