Inside the VC Pulse: Making Sense of U.S. Funding Trends in September 2025

Venture capital has been on a stride in the past couple of quarters, owing to the AI revolution. Without a doubt, few forces have reshaped funding activity as profoundly as AI.

This makes it worth noting to decipher what is happening in the US VC market. September 2025s US deal data offers a telling snapshot of how this story is unfolding.

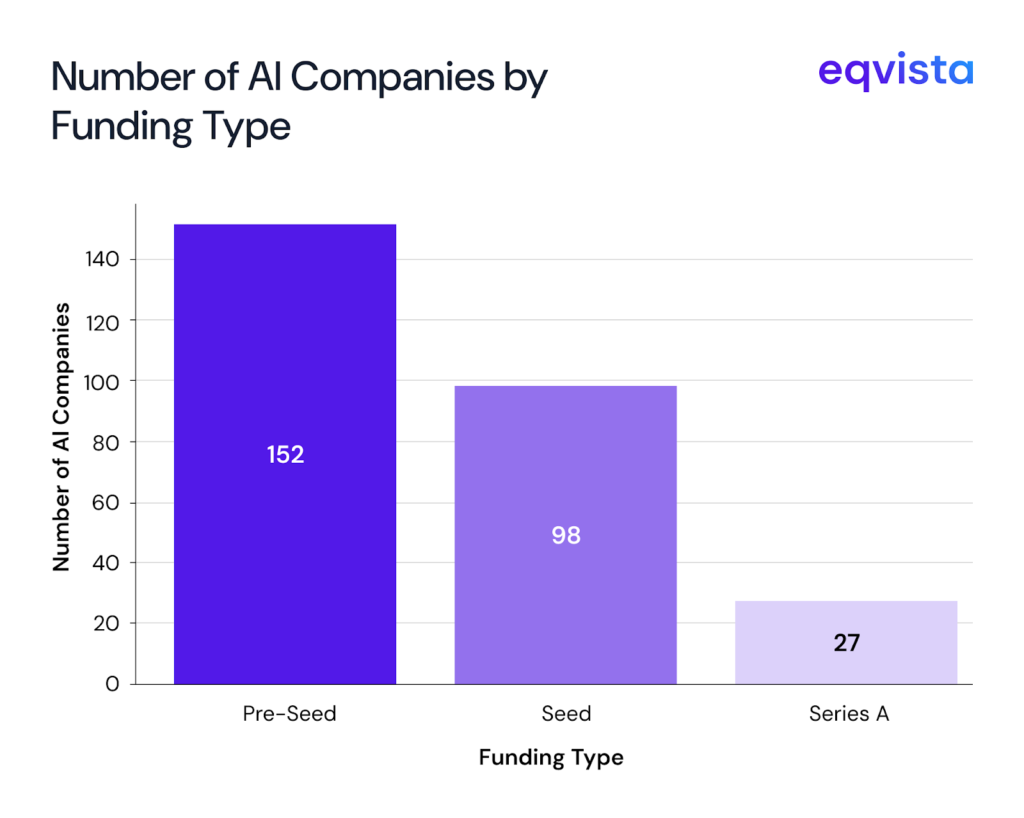

Number of AI companies by funding type and funding raised

Figure 1: Number of AI companies by Funding Type, Data source: Crunchbase

Out of 236 pre-seed, 292 seed, and 90 Series A deals in the US in September, 52% of pre-seed, 33.6% of seed, and 30% of Series A deals were in AI. While this may look high, the capital consumed by AI companies is even more baffling.

