Mastering Cap Table Management

Your company’s cap table, the capitalization table, is the essential document for monitoring ownership. It lists everyone with a share in your company, including individuals, institutions, and other entities. In 2022, the global market’s value for equity management software was at approximately $11.2 billion, and forecasts indicate it is poised to grow to an impressive $20.3 billion by 2030.

Choosing popular cap table management tools like Eqvista, Eqvista’s cap table which offers a comprehensive cap table management, which allows your companies to digitally manage cap tables. So, in this article, we will look at the importance of effective cap table organization for startups and some essential cap table management strategies to implement in your business routine.

Purpose of a cap table Management

Mastering cap table management is critical for startups. It significantly influences fundraising, investor relations, and decision-making. With a clear cap table, founders can strategically manage equity. For instance, it allows them to simulate scenarios, ensuring they don’t dilute their ownership excessively.

For effectively managing ownership structure and equity distributions, startups and established companies utilize cap table management software like Eqvista.This cap table management software streamline the complex equity management process, minimize the risks of errors ,ensure compliance and give transparency to all stakeholders

Startups that handle their cap table well can make wise financial choices for their business’s lasting success by leveraging technology for cap table organization. Thus, startups stand to gain significantly by fully utilizing the cap table’s potential, which is critical to their growth.

Elements of a cap table

A cap table is like a roadmap for a company’s ownership. It shows who owns parts of the company. Here are the vital elements you need to know:

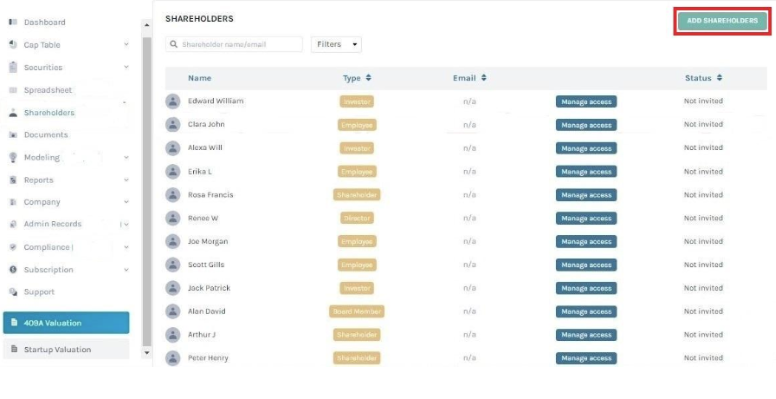

- Shareholders: These are the owners of the company. They can be people, investors, or employees who hold company shares.

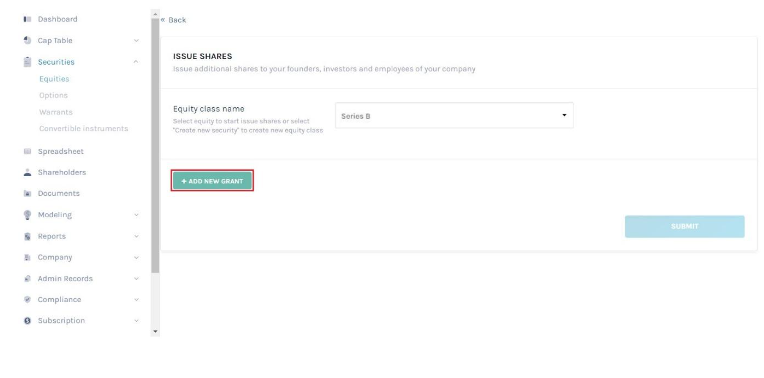

- Stock Types: Companies can issue various stocks, like common or preferred stocks. Each type comes with its rights and benefits.

- Shares: This is how the distribution of ownership works. A share represents a portion of the company. If a company has 100 shares, owning ten means you have 10% ownership.

- Vesting Schedules: Some shares may come with conditions. They might only fully belong to you once you’ve worked for the company for a certain period.

