Fairness Opinion v/s Business Valuation: What’s the Difference?

For two analyses that support completely different purposes, fairness opinions and valuation reports have a lot of common elements. They use the same inputs, such as financial histories, projections, capital structures, and market trends. Even methodologies such as comparable company analysis and the discounted cash flow (DCF) method are common between the two.

So, what’s the difference between fairness opinions and business valuations? And do you really need a fairness opinion if you already have a business valuation report?

In this article, we will answer these queries by noting the differences in purpose and methodology between fairness opinions and business valuations.

What do fairness opinions and business valuation reports look like?

Before we dive into the key differences between fairness opinions and business valuation reports, let us take a look at some examples to build context.

Fairness opinion – Nippon Steel’s acquisition of US Steel

In June 2025, Nippon Steel completed its $14.9 billion acquisition of US Steel. In connection with this merger, US Steel filed a proxy statement containing opinions of Goldman Sachs & Co. and Barclays Capital.

Barclays Capital

Goldman Sachs & Co

409A business valuation report sample

409A valuation reports help companies establish their fair market value (FMV) and issue equity compensation in a tax-compliant manner. It is a comprehensive and detailed report that analyses the company’s corporate structure and financial history, industry trends, and macroeconomic developments.

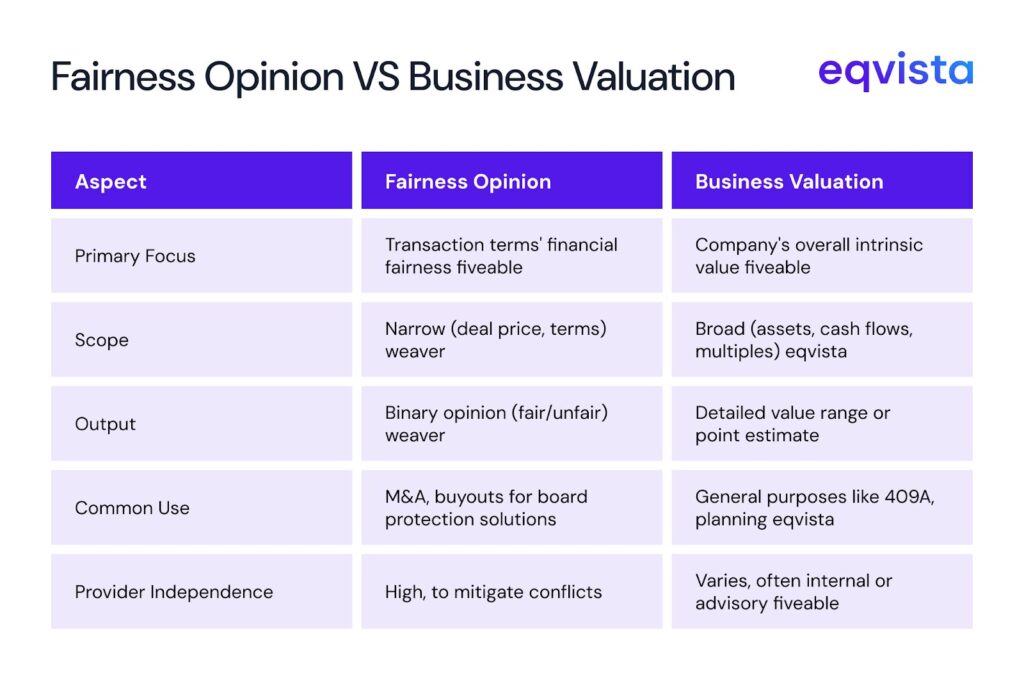

What are the key differences between fairness opinions and business valuations?

This section outlines how business valuations and fairness opinions have different methodologies, purposes, depth, intended audiences, and levels of susceptibility to conflicts of interest.

Methodology

Business valuations: Determining value

A business valuation report is built from the ground up. The valuation professional selects appropriate methodologies based on the nature of the business, the purpose of the valuation, and the data availability.

This process involves collecting and normalizing financial information, assessing risk, making informed assumptions, constructing detailed financial models, and applying valuation techniques to arrive at a valuation. The analysis is typically exhaustive. Assumptions are documented, data sources are cited, and extensive sensitivity analyses are often included to illustrate how changes in key variables impact value.

Fairness opinions: Investigating accuracy

A fairness opinion does not seek to independently value the company from scratch. Instead, it evaluates whether the valuation conclusions and deal terms are reasonable within the context of the transaction.

The analysis focuses on whether the methodologies selected were appropriate, whether the assumptions are reasonable, and whether the resulting consideration falls within a range that can be considered fair. As a result, fairness opinions are narrower in scope and highly subjective. They are concise opinion letters rather than being lengthy technical reports.

Depth

Business valuations: Multi-page, sectioned reports

Business valuation reports may be scrutinized by auditors, regulators, tax authorities, or opposing parties in a transaction, they must be comprehensive and defensible.

Each component of the analysis is typically documented in detail, with supporting exhibits and appendices. The goal is transparency and reproducibility. Another qualified professional should be able to follow the logic and understand how the valuation conclusion was reached.

