Why Do Many Small Businesses Prefer SBIC Financing Over Other Sources?

When Steve Jobs and Steve Wozniak were scaling Apple Computer beyond their garage operation in 1978, they turned to a Small Business Investment Company (SBIC) that provided $500,000 in startup capital. This crucial funding helped launch the revolutionary Apple II computer and transformed a two-person startup into one of the world’s most valuable companies.

Small business owners today face a challenging funding landscape, with 79% reporting difficulty accessing affordable capital. Traditional bank lending has tightened significantly over the past decade, creating a capital access gap that Small Business Investment Company (SBIC) financing is uniquely positioned to fill.

For small businesses, understanding why SBICs offer superior advantages can make the difference between securing growth capital and remaining capital-constrained.

How SBICs Bridge the Financing Gap?

SBICs operate as privately managed investment companies licensed by the Small Business Administration, combining private capital with government-backed leverage to create a powerful funding mechanism.

Unlike traditional lenders who rely solely on their own capital, SBICs can access up to $2 in SBA-guaranteed debentures for every $1 of private capital raised, enabling them to write larger checks with more flexible terms than conventional financing sources.

Financing Options Comparison SBIC financing:

| Financing Source | Min Amount ($K) | Max Amount ($K) | Interest/Cost | Terms |

|---|---|---|---|---|

| Traditional Banks | $50 | $500 | 6-12% | Short-term |

| SBIC Debt | $250 | $10,000 | 9-16% | Long-term |

| SBIC Equity | $100 | $5,000 | Equity Return | Patient Capital |

| Venture Capital | $1,000 | $50,000 | High Equity | High Growth |

This structure creates a win-win scenario: small businesses gain access to patient capital with longer-term horizons, while SBICs benefit from low-cost government leverage.

Real-World Applications: Where SBICs Excel

- Manufacturing and Technology Scaling: Traditional banks might balk at the irregular cash flows typical in government contracting, but SBICs understand these business models. SBIC financing provides $250,000 to $10 million in debt financing with 9-16% interest rates, often with more accommodating collateral requirements than banks demand.

- Growth Capital for Service Businesses: A professional services firm seeking to expand into new markets exemplifies ideal SBIC financing. Unlike venture capital that demands high growth potential, or banks that require extensive collateral, SBICs can provide equity investments from $100,000 to $5 million tailored to steady-growth service businesses that generate consistent cash flows.

- Acquisition Financing: For small businesses pursuing buy-and-build strategies, SBICs offer debt-with-equity combinations ranging from $250,000 to $5 million. This hybrid structure allows business owners to maintain control while accessing the capital needed for strategic acquisitions—something traditional banks rarely accommodate for smaller transactions.

Current Market Conditions and Timing Considerations

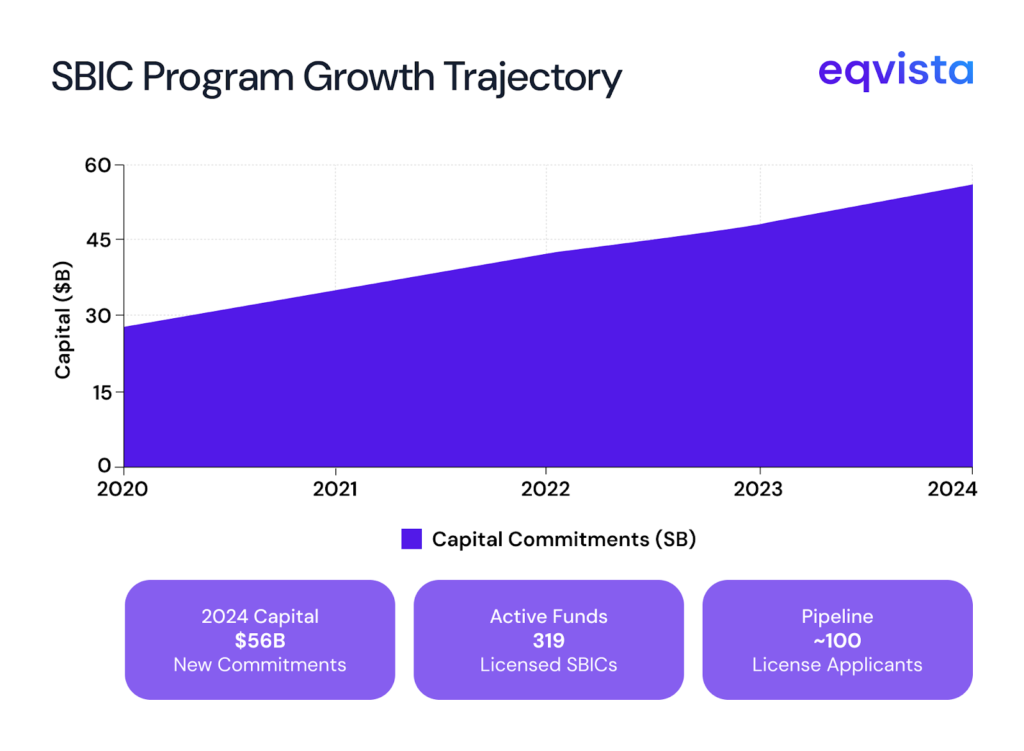

The SBIC program has experienced remarkable growth, with $56 billion in new capital commitments in FY2024 and over 319 licensed SBIC funds currently active. Recent regulatory modernization has made the program more attractive, with the introduction of accrual debentures for equity-focused investments and streamlined licensing processes.