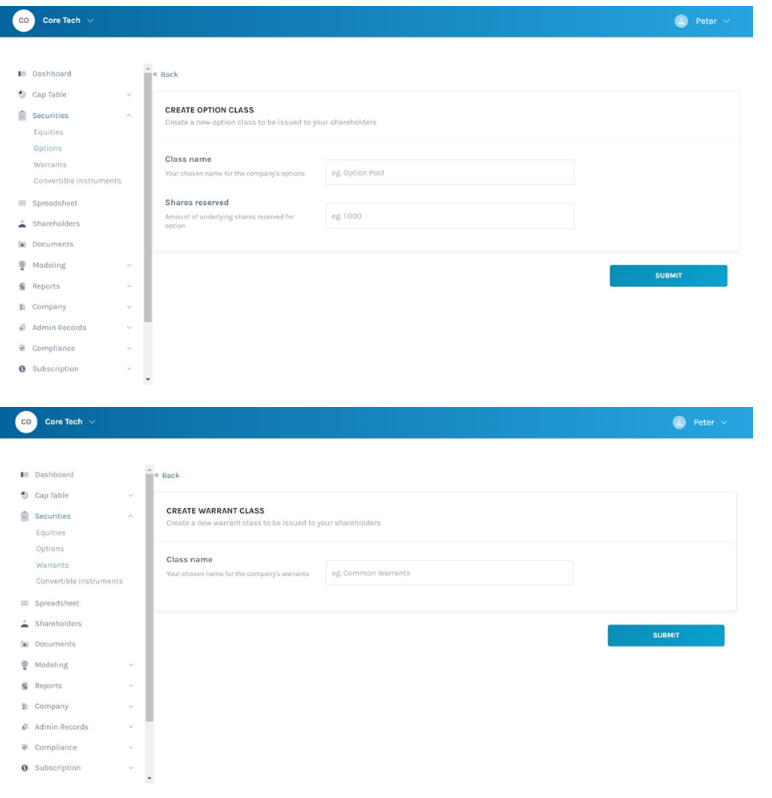

- Convertible Securities: These special instruments, like stock options or convertible notes, can become shares.

- Options and Warrants: These are rights to buy shares in the future at a set price. It’s like a promise to purchase shares.

- Ownership Percentages: Cap tables show who owns what percentage of the company. It is vital for decision-making and understanding the company’s value.

- Investment Rounds: The table also tracks different rounds of investments, like Series A or Series B, which show how much money the company raised.

Benefits of cap table management for business

Accurate cap table management offers several technical advantages to businesses. Here’s a breakdown of them. Cap Table software like Eqvista, that offers cloud based solutions Eqvista’s cap table management software, enabling real time data updates ,easy access to reports and financial models and it also simplifies the complex process of equity distribution.

- Streamlined Decision-making and Planning- Accurate cap table management enhances strategic decision-making and long-term planning with precise ownership percentages and equity types data. This information aids in determining voting rights and dividend distribution, ensuring robust corporate governance.

- Attracting Investors and Partnerships- An up-to-date cap table reflects the company’s stability and transparent financial health, making it an attractive prospect for investors and potential partners. Investors can evaluate ownership structures, assessing risks and opportunities more effectively.

- Facilitating Fundraising and M&A Activities- Maintaining a detailed cap table simplifies raising capital through equity offerings and engaging in mergers and acquisitions. Investors and acquirers can quickly assess the company’s financial health, making negotiations smoother and faster.

- Compliance and Legal Benefits- Accurate cap tables help maintain regulatory compliance by ensuring proper documentation of ownership stakes, essential for adhering to corporate and tax laws. It reduces the likelihood of legal disputes and simplifies compliance audits.

Eqvista’s cap table management software helps the startups and established companies ,offers a wide range of features including ability to create certificates ,board resolutions and valuations.

Strategies for effective cap table management

A few cap table management strategies will help your startup maintain financial transparency, appeal to investors, and precisely navigate equity intricacies. Let’s look into these approaches to make well-considered decisions, safeguard equity, and ensure a secure financial future.

- Organizing and Structuring the Cap Table– Start by meticulously listing all shareholders, including the number of shares, share classes, and ownership percentages. For example, if your startup issues preferred and common shares, specify their rights and preferences, ensuring a comprehensive and structured representation of ownership.

