AI vs SaaS Valuation Multiples

AI companies are now trading at multiples that are several times higher than traditional SaaS companies, despite operating in a funding environment defined by liquidity constraints and heightened investor caution. In public markets, the median AI market cap-to-revenue multiple exceeds 10x, while that of SaaS companies is below 5x.

This widening valuation gap raises two critical questions for investors and founders alike. What structural forces are driving AI’s premium over SaaS, and how long will this trend continue? In this article, Eqvista’s researchers answer these questions through data-backed observations.

Private Market Trends

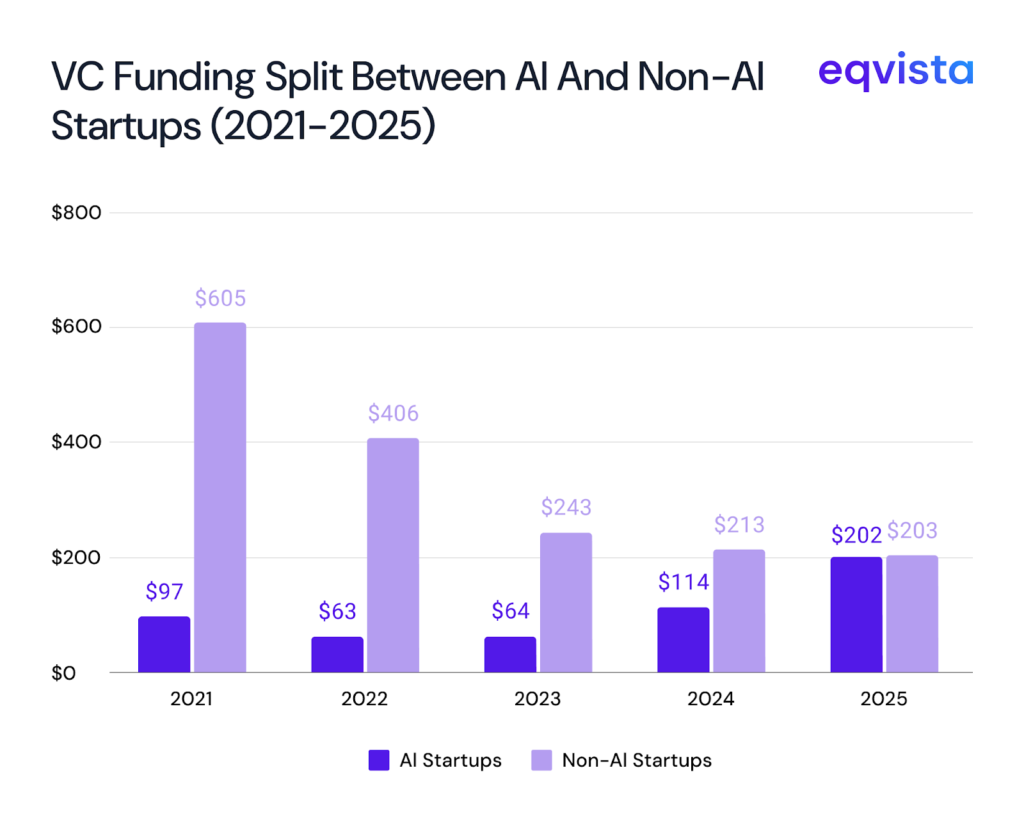

Despite the fact that investors have become significantly more cautious following the zero-interest-rate era, AI startups continue to demonstrate notable resilience in fundraising activity. So far in 2025, venture capital funding has been split almost evenly between AI and non-AI startups.

Source: Crunchbase | 2025 data as of 14th December

While overall venture deal values have declined since their 2021 peak, AI has steadily absorbed a larger share of total funding.

The valuation premium commanded by AI startups is even more striking. According to renowned venture capitalist Tomasz Tunguz, AI startups raise at 40% higher valuations than their peers at the Series A stage.

