Eqvista Valuation Software now offers a PDF Report

Eqvista is pleased to announce that our startup valuation software now includes a PDF download feature. Users may now quickly obtain their comprehensive valuation report with a simple click of a button. Reports are now more easily accessible, allowing you to keep track of your valuations in one place.

Valuation reports for startups just got easier

Getting a valuation can be time-consuming and costly, which is why we want to make it especially easy for startups to have their valuations done without hassle. With Eqvista’s startup valuation software, not only can you have a valuation report ready in minutes, but you can easily keep track of your past valuations and download the necessary reports with just a click of a button. The reports are available for download in PDF format.

What does the valuation report include?

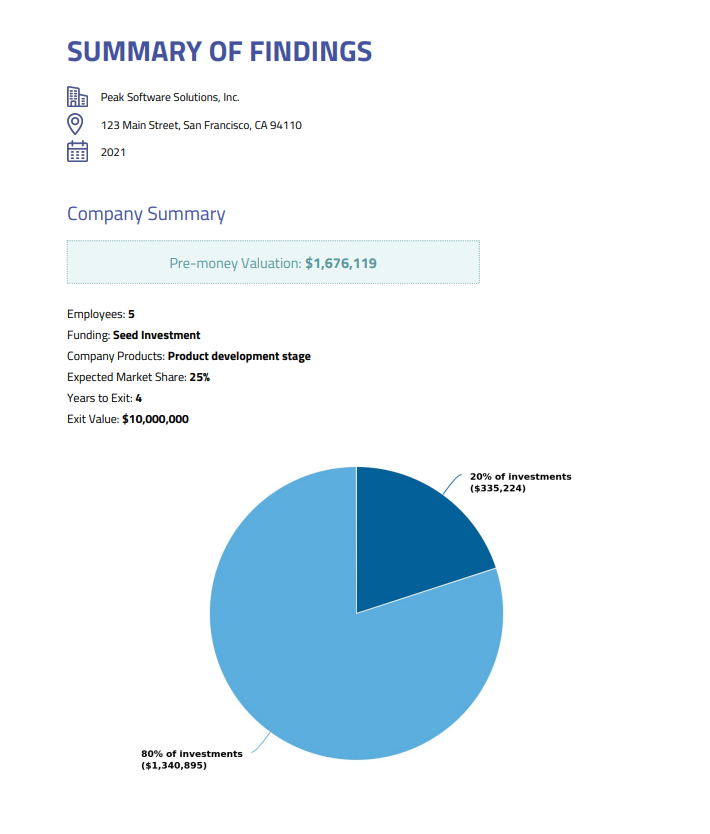

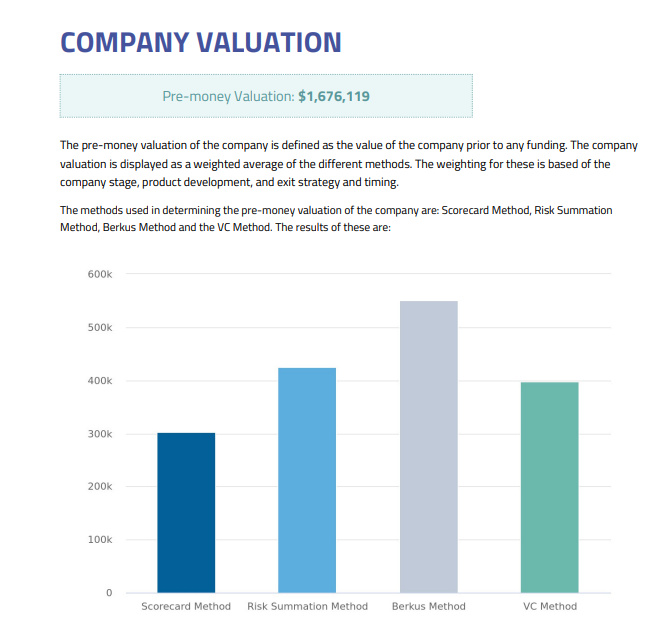

After answering the startup valuation questions, you will be given a brief overview of your valuation. However, this overview is not downloadable and is not comprehensive. With the latest addition to our valuation software, you can download a longer, and more detailed report in PDF format. The report includes default weighting for the company valuation by the stage of development, as well as detailed explanations and graphs of the different valuation methods used in the process:

- Scorecard Method – This method is used to compare target firms to startups that are similar to them in terms of industry, stage of development, and location. You assess the target firm in relation to the median for a number of different variables before adjusting the median.

- Risk Factor Summation (RFS) Method – Used for businesses in their early stages, this method is a crude pre-money valuation technique. The RFS Method values your firm using the base value of a comparable startup. The basic value is modified to account for the 12 common risk variables.

- Berkus Method: This method uses both qualitative and quantitative aspects to compute valuation based on five components in an effort to get around the challenge of measuring something that is not yet feasible to quantify.

- Venture Capital (VC) Method: The VC approach mirrors how investors think, where they aim for an exit in three to seven years. The investment’s anticipated exit price is first estimated. One then works backwards from that point, accounting for time and investment risk, to the post-money valuation as of the current date.

How can I download my valuation report?

You may view your value report after completing the startup valuation questionnaire. The questionnaire contains 30 multiple-choice questions about your company’s management, business, product, market, and sales and marketing. To obtain the whole version of your valuation report, click the “Download PDF” button

Sample PDF Valuation Report

The valuation report is a PDF file that contains numerous pages depending on the amount of information and data available.

Get your startup valuation from Eqvista today!

No need to stress over how expensive and time-consuming getting a valuation is. With Eqvista’s help, you can get a valuation for your startup in about 20 minutes or less. Now with a downloadable and presentable valuation report, Eqvista’s startup valuation is a great tool for funding negotiations and attracting investors. To learn more about our startup valuation, contact us today!