5 Hard Truths About Expanding Our Services from Series B Companies to Unicorns

When a company crosses the billion-dollar threshold, everything changes. The valuation methodologies that worked for Series A and Series B rounds suddenly feel inadequate. The stakeholder expectations multiply. The regulatory scrutiny intensifies. And for valuation analysts, the margin for error shrinks to near zero.

At Eqvista, we built our reputation delivering accurate, audit-defensible 409A valuations for early and growth-stage companies. We’ve valued thousands of startups across every funding stage, valuing billions in client assets monthly. But when we set out to expand our services to unicorns and pre-IPO companies, we encountered challenges that forced us to completely rethink our approach.

Our recent completion of a $25 billion unicorn valuation marked a significant milestone in our evolution. It represented not just our largest engagement, but the culmination of strategic investments in team expertise, analytical capabilities, and service delivery that enabled us to meet the unique demands of billion-dollar companies.

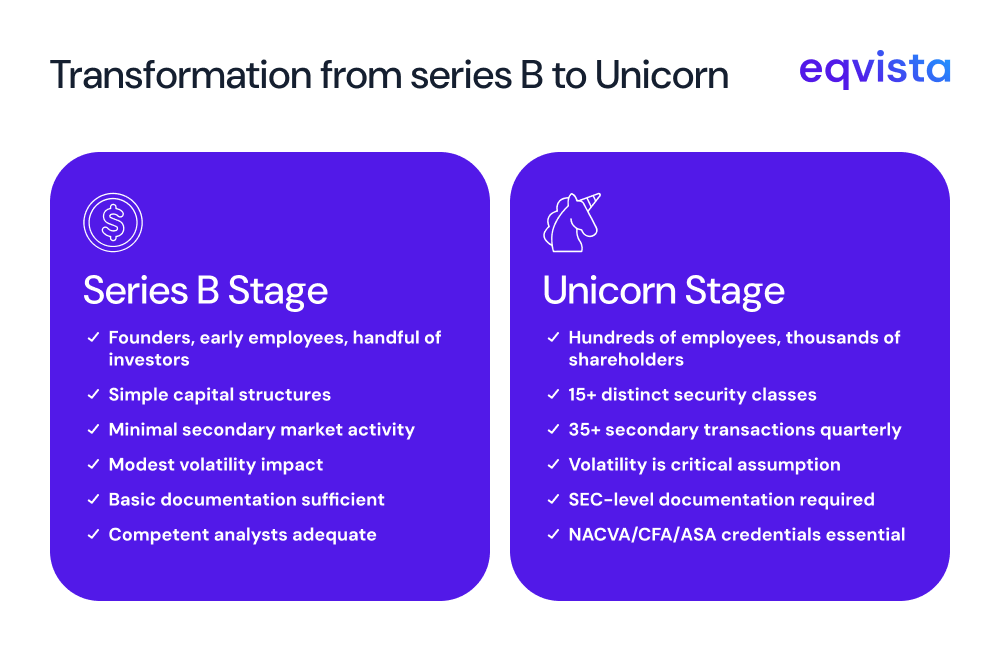

From Growth -Stage to Unicorn Complexity

Through this article, we share critical insights from our journey supporting unicorn companies, the realities that every high-growth company should understand as they scale. While we won’t be sharing proprietary methodology details, we will illuminate the key differences between early-stage and unicorn-level valuations, and what to look for in a valuation partner who can truly support your company at this critical stage.

In late-stage private rounds, every new term sheet reshapes the cap table, and by the time a company hits unicorn status, you’re no longer valuing a single business; you’re valuing a stack of securities with embedded options, asymmetric downside protection, and non‑linear payoffs, said Colin McCrea Partner (CVA, EA) – Partner & Head Of Valuations at Eqvista

If your company is approaching unicorn status, recently crossed that threshold, or preparing for an eventual IPO, understanding these distinctions will help you ensure your valuation partner is equipped to deliver the expertise, rigor, and service your company deserves.

Hard Truth 1: Capital Structure Complexity Requires Specialized Expertise

Valuation firms that assume unicorn valuations simply require more hours from their existing team are dead wrong. Unicorns often have intricate capital structures with multiple liquidation preferences, participation rights, and conversion conditions that create non-linear relationships between enterprise value and individual security values. Traditional allocation approaches struggle with these complexities, leading to inaccurate equity valuations that can expose companies to regulatory risk.

How Eqvista Adapted

We assembled a dedicated valuation team led by NACVA-certified analysts and comprising exclusively of those with advanced (CFA,ASA) credentials and experience in pre-IPO valuations. Our team developed proprietary waterfall models capable of handling up to 15 distinct security classes with varying rights and preferences. This wasn’t about throwing more resources at the problem, it was about building specialized expertise.

More importantly, we developed sophisticated frameworks that can handle extreme capital structure complexity while maintaining defensibility under regulatory scrutiny. Our approach considers multiple allocation methodologies, applies rigorous sensitivity testing, and ensures every assumption can withstand audit examination. We can’t share the specific technical details of our proprietary models, but the results speak for themselves in our ability to defend valuations through IPO and beyond.

Hard Truth 2: Secondary Market Data Creates Valuation Conflicts That Must Be Reconciled

For early-stage companies, there’s rarely secondary market activity to consider. For unicorns, secondary transactions are frequent, and they often tell a different story than the funding rounds. When secondary transactions occur at significant discounts or premiums to funding round valuations, analysts face a genuine dilemma: which data point should drive the current valuation?

For today’s pre‑IPO companies, secondary trades are too visible to ignore and too noisy to trust blindly; the analyst’s job is to separate signals from distress‑driven discounts and hype‑driven premiums and then reconcile those trades with the last institutional round, said Shivank Agarwal CPA (AU), CFA – Analyst, Eqvista

Ignoring secondary market activity invites scrutiny from investors, employees, and regulators who rightfully ask why actual market transactions are being dismissed. Over-weighting secondary pricing can undervalue the company when those transactions involve distressed sellers or lack the sophistication of institutional rounds.

