SaaS Valuation Multiples 2025

Imagine trying to price a rare artwork without knowing what similar works have sold for—every guess feels like a shot in the dark. In the fast-moving world of SaaS, where recurring revenue and growth potential are prized, entrepreneurs, startups, and investors face a similar challenge:

How do you pin down what a software business is truly worth?

The answer lies in valuation multiples, a set of benchmarks that shows how the market values. These multiples don’t just assign a number to a business—they shape strategies, negotiations, and futures within the ecosystem. Moreover, this is a universal language that aligns the interests and expectations of founders, startups, and investors, driving smarter and more strategic decisions across the board.

This article will explore the latest SaaS valuation trend with our data insights.

SaaS Valuation Multiple Trends

With our latest SaaS valuation multiple data, startups can benchmark their company’s value against industry standards, set realistic fundraising and exit targets, and identify which business metrics are most likely to drive higher valuations.

| Symbol | P/E | PEG TTM | P/S | P/B | P/CF | P/FCF | Price / cash | EV | EV / revenue TTM | EV / EBIT TTM | EV / EBITDA TTM |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Microsoft Corporation | 31 | 3 | 11 | 10 | 23 | 41 | 41 | 2.92 T USD | 11 | 25 | 20 |

| Alphabet Inc. | 19 | 1 | 6 | 6 | 15 | 26 | 20 | 1.86 T USD | 5 | 16 | 14 |

| Oracle Corporation | 31 | 3 | 7 | 22 | 18 | 65 | 21 | 450.12 B USD | 8 | 25 | 19 |

| Salesforce, Inc. | 40 | 1 | 7 | 4 | 19 | 20 | 18 | 243.09 B USD | 6 | 32 | 19 |

| Palantir Technologies Inc. | 468 | 4 | 78 | 41 | 194 | 196 | 43 | 202.77 B USD | 71 | 653 | 593 |

| Intuit Inc. | 55 | 6 | 10 | 9 | 29 | 30 | 68 | 168.55 B USD | 10 | 42 | 35 |

| ServiceNow, Inc. | 115 | — | 15 | 17 | 38 | 48 | 28 | 159.3 B USD | 15 | 117 | 87 |

| Adobe Inc. | 23 | 1 | 7 | 12 | 16 | 17 | 21 | 149.35 B USD | 7 | 19 | 17 |

| Palo Alto Networks, Inc. | 95 | — | 14 | 17 | 38 | 41 | 37 | 109.11 B USD | 13 | 110 | 83 |

| Shopify Inc. | 56 | 0 | 12 | 9 | 70 | 71 | 20 | 104.04 B USD | 12 | 83 | 81 |

| CrowdStrike Holdings, Inc. | — | — | 23 | 29 | 68 | 87 | 22 | 90.18 B USD | 23 | — | 934 |

| Autodesk, Inc. | 50 | 2 | 9 | 21 | 35 | 36 | 30 | 55.72 B USD | 9 | 40 | 35 |

| Atlassian Corporation | — | — | 11 | 43 | 36 | 37 | 21 | 50.75 B USD | 11 | — | — |

| Snowflake Inc. | — | −0.73 | 13 | 16 | 50 | 53 | 10 | 46.49 B USD | 13 | — | — |

| Veeva Systems Inc. | 50 | 1 | 13 | 6 | 33 | 34 | 7 | 30.39 B USD | 11 | 44 | 41 |

| Datadog, Inc. | 179 | 1 | 13 | 12 | 38 | 40 | 8 | 29.37 B USD | 11 | 541 | 217 |

| HubSpot, Inc. | 6152 | — | 10 | 14 | 46 | 49 | 13 | 26.2 B USD | 10 | — | 524 |

| Check Point Software Technologies Ltd. | 29 | 6 | 10 | 8 | 23 | 23 | 17 | 21.82 B USD | 9 | 25 | 23 |

| Zoom Communications, Inc. | 22 | 0 | 5 | 2 | 12 | 12 | 3 | 14.04 B USD | 3 | 16 | 13 |