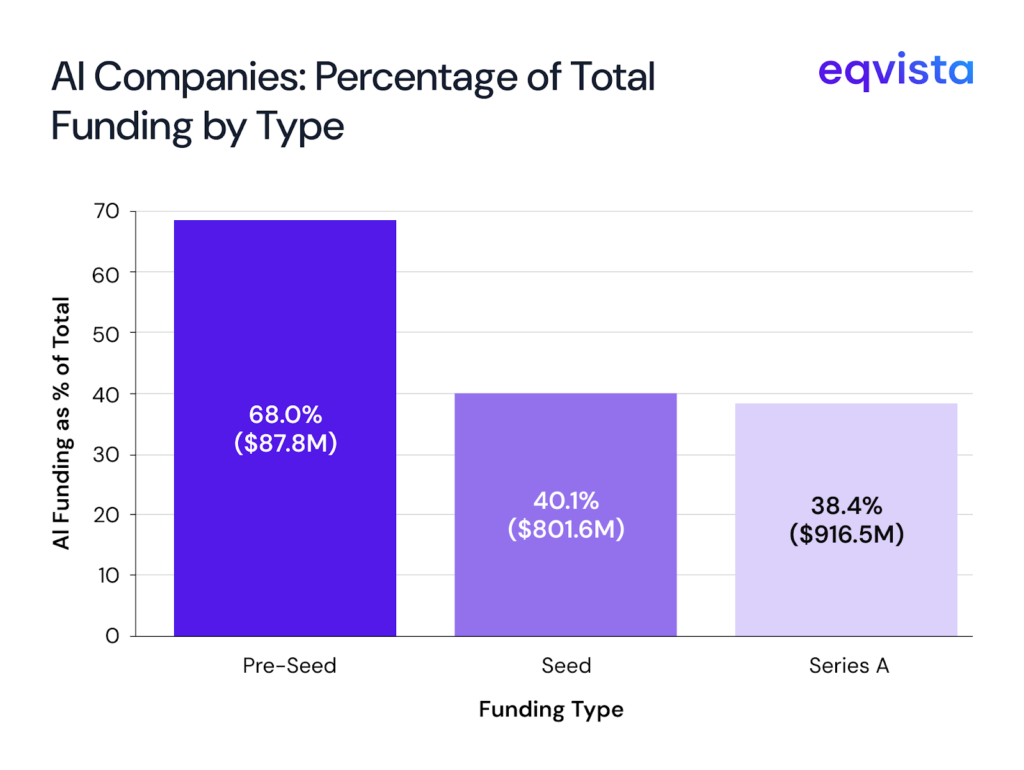

Figure 2: Capital Raise Percentage of AI Companies by Funding Type, Data source: Crunchbase

Although 52% of the AI companies received pre-seed funding, they accounted for an even higher 68% of pre-seed capital raised. Similar uplifts are visible across seed and series A rounds as well, with AI companies receiving the dominant share.

