Waterfall Analysis and Cap Table: Determining Equity Distribution

In this article, we discuss how to correctly examine your business operations and expenses before determining the right pricing for your products.

The corporate environment is becoming increasingly competitive. Even though the epidemic is altering how businesses run their daily operations, company owners are still finding methods to compete. But knowing the market and your competitors aren’t always enough. Setting the proper price for your products is critical to maximizing your earning potential. However, it is easier said than done to know how to determine the proper pricing. In this article, we discuss how to correctly examine your business operations and expenses before determining the right pricing for your products.

Waterfall analysis and cap table

A general ‘waterfall’ is a visual representation of the sequential breakdown of a starting value (ex: revenue) to a final result (ex: profit) by depicting intermediate values and ‘leakage’ points. A cap table (also known as a capitalization table) is a spreadsheet for a startup firm or early-stage enterprise that shows all of the company’s instruments, such as common shares, preferred shares, warrants, and who owns them the prices paid by investors. It shows each investor’s share of the company’s ownership, the value of their securities, and dilution over time. In the early phases of a startup or endeavor, cap tables are generated initially before other company documentation.

What is waterfall analysis?

Waterfall analysis is a financial model that is primarily used by the company’s shareholders (founders, investors, and employees), but it can also be used by individuals making significant financial decisions. The waterfall analysis would indicate to each shareholder the amount they will get following the company’s exit or sale.

How does waterfall analysis work?

A waterfall analysis shows the sequential breakdown of a starting value to a final result by exhibiting intermediate values and ‘leakage’ points. Companies can use this to keep track of data at every stage. Waterfall calculations are used to divide cash flow amongst two or more partners based on return parameters that they have agreed upon.

Why do businesses need waterfall analysis?

Waterfall analysis is useful in showing and explaining how different factors contribute to a final result, whether it’s a gain or loss. The analysis can explain deviations, results and differences for executive management and business owners. A waterfall chart can help you find where the profit comes from rather than how much profit you’ve made.

What is a cap table?

A cap table, or capitalization table, is a spreadsheet or table that shows the equity capitalization of a company including startup firms or early-stage enterprises. In the cap table, it shows all of the company’s common shares, preferred shares, warrants and who owns them, and prices paid by investors. In the early phases of a startup or endeavor, cap tables are generated initially before other company documentation. Cap tables become more sophisticated after a few rounds of financing and indicate possible sources of funding, initial public offerings, mergers and acquisitions, and other activities.

How does a cap table work?

In theory, a capitalization table is rather straightforward to comprehend. It’s a physical table that lists all of your company’s shareholders and shows who owns what, how much they own, and how much value is allocated to the shares they do own. Cap tables are crucial for a variety of reasons, but one of the most significant is that they assist investors understand what they’re purchasing and all shareholders keep track of their position as your firm grows.

Why do businesses need a cap table?

Cap tables are important because they show who owns the company and how much of it they possess. This can have an impact on anything, from who controls the company to how future funding rounds are priced. Let’s pretend you’re the company’s creator and you don’t have access to a cap table to guide your decisions. You may end up giving away a large number of shares of your company to your employees or investors, leaving you with far less than you anticipated.

Equity distribution with waterfall analysis and cap table

The cap table must be updated with each new round of funding. The cap table must be adjusted to reflect changes such as issuing additional shares of existing security, increasing or decreasing stock options for employees, and issuing new shares of a security. In addition, the corporation must update the cap table when significant shareholders leave, transfer shares to another current or new shareholder, and terminate or retire personnel. In a liquidity situation, waterfall analysis shows how much each shareholder on the cap table would receive based on the quantity of equity available. Liquidity events are invariably unpredictable, and shareholders cannot know how or when they will occur. Waterfall analysis uses a set of assumptions to calculate the real percentage of proceeds allocated to shareholders if the company is liquidated.

Understand why businesses need waterfall analysis and cap table

It helps if you have actual facts and data for your recommended valuation ready ahead of time. If you do your homework, you’ll be astonished at how little tiny difference adjustments in valuation make for founders, and you’ll be prepared to have an informative conversation with them. It’s probably worth mentioning to the entrepreneur that there are two more benefits to keeping the pre-money low: It makes it easier to attract investors to the round, allowing them to complete the fund-raising process swiftly and return to focusing on the company’s activities. And it means the post-money valuation will be more realistic, which will be less of a yoke around their necks as they face the unknowns ahead and try to explain their valuation for the next round.

