What Is Subordinated Debt?

In this article, we will explore why companies issue subordinated debt.

Subordinated debt is a form of unsecured debt that has a lower priority than all of the other debt taken on by a company. Its claim on the earnings or assets of the company ranks lower than that of the other loans. So, when a company makes earnings or is being dissolved, subordinated debt is paid back or settled after all the other debts.

Such debt is riskier and hence carries a higher interest rate.

In this article, we will explore why companies issue subordinated debt, how such debt appears on financial statements, and how investors can assess subordinated debt opportunities.

Why Do Companies Issue Subordinated Debt?

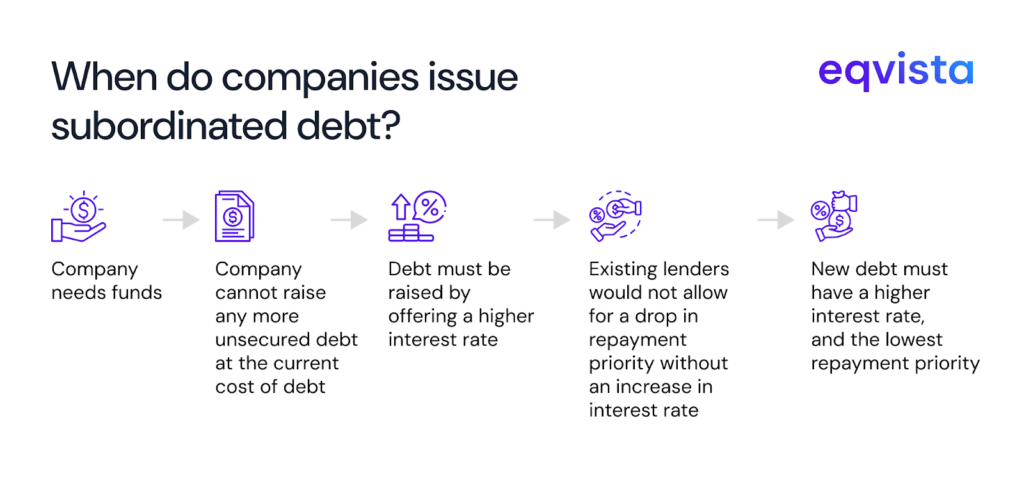

If a company in need of funds has already exhausted the amount of unsecured debt it can access at its current cost of debt, it must issue subordinated debt.

Lenders may argue that the company’s risk profile changes altogether once the overall debt crosses a certain threshold, and thus, any additional debt must have a higher interest rate.

At the same time, if the loan terms are unchanged for existing debt holders, they would experience both of the following setbacks:

- The interest rate is lower since they invested at a less risky juncture

- Repayment priority is the same as the newer, higher-interest-rate loans

So, existing debt holders would want the company to, at the very least, reserve the highest repayment priority for existing debt if they cannot negotiate a similar interest rate as the new debt.

As a result, any new debt must carry a higher interest rate and have a lower repayment priority, which by definition is subordinated debt.

How To Spot Subordinated Debt in Financial Statements?

Since subordinated debt is a long-term, unsecured debt, in balance sheets, it is listed after the current liabilities, grouped among other long-term debt obligations.

Companies may declare their subordinated debt as a risk factor in their annual Form 10-K filings because such debt affects the ability to pay dividends or execute buybacks. An example of subordinated debt being declared in a Form 10-K is as follows:

When it comes to private entities, you may need to inquire about existing debt obligations, their types, and repayment priorities, as such companies do not typically prepare Form 10-K filings.

How Should Investors Assess Subordinated Debt Opportunities?

You should check the following factors to assess whether a subordinated debt investment opportunity is worth pursuing:

Leverage

Debt is sometimes referred to as leverage since it allows the company to deliver higher returns to shareholders at a fixed cost. You can measure leverage using the following formula.

Leverage =Total Assets / Shareholder’s Equity

When a company’s debt increases, the leverage ratio also increases, while a reduction in debt lowers it.

A company that has excessive leverage is exposed to a heightened risk of falling behind its debt repayments due to the sheer scale of debt. To assess whether a company’s leverage is excessive or not, you should compare it with that of similar companies.

Fixed-Charge Coverage Ratio (FCCR)

Typically, investors look at the interest coverage ratio to assess cash flow availability for debt repayment. But since many companies can have other large fixed costs, the repayment capacity is better captured by the fixed-charge coverage ratio (FCCR), which can be calculated as follows:

Fixed-Charge Coverage Ratio (FCCR)=Earnings before interest and taxes (EBIT) + Fixed charges before taxes/Interest expenses + Fixed charges before taxes

Periodic lease payments and other such fixed costs can create a strain on a company’s finances comparable to interest payments and must not be overlooked by investors.

Generally, a higher FCCR is always better. Here’s how you can interpret FCCR values:

- FCCR>1: The company’s earnings can cover the interest payments and other fixed costs.

- FCCR=1: The company can barely manage to pay for the interest payments and other fixed costs.

- FCCR<1: The company is no longer able to repay its interest payments and other fixed costs. The debt is unsustainable at current earnings levels.

Maturity Schedule

A maturity schedule outlines the amounts of debt that mature and must be repaid within specific time periods. To be completely transparent about its debt obligations, ideally, a company’s maturity schedule should extend up to the maturity date of its longest-term obligations.

An example of a maturity schedule is as follows:

| Maturity | Amount | Percentage of total debt |

|---|---|---|

| Under one year or on demand | $40 million | 3.85% |

| 1-2 years | $200 million | 19.23% |

| 2-5 years | $300 million | 28.85% |

| More than 5 years | $500 million | 48.08% |

| Total | $1,040 million | 100% |

When reviewing a maturity schedule, you should first assess whether the company has sufficient cash reserves to cover both short-term debts maturing within one year and any debt that is payable on demand.

Then, you should prepare cash flow projections to evaluate whether the company can maintain adequate cash reserves to meet repayment requirements in future periods. If the projections are favorable, you should repeat the analysis after factoring in the additional repayment burden from the to-be-issued subordinate debt.

Eqvista – Accurate Insights for Confident Decision-Making!

Subordinated debt can offer investors attractive opportunities for higher, fixed-interval returns. However, such investments should be pursued only when the issuing company demonstrates strong financial health. That being said, it would be an oversimplification to assume that all companies with subordinated debt are financially weak.

If such companies manage their cash flows well and effectively use the additional leverage, subordinated debt may not be a cause for concern.

If you are an investor who often deals with such complex yet rewarding opportunities, consider Eqvista’s data-backed valuation reports. We deliver actionable and defensible insights that enhance clarity and empower confident decision-making. Contact us to know more!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!