Should Startup Employees Have Access to the Cap table?

Employee equity management is an important part of business strategy.

A cap table is a game-changer for monitoring and overseeing who owns what in a company! This is pivotal for both founders and investors, as it provides a clear insight into the company’s ownership structure and assists in making well-informed decisions regarding equity matters. They also aid in financial planning, market value assessment, and preparation for new funding rounds for startups and early-stage companies.

The question of whether startup employees should have access to the cap table is a complex and debated issue. Let’s learn more about how this approach can really enhance employee engagement and trust while protecting the company’s sensitive information.

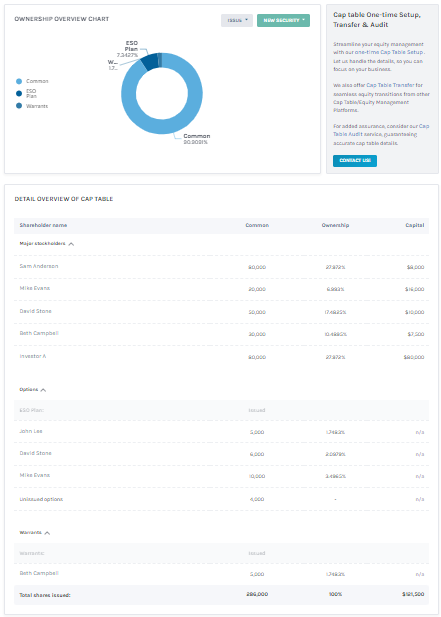

Cap Table

Before we delve deeper into the issue of cap table access, let’s try to demystify the concept of cap tables. This is a widely used term in startup circuits and is the first thing investors question during a funding round. Then what exactly is a cap table for startups and why are they crucial for a business?

What is a cap table?

A cap table is a comprehensive document that details equity ownership in a company. The moment a startup sets aside an option pool and is ready to issue equity to employees, cap tables come into play. Gradually as external funding rounds happen, investor’s shareholding details are also populated into the cap table. At any point in time, a quick reference to a cap table provides a snapshot of the market value of a company.

In the initial stages of a business with a few shareholders, cap tables are maintained manually on a simple excel sheet. The Y-axis carries the names of stakeholders and the X-axis lists the corresponding details of their shareholdings. A cap table must contain details of all types of shareholders – common shares, preferred shares, warrants, convertible notes, and their respective share prices as well. Cap tables are the cornerstone for fundraising activities and employee equity management.

Why are cap tables important for a startup?

Cap tables are the go-to document for any equity-related decision. It is the only comprehensive document that provides all details of a startup’s shareholdings in one place. Here are the most important reasons for having a cap table for a startup:

- Cap tables help maintain the calculation of market value. Every shareholder reporting and new capital issuance is done by referring to the cap table.

- Existing shareholders have a clear idea about how much dilution can be afforded for new investors

- Potential investors can estimate the existing level of shareholdings and the leverage they might have if they decide to come on board.

- Employee equity management becomes a transparent process. Employees holding shares can see their value in real-time

- A historical insight into cap tables provide a sense of the business health and could provide the much needed competitive advantage at attracting investors.

- A well-organized cap table enables the audit and legal teams of the startup to establish the value of the business by reporting best practices.

Employee Equity or Equity Compensation in Startups

Equity compensation in startups is a trend these days. Especially in the US market that enables and nurtures startups, hiring top professionals using lucrative equity compensation has become a norm. Salary packages are no longer about how much, rather what matters is the cash to equity ratio.

What is employee equity compensation?

When a company offers equity to employees as part of their compensation package, it is known as employee equity compensation. It is seldom a stand-alone component. Equity is mostly granted in addition to a basic salary in cash. It is a good recruitment and retention tool, especially for startups that invariably struggle with cash flows in the early stages of operation.

Equity compensation in startups can be in the form of common shares, preferred shares, warrants, or bonds. But the one used exclusively for employees is common shares. Equity grants are always accompanied by vesting schedules that ensure that employees receiving company stock have served time contributing to the business. Based on the position offered, the percentage of employee equity varies with every case.

