How do Liquidation Waterfalls Work?

The technique by which capital is allocated to a fund’s numerous investors as underlying investments are sold for gains is referred to as a distribution waterfall.

Liquidation preference is one of the most essential phrases in venture capital investment, second only to price/valuation. Having a thorough grasp of liquidation preference as a startup company founder is critical, as it could mean the difference between receiving any funds from a firm sale or not. The approach of establishing a valuation range for a debtor in order to evaluate the projected recovery of approved claims is known as liquidation value. To confirm that the recoveries from the reorganization are more than the liquidation value, the recoveries from the liquidation are compared to the recoveries from the reorganization.

Liquidation waterfalls

The technique by which capital is allocated to a fund’s numerous investors as underlying investments are sold for gains is referred to as a distribution waterfall. The total capital gains produced are dispersed according to a cascading system made up of successive layers, which is why the term “waterfall” is used. The liquidation preference is the investor’s placement at the top of the waterfall to ensure that if any proceeds remain for shareholders, they will be able to recover some or all of their invested capital before the other shareholders.

What is a liquidation waterfall?

In some cases, a firm or a startup may need to be liquidated or sold to another organization. Investors in the corporation must be reimbursed for their stake in the company in such circumstances. The term “liquidation waterfall” refers to how existing shareholders will be reimbursed in the case of a company’s liquidation. The liquidity waterfall is critical because it might be the difference between a large return and no return for an investment.

Understand the difference between preference and ordinary shares

Preference shares are a type of financial instrument used by businesses to raise funds for their operations. They are general exclusive share options that allow a company’s shareholders to receive dividends before equity stockholders when they are announced. It also gives them a specific right to dividends during the business’s lifetime, as well as the option of requesting capital payback when the firm closes. Preference shares are regarded as a hybrid instrument since they have the characteristics of both debt and equity investments.

Preference share capital is the capital raised by a corporation by issuing preference shares (to individuals and investors). Ordinary shares are a type of financial instrument used by businesses to raise capital for both short and long-term operations. Shareholders (both individuals and corporations) have the right to vote and participate in the company’s management.

They do, however, receive dividends on their shares after preference from shareholders and only if the company is profitable. In the event that the company goes bankrupt, they have the final right to claim capital payback. Ordinary shares are equity investments. The capital raised by an organization by issuing ordinary shares is referred to as equity share capital. Ordinary shareholders, like preferred shareholders, are also owners within the organization.

What is a liquidation preference?

A liquidation preference is a contractual clause that allows an investor to receive preferential rewards if the firm is sold or undergoes another “liquidity event”. For example, an investor who owns preferred stock with a liquidation preference may earn a portion of the profits before common stockholders, who often include the company’s founders and workers, can sell their shares. If the return amount is insufficient to compensate all current stockholders fully, liquidation preferences can increase the likelihood of the investor receiving a portion of their investment returned.

How does the Liquidation preference work?

A liquidation preference provision determines the order in which investors are paid back following a liquidity event. These clauses are intended to protect you from losing money if you sell for less than you planned. Because when firms fail or are sold for less than their valuation, there may not be enough funds left to repay all investors, the payout order is critical. Liquidation preferences ensure that liquidation preferences holders are made “whole” before common shareholders can sell their stock. A liquidation preference agreement is one of the most crucial clauses in a term sheet for VCs and founders because of the direct impact on returns distribution. Because it requires founders and investors to face the possibility of failure head-on and allocate that risk among the various stakeholders involved, it’s often a matter of careful negotiation.

Types of liquidation preference

A liquidation preference is a provision designed to safeguard investors in the event that a firm leaves at a lower value than anticipated. Here are the four types of the liquidation preference:

- Participating – Investors with a full participating liquidation preference (also known as “participating preferred” “full participating preferred” or “participating preferred with no cap”) receive their full liquidation preference before anything is available for distribution to common stockholders and (ii) their pro-rata share of any leftover proceeds alongside common stockholders during a liquidity event. A complete participating liquidation preference allows investors to obtain twice as much from the profits as a non-participating liquidation preference, but it is less typical.

