Stock Buybacks and Their Motives

This article aims to help you in understanding stock buybacks better by analyzing the reasons for stock buybacks and looking at the impact of stock buybacks.

Dividends are a common way publicly traded firms distribute their profits to their investors. Stock buybacks, sometimes called share repurchase schemes, are another way companies may reward their stockholders. Investors have a surprising amount of mixed ideas about stock buybacks. While some shareholders may see these investments as an unnecessary expenditure, others may see these as an excellent method to increase profits while minimizing tax liability. There are solid claims on both sides; therefore, who is right?

Carrying out stock buybacks correctly undoubtedly increases value for stockholders, making it one of the greatest and safest methods. However, not all businesses successfully use them. This article aims to help you in understanding stock buybacks better by analyzing the reasons for stock buybacks and looking at the impact of stock buybacks on companies.

Stock buybacks and their motives

Many different factors influence a company’s owners to repurchase their shares. To make the most of such choices, you should investigate the factors that led to them. Let’s understand their motives and mechanisms in this section.

What are stock buybacks?

In a stock buyback, the firm uses its funds to repurchase shares of stock from the market. If a firm has excess cash for operations or investments, it may distribute that surplus to its shareholders.

When a private firm engages in a stock buyback, it buys back shares of stock from investors in the secondary market. The corporation does not compel any shareholder to sell their shares in a buyback, and the offer does not limit itself to any particular set of shareholders.

When a public company decides to buy back shares of its stock, it will typically make a “repurchase authorization” from the company’s board of directors. It specifies the amount required for the buyback, the number of repurchased shares, or both.

How do stock buybacks work?

In addition to operating expenses, paying down debt, making strategic acquisitions, and dividend payments to shareholders, a firm may choose to repurchase its shares of stock.

Usually, a company will announce a repurchase authorization before buying back its stock. It says how many shares, what portion of the stock, or the required cash to buy back shares. To repurchase shares, a corporation may utilize its cash on hand or borrowed funds, with borrowed money carrying a higher risk profile.

Buying back shares of stock on the open market is similar to how an individual investor would do it. Since it isn’t interested in targeting particular shareholders, it will acquire shares from anybody willing to sell them. The company is assisting in treating all shareholders fairly since any shareholder may engage in the market by selling their shares. The stock buyback program does not impose any selling restrictions on existing shareholders.

Role of stock buybacks in the corporate financial landscape

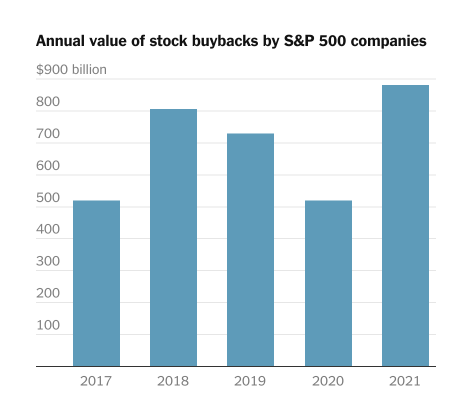

According to EPFR TrimTabs, repurchase announcements hit a record $1.22 trillion in 2022. Although dividend payments are the most often used form of capital return, stock buybacks may serve various purposes in the following ways.

- Directly increase stock prices – The primary objective of any stock buyback plan is to increase the share price. The company’s board of directors may have concluded that the stock is attractively priced at the present moment. Meanwhile, shareholders might see a repurchase as management’s vote of confidence.

- Save money in taxes – Dividends are taxable as income, although increases in the value of an investor’s stock are not. However, shareholders who choose not to sell their shares to the corporation benefit from the increased value of their holdings without incurring any extra tax liability.

- Greater flexibility than profits – Companies that start or raise dividends have a long-term obligation to maintain such payouts. That’s because cutting or eliminating the reward in the future might lead to lower share prices and angry investors. In contrast, share repurchases are far more flexible management tools since they are one-time events.

- Reduce the effects of dilution – There may be stiff competition among rapidly expanding businesses for top employees. If the corporation utilizes stock options as a retention tool, workers exercising their options will dilute current shareholders over time, increasing the number of outstanding shares. Stock buybacks are one strategy for mitigating this result.

Example of Stock Buyback

To understand the concept of Stock Buyback, let us take a simple example:

Valour Inc. a company with a market capitalization of $50 million and 1 million outstanding shares priced at $50 each, plans to utilize 50% of its net income, amounting to $3 million, to repurchase its outstanding shares.

Valour Inc. Overview

| Current Share Price | $50 | Shares Outstanding | 1,000,000 |

| Dividend Per Share | $2 | Market Capitalisation | $50,000,000 |

| Dividend Yield | 4% | Net Income | $6,000,000 |

Buyback Operation Overview

| 50% of Net Income | $3,000,000 |

| No. of Shares Bought Back | 60,000 |

| New Shares Outstanding | 940,000 |

| Pre-Buyback | Post-Buyback | ||

|---|---|---|---|

| Earning Per Share | $6 | Earning Per Share | $6.38 |

| Price to Earning Ratio (P/E) | 8.33 | Price to Earning Ratio (P/E) | 7.84 |

| Dividend Payout % | 33.33% | Dividend Payout % | 31.33% |

| Result | Shareholder Overview | ||

|---|---|---|---|

| Dividend Payout | -2% | Shareholdings of 100,000 | |

| Share Count Drop | -6% | ||

| EPS Change | 6.33% | Pre-Buyback | 10% |

| P/E Change | -5.88% | Post-Buyback | 10.64% |

*EPS = Net Income/ Shares Outstanding

*P/E = Share Price / EPS

*Dividend Payout = (Dividend Per Share * Shares Outstanding) / Net Income

Dividends Vs. Stock Buybacks

There is notable discussion over which method between dividends and buybacks is better for shareholders and corporations in the long run. When a company’s net income decreases, the dividends it pays out to shareholders may also decrease. Although stock prices may continue to fall, the company’s net income could rise, resulting in higher returns and perhaps even dividend increases.