Types of equity compensation

Equity compensation in startups is regulated by IRS and SEC guidelines. Thus companies must hire a professional team of HR and legal personnel who are well equipped to handle employee equity. Certain processes need to be followed while issuing equity to employees. Each one has its own tax implications. The two main categories of equity compensation are:

- Stock options – This is the commonly granted equity to employees. At the time of grant, an employee is granted the right to purchase a certain percentage of company stock at a predetermined price known as the exercise price or strike price. The idea is that over the years, the company’s share value will increase and later when the employee chooses to exercise their options, they will profit from the price differential created by the actual share value. Thus with stock options, employees are granted the right to purchase stocks at a special price and not the stock itself. Stock options are subject to vesting schedules and cliff periods.

- Restricted stock units – This category of equity compensation in startups is reserved for top executives. In this case, the grantee receives the entire stock in one go. They are not required to buy any stocks. These are well suited as incentives and starting bonuses for high flying professionals. However, vesting schedules apply here as well, no matter how short they are.

Startup Employee Equity Management

Employee equity management involves the utmost precision and meticulous work. Manually managing employee entry, premature exits, and multiple investor exchanges all on a single excel sheet is a highly risky prospect. Even the minutest of error or miscalculation in the cap table can send the entire equity structure of a startup into a spiral. This may have legal implications as well. Thus the trend in equity management today is the replacement of excel sheet cap tables with automated software. Here is why:

Why use equity management software instead of excel sheets?

The idea behind a cap table for startups is to consolidate all equity-related information in one place. This data is highly sensitive and informs the financial strategies of a startup. Now imagine how risky it is to maintain this massive chunk of data on a spreadsheet that anyone can access and manipulate if needed! Hence the shift towards automated cap table software.

The best cap table software in the market is highly sophisticated and offers a spectrum of services that go beyond simple cap table management. Pioneers such as Eqvista are thus rightly referred to as equity management software. The top advantages of relying on cap table software are:

- User-friendly interface allowing customized access to equity holders – employees and investors alike. This is not possible with just excel sheets.

- The risk of entering improper data is minimized by built-in checks.

- Issuing equity is just a matter of a few clicks. This software also allows the issuance of electronic share certificates.

- All equity-related data and documents are available for quick access.

- Complex calculations such as estimating the fair value of shares based on multiple factors such as discount rates, equity value and much more can be done easily using this software.

- Master controls are provided only to pre-authorized personnel. Thus equity data is well guarded.

Pros and Cons of Granting Startup Employees Access to the Cap Table

While both sides have valid arguments, many startups opt for a middle ground. They provide employees with information about their equity stakes and the company’s overall structure without granting full access to the entire cap table. This approach balances transparency with the need to protect sensitive information. Additionally, cap table management software can help provide customized, limited access to employees while maintaining confidentiality.

Here are the key pros and cons of granting startup employees access to the cap table:

| Cons of cap table | Pros of cap table |

|---|---|

| Confidentiality concerns: The cap table contains sensitive business information that startups may want to keep private, especially from competitors. | Employee empowerment: Employees can see their equity stake and its real-time value, helping them understand their ownership in the company. |

| Salary comparisons: Revealing equity information is like publishing salary details, which can lead to workplace tensions and comparisons. | Transparency: Providing access to the cap table can create a more open and transparent company culture, aligning with startup values. |

| Misinterpretation: Employees without financial expertise may misinterpret the information, leading to confusion or unwarranted concerns. | Motivation: Seeing their stake in the company's success can motivate employees to work harder and more committed to long-term goals. |

| Counterproductive effects: Since not all employees receive the same equity percentage, revealing this information could be counterproductive and potentially harm company morale. | Alignment of interests: By providing access to the cap table, it helps to align employee interests with those of founders and investors, as everyone can see how their efforts turn to the company's overall value. |

| Potential for information leaks: Wider access increases the risk of sensitive cap table information being leaked outside the company. | |

| Administrative burden: Maintaining and updating access for all employees can be time-consuming, especially for early-stage startups with limited resources. |

Should Employees Get Access to the Company Cap Table?

This is one of the most heavily debated topics in the startup world. How transparent can a startup be with employee equity information? Employee equity management is an important part of business strategy as well. Does it make sense to make such data a free source? Here are some pointers in this direction:

- Employee equity is salary. Though cash-less, it is still part of the salary structure in the form of equity compensation in startups. Thus revealing this information is as good as publishing salary details of all employees, which for sure does not make sense.