Fairness opinions: Single-page letters

Fairness opinions are executive-level documents designed to support board decision-making.

Rather than presenting every calculation, they summarize key analyses and express an overall conclusion regarding fairness. The brevity is intentional, but it does not imply a lack of rigor. Instead, the rigor lies in the professional judgment applied to evaluating the transaction as a whole.

Intended audience

Business valuations: Wide range of stakeholders (including regulators)

Business valuations are used by a broad range of stakeholders, including management, investors, auditors, courts, and tax authorities. The report is often a reference document that may be relied upon long after it is issued.

Fairness opinions: Shareholders

Fairness opinions are primarily tools of governance. Shareholders review these documents to understand whether the consideration is fair and if the board diligently represented the shareholders’ interests.

Conflicts of interest

Business valuations: Third-party reports

Ideally, a business valuation is performed by a reputable third party with no economic interest in the outcome. This independence enhances credibility and is particularly important in contexts such as equity compensation or shareholder disputes.

When independence is maintained, the valuation can serve as a reliable anchor point for negotiations and regulatory compliance.

Fairness opinions: Investigations of biases and misrepresentation

Fairness opinions exist precisely because conflicts of interest can arise in major transactions. Investment banks and financial advisers may have fees tied to deal completion or transaction size, creating incentives that may not align perfectly with shareholder interests.

Problems emerge when the fairness opinion is provided by the same firm advising on the transaction. In such cases, the opinion may satisfy procedural requirements while offering limited substantive protection.

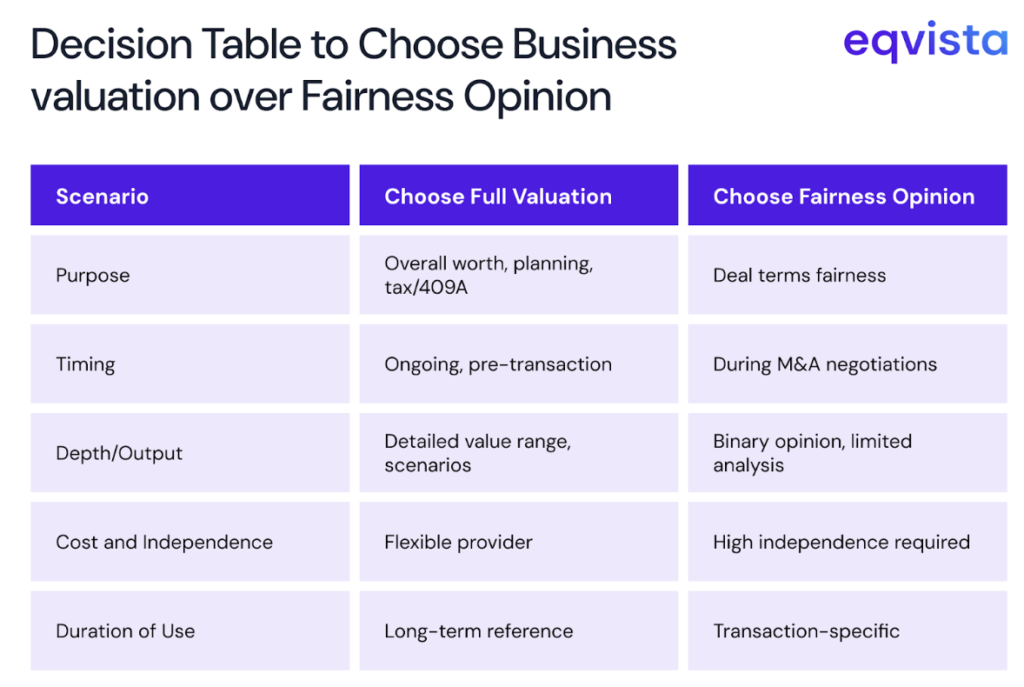

When to choose business valuation over a fairness opinion

A full valuation is best for comprehending overall company value, strategic planning, and tax or 409A needs, and is usually conducted on an ongoing, pre-transaction basis. It provides a detailed value range and scenario analysis and can be obtained from a flexible provider like Eqvista, making it useful as a long-term reference.

In contrast, a fairness opinion is used specifically during M&A negotiations to assess whether deal terms are fair, offers only a binary conclusion with limited analysis, requires a highly independent provider, and is intended for a single transaction.

This decision table compares when a company should choose a full business valuation versus a fairness opinion.

Eqvista- Sound Judgment in Complex Transactions!

A well-prepared valuation establishes what a business is worth. A carefully considered fairness opinion investigates methodologies, assumptions, and transaction structures to verify whether all stakeholders are treated equitably.

The two analyses are not substitutes. When used together appropriately, they address both economic and governance considerations.

In major transactions, businesses can leverage third-party valuation reports as a credible and unbiased starting point and then use fairness opinions to build consensus quickly and execute.

In complex or sensitive transactions, engaging a seasoned valuation expert such as Eqvista is often the difference between procedural compliance and genuine confidence in the outcome. We provide rigorous analysis and independent opinions, enabling stakeholders to make decisions with confidence and clarity. Contact us to know more!