When Is a Fairness Opinion Required? Comparing Public vs. Private Company Transactions

In this article, we will explore when exactly fairness opinions are required by public companies and why even private companies can benefit from them.

Fairness opinions are reports prepared by a qualified third party that evaluate whether a merger (or acquisition) offer is fair. These reports evaluate the offer price in the context of market equivalents as well as other key terms and conditions of the offer to inform shareholder decision-making.

Most shareholders do not have the bandwidth to assess whether an offer price is fair, let alone assess the various terms and conditions. A fairness opinion provides an unbiased and expert walkthrough of the deal terms, allowing shareholders to make informed decisions.

What role do fairness opinions play for public companies?

While there are no SEC regulations or federal or state laws requiring fairness opinions for public companies in the US, they have become common practice because they aid shareholder decision-making.

Some of the features that make these documents crucial in public M&A transactions are:

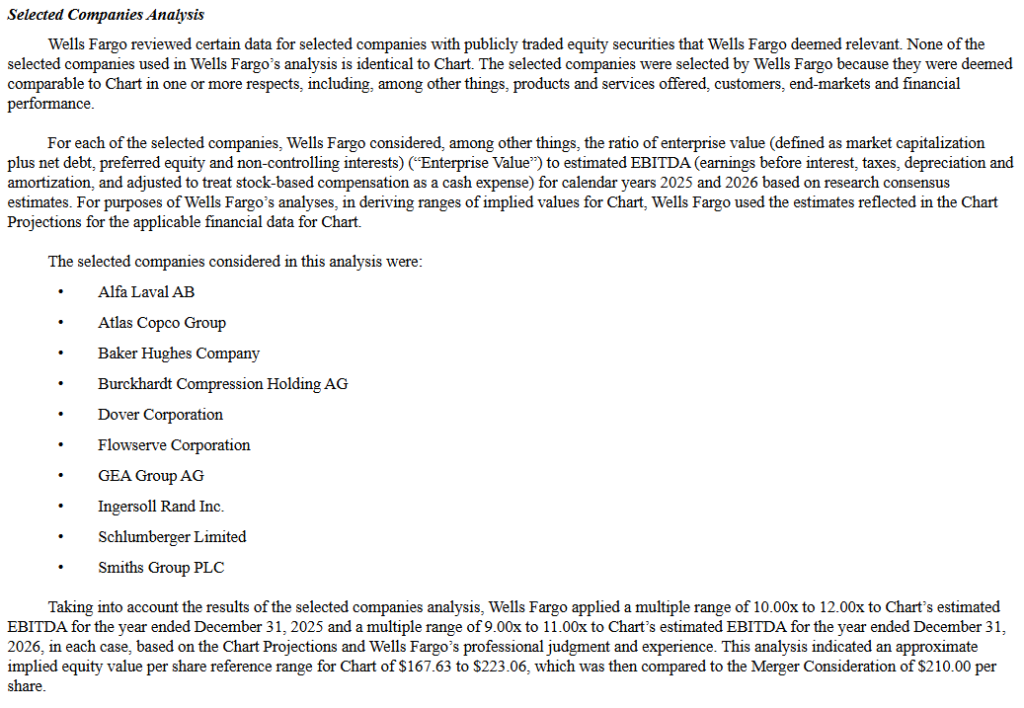

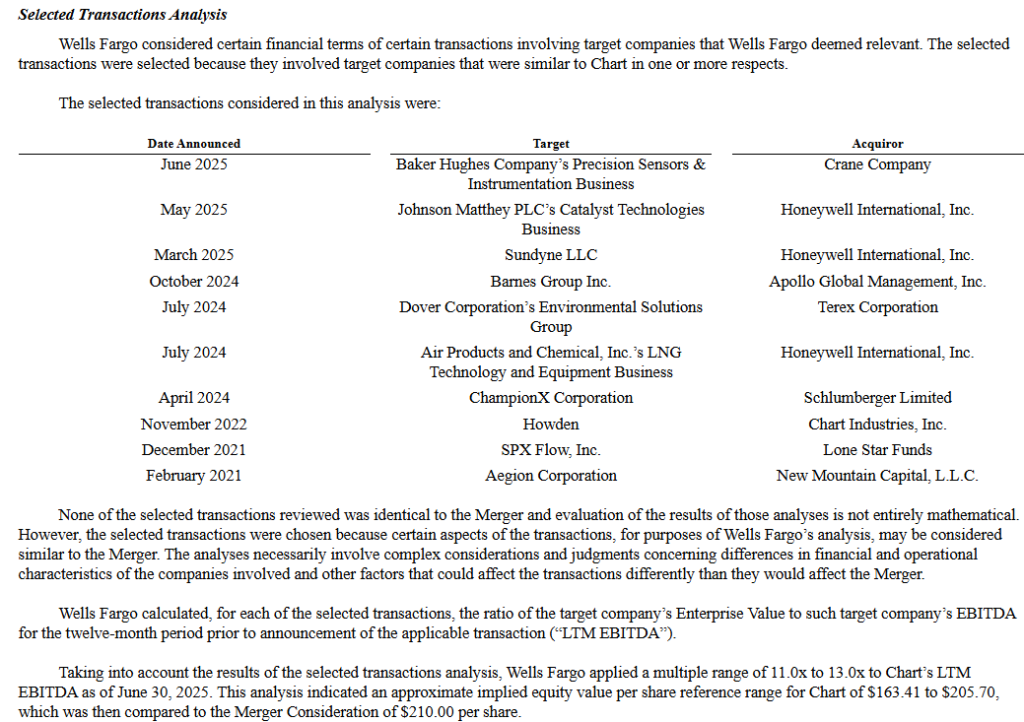

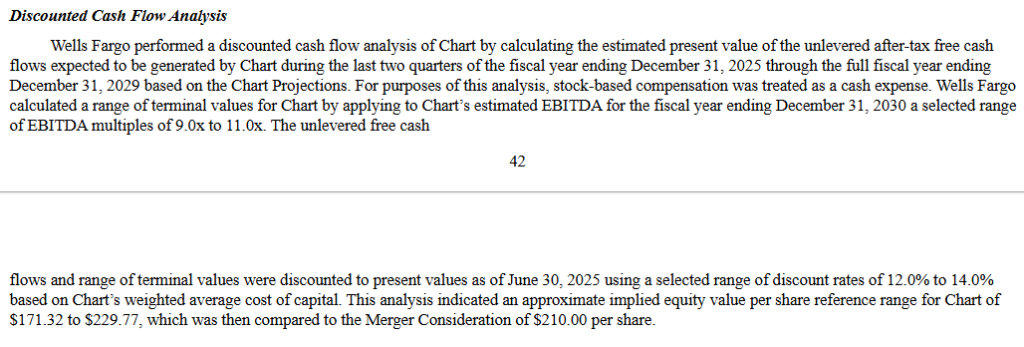

Valuation Analysis

Fairness opinions help ensure that the economic terms of a proposed transaction are financially fair to shareholders. By offering an independent assessment of whether the consideration falls within a reasonable valuation range, they give both boards and shareholders an objective benchmark when evaluating offers that may significantly affect ownership or control.

Example: Sets of valuation analysis performed by Wells Fargo in its fairness opinion in relation to Baker Hughes’ acquisition of Chart Industries