Key features you should consider in waterfall analysis and cap table

There are a few key features that one should consider in the waterfall analysis and the cap table management, which are as follows:

- Capital structure – The mix of various sources of external cash, known as capital, used to support a corporation is referred to as capital structure in corporate finance. It is listed in the company’s balance statement and comprises shareholders’ equity, debt, and preferred stock. The exact mix of debt and equity used to finance a company’s assets and activities is referred to as capital structure. From a business standpoint, equity is a more expensive, long-term source of capital with more financial flexibility.

- Equity rights – Any warrants, options, or other rights to subscribe for or purchase, or obligations to issue, any of the company’s equity interests, convertible securities, or stock appreciation rights, including any options or similar rights issued or issuable under any employee stock option plan, pension.

- Exit strategy – An exit strategy is a contingency plan used by an investor, trader, venture capitalist, or business owner to liquidate a financial asset or sell tangible business assets once specified conditions have been fulfilled or exceeded. An exit strategy is a plan for leaving one’s current circumstances, either after achieving a set goal or as a way to avoid failure.

- Types of Shares and equity – The capital of a firm is split into small, equal units of a finite number. A share is a name for each unit. A share is a percentage of ownership in a corporation or a financial asset in basic terms. Shareholders are individuals who own shares in a corporation. Before any dividend is paid to equity owners, cumulative stockholders have the right to obtain dividend arrears.

How do waterfall analysis and cap tables work?

Waterfall analysis uses a set of assumptions to calculate the real percentage of proceeds allocated to shareholders if the company is liquidated. The accounting ownership of individual shareholders, which is the real ownership proportion, is often shown in the cap table.

- Vest Options – The process by which an employee obtains a “vested interest” or stock option is known as vesting. An option writer is a person who sells stock options and is paid a premium from the contract purchased by the stock option buyer, in their company.

- Accelerate options – Acceleration does not imply that all of your options will be exercised. When you have full acceleration, all of your stock options vest at the same moment as the trigger. Acceleration clauses, on the other hand, can limit acceleration to a certain area of your options.

- Exit planning – Exit planning is the process of preparing an entrepreneur to leave his company in order to maximize the enterprise value of the company in a mergers and acquisitions transaction and thus his shareholder value, though other non-financial goals such as the company’s transition to the next generation may be pursued.

Liquidation waterfall analysis example

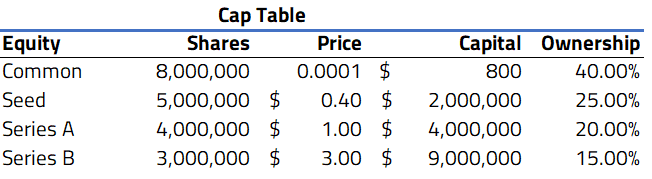

Let’s take a look at a sample company, Kertzmann Group, which underwent Series A and Series B rounds recently. Here is a basic look at their cap table:

This company has four equity classes as: Common shares, Seed Preference Shares, Series A & Series A-1 shares. With the share prices coming in at $0.40, $1.00 and $3.00 for the Seed, Series A and Series B rounds respectively, the total investment in the company was around $15,000,000.

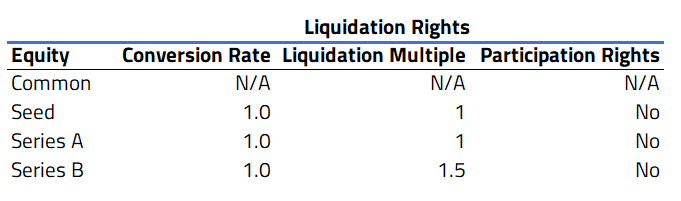

Here is a look at the liquidation preferences for each:

For all the preference shares, they have a conversion rate of 1.0. However, for liquidation multiples, Series B has a multiple of 1.5. In order to keep this example fairly simple, the preference shares do not have participation rights.

Let’s say the company was offered an acquisition price of $50,000,000, and would like to calculate how much each equity holder would receive in case of this buyout.

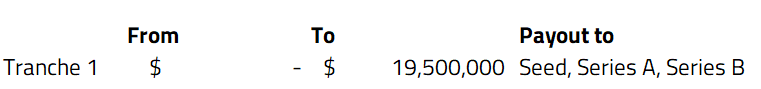

After finding the rights of each equity, you would need to determine how the liquidation waterfall would work in the case of an exit. For this we must calculate breakpoints for each, and a “tranche” for the range of when equity classes would flow down the waterfall.

