How to Raise Debt Financing For Startups?

If you are wondering how to establish your venture, this article is for you.

The success of a startup is highly dependent on funding, regardless of the stage it is in. There are multiple sources which entrepreneurs can extract funds from today. But understanding the types of financing and putting them into action according to your business needs is the most challenging part. Navigating your dream business beyond the idea stage requires researching how startup financing works and if the funding option is viable for your business growth. If you are wondering how to establish your venture, this article is for you. Also, you will understand the different types of debt financing for startups, when and how to raise debt financing and make an informed decision.

Debt Financing and Startups

If you consider the financial crisis that emerged in 2008 and lasted for almost a year, traditional banking options have become less available since then, doubting the potential of small businesses. Companies with an established presence and collateral assets needed more funding options. This was when various startup financing sources started coming in, making it easier for innovative ideas to take a business form. You must first understand how startup financing works to identify the best funding method for your company.

Understanding Startup Financing or Funding

Founders at their company’s pre-seed or seed stage can afford to invest money from their pockets. But once the business develops, you need more funds to set up and manage a company to scale better. Most companies consider three significant financing solutions – funds in return for equity, debt, or both. Equity funds involve lesser monetary risks for the company but require you to give up autonomy in company decisions. Debt funds are advantageous as you don’t have to trade company shares but enjoy certain tax deductions simultaneously. But to know if debt financing is for your business venture, you must understand the other types of startup financing.

Types of Startup Financing

There are five types of startup financing Series funding, Crowdfunding, Loans, Angel Investing and Venture Capital. How each type of funding will contribute to your business’s growth will depend on your priorities, ability to repay, and potential.

- Series Funding – In this type of startup financing, you can gather rounds of funds depending on its stage. Series A is the first round where your company has started experiencing some traction, like an income, reach, or customer base. This is a critical round as some companies may fail even after successfully raising funds from the seed stage. The company is looking for funds to widen operational activities in Series B. Series C, D, and beyond are the next level of funding rounds where your business is either looking to acquire other ventures, expand internationally or even go public.

- Crowdfunding – Crowdfunding, as the name suggests, is a method of raising funds from multiple investment options, including family, friends, clients, and affluent investors. It is also easy to attract investors who share your visions and find your business plan impressive. Many online platforms in crowdfunding allow you to pitch ideas to potential resources and get ahead with your business.

- Loans – Loans are one of the conventional methods of securing funds for your startups. You can apply for a small business loan where you receive financial, moral, and technical support from local lenders. Or you may even use a credit card to get instant cash to help your business take off. However, the high-interest rates of credit cards must be considered well in advance. Some friends and family members can offer you loans for your business, but you need to be more careful with the relationship and repayment.

- Angel Investing – Angel investing is a form of startup financing where investors with considerable expertise in your industry fund your company. They can also help you network with influential people who can guide you. You can find them through authentic angel investor communities online, pitch your ideas and find opportunities. There is no restriction on the amount you receive as funds from angel investors. However, they tend to limit the investment to around $500,000 in most cases.

- Venture Capital – Venture Capital firms usually invest in companies that are sure to reach heights in terms of revenue. It is instrumental in extracting large sums of money for businesses with significant growth potential. Venture capitalists are involved in a company’s investment for up to 10 years, after which they secure high returns and exit. As much as their returns are high, they also engage in business activities with more significant risks.

What is Debt Financing?

Debt financing is a form of startup financing that offers funds or loans to a business that can repay it with interest. Although equity financing is popular among business owners now, debt financing is one of the companies’ most traditional and convenient financing models. Unlike equity financing, there is no need to offer company shares to investors in exchange for a loan. The lenders also do not involve themselves in company decisions or management activities.

How Does Debt Financing Work?

When an entrepreneur needs funds to grow his company or even get the business plan off the ground, he seeks debt funding. The investor in consideration offers the loan at a defined interest rate for a stipulated period. The company has to sign bonds assuring the repayment and paying them on time and the fixed interest. Startup financing usually has a higher interest rate, considering the risks involved. Also, the loan requires the applicant to produce documents of company assets and securities so that if any misfortune happens in the future, the lender does not face financial losses. However, the growth of the business is exclusively for the founders to cherish, as there would be zero involvement from the lender’s end.

Debt Funding Options

The needs of every business may vary with their models, so it is necessary to understand them before looking for debt funding options. These funds do not require the startups to be at a particular growth stage to qualify for a loan. But based on the tenure of the repayment, the debt financing is classified as short-term and long-term loans.

- Short-term loans – A business must pay for costs beyond just the capital. For example, salary allocation of the workforce, rent, purchasing raw materials, and maintenance fees may sometimes insist that business owners secure a quick loan. This type of funding may take only a short period to be repaid and might incur only a small percentage of interest. Short-term loans like these do not require proof of collateral property or security.