- Employees need to know how much equity they own, its real-time value, and the extent of preference preceding them. As long as this information is provided, not much is required to be shared. It is difficult to provide customized access using excel sheets. But cap table software provides this personalized feature to every employee.

- A select category of staff such as the board members, CFO, key members of the finance team, legal team, and investors with significant information rights can be allowed to access startup cap tables. These people are key to drive business and need to know cap table status to plan a secure financial future for the startup.

- Though it is debated that granting all employees access to the cap table creates an open and fluid environment in sync with the startup culture, considering not all employees are granted the same percentage, revealing the cap table will be counterproductive. Only the hiring team understands the discretion behind granting variable equity structures for employees. Such sensitive data thrown out of context will only harm the company.

Levels of Access to the Cap Table

The decision on how much cap table access to grant employees is not just a choice, but a strategic one of significant importance, each company must make based on its unique circumstances and goals.

The level of access granted often depends on factors like:

- Stage of the company (early-stage startups tend to be more open).

- The employee’s role and seniority in the company

- Company culture and transparency philosophy

- Legal and compliance considerations

There are typically different levels of cap table access that companies can grant to employees:

- Limited personal access – Employees can view only their own equity information, such as the number of shares they own, vesting schedule, and current value.

- Partial access – Key employees or executives may be given more detailed information about the company’s capitalization but not full access to the entire cap table.

- Full access – Generally reserved for founders, board members, CFO, and select members of the finance and legal teams. This provides complete visibility into all equity ownership details.

- No access – Some companies do not share cap table information with most employees beyond their personal equity grants.

While full transparency can promote trust, there are reasons why companies may limit access:

- Protecting sensitive financial information

- Avoiding potential conflicts or comparisons between employees

- Simplifying equity management as the company grows

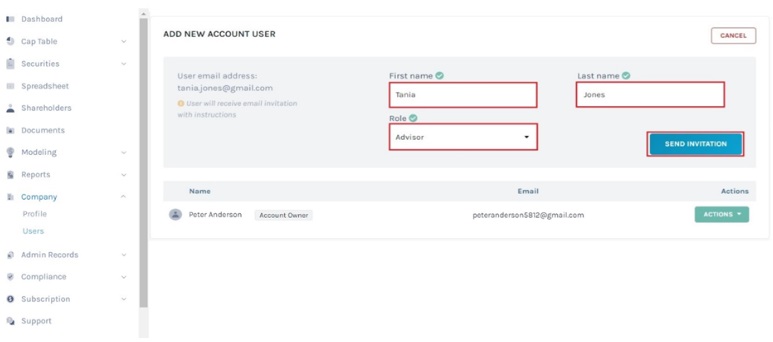

Many companies use cap table management software like Eqvista, that allows for customized access levels, making it easier to control what information each employee or stakeholder can view.

