SaaS Index 2026: Tracking Revenue Multiples and Market Hype in SaaS

The Eqvista SaaS Index 2026 tracks valuation trends, investor sentiments, and growth velocity across the global and regional software-as-a-service (SaaS) landscape. In the current VC landscape, where investors exhibit caution that’s not AI, understanding how valuations respond to market cycles is critical for founders planning funding rounds.

Our analysis expands on public SaaS insights by exploring the private segments to provide comprehensive and actionable insights into what drives revenue multiples, how narratives shift investor appetite, and where the industry stands currently.

Key findings

- Private SaaS revenue multiples stabilized around 16.11x in Q1 2025

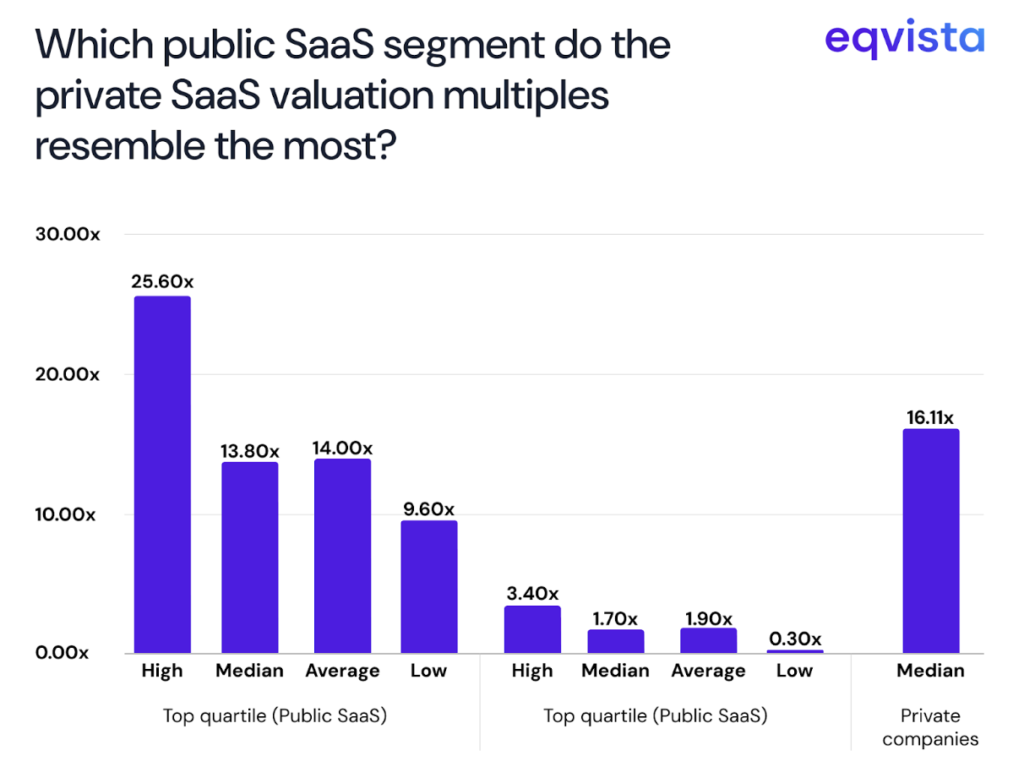

- Private SaaS median multiples align more closely with top quartile public SaaS companies than the overall public SaaS market medians

