How Do You Calculate Enterprise Value?

In this article, we discuss the concept of enterprise value and the various methods to calculate it.

Company valuation, among other functions, is the foundation of mergers and acquisitions. Unless the true value of a company is derived, neither the acquirer nor the target company can proceed with the deal. Ever wondered how investors decide on the worth of a company? Over the years, the business world has developed several finance metrics that help decision-makers make profitable deals. The enterprise value formula is one such metric.

What is Enterprise Value?

Enterprise Value (EV) is the total estimated market value of a company. It is an important company valuation metric used, especially during mergers and acquisitions. EV goes beyond the commonly used market cap valuations that do not account for debts and cash surplus. This is why it is comprehensive, reliable, and forms the basis of many valuation multiples such as EBITDA. Therefore, analysts facilitating a company takeover must lean on a reliable enterprise value calculator.

Uses of Enterprise Value

Enterprise Value finds its actual utility when used as a part of valuation multiples. The most popular one is EV/EBITDA multiple, where the enterprise value is read as a ratio of EBITDA (Earnings Before Interest Taxes Depreciation and Amortization). It is useful in this form because:

- In an EV/EBITDA multiple, EV determines the theoretical market value of the company while EBITDA estimates its profitability. Together in a valuation multiple, EV helps stock market investors get a good idea about the overall profit prospects of investing in a business.

- Besides, the enterprise value formula accounts for all forms of debts in the business. It neutralizes any market fluctuations surrounding the debt factors within the companies being compared for a takeover.

- Same is the case with holders of other forms of controlling interests in the business. The enterprise value accounts for all changes that might occur after an acquisition including the possible ones in the capital structure of the acquired business.

How is it different from equity value?

Equity value is the total value of diluted shares of a company. It is a common mistake to assume that equity value is the same as market capitalization (market cap). Market cap is only the total value of common shares. It is derived by multiplying the total number of diluted shares with the current price per share. For example, if a company has issued 1,000,000 shares to common shareholders in the market and each share is worth $10, the market cap will be 1,000,000*$10 = $10,000,000. But equity value does not always stop here. It further includes the total value of other classes of shares such as preferred shares, convertible notes, bonds, and warrants.

Equity value is an inclusion in the enterprise value formula. This simply means that the enterprise value begins with equity value and moves on to add many other components of the business, such as short-term and long-term debts and minority stakes in other companies. Enterprise value also accounts for the cash reserves of the target company. Since the acquirer takes over the cash surplus of the target company, this is deducted from the overall acquisition value. This cash chest becomes an asset for the investor.

Importance of Enterprise Value

When an investor or a large corporation sets out to acquire companies, it is usually a decision driven by profitability. Acquiring a new company must strengthen its already existing portfolio. Therefore, the positive financial health of the target company and its profit potential are non-negotiable factors. Enterprise value calculator from the balance sheet plays an important role here. It is common practice to shortlist some comparable companies from the same industry and evaluate them before finalizing one. Enterprise value is significant here because:

- Enterprise value is a comprehensive measure of a company’s actual worth. Since it involves all the important aspects of a business, it is a reliable contributor to many valuation multiples such as EBITDA, EBIT, and FCFF.

- It helps compare companies with a varying market cap.

- Since enterprise value provides a holistic picture and does not focus on one single component of a thriving business, it helps neutralize market risks.

- The enterprise value formula includes the total debt of a company. This is an important inclusion because the acquirer will automatically inherit the outstanding debts of a company. Thus, it should be part of the company valuation.

- Enterprise value also includes cash reserves of the target company. The acquirer will inherit this as well. But it is an asset and not a liability. Thus, the cash component is deducted from the total value. The higher the cash reserves, the better it is for the investor.

Enterprise Value Calculator

Enterprise value is a valuable metric, but its calculation is straightforward. All components of the enterprise value formula can be easily derived from a balance sheet. Though it is a simple process, it is best to have professionals to oversee the entire valuation process.