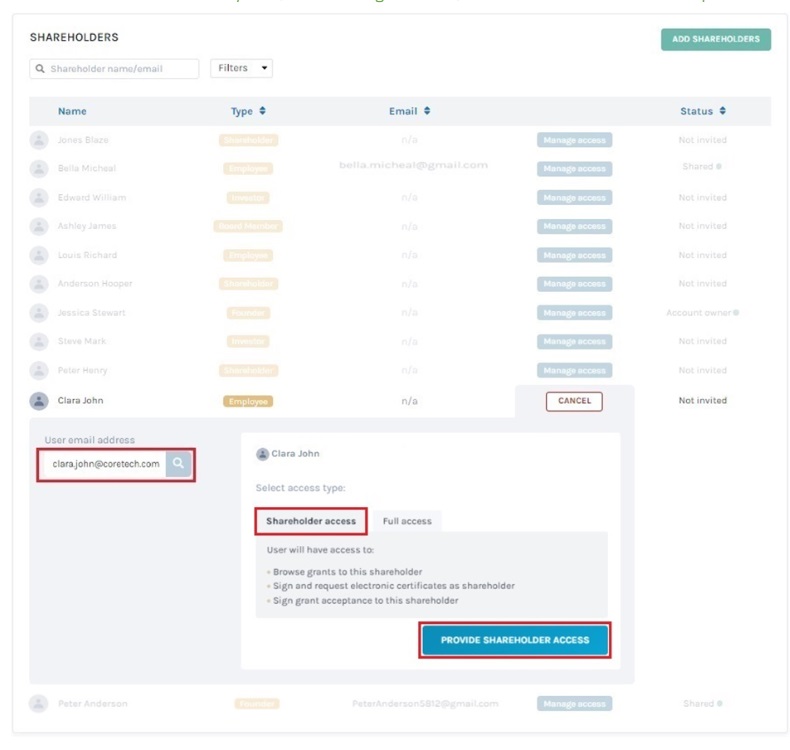

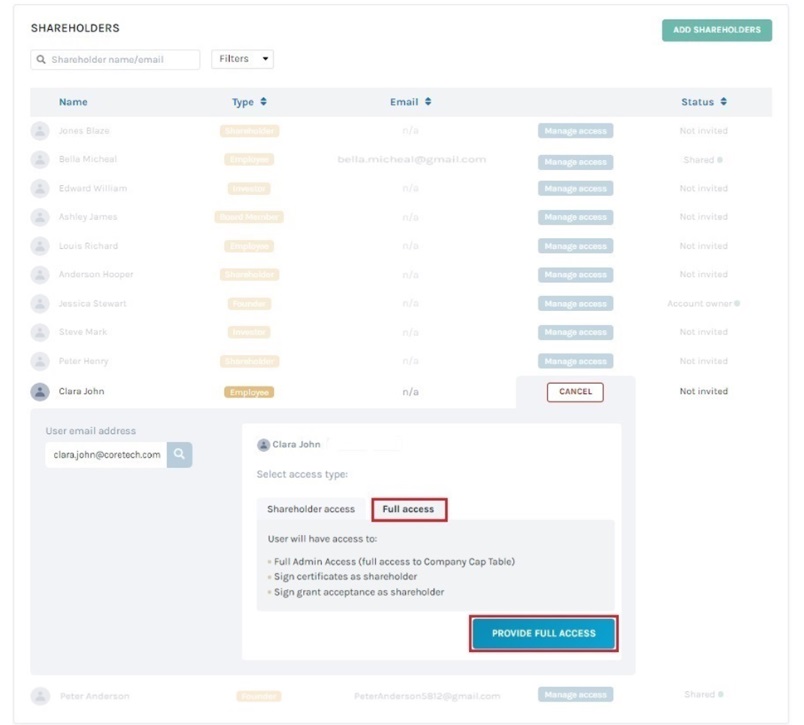

Create and Easily Share Access to Startup Cap Table on Eqvista

Eqvista’s software aims to balance transparency with confidentiality. It allows startups to share appropriate levels of cap table information with different stakeholders while maintaining control over sensitive financial data. The platform’s customizable access features enable companies to tailor cap table visibility based on organizational roles and needs.

Eqvista offers different levels of access to a startup’s cap table:

- Customized access – Eqvista allows companies to provide customized access to their cap table, enabling them to control what information each employee or stakeholder can view.

- Employee access – Employees can see their own equity details and some aggregated data about the company’s overall equity structure. This typically includes information like the number of shares they own, their vesting schedule, and the current value of their options.

- Founder/executive access – Founders and key executives likely have full access to all cap table information through Eqvista’s platform.

- Investor access – Investors can be granted appropriate levels of access to view relevant ownership information

Try the Eqvista platform

Eqvista is one of the market leaders in cap table software. It is one of the most powerful share management platforms in the market today. Our top features include:

- Possibility of managing unlimited companies using a single account

- Easy, customized access to the cap table

- The issue, record, and manage convertible notes, KISS, SAFE, all in one place

- Sophisticated equity plan management

- Easy management of employee stock options

- Waterfall analysis

- Financing rounds modeling

A New Definition to Cap Table Management – Eqvista

In short, while cap tables are not directly related to employee engagement, transparency around company ownership can contribute to employee engagement and trust. The level of transparency around ownership information should be carefully considered based on the company’s culture, stage, and goals.

Eqvista is an advanced cap table management and equity administration platform created to assist companies in efficiently issuing, managing, and tracking their shares. The cap table solution offered by Eqvista is tailored to simplify equity management for companies of all sizes, ranging from early-stage startups to pre-IPO companies. With a comprehensive set of tools for managing shares, valuations, and compliance, Eqvista aims to streamline the often intricate process of equity administration. Contact us today to learn more about managing your cap table!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!