How to Convert a Pass-Through Entity to Qualify for QSBS Benefits?

In 1976, Apple started as a partnership between Steve Jobs, Steve Wozniak, and Ronald Wayne. To attract investors and scale its operations, the budding tech company soon became a corporation, a pivotal move that set the stage for its rise to become one of the largest companies in the world.

Today, many small businesses find themselves at a similar crossroads. As they aim to expand and secure funding, incorporating as a C-corporation becomes an attractive option. Tax authorities offer Qualified Small Business Stock (QSBS) benefits to incentivize this further, which reduces tax liabilities for investors.

In this article, we will explore the value of QSBS benefits, how you can convert your sole proprietorship, partnership, or any other pass-through entity into a C-corporation, and discuss key considerations to ensure a fruitful transition. Read on to know more!

QSBS Benefits

The key benefits of qualifying for QSBS treatment are as follows;

Capital gains exclusion

As per Section 1202 of the Internal Revenue Code (IRC), if an individual investor acquires a stake in a qualified small business (QSB) via an original issue and holds the qualified small business stock (QSBS) for at least five years, they can exclude a maximum of 100% of their capital gains from the income reported for federal individual income tax. The 100% income tax exclusion applies to all QSBS acquired after 27th September 2010.

Deferral of capital gains

If you sell your QSB stocks before the holding requirement of 5 years is met, you can defer capital gains tax by investing the proceeds into another QSB within 60 days. If the total holding period from these two consecutive investments is at least 5 years, you will receive the same tax exclusion benefits.

AMT relief

Alternative minimum tax (AMT) was introduced to ensure that high-income individuals do not pay little to no tax by utilizing tax deductions or other provisions. However, AMT does not apply to QSBS investments.

Encouraging investments in small businesses

By ensuring tax benefits for investors, the QSBS provisions encourage investments in small businesses and startups. This has a positive impact on the economy as small businesses employ 45.9% of the US workforce.

Employee compensation and retention

The tax exclusion benefits of QSBS make a company’s equity compensation even more attractive. As a result, such companies will find it easier to attract and retain employees.

Hence, attaining QSB status is an attractive and viable way to boost a company’s ability to raise funds.

To become a QSB, a business must be an active domestic C-corporation with gross assets worth up to $50 million, 80% of which are actively being used in a qualified trade or business. Some sectors that are excluded from QSBS benefits are:

- Health

- Law

- Engineering

- Architecture

- Farming

- Consulting

- Athletics

- Financial services

- Hospitality

- Businesses where the reputation or skill of one or more employees is the principal asset

How to convert a pass-through entity to a C-corporation to qualify for QSBS benefits?

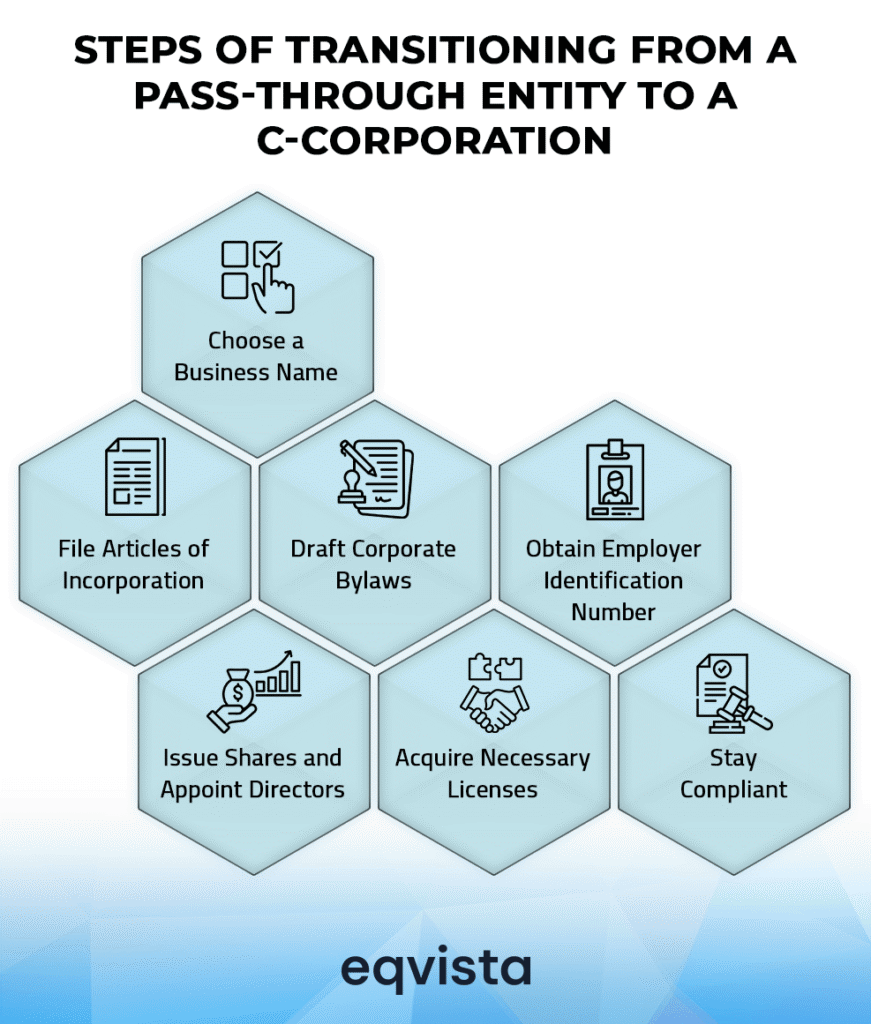

In order to transition into a C-corporation from a pass-through entity, you must take the following steps.