- Companies prioritizing revenue growth over margins achieve higher valuations

- The Rule of 40 remains the dominant framework for SaaS valuations

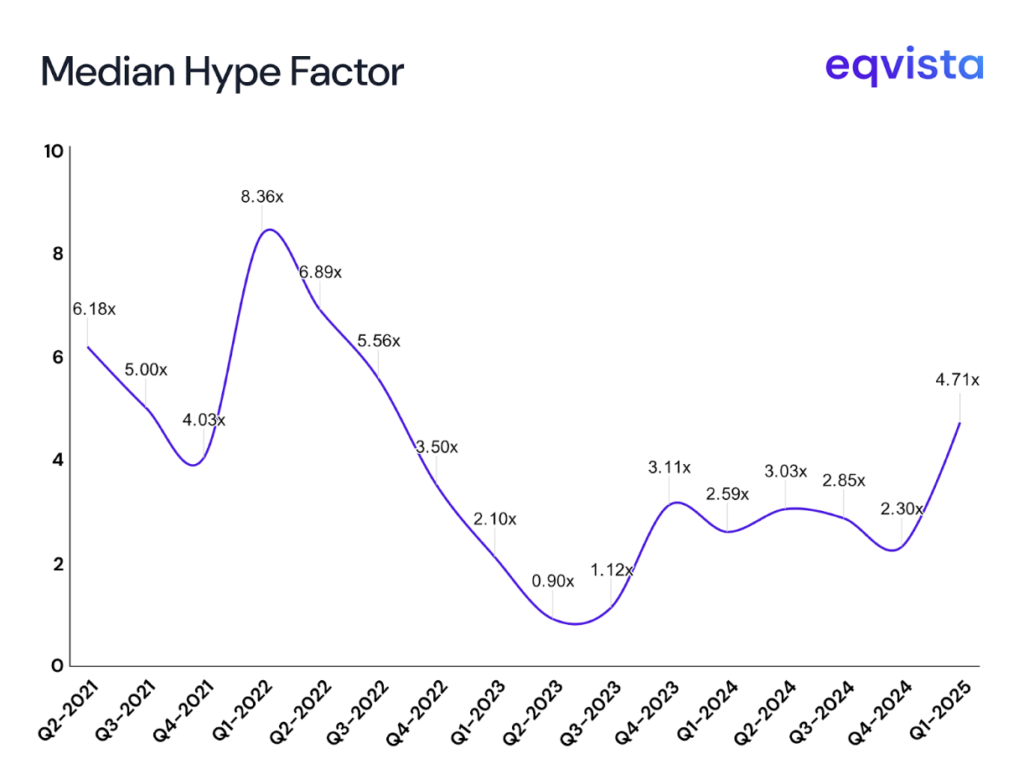

- The Hype Factor recovered from 0.90x in Q2 2023 to 4.71x in Q1 2025, indicating improved but measured optimism

2021-2025 Timeline

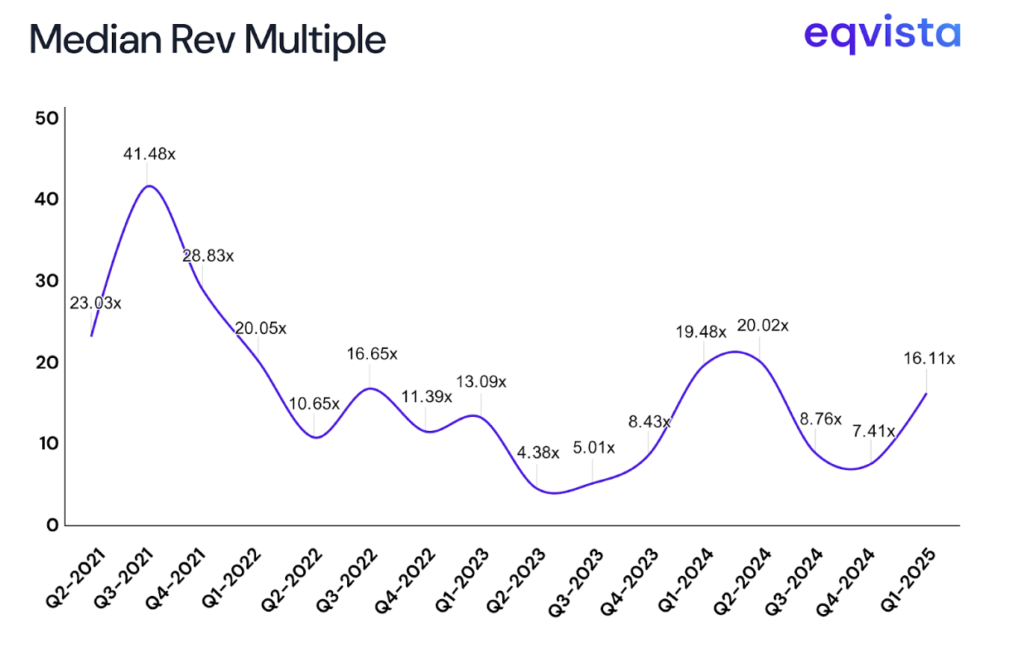

Our analysis of thousands of companies in the Eqvista database reveals that SaaS revenue multiples peaked at 41.48x in Q3 2021, driven by pandemic-era digital transformation and historically low interest rates. The market then cascaded to a local minimum of 4.38x in Q2 2023 as interest rates rose and the hype wore off, giving way to greater scrutiny of profitability metrics.

Since then, revenue multiples have recovered and ebbed, stabilizing at 16.11x in Q1 2025. This normalization reflects a shift from exuberance to cautious optimism.

Eqvista SaaS Index – Median Revenue Multiple (2021-2025 | Quarterly)

When we examine the EV/Revenue multiples for the top and bottom quartiles and compare them with the private company median, a clear pattern emerges, the median of 16.11x sits closer to the top quartile median (13.80x) and average (14.00x) than to the public market median. This suggests that private SaaS companies being valued closely resemble the stronger performers in public markets.

The Rule of 40 in Action!