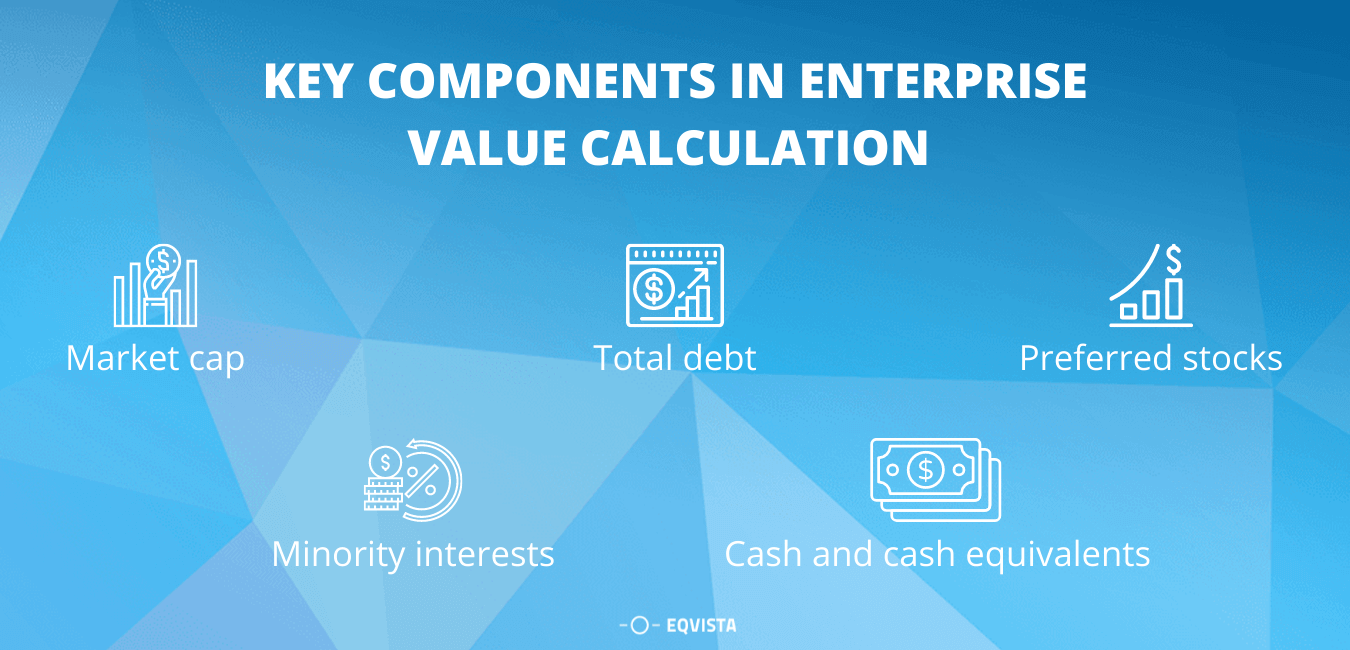

Key Components in Enterprise Value Calculation

In the simplest form, the enterprise value calculator only includes market cap, debt, and cash. However, these may be too general. A thriving business being eyed for a takeover usually functions as an intricate web of multiple functions. Thus, debt is not just available in one form. How much the company owes and to whom can take some time to derive. The same goes for equity components. To give a clear picture of the various components of an enterprise value, we have compiled the following points:

- Market cap – Market cap is a basic indication of the value of a company. It covers only the equity component. This includes common shares and convertible securities that do not reflect on a cap table immediately but will eventually convert into stocks at a finance event. Market cap is calculated by multiplying the total number of diluted shares with the price per share.

- Total debt – A profitable business cannot thrive on its revenue alone. Seeking out debts from banks and other financial institutions is part of a business strategy. Especially in the case of operations where a company first has to purchase assets on debt and gradually write it off as profits churn. Thus, estimating the total debt of a business is an essential aspect of its evaluation. This includes short-term as well as long-term debts.

- Preferred stocks – Preferred stocks are a unique aspect of a company cap structure. In the context of the enterprise value formula, it is considered as a part of company debt. Shareholders holding preferred stocks always receive preferential treatment over common shareholders. They are also the only class of shareholders who are entitled to a fixed dividend payback. Besides, in the case of liquidity, preferred stockholders are on the priority list of payback receivers. As far as an acquirer is concerned, preferred stockholders are a liability and must be added to the total acquisition value of a company.

- Minority interests – Enterprise value calculator accounts for all assets and liabilities that an investor must be aware of before taking over the reins of a new company. To do this best, EV includes minority interests as well. This is a situation where the target company has less than 50% stakes in other businesses but is still responsible for their finances. This is a typical case where the target company is the parent business and runs subsidiaries with minority stakes. Being a minority shareholder does not absolve them of the responsibilities of these companies’ cash flow, revenues, and expenses. This is also a financial liability for an investor, and its net value must be added to the acquisition cost.

- Cash and cash equivalents – During its business process, every company accumulates a considerable amount of cash. This is an asset for an investor. After a takeover, investors usually use this money to pay off carried over debts and then channel the surplus into existing operations. Overall, this section also includes all non-operating assets that are part of a company’s business structure but do not cost the investor anything. The enterprise value calculator subtracts the net value of all these components from the total acquisition cost.

Enterprise value formula

The enterprise value formula can be represented in three ways. The simplest one is:

This does not provide much insight into each of these components. To make it more detailed and inclusive, here is an elaborate version is:

Another variation of this formula is:

The ‘liabilities’ component here not only represents common shareholders but all other investor groups as well. This is an important inclusion in the enterprise value formula. Since the acquiring company has to take responsibility for all forms of outstanding liabilities of the target company, analysts must especially focus on this aspect. This helps the investor get an actual reading into how much the target company is finally worth.

How to Calculate Enterprise Value?

The enterprise value formula first begins by deriving the market cap. It is then followed by adding all other components and deducing the cash component. Here is a comparative example of three different companies.

| Component | ABC Inc. | XYZ Inc. | TNT Inc. |

|---|---|---|---|

| Total diluted shares | 50,000 | 100,000 | 500,000 |

| Price per share | $2 | $5 | $10 |

| Market value of common shares (A) | $100,000 | $500,000 | $5,000,000 |

| Market value of preferred shares (B) | $50,000 | $40,000 | $40,000 |

| Market value of total debt (C) | $10,000 | $10,000 | $10,000 |

| Market value of minority interests (D) | $20,000 | $25,000 | $30,000 |

| Total cash (E) | $50,000 | $50,000 | $50,000 |

| Enterprise value (A + B + C + D - E) | $130,000 | $525,000 | $5,030,000 |

As per the enterprise value calculator, the EV of the three companies is as follows:

- Enterprise value of Company 1 (ABC Inc.) = $130,000

- Enterprise value of Company 2 (XYZ Inc.) = $525,000

- Enterprise value of Company 3 (TNT Inc.) = $5,030,000

Of the three, the enterprise value of ABC Inc. is the lowest. Thus from an investor point of view, company 1 is the most profitable option for a takeover.

How can Eqvista help with your Enterprise value calculation?

Eqvista is a leading equity management software. Our expert team is adept to handle all aspects of company formation and equity issuance, tracking, and distribution. Company valuation is an intrinsic part of this process. Eqvista is an expert in various valuation multiples, including enterprise value. For further information, reach us today.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!