- Utilizing Cap Table Management Software- Employ specialized software like Eqvista. Eqvista’s cap table management automates complex calculations and updates your cap table when your business gathers new investments in real time. It reduces the risk of manual errors and significantly saves time and resources.

- Regular Audits and Reconciliations- Schedule periodic audits to meticulously review your cap table for discrepancies. For example, a quarterly audit involves verifying ownership records, ensuring consistency, and identifying discrepancies in share numbers, safeguarding your startup against legal disputes.

- Educating Stakeholders and Employees- Ensure all involved parties comprehend the cap table’s significance and how it operates. Host workshops and provide educational materials on effective cap table management strategies. For instance, explaining the effects of dilution with concrete examples can empower stakeholders to participate in the decision-making process actively.

- Forecasting and Scenario Planning- Consider how investments impact your company’s equity structure. For instance, if you plan to raise $1 million and offer 10% equity, you can forecast a post-investment valuation of $10 million, helping you set realistic goals, secure capital, and avoid equity pitfalls.

- Compliance with Legal and Tax Regulations- Maintain strict adherence to legal and tax requirements. Failing to do so could result in substantial penalties. For example, staying compliant with tax laws ensures your company avoids potentially costly tax liabilities and maintains a solid financial foundation.

Leveraging Trends in Cap Table Management

- Cap table management is not static; it evolves with time. Businesses must keep an eye on emerging trends in this critical aspect of corporate governance to remain competitive and efficient. These can be helpful in effective cap table organization for startups.

- Blockchain Integration: Startups are increasingly considering blockchain technology to enhance the transparency and security of their cap tables. For instance, a startup in the renewable energy sector might use blockchain to create digital tokens representing equity ownership. It provides a transparent and tamper-proof record of ownership and facilitates the trading of equity tokens among investors, simplifying raising capital.

- Real-time Updates: Modern cap table management tools, like Eqvista, provide real-time updates. Consider a tech startup that uses such a system. Whenever the startup issues new shares to investors, all stakeholders instantly see the changes on the cap table, ensuring everyone can access the most up-to-date equity information.

- Scenario Analysis: Many startups now employ scenario analysis tools for cap table management. Imagine a biotech startup using such a tool to plan for future financing rounds. By inputting different funding scenarios, they can predict how equity dilution and valuation changes might affect ownership and investor returns, guiding them in making well-informed financial decisions.

- Global Accessibility: Cloud-based cap table management platforms allow stakeholders to access cap tables anywhere. For instance, a SaaS startup with international operations can easily access its cap table for investors, employees, and partners in various countries, facilitating cross-border equity management and promoting global expansion.

