What is the Gross Profit Margin for Saas and Tech Companies?

Tech companies, especially software-as-a-service (SaaS) companies, have been investor favorites for decades and for good reason. These companies often create a new niche for themselves and are highly scalable.

In this article, we will take a close look at the gross profit margins of such companies, one of their key differentiators in the eyes of investors. We will explore the definition of gross profit margin, how it can be interpreted, and the available alternatives that can provide additional insights. Then, we will move on to examining the average gross profit margins of the top SaaS and tech categories. Read on to know more!

What is the gross profit margin?

Gross profit margin is a profitability metric that considers the direct costs involved in production. To calculate it, you must subtract the cost of goods sold (COGS) from the revenue and divide the result by the revenue. This metric is usually expressed as a percentage.

Formula for gross profit margin:

Gross profit margin = Revenue-Cost of goods sold (COGS)/Revenue

The cost of goods sold (COGS) is calculated based on direct inputs such as raw materials, labor, and manufacturing overhead. In the case of software-as-a-service (SaaS) and tech companies, COGS would include items such as cloud hosting fees, colocation service charges, and salaries of DevOps employees involved in managing and maintaining the platform.

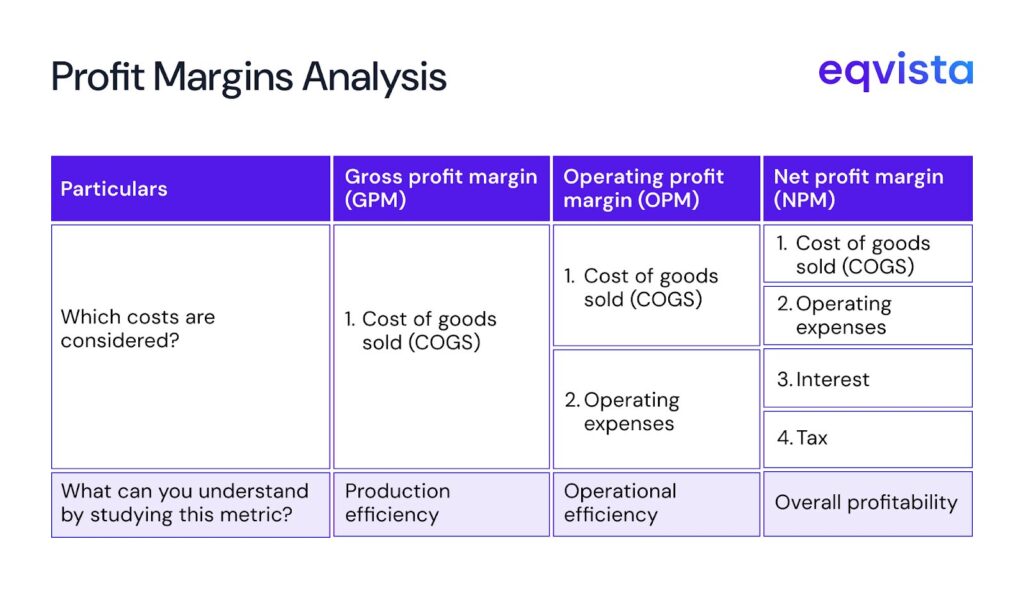

The gross profit margin can help you gain insights about the production efficiency of a business. But for better visibility about a business’s overall profitability, you should consider the operating profit margin (OPM) or the net profit margin (NPM).

By analyzing these profitability metrics, you can understand the production efficiency, operational efficiency, and overall profitability.

At the company level, higher gross profit margins are always preferable. At the industry level, gross profit margin levels can be an indication of the level of competition.

If an industry is highly competitive, the average gross profit margin can be extremely low due to price competition. Conversely, in a monopolistic industry, the gross profit margin can be high due to a lack of price-based competition.

What are the gross profit margins for SaaS and tech companies?

SaaS and tech companies typically have higher gross profit margins than other industries. These companies incur low costs for producing additional units, whether it is another account, another software use license, or some form of digital service.