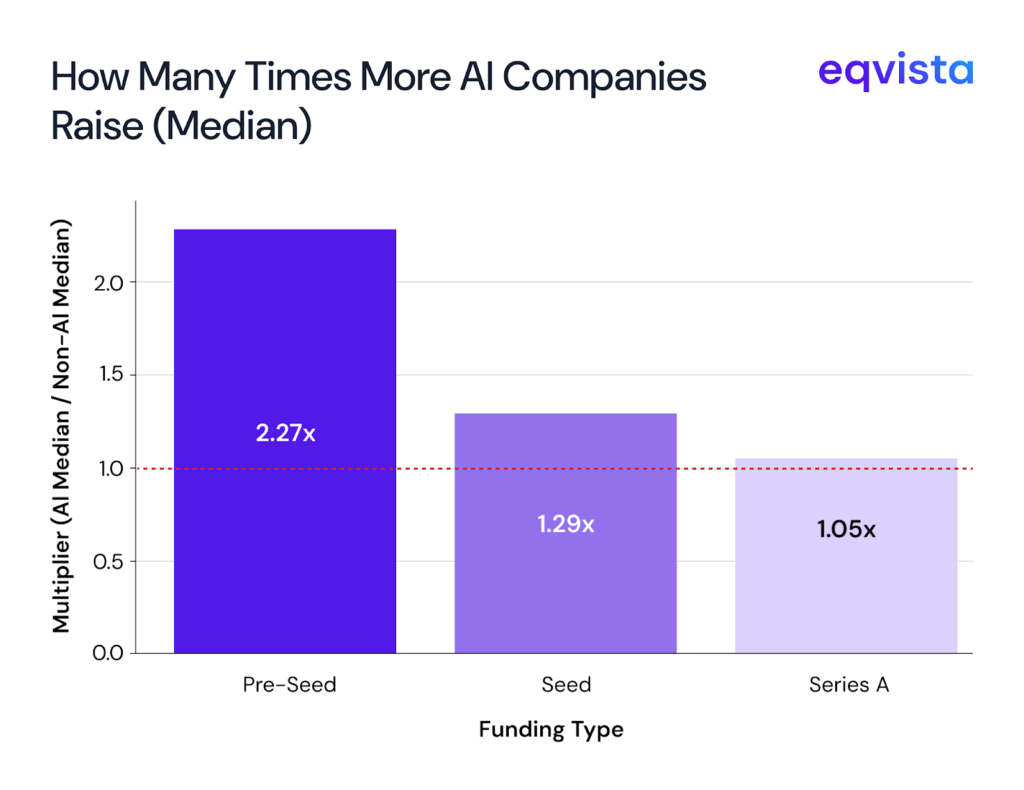

Figure 3: Raise Premium of AI Companies by Funding Type, Data source: Crunchbase

In addition, on a median basis, AI companies raised 127% more in pre-seed, 29% more in seed, and 5% more in Series A rounds as compared to other industries. This shows that VCs are backing AI startups with remarkable generosity.

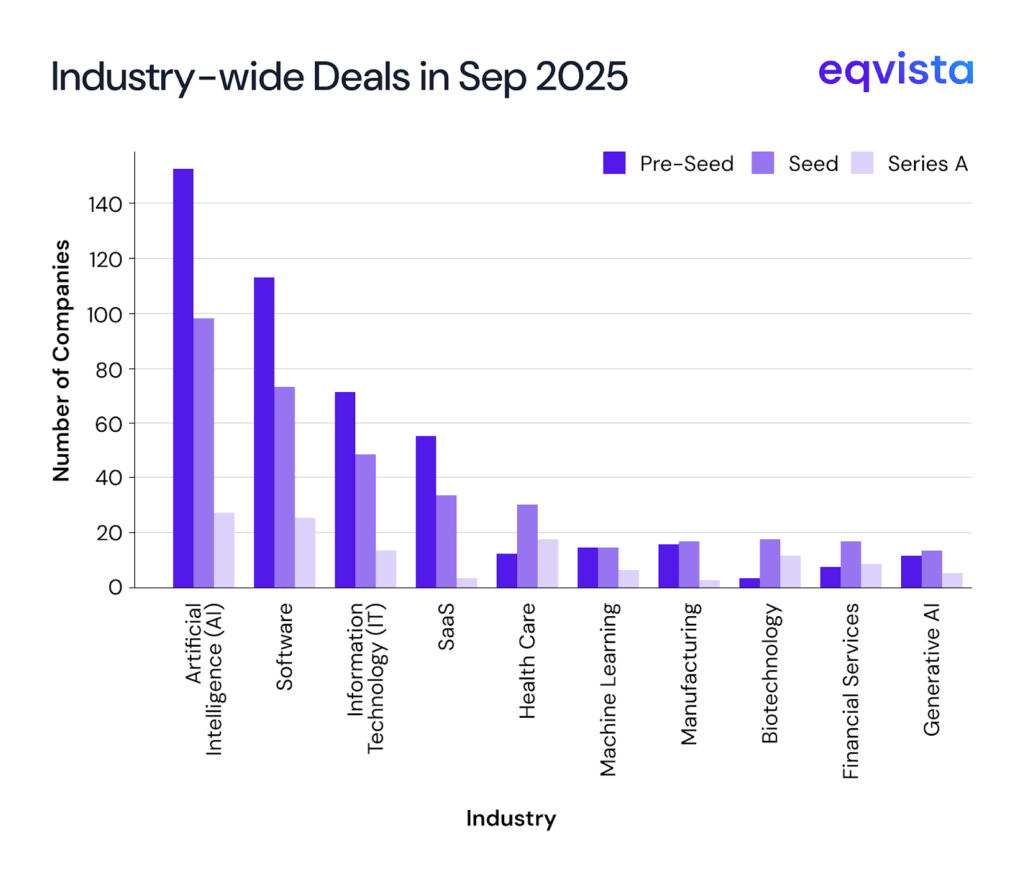

Figure 4: Top 10 Industries by Frequency in Capital Raise, Data source : Crunchbase

Further, AI across pre-seed, seed, and Series A stages (on a cumulative basis) saw 35% more activity than Software, the next major category.