How Eqvista Adapted

We developed a systematic framework for incorporating both primary and secondary market data. This includes adjusting historical transactions for current market conditions, evaluating transaction quality based on volume and participant sophistication, and properly accounting for the lack of marketability that affects private company shares.

Rather than mechanically averaging different data points, our framework weighs each transaction based on its relevance and reliability. This ensures our valuations reflect market reality while maintaining the defensibility required for regulatory compliance. The specific weighting methodology we’ve developed is proprietary, but it allows us to reconcile seemingly conflicting market signals into coherent, supportable conclusions.

Hard Truth 3: Volatility and Risk Assessment Become Critical and Controversial

For Series B companies, small variations in volatility assumptions have a modest impact on valuation conclusions. For unicorns using option-based allocation methods, volatility becomes one of the most influential assumptions in the entire analysis.

The problem is that private companies don’t have observable volatility. Analysts must estimate it, and different estimation approaches can yield materially different results. Make the volatility too low, and you undervalue the optionality in junior securities. Make it too high, and you may overstate common stock value in ways that create problems for option pricing and employee communications.

In option‑based valuation models for unicorns, volatility is the silent lever; move it a few points, and you can materially change common stock value and option strike decisions, which is why we triangulate it from multiple peer sets and cross‑check it against actual transaction behavior, said Edison Chan, Senior Analyst of Eqvista

How Eqvista Adapted

We invested considerable effort in developing robust volatility estimation techniques that combine multiple data sources and cross-validation methods. This includes analysis of comparable public companies, examination of the subject company’s historical performance metrics, and where appropriate, back-solving from recent market transactions.

Just as importantly, we always present sensitivity analysis showing how valuation conclusions change across reasonable volatility ranges. This transparency helps stakeholders understand that valuation involves professional judgment, not just mechanical calculation. Our reports document the rationale for our volatility selection in detail sufficient to withstand regulatory scrutiny while acknowledging the inherent uncertainty in any estimate.

Hard Truth 4: Stakeholder Expect Excellent Communication, Not Just Technical Accuracy

A Series B company’s stakeholders typically include founders, early employees, and a handful of investors. A unicorn might have hundreds of employees with equity compensation, dozens of institutional investors, multiple board members, and potentially thousands of secondary shareholders.

Each group needs to understand the valuation, but each has different levels of financial sophistication and different concerns. Delivering a technically accurate report isn’t enough if the CFO can’t explain it to the board, or if employees can’t understand what their options are worth. We learned this the hard way when an early unicorn client struggled to communicate our first valuation to their employee base, despite the report being technically flawless.

How Eqvista Adapted

Beyond producing comprehensive valuation reports, we now provide executive summaries tailored for different audiences, conduct board presentation sessions where our analysts walk you through key assumptions and findings, and offer ongoing consultation to help CFOs and legal teams address stakeholder questions.

We recognize that at the unicorn stage, communication is as important as calculation.

Our clients don’t just receive a report. They receive a partner who helps them navigate the complexities of explaining valuation results to board members, investors, employees, and auditors. This commitment to multi-tiered communication has become a differentiating factor in our unicorn practice.

Hard Truth 5: Regulatory Scrutiny Demands Bulletproof Documentation

At the unicorn scale, SEC registration becomes increasingly likely, and what passes as sufficient documentation for a Series B valuation won’t withstand the scrutiny that pre-IPO companies face. Every assumption must be supported by market data. Every methodology choice must be justified in the context of industry standards and company-specific circumstances. Every calculation must be traceable and verifiable. The stakes are real. Inadequate documentation of historical stock option valuations can delay IPO timelines, trigger restatements, or create liability for the company and its advisors. We’ve seen competitors’ work rejected during IPO readiness reviews because the documentation didn’t meet SEC standards, forcing companies to restart their valuation history.

How Eqvista Adapted

We implemented a multi-layer review process for unicorn valuations that includes technical review by senior analysts, methodology review by our head of valuation, and final compliance review by our tax specialists. Every valuation undergoes scenario testing to ensure the conclusions remain reasonable under different assumptions.

We maintain extensive documentation that traces every material assumption to its source and explains the professional judgments we applied. Our reports include detailed sensitivity analyses showing how changes in key assumptions affect valuation conclusions, and we document why we selected specific methodologies over available alternatives. This level of rigor has allowed our clients to navigate IPO readiness reviews without material valuation questions.

Eqvista – Where Unicorn Expertise Meets Series B Accessibility!

Our journey from Series B specialists to unicorn valuation partners required more than incremental improvements. This transformation required fundamental changes to our team structure, analytical frameworks, quality control processes, and client communication approach. The challenges we faced were real and substantial, but so were the solutions we developed.

The completion of our $25 billion unicorn valuation represented not just technical capability, but the maturation of systems designed to deliver sophisticated analysis within timeframes that growing companies require. While we can’t disclose the specific methodologies that make this possible, we can point to the results: consistent ability to deliver audit-defensible valuations that withstand regulatory scrutiny and serve our clients through successful IPOs.

Today, Eqvista stands as one of the few valuation firms capable of serving companies across the entire lifecycle from startup through unicorn to pre-IPO. We bring the same commitment to accuracy, transparency, and client service that made us the trusted choice for early-stage companies to the unique demands of billion-dollar valuations.

Whether you’re preparing for your next funding or navigating the complexities of IPO valuations, Eqvista delivers the specialized expertise and responsive service you need. Connect with our valuation team today to discuss how we can support your company’s next chapter!