Tips for Implementing Cap Table Management Strategies

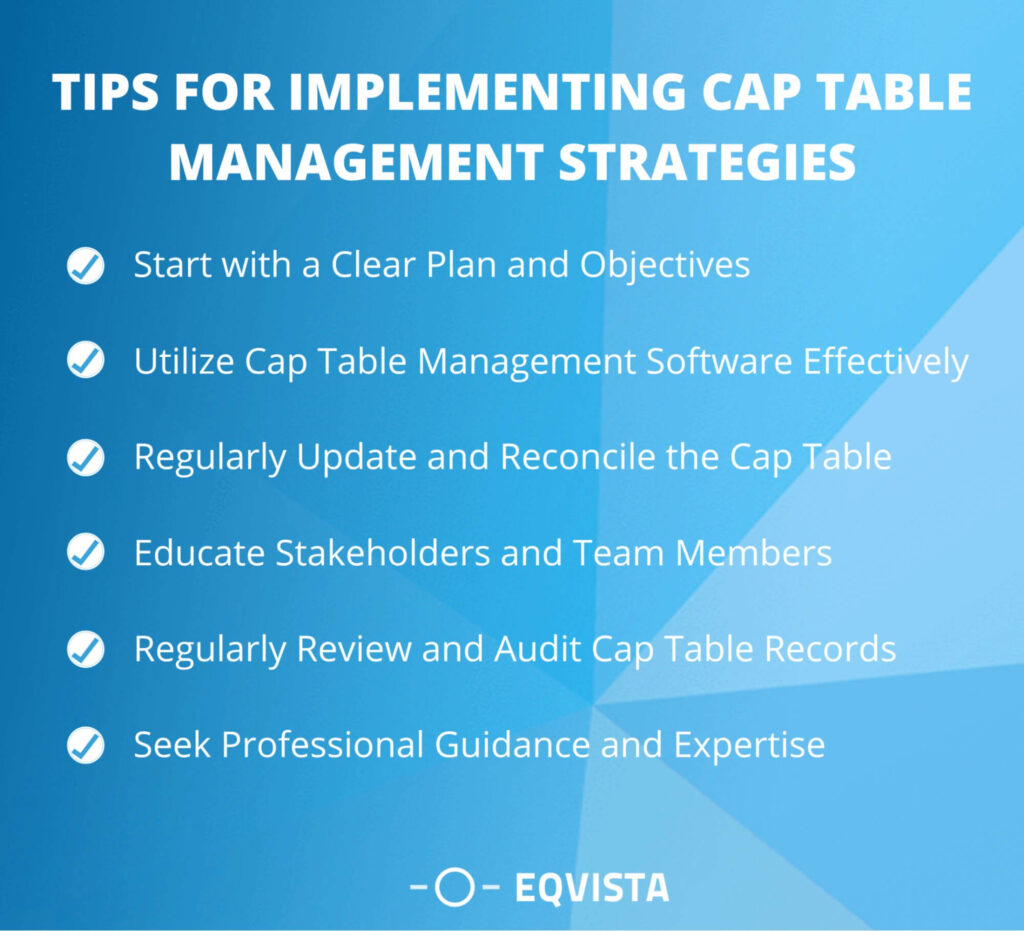

Effective cap table management is critical for businesses, both large and small. Here, we’ll explore key strategies to implement cap table management successfully. Each approach ensures precise tracking of equity ownership, promoting sound financial decisions and regulatory compliance.

- Start with a Clear Plan and Objectives – Cap table management necessitates a well-thought-out plan. Consider a startup aiming to secure Series A funding to preserve founder equity at 80%. This plan allows the startup to make informed decisions during the fundraising process and determine the percentage of equity to allocate to new investors while achieving their objective.

- Utilize Cap Table Management Software Effectively – Using cap table management software is important for error reduction and real-time updates. With this software, you can automate complex equity calculations, such as dilution, and maintain an up-to-date cap table. For instance, Eqvista’s cap table management simplifies issuing new shares, enabling you to update equity records with each investment round instantly. This technology offers significant advantages, saving valuable time and resources.

- Regularly Update and Reconcile the Cap Table – You must update cap tables continuously to reflect any changes accurately. For example, when a startup secures new investors, each shareholder’s ownership percentage changes, and adjustments must be promptly made. Keeping the cap table management current offers real-time insights into equity distribution.

- Educate Stakeholders and Team Members – Everyone involved must comprehend the significance of the cap table. Consider providing educational materials and conducting training sessions. For instance, clarify how equity ownership influences decision-making. If employees are offered stock options as part of their compensation package, ensure they understand the value and implications.

- Regularly Review and Audit Cap Table Records – Frequent reviews help identify and rectify discrepancies in cap table management before they escalate. For example, quarterly audits verify equity records and ensure consistency, aligning your cap table with the actual situation. Consistent reviews and audits foster transparency and accuracy in your financial records.

- Seek Professional Guidance and Expertise – Consult a financial expert like a Certified Public Accountant (CPA) when facing intricate equity issues. They provide guidance and expertise in navigating complex cap table management strategies. For instance, Eqvista’s professional advice ensures accuracy and compliance when dealing with complex financing rounds, safeguarding your startup’s financial foundation.

Start Managing Your Cap Table With Eqvista’s Freemium Package!

Eqvista’s cap table management offers a range of premium features and services,including cap table on boarding services, that helps users in transitioning easily into Cap table management. Also Eqvista’s cap table ensures compliance and accuracy through cap table audit.

Eqvista’s cap table stands out by giving advanced features and services to users. Besides Eqvista offers a free cap table setup valued at 350$. Also freemium plan allows users to sign up for free and later they have the option to upgrade when the company expands.