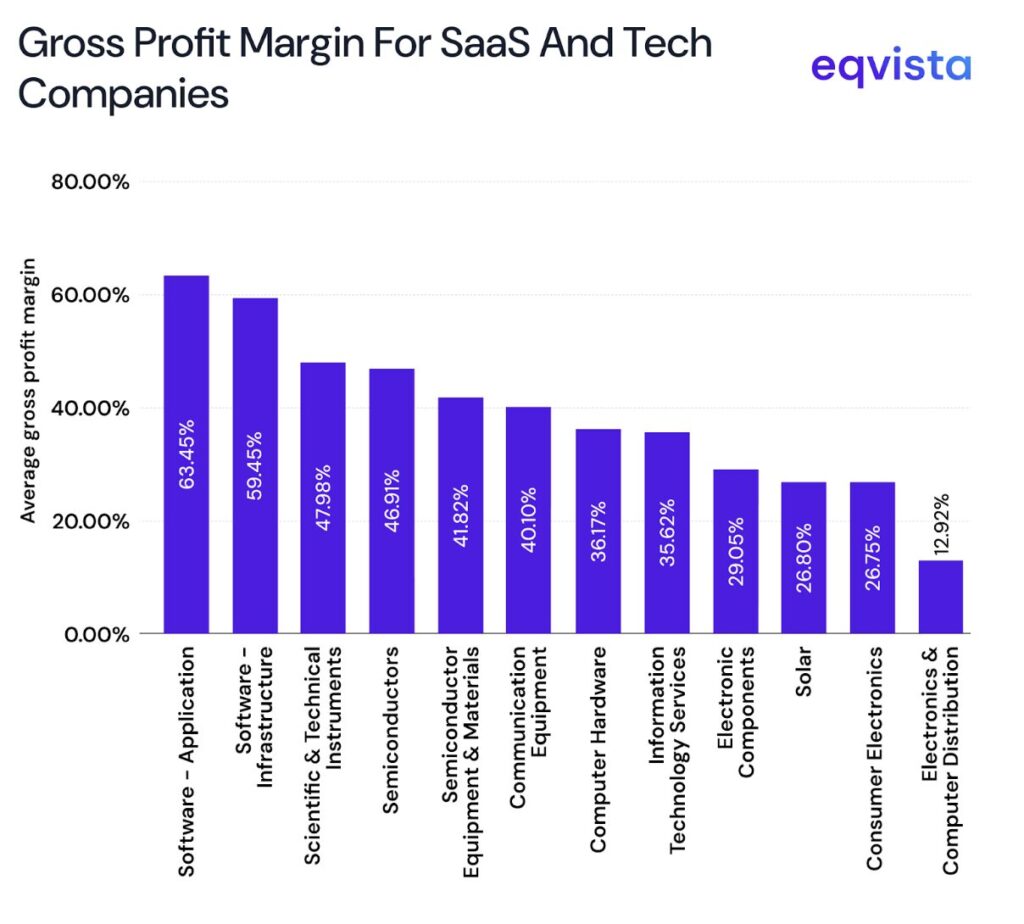

As you can see in the following chart, the average gross profit margin of certain SaaS and tech companies can go above 50%.

High performers – GPM higher than 45%

Software applications and software infrastructure, the frontrunners in the SaaS and tech segment, have some significant similarities in their business models.

Software application companies must make significant research and development (R&D) investments to bring their products to life. Similarly, the software infrastructure companies must build high-end servers, cooling systems, and power infrastructure before they can begin doing business. However, such companies benefit from low marginal costs.

The cost of extending a software service to a new user can be almost negligible compared to the prices charged. Similarly, if a software infrastructure company is not operating at full capacity, it will not incur significant costs to onboard a new client. In fact, additional clients may actually improve its cost efficiency.

There can be a high level of differentiation in the products made by scientific and technical instrument companies. These companies are involved in the production of specialized and hard-to-replicate products. As a result, they can command premium prices.

The semiconductor industry benefits from high demand. Their products are needed in the production of almost all electronic devices. At the same time, since the production requires rare and valuable metals, the supply is often slow to catch up. Thus, because of sustained high demand and limited supply, prices are naturally high in the semiconductor industry.

Average performers – GPM between 30% to 45%

Semiconductor equipment and materials companies produce highly specialized products put to use by a very lucrative industry. Yet, these companies have an average gross profit margin lower than semiconductor companies. This is mainly because 5 companies control 90% of the semiconductor market.

Communication equipment such as routers, base stations, and Ethernet plays a key role in enabling the information technology industry and there is considerable standardization in these products.

There is a high amount of price-based competition in the computer hardware market. At the same time, large companies can access global supply chains that can significantly minimize costs. This results in moderate gross profit margins.

Providing IT services requires a company to hire highly skilled and experienced employees. As a result, the labor costs of these companies can be extremely high. Since these companies can unlock significant value for clients with tailor-made solutions, they can have premium billing rates.

Low performers – GPM below 30%

The electronic components industry is highly commoditized, and the products are easily substitutable. However, the level of competition is also extremely high. As a result, electronic component companies end up being price takers and not price makers.

As concerns over climate change increase, renewable energy sources such as solar energy are attracting a lot of interest. However, lack of land availability, weather-dependent production, and need for energy storage limit the integration of solar energy into existing electricity grids. Individuals and businesses are discouraged by the same factors.

Consumer electronics is another highly competitive market. There is a certain level of product differentiation and brand loyalty commanded by large players such as Apple and Samsung. However, consumers understand product specifications and have access to pricing information. The resulting high substitutability leaves little scope for premium pricing.

Also, retailers and distributors demand significant discounts during seasonal peaks to maximize sales. Thus, due to high competition and dominant downstream players, the margins are low in consumer electronics.

Electronics and computer distribution companies deal with similar challenges as consumer electronics companies. Additionally, these companies cannot differentiate their service beyond the quality of logistics and financing. This kind of differentiation always involves higher costs. Thus, these companies have low margins on account of limited product differentiation and high costs.

Eqvista- Nuanced insights for confident decision-making!

In this article, we saw that not all SaaS and tech companies command high gross profit margins. We discovered that such margins stem from limited price-based competition, strong product differentiation, substantial pricing power, and significant bargaining leverage over suppliers.

While high gross profit margins can indicate advantageous market conditions, they are not a guarantee. Sometimes, competition is based on brand instead of price. In such markets, there is a wide gap between gross profit margins and operating profit margins due to egregious marketing expenses.

For such nuanced valuation insights, consult Eqvista. Our seasoned valuation experts can provide in-depth assessments that enable investors to identify true competitive advantage and craft winning strategies across any industry or market environment. Contact us to know more!