| Samsara Inc. | — | — | 17 | 20 | 162 | 191 | 31 | 20.9 B USD | 17 | — | — |

| Toast, Inc. | — | — | 4 | 13 | 57 | 67 | 14 | 18.21 B USD | 4 | 289 | 164 |

| Okta, Inc. | 1738 | — | 7 | 3 | 24 | 24 | 7 | 16.13 B USD | 6 | — | 645 |

| PTC Inc. | 45 | 1 | 8 | 5 | 22 | 22 | 89 | 19.01 B USD | 8 | 32 | 26 |

| F5, Inc. | 26 | 1 | 5 | 5 | 19 | 19 | 13 | 14.21 B USD | 5 | 20 | 17 |

| DocuSign, Inc. | 15 | 0 | 5 | 8 | 16 | 17 | 17 | 14.22 B USD | 5 | 62 | 42 |

| Twilio Inc. | — | — | 3 | 2 | 19 | 20 | 6 | 12.04 B USD | 3 | — | 69 |

| MongoDB, Inc. | — | — | 7 | 5 | 91 | 114 | 6 | 10.91 B USD | 5 | — | — |

| Dynatrace, Inc. | 27 | 0 | 8 | 5 | 31 | 32 | 13 | 11.97 B USD | 7 | 75 | 56 |

| Paycom Software, Inc. | 24 | 0 | 6 | 8 | 23 | 36 | 30 | 12.16 B USD | 6 | 19 | 14 |

| monday.com Ltd. | 398 | — | 13 | 12 | 41 | 43 | 9 | 10.87 B USD | 11 | — | — |

| Paylocity Holding Corporation | 48 | 1 | 7 | 9 | 27 | 28 | 22 | 10.37 B USD | 7 | 36 | 28 |

| Doximity, Inc. | 53 | 1 | 19 | 10 | 45 | 46 | 13 | 9.08 B USD | 17 | 41 | 39 |

| Procore Technologies, Inc. | — | — | 8 | 7 | 46 | 71 | 12 | 8.39 B USD | 7 | — | — |

| Elastic N.V. | — | — | 6 | 10 | 36 | 36 | 6 | 7.64 B USD | 5 | — | — |

| Klaviyo, Inc. Series A | — | — | 8 | 7 | 44 | 49 | 8 | 6.57 B USD | 7 | — | — |

| Confluent, Inc. | — | — | 7 | 7 | 212 | 747 | 4 | 6.38 B USD | 7 | — | — |

| GitLab Inc. | — | — | 10 | 9 | — | — | 7 | 5.93 B USD | 8 | — | — |

| Open Text Corporation | 11 | 0 | 1 | 2 | 8 | 10 | 6 | 12.18 B USD | 2 | 12 | 7 |

| Informatica Inc. | 571 | — | 3 | 2 | 13 | 13 | 4 | 6.63 B USD | 4 | 47 | 24 |

| UiPath, Inc. | — | — | 4 | 3 | 19 | 20 | 4 | 4.44 B USD | 3 | — | — |

| Clearwater Analytics Holdings, Inc. | 14 | — | 13 | 5 | 80 | 86 | 23 | 5.77 B USD | 13 | 281 | 176 |

| SentinelOne, Inc. | — | — | 7 | 3 | 168 | 838 | 8 | 5.09 B USD | 6 | — | — |

| SPS Commerce, Inc. | 65 | 4 | 8 | 6 | 32 | 37 | 21 | 4.78 B USD | 7 | 54 | 36 |

| Varonis Systems, Inc. | — | — | 8 | 10 | 40 | 43 | 8 | 4.83 B USD | 9 | — | — |

| Qualys, Inc. | 27 | 2 | 7 | 9 | 19 | 20 | 12 | 4.19 B USD | 7 | 22 | 20 |

| BILL Holdings, Inc. | 444 | — | 3 | 1 | 14 | 15 | 2 | 3.71 B USD | 3 | — | 174 |

| Paycor HCM, Inc. | — | — | 6 | 3 | 34 | 35 | 35 | 3.99 B USD | 6 | — | 22 |

| Tenable Holdings, Inc. | — | — | 5 | 10 | 19 | 20 | 7 | 3.79 B USD | 4 | 3309 | 110 |

| Freshworks Inc. | — | — | 5 | 3 | 24 | 26 | 4 | 2.75 B USD | 4 | — | — |

| Asana, Inc. | — | — | 5 | 16 | 241 | 1361 | 8 | 3.43 B USD | 5 | — | — |

| JFrog Ltd. | — | −8.84 | 8 | 5 | 31 | 32 | 7 | 3.04 B USD | 7 | — | — |

| SolarWinds Corporation | 29 | — | 4 | 2 | 18 | 18 | 13 | 4.2 B USD | 5 | 18 | 14 |

| Braze, Inc. | — | — | 6 | 7 | 85 | 133 | 6 | 2.75 B USD | 5 | — | — |

| BlackLine, Inc. | 20 | 0 | 5 | 6 | 18 | 18 | 4 | 2.94 B USD | 5 | 145 | 42 |

| Zeta Global Holdings Corp. | — | — | 3 | 4 | 23 | 28 | 8 | 2.7 B USD | 3 | — | — |