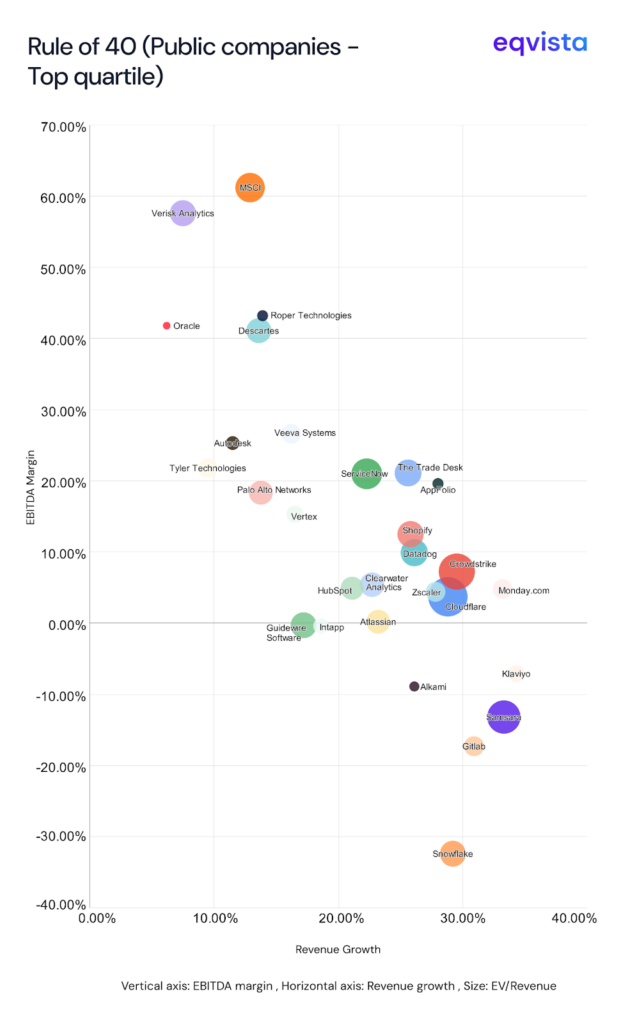

In the SaaS industry, investors rely on the Rule of 40 to judge whether a company balances growth against profitability effectively. This rule requires the sum of revenue growth percentage and EBITDA margin to reach at least 40%.

The top quartile of public SaaS companies by EV/Revenue matches the private SaaS valuation landscape best. Nearly all companies in this sub-group satisfy the Rule of 40.

A clear pattern is that companies with substantial revenue growth but limited EBITDA margins command the highest EV/Revenue multiples.Cloudflare leads with a 25.6x multiple on 28.8% revenue growth and just 3.7% EBITDA margin, while CrowdStrike commands 22.5x despite only 7.5% EBITDA margin.

Hype vs. Fundamentals

Investor sentiment can drive SaaS valuations as much as fundamentals, with revenue multiples expanding in risk-on periods and compressing when markets refocus on profitability.

SaaS IPO Pipeline : In 2025, IPO appetite improved only slightly amid tariff uncertainty, with tech IPOs raising $3.55 B by midyear, just above H1 2024. SailPoint, the only enterprise software IPO in H1 2025, traded 25% below issue within four months, while Klarna was down 22.6% by late November 2025, reinforcing investor caution on growth names.

VC Deal Flow: SaaS VC value fell from $150.6 billion across 5,491 deals in 2021 to $80.6B in 2023, then edged up to $84.3B in 2024. Mid‑2025 levels of $82.3B across just 1,569 deals underscore a regime of fewer, larger rounds concentrated in perceived category leaders.

How do SaaS IPO sentiments and VC deal flow intensity translate into the hype factor?

The Hype factor measures how “hyped” a company’s raise is when comparing their annual revenue to their capital raised. We calculated this in its most direct way with last capital raised to the previous year’s revenue. A high Hype Factor is an indicator of valuations being misaligned with fundamentals and being influenced by market sentiment.

Eqvista’s database of thousands of companies shows the median Hype Factor peaked at 8.36x in Q1 2022 as late-stage pandemic optimism persisted, then collapsed to 0.90x in Q2 2023. Since then, the factor has gradually recovered to 4.71x in Q1 2025, suggesting that while sentiment has improved from lows, investors remain more disciplined than during the 2021-2022 euphoria.

Eqvista SaaS Index – Median Hype Factor (2021-2025 | Quarterly)

Eqvista- Navigating SaaS Valuations with Confidence!

The Eqvista SaaS Index reveals an industry rebounding with discipline but sustained optimism. The current market rewards both growth and profitability, although growth carries more weight. Private SaaS valuations now align closely with public investors rewarding companies with stronger fundamentals.

Established SaaS players dominate enterprise deals, using credibility and cash to fuel acquisitions,while venture capital increasingly favours AI-first vertically integrated challengers. Going forward, competition will center on affordability and user-friendliness.

Eqvista publishes ongoing valuation insights across industries, valuing $2-3B in client assets every month. If you need accurate, audit-ready SaaS valuations for fundraising, M&A, or financial reporting, reach out to Eqvista today.