What is a Pass-Through Entity?

This article will explore pass-through entities, their tax benefits as well as disadvantages.

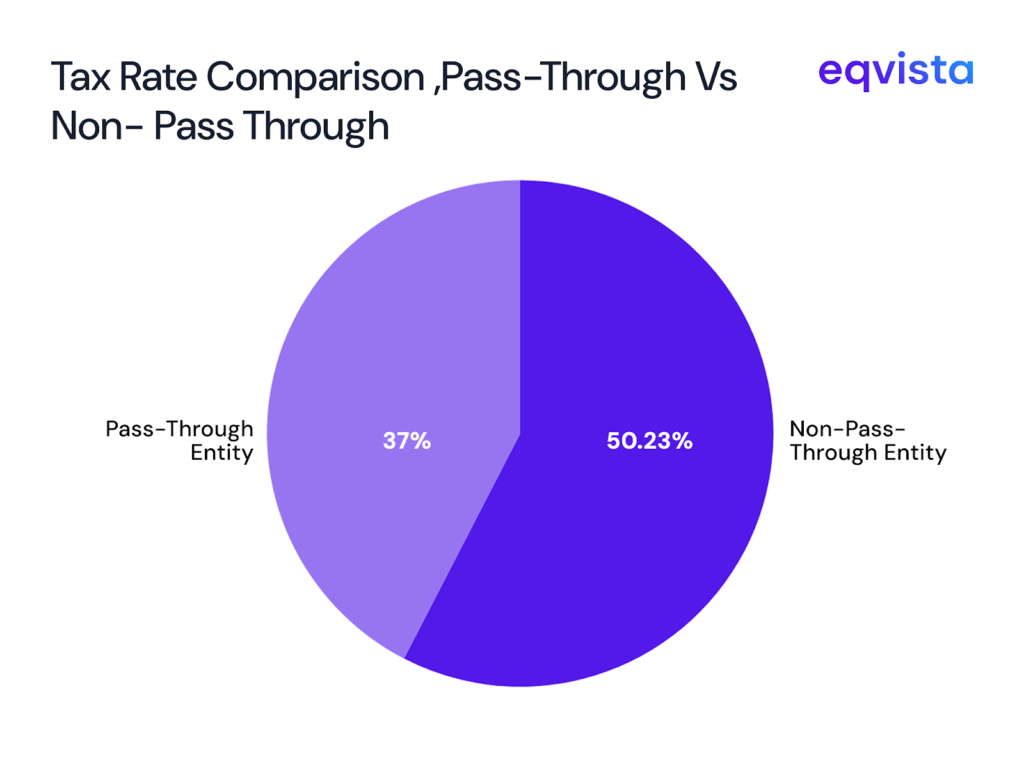

Due to double taxation, you could lose more than 50% of the income generated by your business to taxes. An effective way of sidestepping this drawback is operating as a pass-through entity.