- Non participating – Non-participating preference (also known as “straight preferred”) stockholders have the option of receiving an amount equal to the liquidation preference multiple, plus any unpaid dividends, during a liquidity event or converting their preferred shares into common stock and participating in the liquidity event as if they were common shareholders. If there are sufficient returns to distribute to investors, converting to common stock and receiving the price per share for that stock may be worthwhile.

- Conversion rights – Conversion Rights and Liquidation Preference “Conversion rights” are used to do this. Conversion rights allow an investor to convert her preferred shares into the same percentage of common shares that she owns. There is no liquidation preference or participation rights for common shares.

- Multiples – Liquidation preferences are frequently expressed as a multiple of the original investment amount, such as 1x or 2x. The most typical liquidation preference is 1x. An investor with a 1x liquidation preference receives their entire investment back before any shareholders lower in the priority stack get paid. A liquidation preference of more than 1x, such as 2x or 3x, is less prevalent. Before any shareholders below in the preference stack receive anything, an investor with a 2x liquidation preference receives double their original investment amount.

How does a liquidation waterfall work?

Upon a “liquidation event” the liquidation preference specifies the sequence in which the company’s funds will be distributed among holders of its various classes of shares. The term “liquidation waterfall” is also used to describe this notion. The original acquisition price of the eligible shares of preferred stock is normally multiplied by the liquidation preference.

A 1x liquidation preference means that holders of the corresponding series of preferred stock will get their money back before junior preferred stock or common stockholders. A 2x liquidation preference means that holders of the relevant preferred stock series will receive a two-fold return on their investment before anyone below them on the liquidation “waterfall” is paid.

Liquidation preferences are normally only 1x in a company-friendly fundraising environment. In weak markets, when startup firm investments are intrinsically riskier, and investors have more power, you’ll find 2x and even 3x liquidation preferences.

Clauses of liquidation waterfall and how they work

A liquidation preference is a contract clause that specifies the payout order in the event of corporate bankruptcy. In the event that the company must be liquidated, investors or preferred shareholders typically receive their money first, ahead of other types of stockholders or debtholders.

- Liquidation preference – A liquidation waterfall is a sort of scenario modeling used to calculate each investor’s payoff in the case of a liquidation. A liquidation preference is a contract clause that specifies the payout order in the event of corporate bankruptcy. In the event that the company must be liquidated, investors or preferred shareholders typically receive their money first, ahead of other types of stockholders or debtholders.

- Participating preference – Participating preferred stock is preferred stock that pays a certain dividend before common stockholders receive dividends and takes precedence over common stock in the event of a liquidation. Private equity investors and venture capital businesses use this type of financing.

- Participation cap – A cap on participation limits the amount obtained by the preferred stock. The cap is usually set at a multiple of the initial investment, like 2x or 3x. Once preferred stock investors have received the cap amount, they will no longer be eligible for common stock distributions.

Snapshot of Waterfall example

In the event of a liquidation event, the number of proceeds is guaranteed to the investor before the common shareholders. This can be expressed as a multiple of the amount invested in the firm, but it is normally limited to 1x, given that this clause was established to protect investors in the event that the company was sold for less than planned. A 1x liquidation preference ensures that the investor gets back at least the amount they put in.

Let’s use an example to demonstrate this. MPG, a venture capital firm, invested $3 million in FW, a fintech company, for a 40% ownership. Assume there is no preferential participation, and MPG is the sole shareholder in FW.

As can be shown, despite owning a 40% share in FW, MPG took home more than 40% in each scenario. MPG keeps everything in the last case, leaving nothing for the FW founders.

Non-participating preferred refers to preferred shareholders who only have a liquidation preference. If the payment from common stock is greater than the liquidation preference, the investor may choose to convert to common stock. If MPG is sold for more than $7.5 million, their 1x liquidation preference stock will be converted to common stock.

How does liquidation waterfall influence investors?

It’s essentially a way for an investor to ‘double-dip’ at the expense of others. In addition to earning a larger percentage of the company in the event of a winding-up or a fire sale, the investor can also receive a larger proportionate part of any proceeds in a profitable sale event. The investor enjoys downside protection and disproportionate upside in terms of capital rights.

When an investor receives a non-participating liquidation preference, the outcome is that the investor will get a payment per share equal to the subscription price paid up plus any dividend arrears payable on those shares by the company, in priority to others. The remaining funds (if any) are distributed to the other stockholders.