For small businesses considering SBIC financing in 2025, several timing factors favor this approach:

- Interest Rate Environment: While SBIC debenture rates have increased to 4.963% in March 2025, they remain competitive compared to traditional bank lending, especially for businesses that don’t qualify for banks’ lowest rates.

- Regulatory Tailwinds: The SBA’s recent regulatory amendments have reduced barriers to program participation, particularly for funds investing in underserved communities and critical technologies.

- Market Capacity: With approximately 100 additional license applicants in the pipeline, SBIC capacity continues expanding, creating more options for small businesses seeking capital.

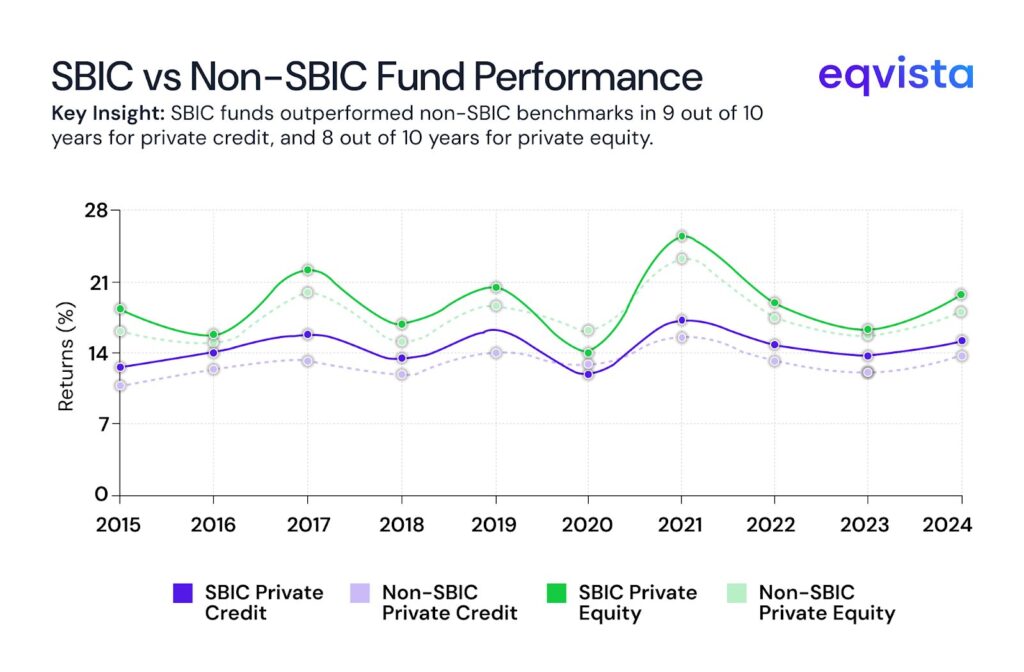

Performance Track Record: Why SBICs Outperform

Recent performance data reinforces SBIC superiority. For nine out of ten years, SBIC private credit funds outperformed non-SBIC benchmarks, while SBIC private equity funds outperformed median benchmarks in eight of ten years. This consistent outperformance reflects the program’s unique structure, combining private sector expertise with government backing.

The program’s 20-year average internal rate of return of 16.9% demonstrates that SBICs can generate strong returns while providing patient capital to small businesses—a combination that traditional lenders struggle to match.

Making the Decision: When SBIC Financing Makes Sense

SBIC financing particularly appeals to small businesses that:

- Need flexible capital structures combining debt and equity

- Require longer-term capital than traditional bank loans provide

- Want to maintain operational control while accessing strategic expertise

- Seek government contractor affiliation benefits

- Value relationship-focused capital partners over transactional lenders

For small business owners weighing financing options, SBIC programs offer a compelling middle ground between restrictive bank lending and dilutive venture capital, backed by a zero-subsidy government program that has generated surplus revenue for taxpayers over 24 years.

The combination of competitive terms, flexible structures, regulatory advantages, and proven performance makes SBIC financing an increasingly attractive option for small businesses ready to scale.

For businesses and funds looking to tap into the SBIC opportunity, the right infrastructure for equity management, compliance, and growth isn’t optional—it’s essential.

How Eqvista Can Support Your SBIC Financing Journey

Securing SBIC financing is not just about finding the right partner—it’s also about being prepared with accurate valuations, well-structured equity, and transparent financial data. At Eqvista, we help small businesses streamline equity management, perform precise valuations, and stay investment-ready. We ensure that your business is equipped with the tools and insights to confidently approach investors.

Start your journey with Eqvista today and give your small business the financial edge it deserves.