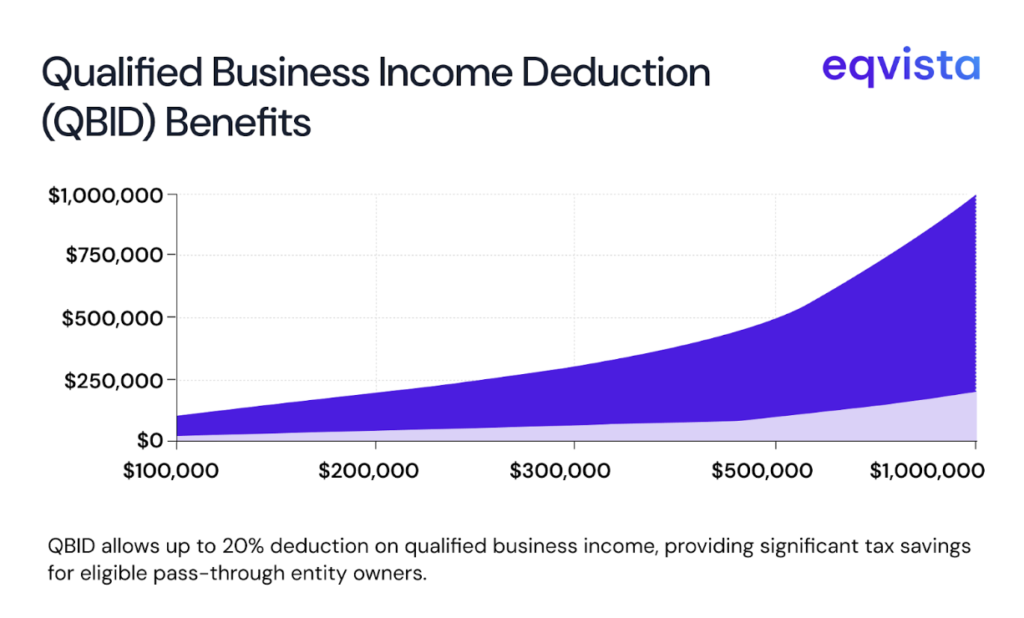

This approach can unlock further tax savings through the qualified business income deduction (QBID). However, this structure also exposes you to self-employment tax and affects your ability to reinvest profits.

This article will explore pass-through entities, their tax benefits as well as disadvantages, and help you identify which pass-through structure is right for you.

What is a Pass-Through Entity?

A pass-through entity, also called a flow-through entity, is a business that does not pay corporate income tax. Instead, the income “passes through” the business to the owners, who report and pay taxes on it on their personal tax returns. Examples include sole proprietorships, partnerships, limited liability companies (LLCs), and S corporations.

Let us examine the difference in taxation of pass-through entities and other companies with an example.

Taxation of a pass-through entity’s profits

| Particulars | Pass-through entity | Non-pass-through entity |

|---|---|---|

| Profit | $1,000,000 | $1,000,000 |

| Corporate tax rate | 0% | 21% |

| Corporate income tax | $0 | $210,000 |

| Profits transferred to the owner | $1,000,000 | $790,000 |

| Individual tax rate | 37% | 37% |

| Individual income tax | $370,000 | $292,300 |

| Post-tax income | $630,000 | $497,700 |

| Tax savings through pass-through treatment | $132,300 | |

Due to double taxation, the business owner of the non-pass-through entity received less than half the income generated by their business. Being able to avoid double taxation is the primary benefit of operating as a pass-through entity.

If your business was founded as a partnership or LLC, you might need to convert it to an S corporation. This will help you avoid self-employment tax. However, S corporations must convert into C corporations to raise a large amount of funds through equity. This is because S corporations cannot go public and can have only up to 100 shareholders.

Certain pass-through entity owners can claim a qualified business income deduction (QBID) under Section 199A of the Internal Revenue Code (IRC). The complete benefits of this provision are:

- 20% deduction of qualified business income (QBI)

- 20% deduction of qualified real estate investment trust (REIT) dividends

- 20% deduction of qualified publicly traded partnership (PTP) income

The maximum QBID is either 20% of the sum of QBI, qualified REIT dividends, and qualified PTP income, or 20% of the taxable income minus net capital gains, whichever is lesser.

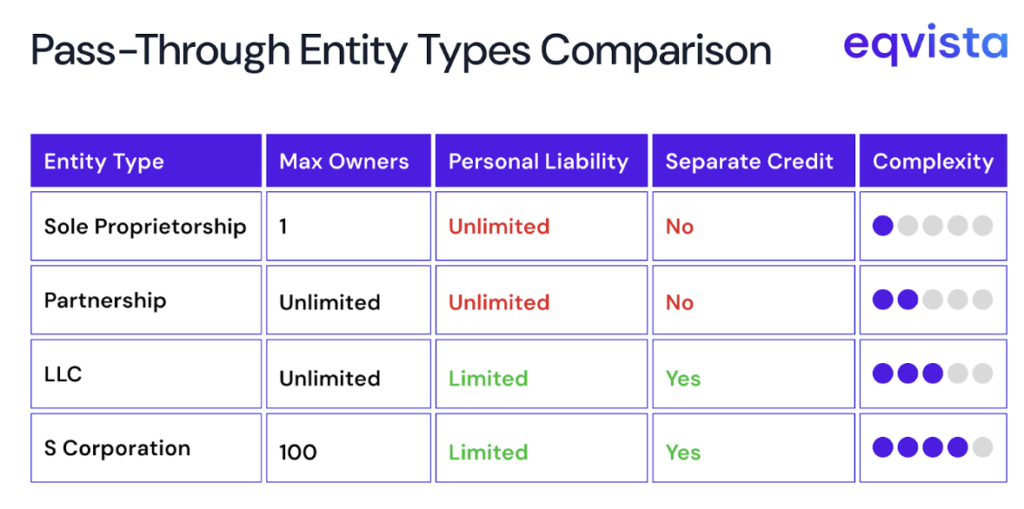

Types of Pass-Through Entities

Here, we will examine the unique benefits of each pass-through entity structure to help you identify the right structure for your business.

