Private Company Compliance Requirements Explained: Equity, Reporting, and Governance

As private companies scale from early-stage startups to venture-backed enterprises, their compliance obligations evolve dramatically. What begins as informal updates to angel investors can quickly transform into rigorous reporting requirements that rival those of public companies.

Understanding these requirements early helps founders avoid costly mistakes, maintain investor confidence, and position their companies for successful funding rounds.

This article explores the importance of good governance, SEC reporting triggers, equity reporting, and compliance, and how to align your reporting standards with VC and PE fund reporting obligations.

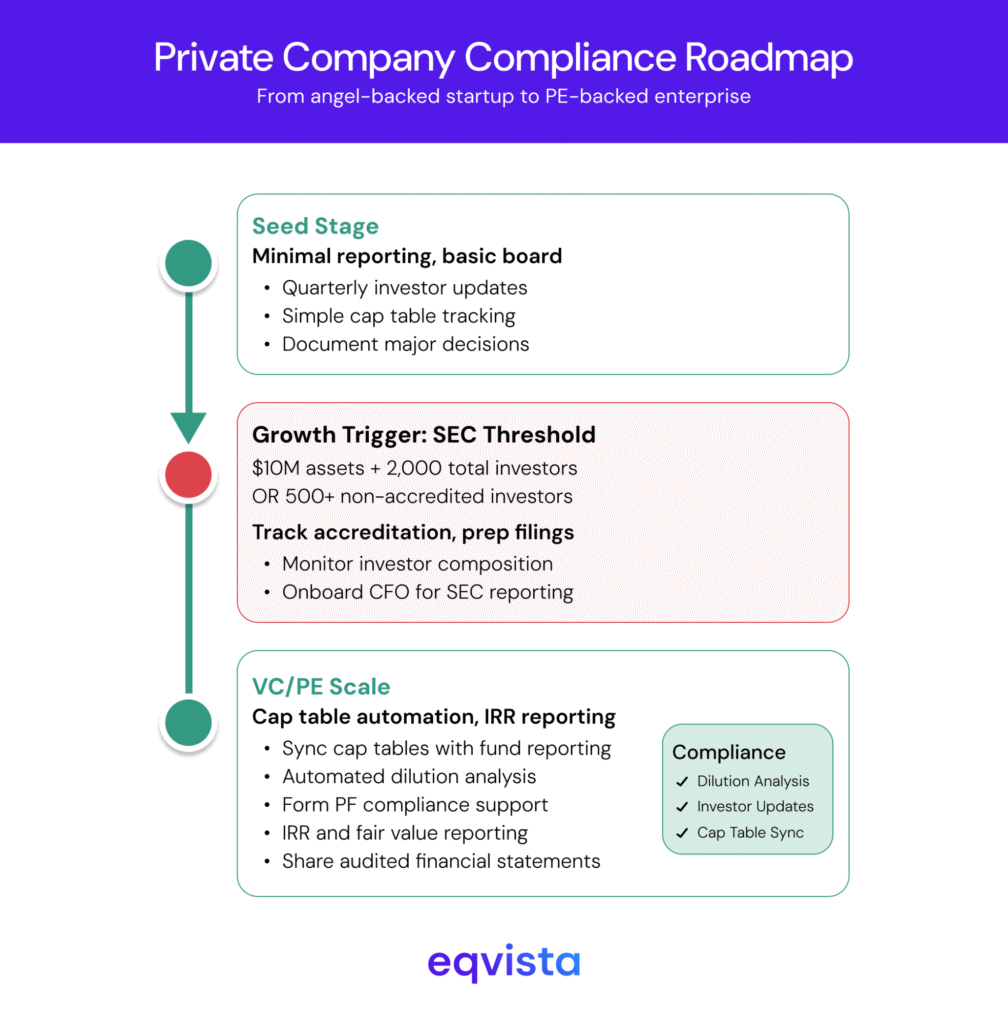

Summary Of Compliance Journey

Here, we added a visual roadmap to help founders quickly see how compliance requirements evolve as their company grows. It connects each funding stage to the specific reporting and governance actions they need to stay ahead of regulatory and investor expectations.