Interestingly, Healthcare ranked fifth in cumulative deal count but stood second in Series A deals. Biotechnology also showcases a similar pattern. This highlights that investors showed stronger conviction in biotech and healthcare at the more mature funding stages, while remaining wary during the early ones.

In terms of Series A, generative AI punched above its weight with more deals than the manufacturing sector.

Furthermore, data shows that the dominant AI sector continues to attract strong interest in earlier stages, with the activity tapering by the time it reaches Series A. This is exactly the opposite of what healthcare and biotech depicted.

This suggests that VCs are ready to bet on slightly unproven business models in the AI space, but in healthcare, their conviction builds only once the business model has demonstrated some real-world success.

Just 10 Cities Account for 59% of U.S. Deals — and 69% of All Capital Raised

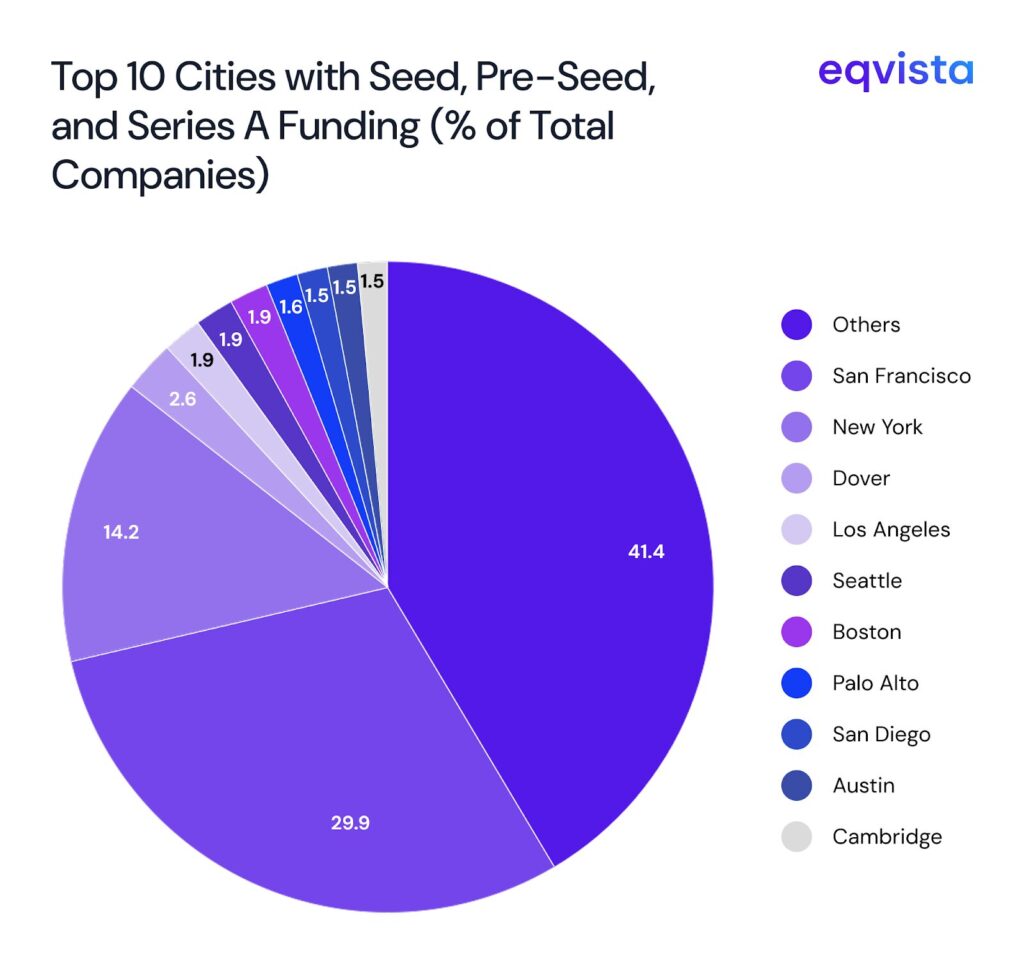

