Understanding of purchase price allocation (PPA) Valuation in 2024

When you buy a company, you usually get a bunch of assets that can make money for you while the organization continues to operate. Since most companies’ operations involve more than one department, when one company buys another, the focus shifts to the combined entity rather than each component and how they interact with one another and the buyer.

The fair market worth of the acquired firm, as established by a business valuation, is crucial information to have on hand while discussing PPA. Before we get an in-depth idea about PPA valuation, it’s important to know the basics, such as the benefits, methods and the kind of challenges associated.

Purchase Price Allocation Valuation

In most mergers and acquisitions (M&A) deals, the most memorable event for all parties involved is signing the contract to purchase or sell a firm.But it’s just one part of the merger and acquisition lifecycle, and each part affects the others.

What is Purchase Price Allocation?

The purchase price allocation procedure is a component of acquisition accounting wherein all assets and liabilities obtained by the target company receive a fair value. This exercise aims to determine the true value of the bought item(s), including all assets (tangible and intangible) and liabilities, and to give each component a fair market value.

It is important to remember the product’s fair value is the amount that a hypothetical buyer in the market would pay for it rather than the amount that any particular buyer would be keen on paying.

Case Study of PPA Valuation

Let’s consider Smith&Sons acquiring TechBand for $100 million. TechBand has identifiable assets like patents, customer relationships, and tangible assets like machinery. The liabilities assumed amount to $20 million. The Purchase Price Allocation calculation involves allocating the purchase price to these assets and liabilities.

Identifiable Assets and Liabilities:

| Patents | $30 million |

| Customer Relationships | $25 million |

| Tangible Assets (machinery) | $15 million |

| Total Identifiable Assets | $70 million |

| Liabilities | $20 million |

| Goodwill | $100 million (Purchase Price) - $70 million (Identifiable Assets) - $20 million (Liabilities) = $10 million |

In this example, the calculated goodwill is $10 million. It represents the premium paid by Smith&Sons over the fair value of the identifiable net assets acquired from TechBand.

How does Purchase Price Allocation (PPA)work?

All business combination deals, including mergers and acquisitions, must use the purchase price allocation technique according to generally recognized accounting standards like IFRS. Keep in mind that historically, only acquisition agreements were subject to the need for purchase price allocation under previous accounting standards.

