Cap table FAQ: 20 Most Asked Questions Answered

People who are new to the idea of cap tables often have many questions, and it can be hard to get answers from their limited knowledge base. You may find yourself on a constant hunt for people with the same or a similar question in order to just get an answer. To help with this, we’ve compiled a list of 20 common questions that people ask about cap tables and put them all together in one easy-to-read FAQ section!

Cap Table FAQs

Many new business owners often don’t know what a cap table is and how important it is for their business, especially for newer startups and new entrepreneurs. Here are the 20 frequently asked questions on cap tables:

1. What is a cap table?

A capitalization table or cap table is a spreadsheet and a term for the chart that shows ownership, equity, dilution, and value of equity in every round of investment the company has raised. Usually, a capitalization table is utilized for startups, early-stage companies, seed-stage companies, and other companies to keep track of investments, ownership percentages, and financial participation in the company. Thus, the capitalization table is an important tool entrepreneurs use to understand their company’s finances and help them better manage their investments.

2. Why do business need a cap table?

A cap table can be used to keep track of the company’s investments since the first investment round, how much they have retained, and how much they are diluting their ownership. It also helps to keep track of the capitalization of a company, and it can be used for internal and external reporting. This means that you can use the cap table to see how much money you will have in the future, who your investors are, and whether or not they are still invested in your company. Overall, it is a powerful tool that can help you keep track of the financial data for your company.

3. What is a good cap table?

A good cap table should be accurate, simple, and easy to read. Basically, it should be straightforward, clean, and efficient. You need to understand what each column means, and it should be easy to track the changes with each investment round. Following are a few characteristics of good cap tables:

- The founder or CEO should own the most equity.

- An employee stock ownership plan (ESOP) should be 15%.

- No prior rounds where the investors have acquired more than 30% of equity.

- The cap table should not have any investors with a bad reputation.

- No more than 50% of equity should be owned by the investors.

4. What is cap table management? Why is it important?

Cap table management is the process of keeping the financial data of your company and understanding how it changes with each investment round. This implies that you should be able to manage your cap table, which means that you should be able to update it and maintain the accuracy of its information at all times. It is important because it impacts your financial performance in terms of your company’s valuation, exit value, and percentage ownership. Moreover, it can affect your company’s ability to attract new investors and employees. Therefore, it is difficult for startups to communicate their financial situation to investors and employees without cap table management.

5. What is cap table management software?

A cap table management software is a program or application that can automate the process of creating and keeping a cap table. It’s a set of functionalities that allows users to effectively manage their financial data effectively. Cap table management software can automatically update the capitalization table as new information is added, and it maintains an accurate picture of what is currently happening with your company’s finances. The software can also be used to manage multiple cap tables for different companies, allowing businesses to keep track of their finances without having to manually update them all the time. With the advancement of technology, there are many online cap management software available on the market.

6. What should be included in the cap table?

A cap table should contain all the technical data such as the running totals of investors’ investments and how they were acquired, common equity shares, preferred equity shares, warrants, and convertible equity. This includes funding rounds and their respective values, liquidation preferences for shareholders in the event of losses, and the amount of money that you have raised from each investment round. Therefore, it is essential to carefully examine the information in your cap table before you begin using it for financial reporting.

7. How to structure a cap table?

It’s important to know how to prepare a cap table. A cap table is usually structured in a spreadsheet with columns and rows that have specific data. You should have distinct fields for the regularly reported data about your company. The first row should contain the total number of shares of the company. Thereafter, you should enter the following information:

- Authorized shares – Number of shares that the company is legally allowed to issue.

- Outstanding shares – Number of shares that have been held by shareholders.

- Unissued Shares – Number of shares that have not yet been issued.

- Shares reserved for stock option plan – Number of shares that are reserved for future hires.

While a separate table is usually used to keep track of all the investors, a cap table should also contain the following information on individual investors:

- Name of shareholder – Name of the shareholder.

- Number of shares held – Number of shares owned by each shareholder.

- Stock options – Stock options are owned by each shareholder.

- Fully diluted shares – The number of outstanding shares.

- Remaining options – Number of shares that have not yet been issued.

8. Why do investors want a cap table?

Cap table for investors helps to perform their due diligence and make investment decisions. Cap tables let investors see the company’s financial situation in detail, understand the current state of affairs, and determine whether or not it will be able to do well in the future. It is also a good way to ensure that all shareholders are treated equally and fairly and that the company is complying with its fiduciary responsibilities.

9. What do investors look for in a cap table?

When examining a cap table, investors will look at the following factors to make an investment decision:

- How much money the company has raised.

- The total amount of equity that the company holds, including common, preferred, and warrants.

- How much money is being held back in the form of a working capital line.

- The details on how much money each investor has invested in the company from previous rounds of investment (see liquidity).

- Amount of capital that will be available to the company during future rounds of investment.

10. How do you maintain the cap table?

In order to maintain the cap table, you need to be able to update it on a regular basis. You should do this after every investment round when the company raises a new investment. When updating the cap table, you must verify all the information that is currently in the table and ensure that it is accurate. Furthermore, you should update the information about shareholders to reflect the changes in their ownership of equity. This can be done manually through a spreadsheet or with the assistance of an online cap table management system. Therefore, it is crucial to have your cap table in a reliable and accurate format to ensure that it can be effectively used as a record of your company’s current financial situation.