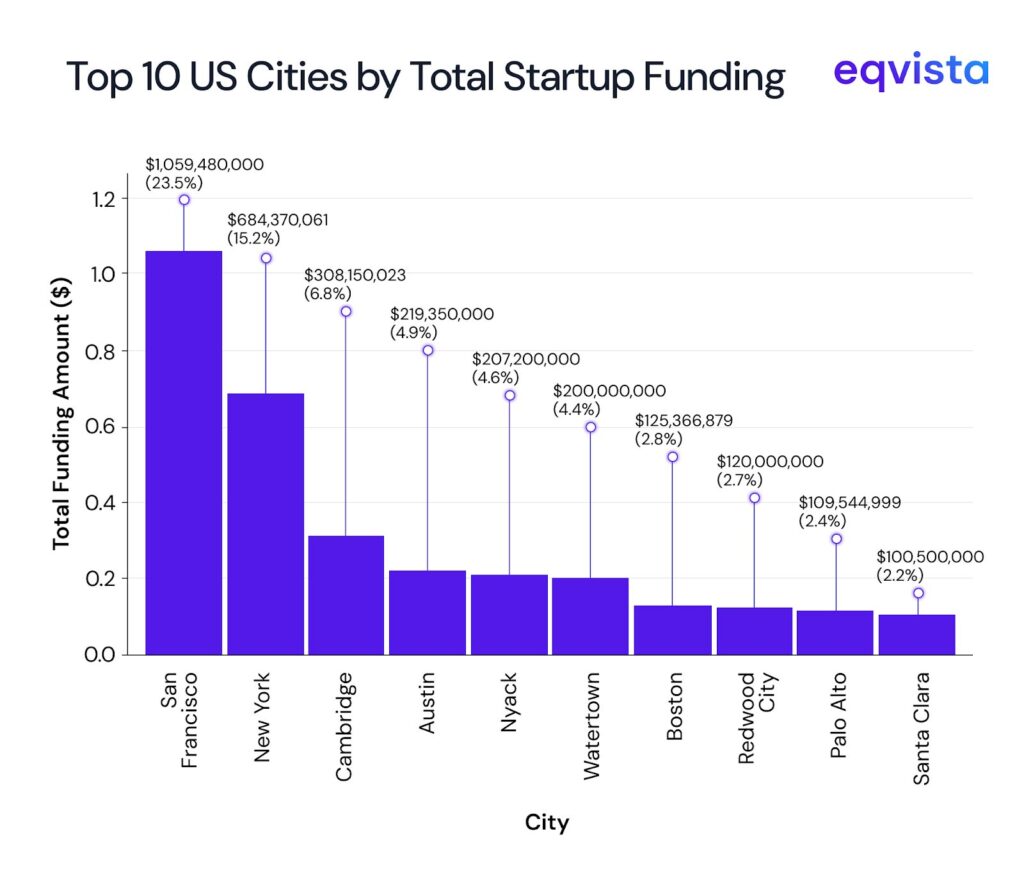

Figure 5: Top 10 Cities and their share by Frequency in Capital Raise, Data source: Crunchbase

To visualize where the early-stage momentum is truly concentrated, it helps to look at the geographic spread of the deals.

The top two cities –San Francisco and New York– together capture 44% of the funding of the entire pre-seed, seed, and series A. San Francisco alone contributed 49.8% of all AI companies receiving funding, underscoring that the dominance of the tech valley continues.

The capital raised is even higher. The top 10 largest cities contributed 69.47% of capital raised in the entire US. Interesting to note that while San Francisco was about 30% in terms of the count of companies raising capital, in terms of total capital raised, this figure was 23%, whereas Cambridge and Austin, which ranked number 10 and 9 respectively by the count of companies, stood at number 3 and 4 respectively in terms of capital raised.