Source: SEC

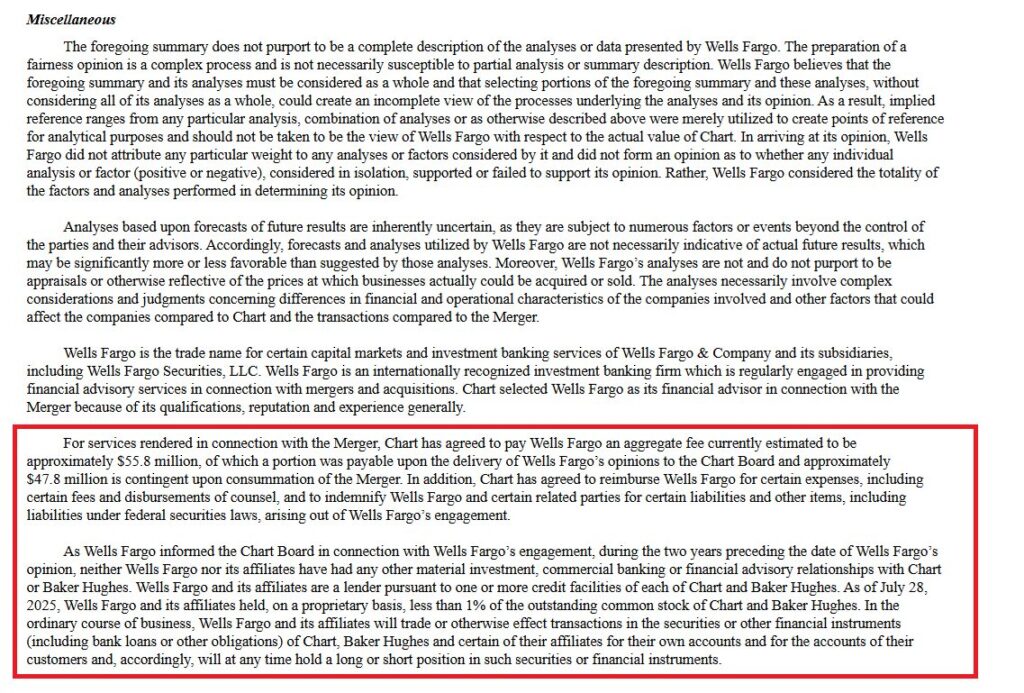

Transparent Disclosures

FINRA Rule 5150 requires firms issuing fairness opinions to disclose their role transparently. Firms must reveal whether they served as financial advisors to any transaction party and whether their compensation depends on deal completion. They must also disclose other contingent fees, material relationships in the past two years or expected going forward, and related compensation.

Such transparency ensures that shareholders receive unbiased and expert opinions to vote on the proposed transactions.

Example: Key disclosures about Wells Fargo’s role in its fairness opinion

Source: SEC

Rigorous Investigations

Rule 5150 also requires firms to state whether they independently verified key information supplied by the company and, if so, what categories of data were verified. This transparency allows shareholders to assess how much of the valuation relies on management’s representations versus independent due diligence.

Fairness opinions must also disclose whether they evaluate the fairness of compensation to insiders compared with public shareholders.

Balanced Internal Review

Firms issuing fairness opinions often also advise companies on M&A transactions. So, to ensure balanced reviews, under FINRA 5150, firms must maintain written procedures for approving fairness opinions. These procedures must indicate how members were chosen for the internal approval of fairness opinions. Firms also need to ensure that individuals outside the deal team review the analysis and approve it before it is shared with the client.

These measures reduce deal-team bias.

Because of these disclosure and procedural standards, fairness opinions promote transparency, enhance shareholder trust, and help boards demonstrate that they are faithfully representing shareholder interests in major corporate transactions.

Why should private companies consider getting fairness opinions?

In 2024, the United States Court of Appeals for the 5th Circuit unanimously scrapped the SEC’s new rules for private equity funds. One of these rules would have required PE fund advisers to get fairness opinions in an adviser-led secondary transaction.

While these rules were scrapped, fairness opinions are considered best practices because of the following reasons:

Facilitates price discovery

Private markets lack the price discovery mechanisms available to public companies. Without active trading markets, determining fair value becomes more complex and subjective.

A fairness opinion provides an independent, methodical valuation that considers multiple approaches, such as discounted cash flow analysis, to establish whether the proposed price falls within a reasonable range.

This objective assessment protects minority investors who may lack the resources or expertise to challenge valuations presented by controlling stakeholders.

Exposes any conflicts of interest for GPs

In adviser-led secondary transactions, general partners (GPs) often sit on both sides of the deal. They manage the selling fund while also controlling the acquiring vehicle. This dual role creates inherent conflicts that can disadvantage limited partners (LPs).

A fairness opinion from an independent third party scrutinizes the transaction structure, pricing, and terms to identify whether GPs are extracting disproportionate value.

Through transparent disclosures about relationships, fees, and verification procedures, fairness opinions shine light on potential conflicts and ensure GPs are acting in LPs’ best interests rather than prioritizing their own gains.

Catalyzes consensus building

Private company transactions frequently involve diverse stakeholder groups with competing interests. Founders seek liquidity, early investors and employees want positive returns, and incoming investors want a favorable entry price.

A fairness opinion serves as a neutral anchor point that facilitates productive negotiations.

When all parties can reference an independent valuation backed by rigorous analysis, discussions shift from biased bargaining to constructive dialogue. This shared framework accelerates deal closure by reducing suspicion and building confidence that the transaction treats all stakeholders fairly.

Eqvista – Expert Valuations for Fair Outcomes!

Fairness opinions have become strategic tools that protect stakeholders and streamline transactions. Whether navigating public market scrutiny or private deal complexity, these expert assessments provide the transparency and objectivity that modern transactions demand.

They demonstrate fiduciary responsibility, mitigate litigation risk, and accelerate deal closure by ensuring all parties operate from a foundation of trust.

Our valuation experts deliver comprehensive fairness opinions that combine rigorous analysis with clear communication, helping you demonstrate good faith and protect all parties’ interests. Contact us to discuss how a fairness opinion can strengthen your next transaction!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!