11. Who manages the cap table?

A cap table is an important document that must be maintained and updated by the company’s management team or competent legal counsel. Generally, competent legal counsel is the one who manages the cap table to ensure that it is accurate and up-to-date. However, the company’s management team must also be aware of what information is included in the cap table. Choosing the right competent legal counsel or management team is vital as they will play a large role in how your cap table is managed. The right expert will be able to implement the right action plan to ensure that you can effectively manage your cap table.

12. Can you include options in the cap table?

Yes, a cap table should contain all types of options. This includes stock options, employee stock options, and warrants. It is important to keep track of these options because they will help in calculating the company’s total value. When you know the current value of each type of stock option, you can do a proper analysis to determine the best way to structure your business, which can be beneficial in creating a better working capital line and/or equity.

13. Are cap tables confidential?

Usually, companies give senior-level management and authorized legal counsel the right to know the cap table. However, no legal requirement states that the cap table must be kept confidential. If you choose to keep your cap table confidential, it is important to issue a disclosure statement stating that the cap table is confidential and not for public dissemination.

14. What is a fully diluted cap table?

A fully-diluted cap table is an adjusted cap table that takes into account the total number of currently outstanding shares for every security the sum total from every convertible security in case they were exercised. The convertible security means all convertible notes, convertible preferred stock, and options.

15. How to calculate cap table dilution?

Dilution means the decrease in equity that results from issuing stock on the conversion of preferred stock or options. To calculate your fully diluted cap table, you must take into account the total number of shares outstanding and the number of shares held. To better understand, let’s look at the example: If you have 8 million shares outstanding and you hold 2 million shares, then that equals 25% of the outstanding stock. While if the company issues another 2 million shares, it means that the ownership will drop down to 20%.

16. What is a cap table in venture capital?

The cap table structure is analyzed by venture capital firms and other funding sources in order to determine the company’s current capitalization and its future potential. The cap table lists all existing shareholders, the number of shares owned by each shareholder, and the percentage each owns due to issuing stock in previous financing rounds. A venture capital firm will closely understand the existing cap table before investing in a business.

17. Can LLC have a cap table?

Yes, a Limited Liability Company (LLC) can have a cap table. A cap table is a legal document that will allow the investors to see the details of the company’s current financial situation. In essence, a cap table serves as a legal record between investment analysts, venture capitalists, and founders. As a result, a cap table is an important document for any company in order to be effective and efficient.

18. What are the 5 best free cap table management software?

Several cap table management software companies can help you manage your cap table more effectively. Here are the top 5 cap table management software:

| Eqvista | Carta | Pulley | Ledgy | Global Shares | |

|---|---|---|---|---|---|

| Free Cap Table Migration | Yes | No | No | No | No |

| Equity Onboarding in 10 min | Yes | No | No | No | No |

| Equity Self-Onboarding | Yes | No | No | No | Yes |

| Equity Onboarding & Maintenance Specialists | Yes | Yes | Yes | No | Yes |

| Round Modeling & Waterfall Analysis | Yes | Yes | Yes | Yes | Yes |

| 83(b) Elections | Yes | Yes | yes | No | No |

| Unlimited 409a Valuation | Yes | No | No | No | No |

| Stock-Based Compensation (3921, ASC 718) | Yes | Yes | Yes | Yes | Yes |

- Eqvista – It is an online cap table management tool that is geared towards allowing the company to manage the cap table in a better way. If you use Eqvista, you will be able to streamline the cap table, know your numbers, and have a customized dashboard for your company.

- Carta – A cap table management tool that is designed to handle all the important aspects of the company’s cap table. One of the great features of Carta is its flexible data collection process, which allows the company to collect data more easily. Also, the software allows the company to simplify its financial reporting.

- Pulley – A cap table management tool that is designed to allow the company’s executive team to manage the cap table effectively. Using this software, the executives can manage their share options, track performance, and have access to analytics reports to help in decision making.

- Ledgy – Ledgy is a cap table management tool that is designed to follow the latest trends in the cap table management industry. It incorporates all the best features from other cap table management tools and is designed to improve the cap table management process.

- Global shares – A new cap table management tool allows startups to choose the level of financial analysis they require while ensuring full control over their cap table management process. Cap table allows you to choose which questions you want to answer regarding your company’s cap table, which will help determine your next steps in terms of action and implementation.

19. How to calculate post-money valuation with a cap table?

A post-money valuation basically means the value of the company after it has completed an investment round. The post-money valuation should normally increase in proportion to the company’s amount. In most cases, it will be a far more accurate amount than any pre-money valuation, which can often be misleading. The cap table can help to determine the post-money valuation. To calculate the post-money valuation, you will need to add the pre-money valuation with the new money raised; you can obtain the post-money valuation with this simple calculation.

