How to apply IPEV guidelines to portfolio valuations?

In this article, you will learn that understanding IPEV principles is essential for navigating private markets safely and confidently.

The International Private Equity and Venture Capital Valuation (IPEV) guidelines provide a comprehensive framework for valuing private capital investments. These guidelines are formulated by individuals leading some of the most notable private equity firms and advisors.

Currently, they serve as the gold standard for general partners, auditors, and regulators seeking consistent, defensible valuations. In an asset class where market prices are rarely available, IPEV offers crucial standardization, ensuring that investors can compare performance across funds.

Whether you’re a GP reporting to LPs or an investor conducting due diligence, understanding IPEV principles is essential for navigating private markets with confidence and credibility.

Key Takeaways

- IPEV provides a standardized, fair value framework, so private capital valuations are consistent and comparable across funds.

- Funds must use consistent valuation methods and allocate enterprise value systematically.

- Calibration, backtesting, and clear rules strengthen rigor and audit defensibility.

- Valuers must apply market participant-based judgement and document assumptions to reduce disputes.

Core IPEV principles that apply throughout the fund lifecycle

At the time of purchase, if the transaction was conducted in an orderly fashion in the principal market of the asset, you do not need to perform a fresh valuation for investor reporting. The same can be said for asset sales. However, in the period between purchase and sale, you must apply the following core IPEV principles:

Fair value measurement

IPEV’s definition of fair value is consistent with GAAP and IFRS. Here, too, an asset’s fair value is the price at which two knowledgeable parties would enter into a transaction in its principal market on measurement date. If the principal market does not exist, you must consider the most advantageous market.

For actively traded assets with a quoted price, the market prices should form the exclusive basis for valuation.

Consistent methodology

Funds are required to apply the same methodology consistently from one measurement date to the next, unless there’s a change in market conditions that impacts how market participants assess asset value.

The keyword here is ‘market participants’, unless the participants in the principal or most advantageous market reconsider the methodology, funds cannot unilaterally change said methodology.

Enterprise value allocation

The IPEV guidelines specifically outline how private capital investment should be valued. It recommends the following process:

- Calculate the enterprise value using IPEV-recommended valuation techniques

Adjust enterprise value for surplus assets, excess liabilities, and other factors that the principal market’s participant would consider relevant - Subtract the value of any financial instruments issued by the company that would rank higher than the securities held by the fund

Incorporate the impact of convertible debt, ESOPs, and other instruments that may dilute the fund’s investment - Allocate the adjusted enterprise value across the securities issued by the company based on their ranking

- Calculate the value of the fund’s holdings based on adjusted enterprise value allocated to the relevant securities and the fund’s percentage holding of said securities

Calibration

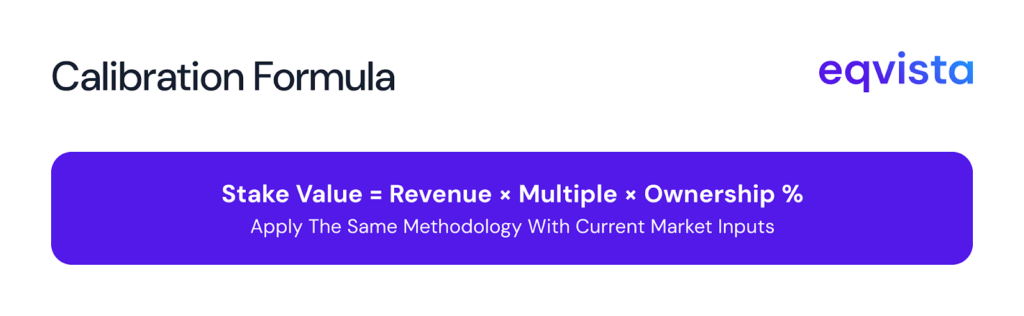

If the initial purchase of an asset qualifies as an orderly transaction, the IPEV framework allows for a simplified calculation method for subsequent valuations. In such cases, the fund can simply reapply the valuation techniques used at the time of purchase using the measurement date market inputs. This technique is called calibration.

For instance, suppose your fund purchased 20% of a climate tech startup for $80 million, applying a market multiple of 20x on its annualized revenue.

Now, suppose the annualized revenue increases to $35 million and the market multiple drops to 15x.

Then, you can calibrate this asset’s valuation as:

Value of stake = Current annualized revenue × Current market multiple × Ownership percentage = $35 million × 15 × 20% = $105 million

Backtesting

An important IPEV guideline, which is often overlooked by funds, relates to backtesting. Backtesting involves comparing exit prices to prior valuations and assessing whether previous valuation methodologies accurately captured all relevant known and knowable inputs as of the measurement date.

Exchange rate

Private equity and venture capital funds often invest across different geographies. This creates room for exchange rate discrepancies. General partners may often wonder if they should choose the measurement date exchange rate or the reporting date exchange rate, or the more favorable one of the two.

IPEV removes this confusion by recommending the usage of the bid spot exchange rate at the measurement date.

Choice of valuation methodologies

IPEV recommends using one or a combination of the following methodologies to value assets.

These methodologies are meant to be applied in line with how a market participant would and not solely based on the general partner’s assumptions. In all of these methods, the enterprise value allocation guideline applies.

Use of judgement

The valuer is expected to use sound judgement in choosing the valuation techniques, making assumptions, and calculating estimates in line with the perspective of market participants. These represent the only explicitly ‘undefined’ inputs under the IPEV valuation frameworks and hence, are the most vulnerable to challenges.

So, you must document the rationale for all such inputs to avoid future disputes.

Secondary transaction

If you know the terms of an orderly transaction for a particular fund’s interests, you must use that information as an input to estimate the fair value of said fund’s interests. This guideline pertains to funds that invest in other funds.

Eqvista – Valuations that inspire confidence!

The IPEV framework transforms private capital valuation from an art into a disciplined science. By anchoring valuations in fair value principles, demanding methodological consistency, and providing clear guidance on enterprise value allocation and calibration, IPEV ensures that portfolio valuations reflect market participant perspectives rather than wishful thinking.

The requirements for backtesting strengthen process rigor over time, while prescribed approaches to exchange rates and valuation methodologies eliminate ambiguity. Most critically, IPEV’s emphasis on documented judgment protects valuers from future challenges.

At Eqvista, we simplify financial reporting for funds with IPEV-compliant portfolio valuations compiled by seasoned, in-house experts. Contact us to know more about our services!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!