- Long-term loans – Long-term loans are a considerable amount of principal that a business requires at several stages of growth. This involves the costs of setting up a firm, purchasing equipment and drafting a business plan. This type of funding incurs higher interest rates and has a longer tenure. Investors belonging to this funding category expect collateral securities from the startups.

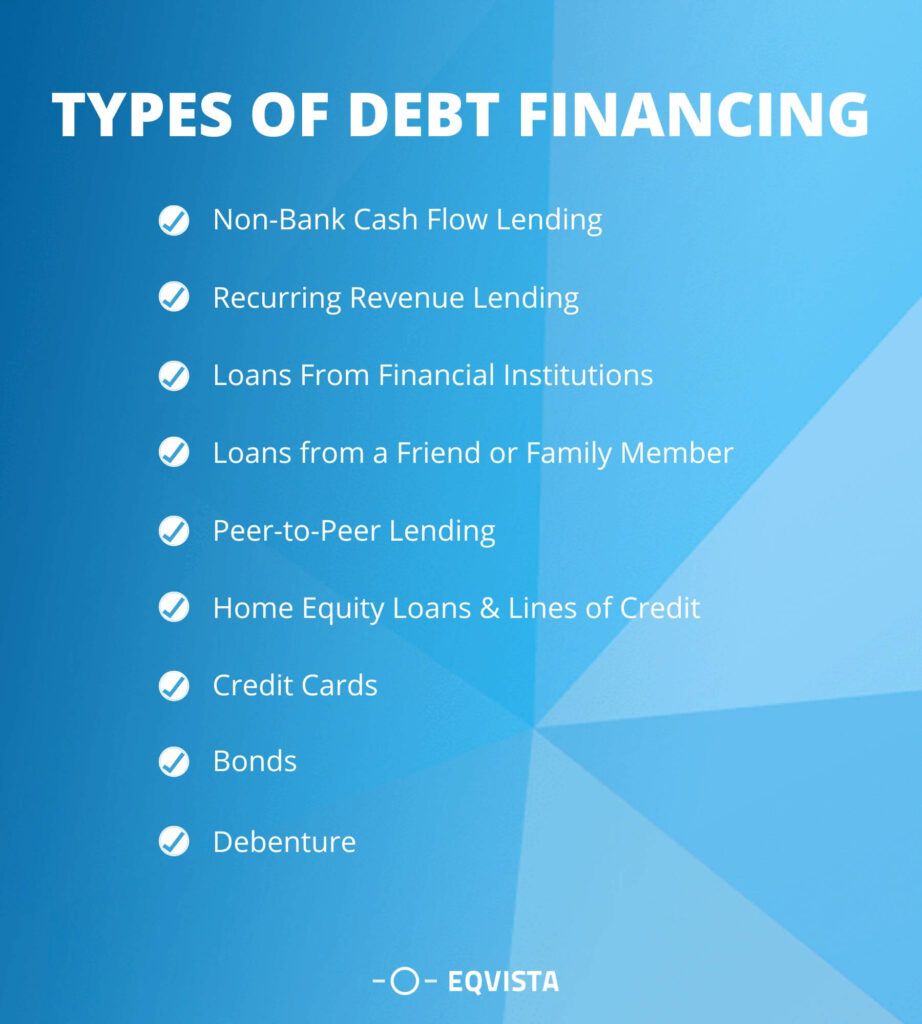

Types of Debt Financing

You can choose from multiple types of debt financing for startups depending on your goals and strategy. Most small and medium-scale businesses opt for the following primary funding options.

- Non-Bank Cash Flow Lending – When you approach a lender for investment options for your business, and he looks for your cash flow history rather than assets as security, it is Non-bank cash flow lending. Such lenders offer up to $250,000 as capital to early- companies. It is more flexible when compared to bank loans, as it allows you to repay a percentage of your sales revenue until the principal is cleared. But seeking loans from authentic investing agencies is essential as some people set higher interest rates.

- Recurring Revenue Lending – This type of debt financing offers you loans based on your monthly recurring revenue (MRR). These lenders can be ideal funding options for businesses with excellent customer retention and sales records. Recurring Revenue Lending is an attractive offer if your business has little collateral assets but high growth potential. However, it is essential to research your lender history to avoid hidden charges or fraud.

- Loans From Financial Institutions – These are the traditional bank loans you secure for a business. Although many funding options are available for today’s entrepreneurs, conventional business loans from financial institutions are the most prevalent. Long-term and short-term loans are available in this type based on tenure.

- Loans from a Friend or Family Member – This type of loan usually helps you start the business. Friends and family members may offer the amount they can, mostly at lower interest rates and minimum terms and conditions. While this option may sound like a great idea, it is essential to remember the impact it can have on your relationships if you do not repay them on time. Have a detailed plan about proceeding with the loan and exact repayment dates before getting into a contract.