On the other hand, once the company announces a repurchase, it assures a fixed payment. Although prices are subject to vary throughout each repurchase period, they are typically stable throughout. However, even if you merely sell a portion of your shares back, there is no assurance that you will make money from the repurchase in the long term.

The Motives Behind Stock Buybacks

Stock buybacks make sense based on the state of the market, the rules of company control, and how these things affect executives’ pay. Investors and other stakeholders need a thorough understanding of the following factors to fully appreciate the potential impact of such initiatives on the company’s bottom line.

- Companies often undertake stock buybacks to boost shareholder value. They may increase their profits per share (EPS) and the value of their stock to investors by lowering the total number of shares in circulation.

- Companies may more effectively deploy cash via stock repurchase programs. When a business thinks its stock is cheap, it may repurchase it rather than invest in new initiatives or distribute the money as dividends.

- Launching a stock buyback plan is a vote of trust in the company’s current and future financial health and prospects. A boost in investor confidence might result from this vote.

Influence of the Share Repurchase Decision

Several factors determine stock buybacks, including the state of the market, corporate governance rules, and the correlation between buybacks and CEO remuneration.

- Market Conditions – The decision to buy back shares relies on economic circumstances, the market’s performance, and the valuation of the company’s stock concerning its intrinsic worth. If a company thinks its stock price is low, it may repurchase some of its shares.

- Corporate Governance – The board of directors and the firm’s management usually play crucial roles in deciding whether or not to launch a stock buyback program. Principles of good corporate governance and the needs of shareholders play an integral part here.

- Executive Compensation – Executives’ pay packages, often based on performance indicators like EPS and stock performance, might affect the choice to carry out stock buybacks. They may receive increased salaries if buybacks cause a rise in earnings per share.

Improving Shareholder Value and Market Perception

When firms want to increase shareholder value and improve their standing in the eyes of the market, they often resort to stock buybacks as a strategic move. Repurchasing shares can reduce their share count and reap many advantages that boost shareholder value and the company’s position in the market.

If a company is confident in its financial health, it may reduce the number of shares outstanding to boost profits per share and the ownership proportion of current shareholders. This change may improve the market’s image and bring in additional investors. But if you do too many buybacks, you may also spend money on long-term investments or new ideas, which may slow down your company’s development.

Additionally, shareholders must remember that for stock buybacks to provide value and maintain the firm’s competitiveness, they must strike the correct balance between short-term financial advantages and long-term strategic objectives.

Capital Allocation and Cash Utilization

Repurchasing company stock is vital to capital budgeting and cash flow management. In the last decade, Apple has generated more cash than any other firm while simultaneously buying back more shares of stock than any other company. The reason is stock buybacks are a popular choice for companies with surplus cash since they allow for efficient use of the funds. Companies have two primary considerations when choosing between buybacks and other investments. They are:

- Flexibility and Efficiency – Stock buybacks allow businesses to put spare funds to good use. When a firm decides to repurchase its shares, it shows confidence in its long-term prospects by investing in its stock at a discount.

- Capital Optimization – When deciding how to allocate their capital, businesses prioritize buybacks above investments in new ventures if they feel their stock is cheap. By doing so, these firms can better use their resources and provide maximum returns to their investors.

From a tax standpoint, shareholders prefer stock buybacks to dividends since taxes on capital gains are often lower than payout tax rates. It also gives companies more flexibility than dividend payments, which require them to send money to owners regularly. The company may implement buybacks at different times and in different amounts depending on the state of the market and its cash flow.

Market Signals and Insider Confidence

Buying back the firm’s shares of stock may send a positive message to investors and other market participants about the outlook for the company. It means that the companies that announce buyback plans often feel their stock is cheap and that buyback is a more efficient use of money than pursuing other opportunities. Stock price rises, and new investors may result from increased trust in the company’s financial soundness as a result of this. Stock buybacks may have an effect such as:

- Earnings per share (EPS) increases when a corporation buys back its shares because of the lower number of outstanding shares.

- Companies with greater EPS growth tend to be more highly valued by investors, which may contribute to a rise in stock price.

- By increasing the number of shares owned by the company’s current shareholders, buybacks may boost confidence in the stock and attract long-term investors.

Concerns about Stock buybacks

Regarding market signaling and investor confidence, it is crucial to consider the criticisms and issues surrounding stock buybacks. Here are some of them:

- Concerns about timing arise because certain corporations may conduct buybacks in response to temporary movements in the stock market.

- When a stock is momentarily cheap for external reasons, it could look like market manipulation to repurchase those shares.

- Potentially jeopardizing long-term growth and innovation, buybacks raise concerns when corporations prioritize them above other long-term expenditures.

Manage your stock on Eqvista!

When deciding whether or not to invest in a firm, current and prospective shareholders should consider the possibility of a stock buyback. Learning how a share repurchase impacts investors, existing shareholders, and the company will help you understand its objective.

Eqvista is an advanced platform that streamlines the stock management and shares issuing processes. We have a robust and straightforward system for handling equity data and related tasks like creating cap tables. Call us now to avail yourself of all the tools you need to manage your company’s share structure and make educated choices!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!