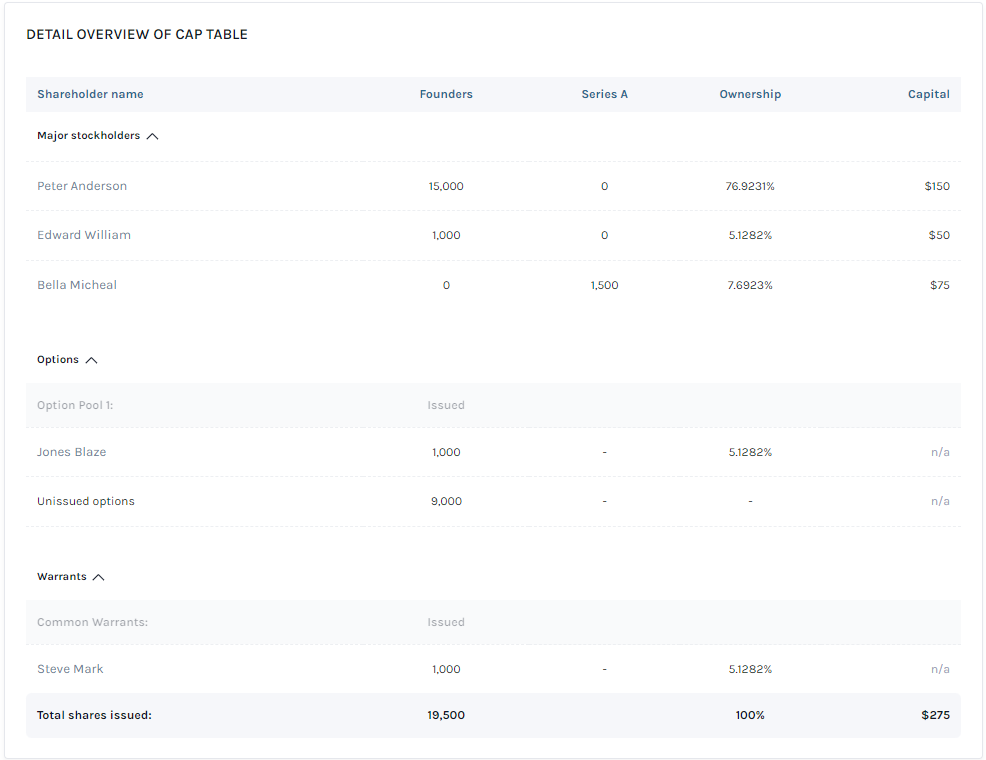

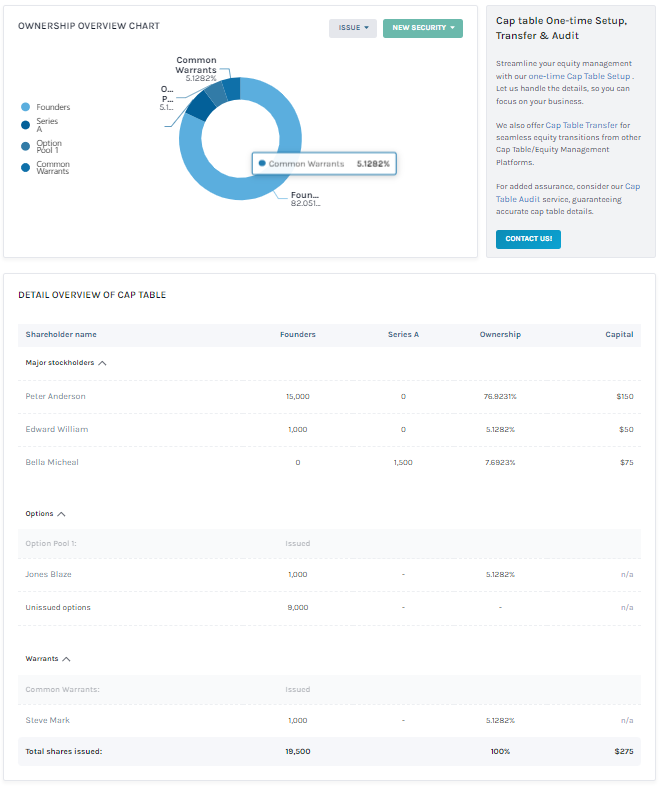

20. What is an example of a cap table?

The cap table includes a spreadsheet that contains two parts – valuation and ownership. Let us look at a cap table example.

First, enter the company’s current valuation (the pre-money valuation), and then in the next section, enter the amount every investor is contributing to the funding round. If the current valuation is $1,000,000 and the new money raised from investors is $1,500,000, the post-money valuation will be $2,500,000. You will then find each investor’s percentage ownership in the company.

Use Eqvista for your Cap Table Management!

When choosing cap table management software, consider ease of use, customization, scalability, and customer support. Ensure the software can track ownership percentages, equity grants, and changes over time.

Consider Eqvista’s cap table management software that offers a wide range of features tailored for startups and established businesses. From creating share certificates to managing board resolutions, conducting valuations, filing IRS reports, and reporting stock compensation, Eqvista has you covered. Its user-friendly design simplifies cap table management, improving efficiency. Eqvista’s competitive pricing makes it a cost-effective choice, distinguishing it from other cap table management solutions.