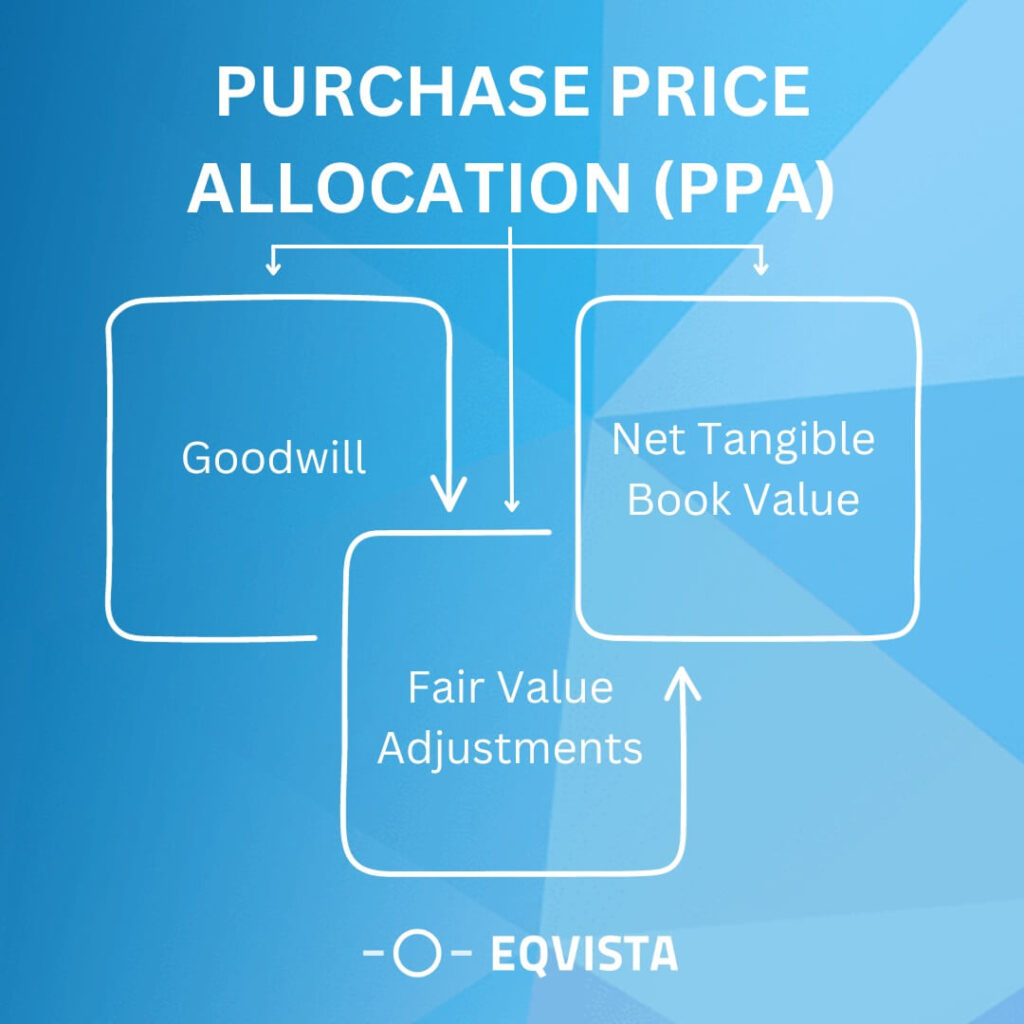

When a company acquires another company, the acquiring firm values the assets and liabilities of the target company based on their fair market value. Goodwill is the remaining amount after allocating all assets and liabilities in a business transaction. If an acquirer pays more than the identified assets’ fair value, the difference is goodwill in accounting.

Benefits of PPA Valuation

The Purchase Price Allocation is usually necessary when filing taxes and financial reports after a merger or acquisition. Let’s discuss more benefits in detail,

- Seller’s Preparation for Sale:

- A purchase price allocation (PPA) is a powerful tool for preparing the firm for sale.

- It helps create a pitch book to attract potential buyers.

- Identifies and evaluates the company’s primary tangible and intangible assets.

- Objective Valuation:

- An impartial third party can evaluate the firm’s parts and provide an unbiased PPA valuation.

- Helps estimate and justify the purchase price and potential earnings impact from asset amortization.

- Preventing Future Problems:

- Early due diligence through PPA helps prevent future issues by revealing discrepancies between assumptions and reality.

- Allocating the buying amount beforehand can mitigate risks and ensure a smoother deal closure.

- Post-Deal Considerations:

- Necessary for investor reporting and tax and accounting considerations after the deal closes.

- A cautious move that provides insights into the actual situation and avoids potential deal-breaking discrepancies.