| nCino, Inc. | — | — | 5 | 3 | 50 | 52 | 23 | 2.9 B USD | 5 | — | 94 |

| ZoomInfo Technologies Inc. | 95 | — | 2 | 2 | 7 | 9 | 19 | 3.93 B USD | 3 | 30 | 18 |

| C3.ai, Inc. | — | — | 7 | 3 | — | — | 4 | 1.94 B USD | 5 | — | — |

| DigitalOcean Holdings, Inc. | 32 | 0 | 3 | — | 9 | 27 | 6 | 3.81 B USD | 5 | 42 | 17 |

| Alkami Technology, Inc. | — | — | 7 | 7 | 135 | 145 | 21 | 2.42 B USD | 7 | — | — |

| RingCentral, Inc. | — | — | 1 | — | 4 | 5 | 9 | 3.61 B USD | 2 | 262 | 14 |

| DoubleVerify Holdings, Inc. | 39 | — | 3 | 2 | 14 | 16 | 7 | 1.82 B USD | 3 | 22 | 14 |

| Appian Corporation | — | — | 3 | — | 291 | 649 | 13 | 2.16 B USD | 3 | — | — |

| Sprinklr, Inc. | 16 | 0 | 3 | 3 | 25 | 33 | 4 | 1.42 B USD | 2 | 53 | 31 |

| EverCommerce Inc. | — | — | 3 | 2 | 16 | 20 | 14 | 2.26 B USD | 3 | 24 | 12 |

| Five9, Inc. | — | — | 2 | 3 | 14 | 20 | 2 | 1.99 B USD | 2 | — | 20 |

| AvidXchange Holdings, Inc. | 197 | — | 4 | 2 | 22 | 23 | 4 | 1.26 B USD | 3 | — | 36 |

| Jamf Holding Corp. | — | — | 2 | 2 | 49 | 70 | 6 | 1.61 B USD | 3 | — | — |

| PagerDuty, Inc. | — | — | 3 | 11 | 12 | 13 | 2 | 1.32 B USD | 3 | — | — |

| Enfusion, Inc. | 530 | — | 5 | 14 | 29 | 43 | 19 | 1.39 B USD | 7 | 225 | 89 |

| Lightspeed Commerce Inc. Subordinate Voting Shares | — | — | 1 | 1 | — | — | 2 | 750.22 M USD | 1 | — | — |

| SEMrush Holdings, Inc. | 160 | 0 | 3 | 5 | 28 | 31 | 6 | 1.09 B USD | 3 | 115 | 56 |

| MeridianLink, Inc. | — | — | 4 | 3 | 16 | 16 | 14 | 1.65 B USD | 5 | 190 | 25 |

| Sprout Social, Inc | — | — | 3 | 7 | 43 | 48 | 12 | 1.1 B USD | 3 | — | — |

| Amplitude, Inc. | — | — | 4 | 4 | 61 | 67 | 5 | 898.54 M USD | 3 | — | — |

| Olo Inc. | — | — | 4 | 2 | 26 | 26 | 3 | 677.57 M USD | 2 | — | — |

| Docebo Inc. | 36 | 0 | 4 | 16 | 31 | 32 | 10 | 810.03 M USD | 4 | 45 | 38 |

| Couchbase, Inc. | — | — | 4 | 6 | — | — | 5 | 664.8 M USD | 3 | — | — |

| Vimeo, Inc. | 31 | 2 | 2 | 2 | 15 | 15 | 3 | 490.83 M USD | 1 | 24 | 22 |

| Weave Communications, Inc. | — | — | 3 | 10 | 49 | 67 | 7 | 671.48 M USD | 3 | — | — |

| Riskified Ltd. | — | — | 2 | 2 | 18 | 18 | 2 | 362.88 M USD | 1 | — | — |

| E2open Parent Holdings, Inc. | — | — | 1 | 1 | 8 | 13 | 4 | 1.65 B USD | 3 | — | 9 |

| Similarweb Ltd. | — | — | 2 | 21 | 19 | 20 | 8 | 541.78 M USD | 2 | — | 215 |

| ZipRecruiter, Inc. | — | — | 1 | 40 | 12 | 12 | 1 | 589.67 M USD | 1 | 467 | 44 |

| BigCommerce Holdings, Inc. - Series 1 | — | — | 1 | 13 | 16 | 19 | 2 | 465.33 M USD | 1 | — | — |