- Peer-to-Peer Lending – This type of debt financing is ideal for small businesses willing to share financial statements and records of assets on public platforms. Peer-to-peer lending platforms give you access to investors who may find your prospect impressive. There needs to be more flexibility and opportunities for professional guidance here compared to the other debt financing options.

- Home Equity Loans & Lines of Credit – If you are a business owner with real estate equity and a good credit score, you can secure a home loan quickly. It is similar to a housing mortgage, where you repay the amount in parts every month. You can also opt for a line of credit where you can receive a certain amount whenever there is a requirement. These interest rates are much lower than bank loans and tax deductible under certain conditions.

- Credit Cards – Despite the high interest incurred on the borrower, credit cards are easy options to draw some quick cash. Small businesses that need instant funds to settle a minor business activity can use this type of debt financing. They also offer introductory discounts and sometimes rewards after years of usage and association. However, delay in repayment can cost penalties of high-interest rates.

- Bonds – Some investors buy bonds of certain companies in return for investments. These loans are repaid regularly within a stipulated time. These bonds can be short-term, medium-term, or long-term based on the tenure it takes for the bond to mature. It is an ideal option for startups when bank loans take longer to secure.

- Debenture – A debenture is a bond that relies more on the applicant’s reputation than his collateral assets. Although the investors may face high risks, debentures allow them to receive high returns and interest rates. A typical debenture has a typical 10-year span.

Pros and Cons of Debt Financing

One of the most critical advantages of debt financing is that it does not allow investors to take charge of the company’s decision-making process, and there is no ownership dilution. The lender need not know how the funds are used or what equipment is bought. Unlike other types of financing, this option does not prolong for an uncertain period. There is a defined tenure before which the amount needs to be paid with interest. The interest rate is also a fixed term and does not vary according to your increase in revenue. Most importantly, you can receive debt funding at any stage of your business if your repayment potential is determined.

On the other hand, debt financing can be complex for companies that grow in revenue rather than planned because of the mandatory repayment. Also, if you need more assets or securities to compensate for the loan, lenders can seize your company for failing to repay the loan. The most significant disadvantage of debt financing is its high-interest rates that startups may need help to afford.

How to Raise Debt Financing for Startups?

Raising debt financing may seem easy, but thorough research is needed to get ahead. You need to keep a few aspects in mind before seeking debt funding. For this, you need to have both the perspectives of an investor and an entrepreneur.

Firstly startup ventures must identify investors with a proven successful funding history. Debt funding can be obtained from MFI (Microfinance Institutions)s, NBFC (Non-Banking Financial Companies)s, and banks. Then a comparison of the interest rates must be made so that you can rest assured that you are paying a fair price. After preparing a solid business plan, you must approach these investors and persuade them to fund your venture. The investors will then run a quick credibility check on your business and potential before they decide to help. After drafting loan tenure and repayment schedules, you shall receive the funding your business needs to grow.

Critical Considerations in Raising Debt Financing

After weighing the advantages and disadvantages of debt financing, there are a few concerns you must pay attention to before you raise debt funds.

- First, both parties must agree upon the interest rate and sign a bond that will serve as a security for the lenders.

- All the terms and conditions regarding the loan amount and pay schedules must be well defined.

- Clarity on the lender’s involvement in the company in the future is crucial to any early-stage business.

- First-time entrepreneurs will be levied higher interest rates as the lenders will feel a higher risk in paying them. This is just to guard the investors against financial loss.

- Non-repayment of funds has higher chances of banks or lenders seizing the company.

When to Raise Debt Financing?

The best time to raise debt funds for your business is after understanding why and how you want to spend the capital on approval. If your company needs a considerable amount to upgrade its infrastructure, expand over markets, or develop high-end products, you must request long-term debt financing. In contrast, short-term debt financing is ideal for companies that require little funding for rent, maintenance, or allocating salaries for their employees. It is essential to be prepared for high-interest rates to avoid risking your assets in the future.

Cost of Debt Financing

Every financial institution offers funds to companies on different terms and conditions based on their needs. The cost of debt financing for a lender is the annual interest paid by the borrower. This interest rate is also tax deductible. The sum of annual interest and debt will give you the pre-tax cost of debt. With this value, you can find the post-tax cost of the debt.

The pre-tax cost of Debt = Annual interest Expense/ Sum of debts

Post tax cost of Debt = Pre tax cost × (1 – tax rate)

Get Ready for Your Startup Funding Rounds with Eqvista!

Although gathering funds to run your business is more manageable, you must prove your company’s potential to investors. An accurate valuation of your company can demonstrate why investing in your company is a good option. With Eqvista’s advanced valuation software, you can get instant reports that qualify your startup for its funding rounds. Contact us immediately if you need guidance on funding, valuation, managing your cap table, or anything startup!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!