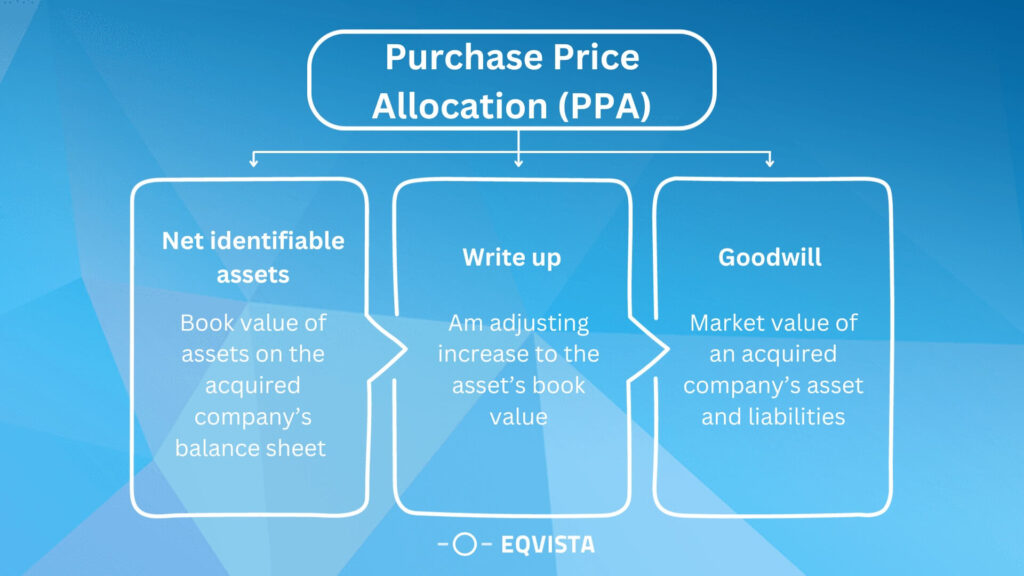

Key Components of Purchase Price Allocation.

Businesses must comprehend the Purchase Price Allocation procedure to participate in mergers and acquisitions. If you are a stakeholder looking for clarity on the valuation process, here are the key aspects of the PPA market.

- Identifiable Assets and Liabilities: The phrase “net identifiable assets” describes the difference between an acquired company’s total assets and its total liabilities. Identifiable liabilities include financial commitments, loans, and contractual obligations. Since the PPA Valuation procedure only applies to identified assets and liabilities, it is critical to differentiate between them.

- Goodwill Calculation: Goodwill, the purchase price above the fair value of identified net assets acquired in a corporate merger, is fundamental to PPA Valuation. Here is the formula for goodwill: Goodwill = Purchase Price – Fair Value of Net Assets. The intangible assets that could contribute to goodwill include customer connections, staff knowledge, and the business’s reputation. It shows the premium for acquiring a firm beyond its assets and liabilities.

- Fair value assessment: Determining the assets and liabilities of the acquired firm at the acquisition date is a crucial step in the Purchase Price Allocation process called fair value assessment. Fair value is the price at which market participants will orderly sell an asset or transfer responsibility. There are several ways to determine fair value, such as cost, revenue, or market-based methodologies.

Methods and Approaches in PPA Valuation With Examples

Sharing the purchase price is an important part of PPA Valuation because it helps the acquirer’s financial records show the true value of the assets and debts of the company they bought.

Let’s discuss the Income Approach, the Market Approach, and the Cost Approach, with the help of examples, the three essential methods used in PPA valuations.

In the acquisition journey of Sole Inc. by Lee Corp., understanding Purchase Price Allocation becomes pivotal. The following examples illustrate PPA Valuation using different approaches for accurately assigning values to acquired assets. Lee Corp. acquires Sole Inc. for $10 million. Sole Inc.’s identifiable assets are worth $7 million, leaving $3 million to allocate to intangible assets.

Income Approach In PPA Valuation

One of the basic techniques for valuation is the Income Approach. It entails calculating the present value of the cash flows that the purchased assets will provide in the future. Trademarks, patents, and client relationships are examples of intangible assets that benefit greatly from this strategy.

- Lee Corp. values Sole Inc.’s customer relationships using the Discounted Cash Flow (DCF) method.

- Sole Inc.’s customer relationships are projected to generate annual cash flows of $1 million for the next 5 years.

- The discount rate is determined to be 8%.

- Using the DCF formula, the present value of the future cash flows is calculated, resulting in a fair value of $4.111 million for Sole Inc.’s customer relationships.

| Estimated annual cash flows from patented technology | $500,000 |

| Discount rate | 12% |

| Present value of cash flows | $500,000 / 0.12 = $4.17 million |

Market Approach In PPA Valuation

The Market Approach examines the subject firm concerning other market entities recently transacted similarly. In the Market Approach, you may often see methods like prior transactions analysis (PTA) and comparable company analysis (CCA).

- Lee Corp. assesses the fair value of Sole Inc.’s trademarks by comparing them to similar trademarks recently sold in the market.

- Comparable trademarks in the market were sold for an average of $2 million.

- Lee Corp. determines that Sole Inc.’s trademarks are comparable, and thus assigns a fair value of $2 million to Sole Inc.’s trademarks.

| Recent sale of a similar patent | $4 million |

| Adjustments | -8% |

| Adjusted value of patent | $4 million * 0.92 = $3.68 million. |

Cost Approach In PPA Valuation

The Cost Approach bases an asset’s worth on how much it would cost to replicate or replace it. Physical assets, such as land, buildings, and machinery, are particularly important. The approach adjusts for depreciation to calculate the current cost of purchasing or manufacturing a similar asset.