Choose a business name

An American C-corporation must have a name different from other entities registered in its state of incorporation. You can visit the National Association of Secretaries of State (NASS) website to check which names are available in your state of incorporation.

File articles of incorporation

You must submit Articles of Incorporation to your state of incorporation, including key details such as the company’s name, the number of shares issued, the registered agent’s name and address, and the incorporators’ names and addresses.

When you file articles of incorporation, you may be required to select a registered agent. This person must be present at business premises during working hours so that they can receive any legal papers on the company’s behalf.

Draft corporate bylaws

Companies draft bylaws to regulate their operations. These set of rules govern decision-making processes, shareholder rights, and grievance redressal mechanisms among other things.

Obtain Employer Identification Number (EIN)

An Employer Identification Number (EIN) is a prerequisite for filing tax returns, opening business bank accounts, hiring employees, and various other activities.

Issue shares and appoint directors

You can issue shares based on original ownership percentages and future fundraising plans. Then, you must hold a shareholder meeting and take votes to elect a board of directors.

Acquire the necessary licenses

Depending on your state of incorporation, your industry, and the nature of operations, you may need to apply for various licenses and permits to continue operations.

Stay compliant

Once you have successfully converted into a C-corporation, you must comply with state and federal regulations otherwise you may lose your C-corporation status. This involves maintaining a detailed corporate record, holding annual meetings, disclosing financial reports, and maintaining a record of votes in important business decisions.

Key considerations before converting to a C-corporation

Converting into a C-corporation can enhance your growth potential by delimiting your maximum number of shareholders. As an added benefit, there is the possibility of qualifying for QSBS benefits which makes it easier to attract investors. However, becoming a C-corporation also has some drawbacks which are as follows:

Double taxation

In a pass-through entity, any income generated will be passed directly to owners and investors without incurring any corporate tax. As a result, investors only pay taxes as per the individual income tax rate.

At C-corporations, the business’ income is subject to a corporate tax rate of 21%. Additionally, dividends and other distributions to investors from C-corporations are taxed again at the individual level, leading to double taxation.

Greater regulatory supervision

Since the number of shareholders is uncapped at C-corporations, they must comply with various regulatory and reporting requirements. These requirements include holding regular board meetings, maintaining voting records, maintaining cap tables, filing annual reports, disclosing financial results, and ensuring that the company bylaws are held in primary business locations.

Cost of incorporation

Converting a pass-through entity into a C-corporation can involve various costs such as filing fees, legal fees, registration fees, and licensing fees. Once your business is incorporated, you will incur audit fees for preparing periodical financial reports.

Additionally, to draft your company’s bylaws, you may need to hire legal professionals as it may require knowledge specific to state laws and your industry.

Eqvista- Enhancing tax savings and fostering growth!

If your business meets the requirements of Section 1202 of the IRC and becomes a qualified small business (QSB), you will find it easier to attract investors since they may have zero tax liability as long as their holding period is at least five years. One of the requirements to be a QSB is being a C-corporation. This involves various steps such as choosing a unique name, acquiring various licenses and an Employer Identification Number (EIN), and drafting bylaws.

Before you start converting your pass-through entity into a C-corporation, you must consider three key drawbacks which are double taxation, greater regulatory supervision, and the cost of incorporation.

If you feel that the QSBS benefits outweigh the cons, Eqvista can help you in your journey through a QSBS attestation that validates the value and usage of your assets being in line with the requirements of Section 1202 of the IRC. Learn more about our QSBS attestation services.

Frequently asked questions

Some common queries regarding QSBS benefits and C-corporations are as follows.

Which companies qualify for QSBS treatment?

An active American C-corporation with gross assets of up to $50 million, 80% of which are actively being used in a qualified trade or business, can qualify for QSBS treatment. Some businesses that are excluded from QSBS treatment are financial services, hospitality, performing arts, and athletics.

What are C-corporations?

In a C-corporation, owners and shareholders as well as the company are taxed separately. Unlike S-corporations, there is no limit on the number of shareholders in C-corporations.

What are QSBS benefits?

If an investor holds their stake in a company that qualifies for QSBS treatment for at least 5 years, they can potentially exclude up to 100% of the federal capital gains tax.

How does QSBS rollover work?

A QSBS rollover allows you to defer capital gains taxes by reinvesting the proceeds from the sale of qualified small business stock (QSBS) into new QSBS within 60 days. The holding period for the new QSBS will start fresh.