Sole Proprietorship

Sole proprietorship is an appropriate structure for small businesses as well as professionals who wish to operate an independent practice.

At present, there are no limits on the number of business locations or employees that a sole proprietorship can have. However, a large number of employees and locations can complicate tax and regulatory compliance. Since a sole proprietor has unlimited personal liability, this means that their personal assets could be seized due to regulatory or tax non-compliance.

Partnership

Partnerships are appropriate for businesses with multiple owners who are comfortable with unlimited liability. While there’s no upper limit to the number of partners in the USA, such businesses often find it challenging to raise funds through equity.

Limited liability company (LLC)

LLC structures are preferred by most business owners because they protect their personal assets from business debts.

At the same time, LLCs are easier to establish when compared to S corporations and C corporations. Another benefit of the LLC structure is that the business has a separate credit identity from its owners.

S Corporation

Unlike other entities, an S-corporation cannot have unlimited shareholders or partners. The number of shareholders is limited to 100 in S corporations. Also, an S corporation must convert to a C corporation to go public. Hence, companies typically convert from S corporations to C corporations to improve their ability to raise funds through equity. S corporations can choose to use cash-basis accounting rather than the more complex accrual method

Key differences between all the pass-through entities

| Particulars | Sole proprietorship | Partnership | Limited liability company (LLC) | S-corporation |

|---|---|---|---|---|

| Number of owners/partners/shareholders | 1 by definition | Unlimited | Unlimited | 100 |

| Personal liability of owners | Unlimited | Unlimited | Limited | Limited |

| Separate credit identity | No | No | Yes | Yes |

Disadvantages of pass-through entities

Pass-through entity owners are taxed on income they have not received yet. While other businesses can set aside a part of their income for reinvestment and lower the taxable income, pass-through entities cannot do that. This makes it harder to grow.

Essentially, the ability of such businesses to accumulate capital is reduced by the marginal tax rate paid by the business owner. Let us understand this with an example.

| Particular | Pass-through entity | Non-pass-through entity |

|---|---|---|

| Income set aside for reinvestment at a later date | $100,000 | $100,000 |

| Type of tax owed | Individual income tax | N.A. |

| Tax rate | 37% | 0% |

| Tax | $37,000 | $0 |

| Income that can actually be reinvested | $63,000 | $100,000 |

From the above example, it is clear that Pass-through entities pay taxes on income before reinvestment, limiting their ability to grow compared to non-pass-through entities.

FAQs

Some common queries about pass-through entities are as follows:

How does pass-through taxation work?

In pass-through taxation, the business does not pay corporate income tax. Instead, the income is taxed after it is passed on to the owners, allowing them to avoid double taxation.

What are the disadvantages of pass-through entities?

Owners of pass-through entities get taxed on income they haven’t yet received. Other entities can reduce their taxable income by setting it aside for reinvestment, but pass-through entities can’t do the same. This affects capital formation and slows down growth.

Which IRS forms must be filed by pass-through entities?

Depending on the type of pass-through entity a business chooses to operate as, it may need to file forms such as Form 1120-S, Schedule C (Form 1040), Form 1040, or Form 1065 to report its income.

What is a tax liability exclusive to pass-through entities?

Certain pass-through entities may need to pay self-employment tax, which is made up of social security tax and Medicare. So, this tax is not entirely different from payroll taxes paid by other businesses.

Eqvista – Compliance with confidence!

While there are significant tax benefits to pass-through entities, they do present management challenges. This is primarily because of the potential for unlimited liability, heightened compliance risks, and challenges in raising funds through equity. Nevertheless, pass-through entity structures can be a great starting point for entrepreneurs seeking to explore business opportunities with favorable tax treatment.

If your business faces tax or equity-related challenges, consider consulting Eqvista. We help businesses of all sizes and industries to stay tax compliant and maximize their tax savings. Contact us to know more!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!