- Lee Corp. values Sole Inc.’s manufacturing equipment using the Cost Approach.

- Sole Inc.’s manufacturing equipment has a book value of $500,000, but a market appraisal reveals that it would cost $700,000 to replace the equipment with new ones.

- The fair value of Sole Inc.’s manufacturing equipment under the Cost Approach is determined to be $700,000.

| Estimated cost to recreate the patent | $3.5 million |

| Adjustment for obsolescence | -5% |

| Adjusted value of patent | $3.5 million * 0.95 = $3.325 million |

After completing these approaches, Lee Corp. would allocate the total purchase price to the various assets acquired, including customer relationships, trademarks, and manufacturing equipment. Goodwill would be calculated as the excess of the total purchase price over the fair values assigned to identifiable assets and liabilities.

The PPA Valuation Process in Detail

Purchase Price Allocation Valuation is an intensive and critical financial accounting process when a firm buys another. It accurately reports and follows accounting rules by allocating the acquisition price to the acquired company’s assets and liabilities. Here is a detailed breakdown of the PPA procedure.

Planning and Preparation

Thorough planning and preparation are the first steps in the process. It involves two stages.

- Forming a Dedicated Team: The first step in a Purchase Price Allocation Valuation is to assemble a committed team of professionals, including accountants, financial analysts, and valuation specialists. This group works together to define the parameters of the PPA valuation, set deadlines, and learn the ins and outs of the purchased company’s activities.

- Determining the Scope and Timelines: Appropriate planning entails establishing precise deadlines and the scope. This stage guarantees that the group can successfully negotiate the intricacies of the purchase process and agree with its goals.

Asset and Liability Identification

The following stage consists of two steps for identifying intangible assets in PPA Valuation.

- Comprehensive Analysis and Classification: One of the most important parts of a PPA Valuation is figuring out what assets and liabilities exist. When a company merges with another, it must carefully examine and classify all tangible and intangible assets.

- Reviewing and Quantifying Intangible Assets: While tangible assets are easy to see, intangible assets such as customer connections, trademarks, and technology can be more difficult to pin down. A careful review of relevant contracts and legal papers and interviews with relevant employees are often necessary to do this.

Valuation Methods Identification

As we discussed before, three commonly used methodologies for assessing intangible assets are income, cost, and market approaches. The initial stage in developing a Purchase Price Allocation Valuation is typically to review the acquirer’s acquisition approach. The next step is to determine the Internal Rate of Return, or IRR, for the acquisition by squaring the rate to the purchase price, which is equal to the current net worth of the projected after-tax cash flows of the acquired firm.

Regulatory Compliance and Reporting Standards of PPA Valuation

It is critical to understand the regulatory landscape and financial reporting standards after a company merger or acquisition. Here’s what you must do to ensure compliance in PPA Valuation.

- Financial Reporting Requirements: If you want your financial statements prepared accurately after an acquisition, you need to use Purchase Price Allocation Valuation. One way valuation improves transparency is by showing the complexities of goodwill on the balance sheet at their fair value. Stakeholders can better make educated decisions by being open and honest about the costs and advantages of acquisitions.

- Compliance with Accounting Standards: PPA Valuation places great importance on following International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP). This conformity guarantees the recommended handling of goodwill via amortization or periodic impairment tests and leads to uniform PPA valuation procedures. By adhering to these standards, financial data is more reliable and comparable and promotes openness.