| Definitive Healthcare Corp. | — | −0.01 | 1 | 1 | 5 | 7 | 1 | 520.19 M USD | 2 | — | 12 |

| Consensus Cloud Solutions, Inc. | 4 | 0 | 1 | — | 3 | 4 | 11 | 947.91 M USD | 3 | 6 | 6 |

| Bandwidth Inc. | — | — | 0 | 1 | 4 | 6 | 4 | 767.16 M USD | 1 | — | 24 |

| Domo, Inc. | — | −2.40 | 1 | — | — | — | 7 | 418.57 M USD | 1 | — | — |

| Kaltura, Inc. | — | — | 2 | 12 | 24 | 25 | 3 | 267.3 M USD | 2 | — | — |

| Agora, Inc.DR | — | — | 2 | — | — | — | 1 | 45.59 M USD | 0 | — | — |

| Expensify, Inc. | — | — | 2 | 2 | 10 | 10 | 4 | 184.53 M USD | 1 | — | 27 |

| ON24, Inc. | — | — | 1 | 1 | 41 | 78 | 1 | 21.7 M USD | 0 | — | — |

| LivePerson, Inc. | — | −0.00 | 0 | — | — | — | 0 | 411.84 M USD | 1 | — | — |

Data Source for Metrics: TradingView and Source for SaaS Companies List: Ordway (Data compiled on 11th April, 2025)

By understanding how their performance compares to that of their peers and what factors influence premium multiples in their sector, founders can make more informed strategic decisions, focus on the most impactful growth initiatives, and communicate a compelling, data-driven story to investors, ensuring their efforts are aligned with what the market values most.

Insights of SaaS Valuation Multiples

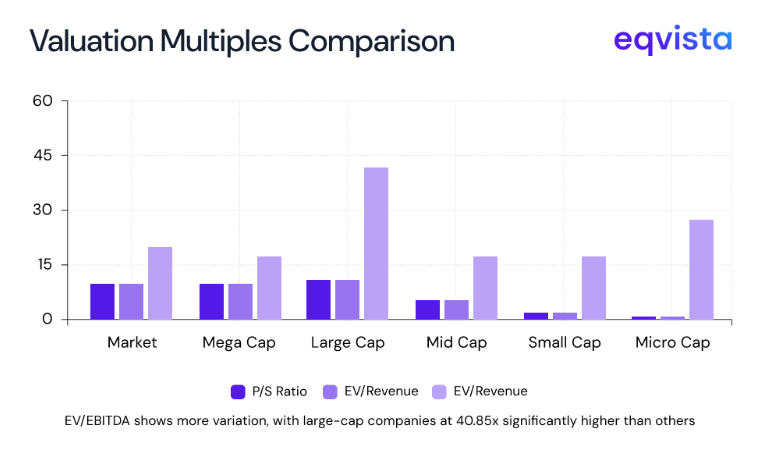

The SaaS market’s price-to-sales (P/S) ratio presently stands at 8.12. Surprisingly, the mega-cap companies seem to be trading at a lower P/S ratio of 8.08. Only large-cap companies have a P/S ratio higher than the market multiple at 9.8. Mid-cap, small-cap, and micro-cap SaaS companies have P/S ratios of 4.64, 2.27, and 1.05.

If we define outliers as companies with P/S ratios higher than twice the market multiple, we end up with only four outliers:

- two large-cap companies,

- one mega-cap company, and

- one mid-cap company.

Two of these outliers, Palantir Technologies and Doximity, have more than doubled their market cap in the past year.

We can observe similar trends when we turn our attention to the enterprise value-to-revenue (EV/Revenue) ratio. Here, too, mega-cap SaaS companies have an EV/Revenue ratio marginally lower than the market. Similarly, large-cap SaaS companies have an EV/Revenue ratio higher than that of the market at 9.4.

| Classification | P/S ratio | EV/Revenue ratio |

|---|---|---|

| Market | 8.12 | 7.93 |

| Mega cap | 8.08 | 7.91 |

| Large cap | 9.8 | 9.4 |

| Mid cap | 4.64 | 4.65 |

| Small cap | 2.27 | 2.31 |

| Micro cap | 1.05 | 0.91 |

However, we can observe a starkly different picture when we turn our attention to the EV/EBITDA figures.

| Classification | EV/EBITDA |

|---|---|

| Market | 19.88 |

| Mega cap | 18.11 |

| Large cap | 40.85 |

| Mid cap | 19.3 |

| Small cap | 18.36 |

| Micro cap | 27.37 |

Large-Cap SaaS Outperform with Sky-High Valuations

Once again, it is the large-cap SaaS companies that have a valuation multiple higher than the market. However, there are over 22 SaaS companies with EV/EBITDA ratios higher than twice the market multiple.