Liquidation waterfall analysis example

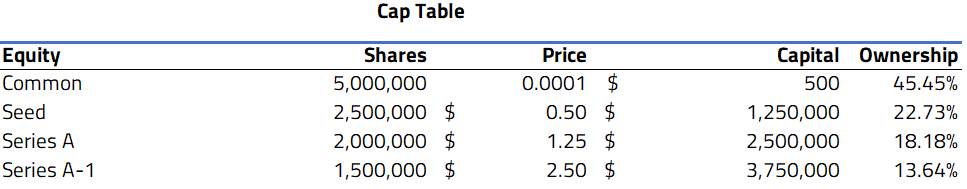

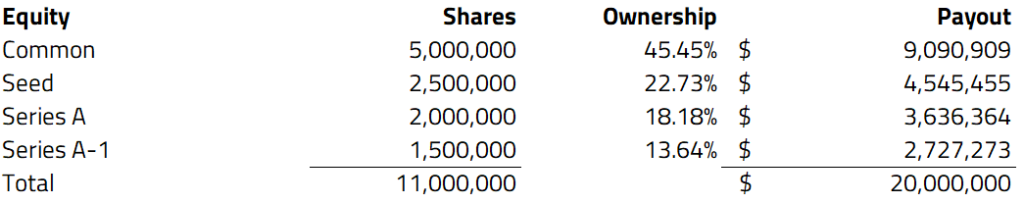

Let’s take a look at a sample company, McGlynn Ltd, who underwent a Series A and Series A-1 round recently. Here is a basic look at their cap table:

As you can see the company has four equity classes as: Common shares, Seed Preference Shares, Series A & Series A-1 shares. With the share prices coming in at $0.50, $1.25 and $2.50 for the Seed, Series A and Series A-1 rounds, the total investment in the company was around $7,500,000.

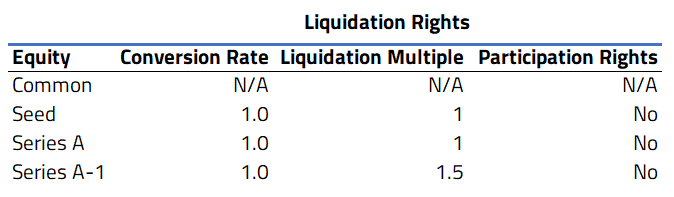

Here is a look at the liquidation preferences for each:

For all the preference shares, they have a conversion rate of 1.0. However in terms of a liquidation multiple, ie. the multiple on how much each investor would get back in case of a liquidation, Series A-1 has a multiple of 1.5. In order to keep this example fairly straightforward, the preference shares do not have participation rights.

Let’s say the company was offered an acquisition price of $20,000,000, and would like to calculate how much each equity holder would receive in case of this buyout.

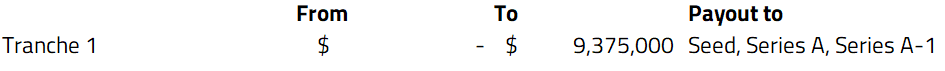

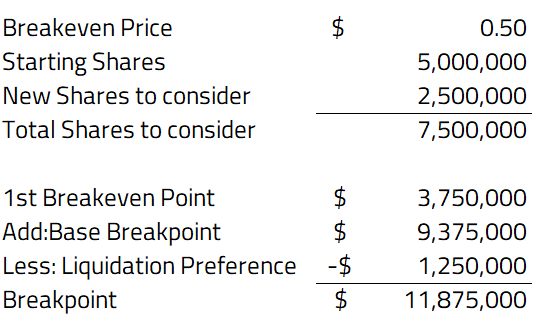

After establishing the rights of each equity, it’s time to determine how the liquidation waterfall would work in the case of an exit. For this we must calculate breakpoints for each, and a “tranche” for the range of when equity classes would flow down the waterfall.

For calculating the first tranche, this would be the total liquidation amount each preference shareholder receives, or for Seed of $1,250,000 x 1 (Capital x liquidation multiple + Series A of $2,500,000 x 1 + Series A-1 of $3,750,000 x 1.5=$9,375,000.