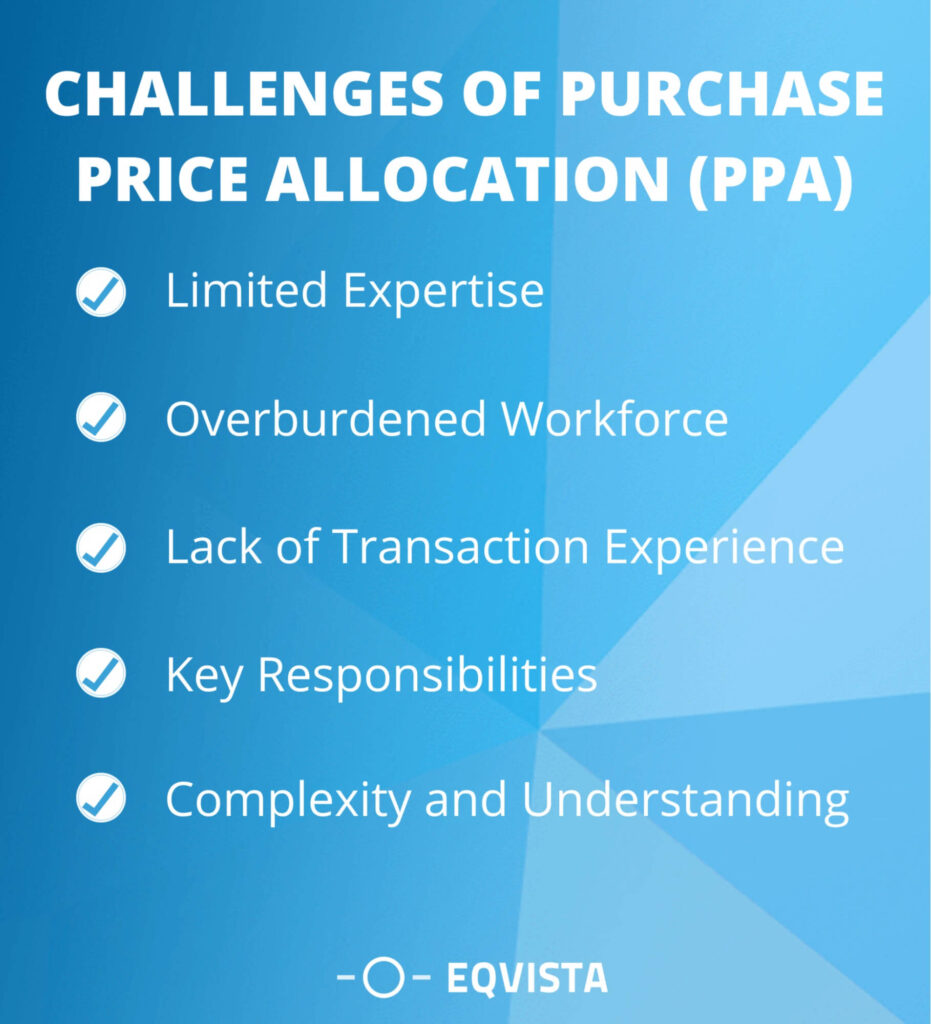

Challenges Of Purchase Price Allocation (PPA)

Addressing these challenges involves providing adequate support, training, and resources to controllers involved in Valuation tasks.

- Limited Expertise:

- PPA Valuation may not be carried out by a member of the M&A transaction team, often handled by the internal financial controller.

- Due to infrequency, controllers may lack specialization , leading to challenges.

- Overburdened Workforce:

- Many workers involved in new deals might not be available to work on .

- Frequent involvement in new deals leaves little time for specialization in PPA valuation -related tasks.

- Lack of Transaction Experience:

- Controllers, lacking transaction experience, face challenges in PPA execution.

- The absence of backing from the M&A transaction team adds to the complexity.

- Key Responsibilities:

- The controller must ascertain the assumptions used for the purchase price.

- PPA valuation of newly discovered assets is a critical task.

- Understanding the terms within the share purchase agreement (SPA) is essential.

- Complexity and Understanding:

- The complexity faced by controllers with limited Valuation expertise is significant.

- Lack of transaction experience may hinder a comprehensive understanding of PPA intricacies.

To ensure accurate and effective purchase price allocations, connect with experts.

Get your PPA valuation done by Eqvista!

Purchase Price Allocation Valuation is highly complex since it necessitates familiarity with approved fair value methodology and an extensive understanding of the relevant company, industry, and accounting regulations. The procedure necessitates constant two-way communication between the accounting and operational teams.

With hundreds of clients across a wide range of sectors, Eqvista has extensive experience doing PPA valuations for mid-market deals. Our team of expert financial professionals offers seamless audit review help, and they have international recognition from CFA and ASA. Get in touch with us today for further details!