The Valuation Gap

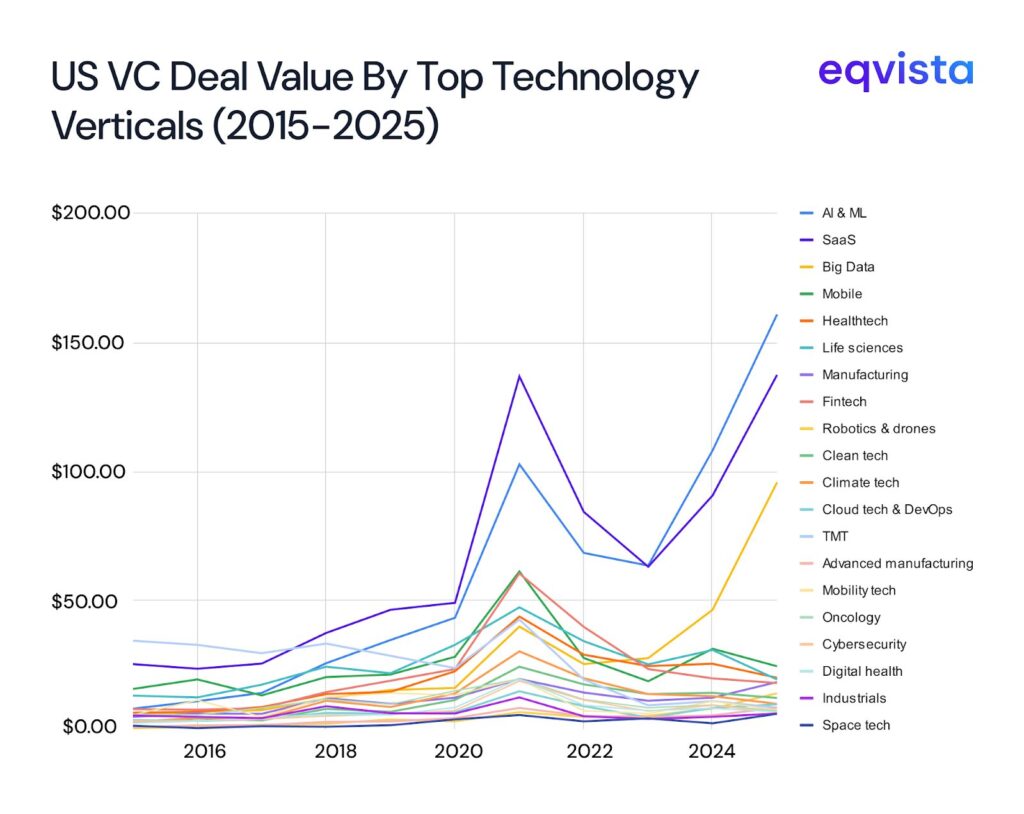

Over the past decade, SaaS has been the dominant force in venture capital markets, ranking 1st or 2nd by US VC deal value nearly every year. However, as the technology, media, and telecommunications (TMT) vertical weakened, AI emerged as SaaS’s most credible challenger.

Source :Pitchbook

By 2023-2024, AI and SaaS commanded comparable deal values, signaling parity in investor attention. Yet valuation outcomes tell a very different story.

In public markets, AI companies trade at materially higher market cap-to-revenue multiples than SaaS peers. Median public AI multiples exceed 10x, with averages pushed far higher (20x) by extreme outliers. In contrast, public SaaS companies show median multiples below 5x, reflecting a more mature market.