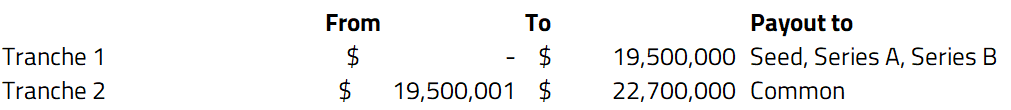

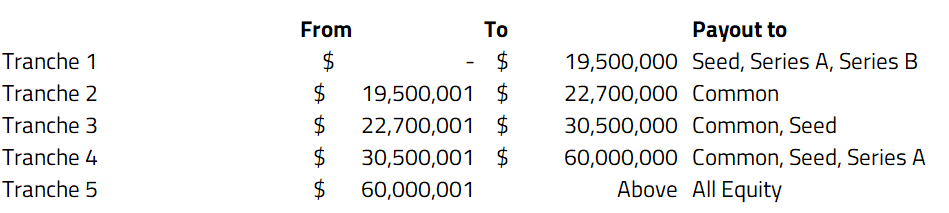

For calculating the first tranche, this would be the total liquidation amount each preference shareholder receives, or for Seed of $2,000,000 x 1 (Capital x liquidation multiple + Series A of $4,000,000 x 1 + Series B of $9,000,000 x 1.5=$19,500,000.

So the first Tranche would look like:

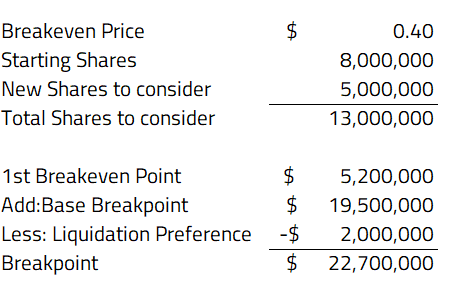

Then for the next Tranche, you would need to find the preference equity class with the lowest share price, and find out in a hypothetical situation, when they would choose to convert their preference shares to common shares at their share price. In this case, it would be the Seed preference shares at $0.40.

The basic formula would be:

For the 2nd Tranche, it would look like this:

So basically any level below the breakpoint of $22,700,000, the Seed shares would be receiving < $0.40, so it would not make sense for them to convert. Once we have this amount, we can fill in the Tranche 2 values:

Then you follow this formula and calculation to fill out the rest of the breakpoints and tranche values according to the company’s cap table:

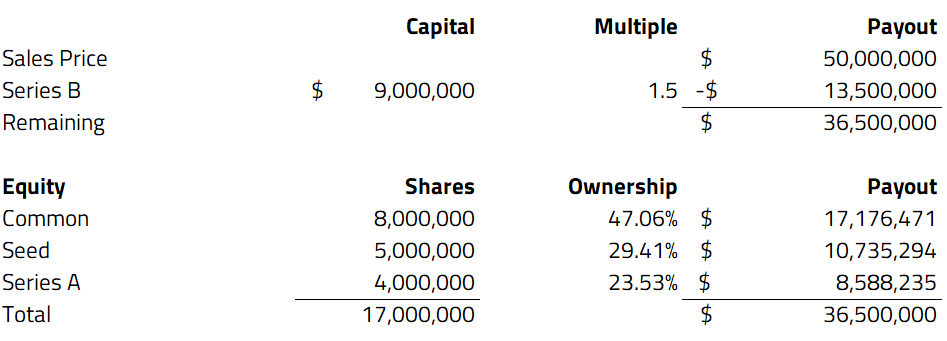

Following the $50,000,000 acquisition price, we can see this would fall within Tranche 4. This would mean it’s better for the Common shares, Seed & Series A to convert to common shares to receive the highest payout. Since the price is below the tranche 5 value of $60,000,000, then it would be better for Series B to only receive its liquidation value and not convert.

We can see this from the calculations below:

So under a $50,000,000 exit value, the Series B would receive $13,500,000 (capital x 1.5), Common would receive $17,176,471, Seed would receive $10,735,294 and Series A would receive $8,588,235. This is an example of how a waterfall analysis and cap table work, and how much each shareholder would receive according to the company’s cap table and exit price.

Why is Eqvista the best platform to distribute your business’s equity?

We have a team of experts who can help you in the distribution of your business equity. We have equity management software that aids in the management of a company’s equity. Businesses who utilize the best equity management software, often known as cap table software in the industry, use it to track and manage their company shares. This makes a complicated procedure much easier for businesses. Issuing grants, managing corporate records and documentation, staying in compliance with laws and regulations, and disseminating information about the cap table are all procedures involved in equity management are some of our services. Contact us today to learn more!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!