This summarizes the shift from light governance at the seed stage to SEC registration triggers as the investor base expands, and finally to the more rigorous reporting standards expected by VC and PE investors.

Importance of Good Governance

In private markets, governance structure depends on whose money you accept. At the seed stage, when you’ve only onboarded angel investors, startups can get away with minimal reporting and lax governance practices. Investors primarily focus on whether the startup finds evidence of product-market fit or achieves other significant milestones necessary for Series A funding.

However, this doesn’t mean that founders can completely neglect corporate governance standards.To maintain strong relationships with early-stage investors and prepare for venture capital funding, startups should establish a functional board structure with clear roles and scalable decision-making processes.

They need to maintain accurate and regularly updated cap tables, provide quarterly investor updates that share key metrics and progress, formally document major company decisions, and implement basic financial controls such as expense approvals and reporting standards expected by institutional investors.

SEC Reporting Triggers

In the US, most private companies must register with the Securities and Exchange Commission (SEC) when they cross the Section 12(g) thresholds. Effectively, you must register if your total assets are greater than $10 million and your investors include 2,000 persons (accredited + non-accredited) or 500 non-accredited investors.

So, private companies that heavily rely on equity financing must be mindful of the following two things:

Track Investor Make Up

Between 2016 and 2024, US seed startups grew at a median CAGR of 68.45%. So, your startup will cross the total assets threshold in no time. Hence, you must proactively track the number of investors and how many of them are accredited versus non-accredited. Since investor accreditation statuses can change overnight, you must periodically request shareholders to confirm them.

Reporting Rigor

SEC registrants under Section 12(g) are subject to reporting requirements similar to those of listed companies. This would mean filing annual, quarterly, and current reports. So, if you expect to cross Section 12(g) thresholds in the next funding round, consider onboarding fractional CFOs or full-time executives who can help shoulder these reporting requirements.

Equity Reporting and Compliance

In private markets, equity reporting revolves around two considerations: growth tracking and dilution analysis. Basically, investors want to know the pace at which your company is growing and how their ownership percentage in your company has changed due to funding rounds and equity compensation.

You can address these concerns effectively using reliable cap table software like Eqvista, which offers automatic dilution analysis for real-time visibility into ownership changes and round impacts. Its scenario modeling tools allow instant visualization of funding round dilution, while a centralized platform ensures a single source of truth and eliminates version control issues.

With controlled user access, you can maintain confidentiality and transparency, and automated calculations help reduce manual errors and data discrepancies.

Aligning Reporting Standards with VC and PE Fund Obligations

If you accept investments from private equity (PE) firms, they may require you to periodically report certain information so that they can meet their own reporting requirements. Some examples of this include:

Form PF Requirements for Fund Advisers

Registered private fund advisers with an AUM of at least $150 million must annually file Form PF, wherein they must list all assets and liabilities with the respective fair values. In the same form, advisers must report monthly, quarterly, and annual performance using a consistently applied methodology like internal rate of return (IRR).

Large private equity advisers (AUM of $2 billion or more) are also required to file details such as gross asset value, debt-to-equity ratio, North American Industry Classification System (NAICS) code, and country ISO code for financial industry portfolio companies.

Investor Dispute Documentation

PE firms are required to share audited financial statements with investors annually if they do not qualify for the audit exception under Rule 206(4)-2. If these statements lead to disputes, swift redressal would require portfolio companies’ financial statements as supporting documents.

Bridge Round and Credit Facility Compliance

If you raise a bridge round and a participating fund relies on credit to extend funding, the fund is required to send a compliance letter discussing the financial covenants and other organizational matters. These covenants must be adequately explained using your company’s valuation and performance.

Eqvista – Your Partner in Compliance-Ready Equity Management!

Navigating the complex landscape of private company compliance requires more than good intentions. It demands robust systems that grow with your company.

From maintaining accurate cap tables and tracking investor accreditation status to managing dilution scenarios and supporting PE fund reporting requirements, the right infrastructure makes compliance manageable rather than overwhelming.

As your company scales through funding rounds and your investor base expands, the stakes only get higher. Eqvista provides the comprehensive cap table management and valuation tools you need to stay compliant and maintain investor confidence. Contact us today to see how we can simplify your equity management and reporting requirements!