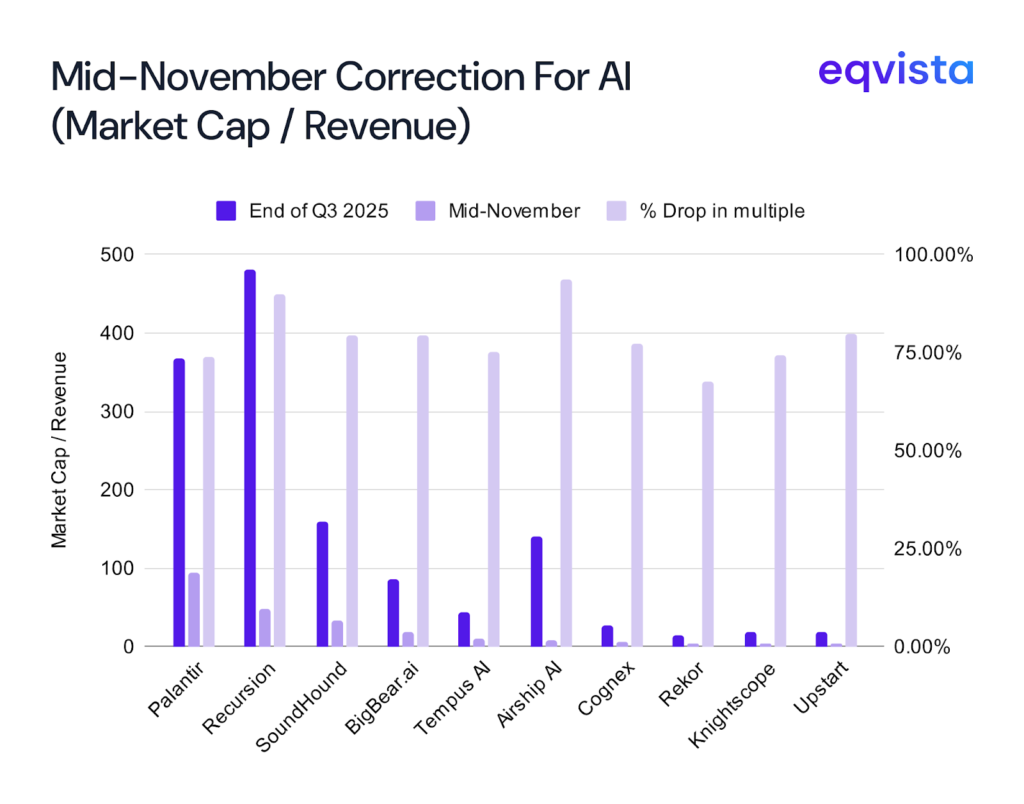

Individual company multiples reveal the full extent of this divergence.

At the end of the previous quarter, Palantir commanded an extraordinary 368x revenue multiple, while Recursion traded at 482x. Even more modest AI performers like Tempus AI (43x) and BigBear.ai (86x) exceed top-tier SaaS companies. In contrast, leading SaaS names like Datadog and ServiceNow (both 56x) represent the high end of their category, with most peers clustered between 25x and 40x.

Key Valuation Differences (2024-2025)

AI startups command revenue multiples that are several times higher than SaaS. Currently, AI has an average revenue multiple of 37.5x against a SaaS multiple of 7.6x. The valuation premium for AI startups reflects both genuine technological disruption and speculative positioning.

Traditional SaaS multiples have stabilized after significant post-2021 compression. Between 2024 and 2025, most traditional SaaS companies trade in a mid-single-digit revenue multiple range, clustering near 2.5-7x EV/Revenue multiple.

This stabilization reflects:

- Predictable recurring revenue models

- Clear unit economics and margin visibility

- Slower but more reliable growth trajectories

In effect, SaaS is now priced as a proven business model rather than a speculative growth vehicle.