Notably, 10 companies have an EV/EBITDA ratio higher than 100, and 4 companies have an EV/EBITDA ratio higher than 500. Among these companies, CrowdStrike Holdings stands out with an EV/EBITDA ratio of 933.72.Over the last three years, the company has almost tripled its revenue, exhibiting a compound annual growth rate (CAGR) of 39.65%. While the company maintains a high gross profit margin, it registered a negative net income in the financial year ending 1st January 2025.

Selling and marketing expenses and general and administrative expenses make up a chunk of the operating expenses. So, if the revenue growth generated by these costs crosses a certain threshold and the company successfully optimizes these costs, it can unlock significant value.

Market size and leadership

The software-as-a-service companies have a combined market size of over $7 trillion. This industry is presently being led by Microsoft, Google (Alphabet), and Oracle, of which Microsoft and Google are trillion-dollar companies. The two other mega-cap SaaS companies are Salesforce and Palantir Technologies.

Among these companies, we can observe that Palantir is trading at significantly higher valuation multiples.

This divide in valuation multiples is due to a change in investor perception of Palantir Technologies over the last year. It could be that the company’s financial performance hasn’t had sufficient time to catch up with investor expectations.

Palantir Technologies enables public as well as private players to derive meaningful insights from complex data sets. The company focuses on augmenting human intelligence by enabling organizations to ask data questions without the knowledge of statistical models and programming.

The company’s solutions are highly valued by the US government, especially the Department of Defense. Since we are in a period where the US defense spending is increasing, investors have placed considerable confidence in Palantir Technologies.

Market Performance

Unfortunately, no stock market index specifically tracks SaaS companies. The closest fit would be the BVP Nasdaq Emerging Cloud Index, which is meant to track the performance of emerging cloud software companies.

Since the start date of the index (16th August 2013), the index has grown by 706.4%. In contrast, Nasdaq, S&P 500, and Dow Jones have grown 439.4%, 261.1%, and 182.1%.However, the industry has lagged behind broad market indices in the last three years.

While Nasdaq grew by 61.8%, the BVP Nasdaq Emerging Cloud Index grew by 19.4% in this period. This index was also outpaced by the S&P 500 and Dow Jones, which grew by 45.5% and 29.3%, respectively.

A primary reason for underperformance in this period could be the corrections that occurred post the zero-interest rate period. The index reached a peak of $3,096.78 in November 2021 but declined by 61.7% by the end of 2022.

While other mentioned indices also experienced similar corrections, their peaks weren’t as pronounced and thus, the corrections were also much smaller.

Source: BVP

On a year-to-date (YTD) basis, the index has performed marginally worse than the mentioned broad market indices.

Profitability Impact

SaaS companies have extremely efficient production processes. The median gross profit margin of 58.54% is a testament to this fact. However, the median net profit margin in this industry is only 0.44%. This suggests that SaaS companies struggle to translate production efficiency to overall operational efficiency.

Hence, profitable SaaS companies are highly valued in the stock market.

For instance, Verisign had a net profit margin of 50.2%, and in the last year, its market cap has increased by 49.37%. Similarly, Yalla Group had a net profit margin of 40.94%, and its market cap grew by 43.53% in the same period.

These trends suggest that investors are no longer blindly chasing high-growth companies. Now, unit economics holds just as much importance as growth in their eyes.

However, you must note that market cap growth is often a result of companies exceeding market expectations. Hence, we often see profitable SaaS companies losing market cap. A prime example of this would be Google, which had a net profit margin of 30.89%, but its market cap declined by 2.04% in the last year.

Eqvista- Precision that unlocks value!

Compared to the zero-interest-rate period, which ended in 2022, SaaS companies are trading at much more grounded valuation multiples. Any company that falls in the mid-cap or lower category is trading at about 4 times its sales.

This suggests that investors have come to dislike the growth-at-all-costs approach of SaaS companies of the past. Instead, investors put their faith in companies with solid unit economics and the ability to secure high-value contracts. In such an environment, SaaS startups must clearly demonstrate how their current position and technology translate into a future of strong customer retention, stable revenue, and operational efficiency.

Eqvista’s valuation experts provide in-depth, data-driven reports that connect your business fundamentals to investor expectations, helping you build credibility, attract capital, and secure favorable terms. Contact us to learn more about our services!