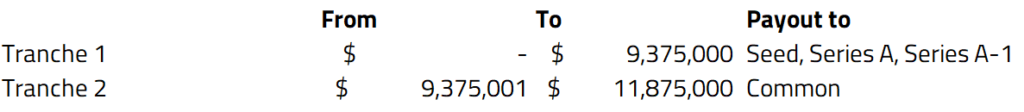

So the first Tranche would look like:

Then for the next Tranche, you would need to find the preference equity class with the lowest share price, and find out in a hypothetical situation, when they would choose to convert their preference shares to common shares at their share price. In this case, it would be the Seed preference shares at $0.50.

The basic formula would be:

For the 2nd Tranche, it would look like this:

So basically any level below the breakpoint of $11,875,000, the Seed shares would be receiving < $0.50, so it would not make sense for them to convert. Once we have this amount, we can fill in the Tranche 2 values:

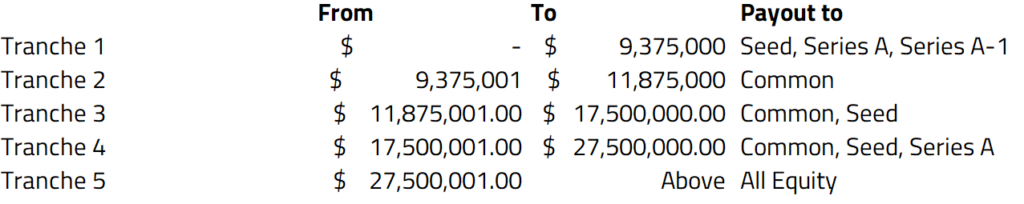

Then you follow this formula and calculation to fill out the rest of the breakpoints and tranche values according to the company’s cap table:

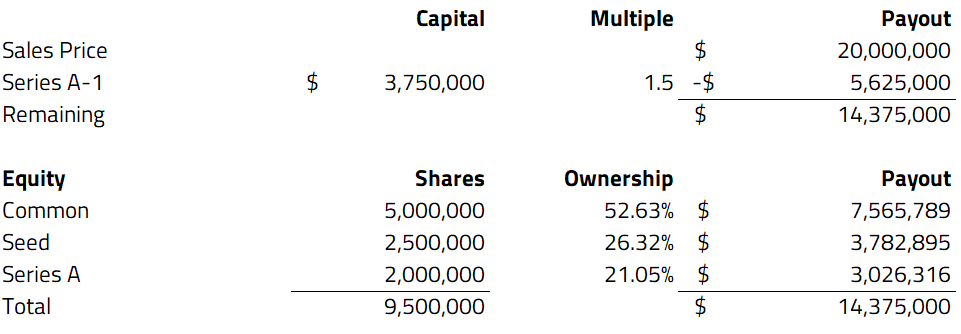

Following the $20,000,000 acquisition price, we can see this would fall within Tranche 4. This would mean that it’s better for the Common shares, Seed & Series A to convert to common shares to receive the highest payout. Since the price is below the tranche 5 value of $27,500,000, then it would be better for Series A-1 to only receive its liquidation value and not convert.

We can see this from the calculations below:

So under a $20,000,000 exit value, the Series A-1 would receive $5,625,000 (capital x 1.5), Common would receive $7,565,789, Seed would receive $3,782,895 and Series A would receive $3,026,316.

We can test this with a hypothetical scenario that all equity holders convert to common stock with the $20M price, as below:

From this scenario, that Series A-1 would receive only $2,727,273, much less than their liquidation preference payout of $5,625,000 ($2,897,727 less to be precise).

This is a good example of how liquidation waterfalls work, and how much each shareholder would receive according to the company’s cap table and exit price.

Do your accurate waterfall analysis with Eqvista’s software!

When a cap table is not correctly managed, starting a firm and managing a cap table for an organization becomes complicated. As the cap table becomes more sophisticated, the risks of making mistakes increase, potentially affecting the management of your company’s shares. That’s why we’d like to introduce Eqvista, a share management application that may help you keep track of your cap table’s details. Eqvista is a cap table program that helps you manage your company’s stock. It is a highly sophisticated and comprehensive equity management software that maintains track of all a company’s equity-based activities. Check out this article waterfall analysis to know more.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!