Subsector Variations

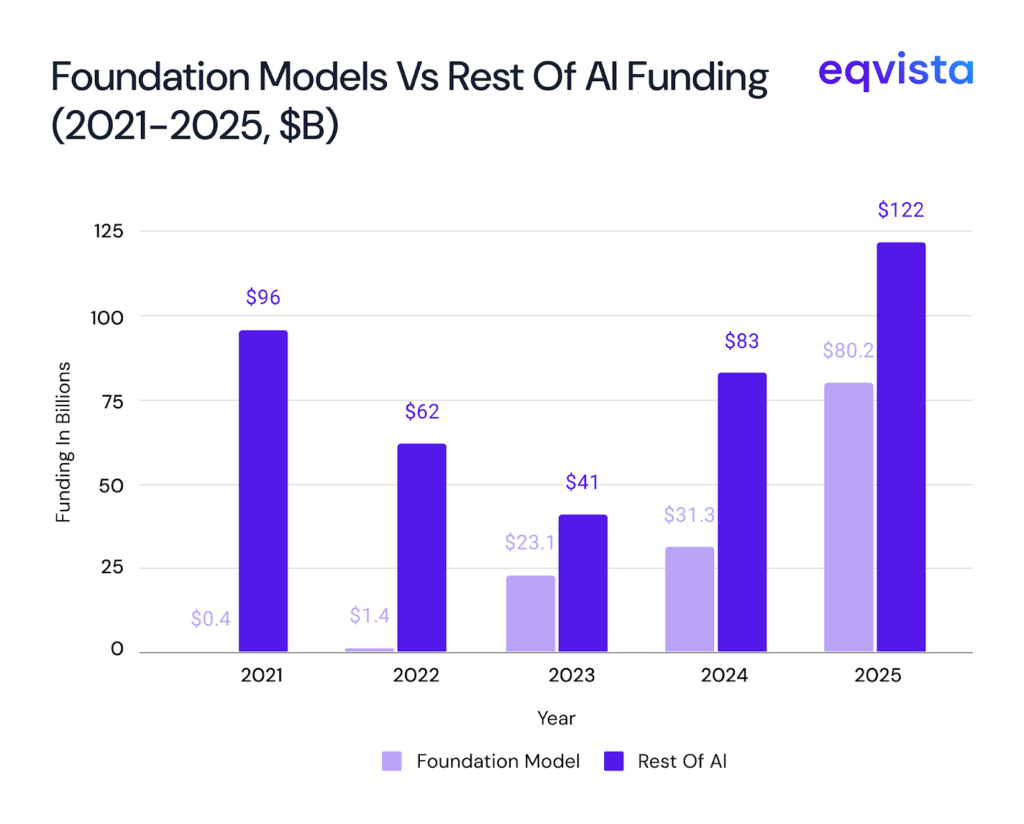

The valuation premium is not evenly distributed across all AI or SaaS businesses. Markets are selectively rewarding AI-native platforms, particularly those positioned as infrastructure or foundational layers, while applying greater scrutiny to applied or derivative AI products.

Capital allocation data shows a sharp rise in funding toward foundation models, underscoring investor belief in their central role within the AI value chain. These companies benefit from optionality across multiple end markets, which partially justifies elevated multiples.

Within SaaS, vertical platforms outperform generic counterparts. Vertical SaaS commands higher multiples (12.3x) than the average SaaS company (7.6x) due to focused value propositions and internalized costs. However, even high-quality vertical SaaS businesses typically trade below AI-native peers.

AI-powered SaaS platforms sit between these extremes at revenue multiples higher than 8x.

SaaS companies combining strong retention, clear go-to-market execution, and demonstrable AI differentiation can achieve premium valuations, particularly in regulated or data-rich verticals such as fintech, logistics, and legal technology.

Recent Trends: Signs of a Bubble?

The magnitude of AI valuation premiums invites comparisons to the dot-com era, especially when you consider the drastic drops in market cap-to-revenue multiples for certain AI companies.

At the peak of the dot-com cycle, many internet companies traded at extreme multiples despite negligible revenues, ultimately failing to justify their valuations. For instance, internet companies like Pets.com, Webvan, Kozmo.com, and Boo.com had market cap to revenue multiples of 70.69, 20,253, 228.57, and 573.53. In contrast, Apple and Compaq, two veterans of IT and computing, had multiples of 9.44 and 2.35.

Among conventional computer hardware companies, slightly on the higher end, you could see NVIDIA trading at 23.47.

But, ultimately, NVIDIA justified its multiples through durable business models, execution discipline, and structural demand tailwinds. Something most internet companies, barring Amazon, could not achieve.