From Founded to Funded: Early-Stage Timelines

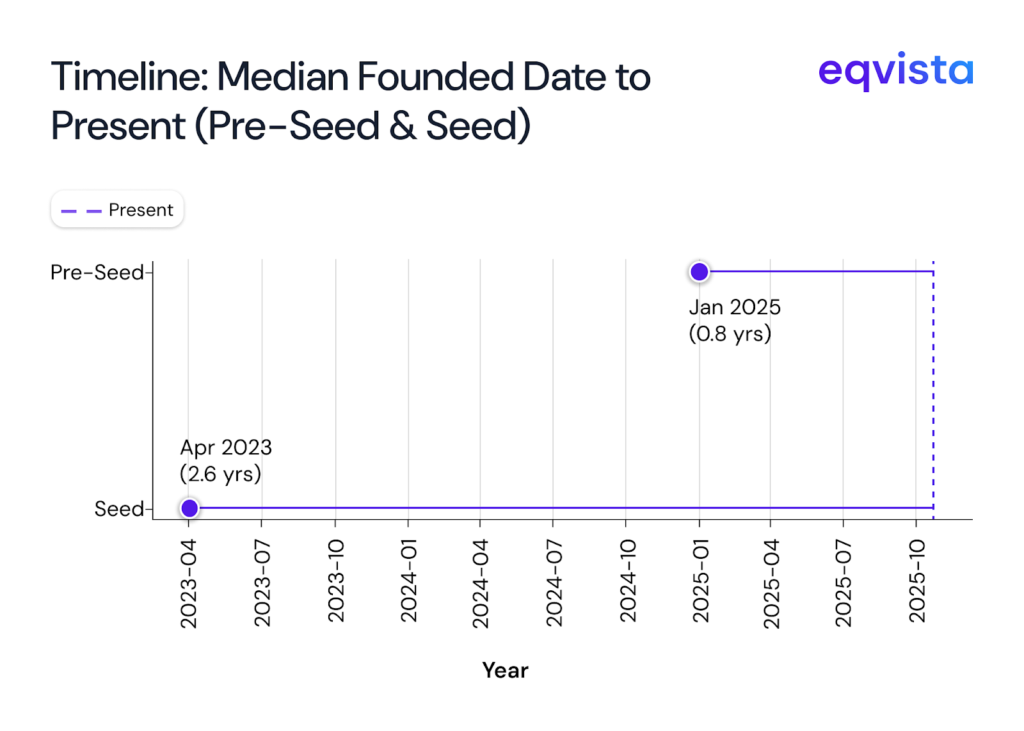

Understanding how long it takes a startup to move from founding to its initial capital raises offers valuable insight into the early growth trajectory of a business.

The data shows that, on a median basis, it took about 0.8 years for a company from its founding date to receive its first (pre-seed) investment. Whereas it took 2.6 years on a median basis for a company to receive a seed round.

Figure 6: Years to become funded from founded, Data source: Crunchbase

The AI industry followed a similar timeline of 0.8 years in pre-seed on a median basis, but stood out for its faster seed stage progression. An AI company typically reaches the seed stage funding in just 1.8 years- nearly a year quicker than the broader startup landscape (30% faster).

This pace of funding, however, varies sharply across industries.

In the pre-seed stage, data shows that DevOps and cybersecurity companies had the shortest time from founding to being funded, a duration of 0.7 years. On the other end of the spectrum, healthcare and marketplace took longer to attract initial capital- 1.4 years and 1.2 years respectively.

A similar story follows seed funding. DevOps and cybersecurity once again led the pack, raising seed rounds within 0.9 years of formation on a median basis. In contrast, life science and legal tech were the laggards – both took 4.8 years to secure seed funding from the formation date.

These patterns suggest that while all startups may be created equal, investor timelines and preferences make it clear that they aren’t treated that way.

What this means for Founders

The September 2025 data paint a clear picture of a venture market still in awe of the AI revolution. Capital continues to chase the unabated technological disruption, and investors remain concentrated in familiar geographies like San Francisco and New York. The data further shows the uneven rhythm- where some industries sprint from founding to funding, while others endure a marathon before being rewarded with support for their ambitions.

The message for founders is clear: innovation may open the door, but timing, sector dynamics, and geography still decide how wide it swings. True — not all startups are treated equally. But perhaps the real question is whether the founder is ready to listen to the melody of the moment.