The question for today’s AI market is whether current leaders can demonstrate similar fundamentals before investor patience runs out. Those with genuine technological moats, growing revenue bases, and credible paths to profitability may emerge as the Amazons and NVIDIAs of the AI era. Others may join Pets.com and Webvan in the cautionary tale column.

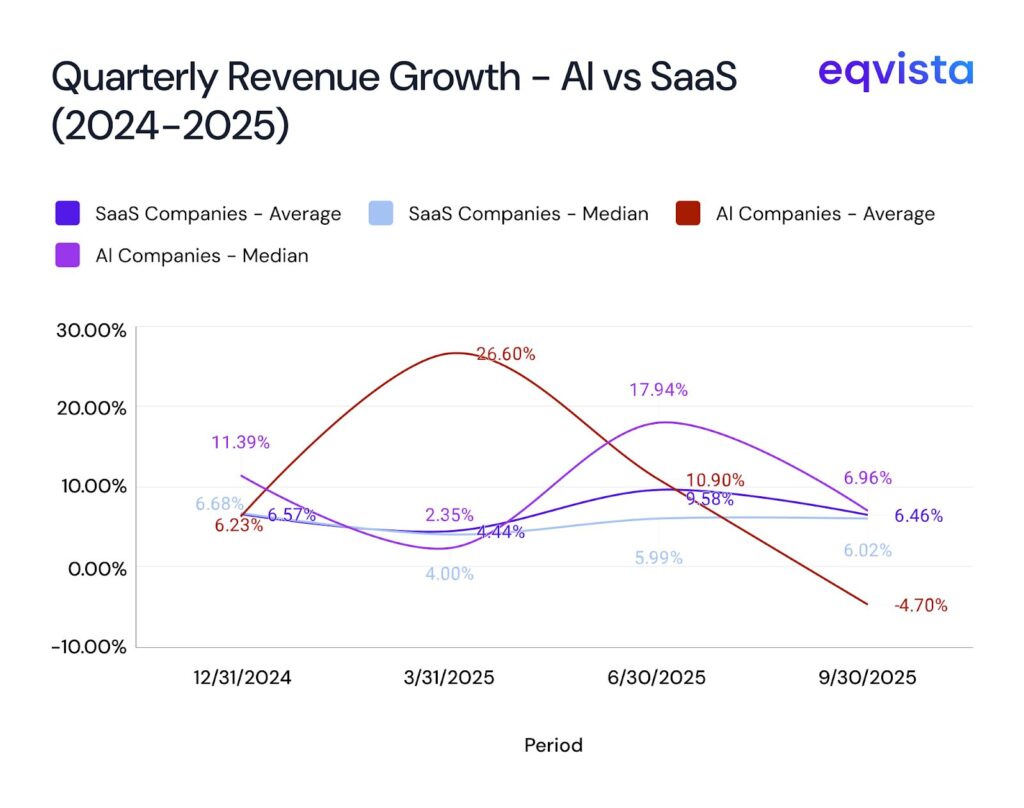

Current AI revenue growth data presents a mixed picture. While some AI companies demonstrate exceptional growth, others show volatility or deceleration, suggesting that valuation dispersion will likely widen further. As with the dot-com cycle, outcomes will depend less on narrative dominance and more on the ability to convert technological leadership into sustainable revenue and margins.

Eqvista- Separating Signal from Speculation!

The valuation gap between AI and SaaS reflects a fundamental shift in investor expectations, not merely short-term hype. AI is being priced as a transformative technology, while SaaS is valued as an established cash-generating model.

However, history suggests that only a subset of companies will ultimately justify today’s premiums. The challenge for investors and founders is distinguishing enduring value creation from transient exuberance.

At Eqvista, we analyze valuation multiples in the context of fundamentals, sustainability of growth, and capital efficiency.

Our accurate and defensible valuation frameworks can prove useful whether you are exploring AI or SaaS investment opportunities or preparing for fundraising or M&A. Contact Eqvista to move forward with clarity!