Equity Compensation vs. Salary for Startup Employees

Understanding startup equity, the different equity compensation types can be a bit complex.

More and more companies are utilizing equity for compensating employees. Since it constitutes a decent part of your wealth, it is important to be aware of what equity compensation is all about and how it is different from a salary. This is especially true for startup companies, as many of them have trouble determining the right option when it comes to equity compensation vs salary.

Equity Compensation vs Salary for Startup Employees

There have been thousands of discussions and debates about salary vs equity. In most cases, people tend to get both of them wrong or confuse them with other concepts. Let us start by discussing what equity compensation really is.

What is Equity Compensation?

Equity compensation is essentially a type of non-cash compensation. It confers non-cash compensation, giving a part of your company’s ownership. Public and private companies provide equity compensation for a variety of reasons. A major reason behind offering this form of compensation is that non-cash compensations let organizations conserve their cash flows, allowing them to grow or prioritize on other plans.

Employee compensation also comes in handy to attract high performing employees, making sure they don’t leave and remain motivated in the company. There are a variety of equity compensation types and each of them has unique benefits and challenges. Therefore, it is essential to keep them in mind as they impact your startup’s overall financial outlook and net worth.

Types of Employee Equity Compensation

There is a plethora of different types of employee equity compensation, and you will need to understand each to see which type is the most suitable for your company.

Let us discuss the three main employee equity compensation types used by most startups:

Employee Stock Options

Stock options are arguably the most renowned equity compensation type out there. Stock options give you the right to purchase a particular amount of company share for a set price, also referred to as strike or exercise price. You can only use these after a pre-set waiting period known as “the vesting period”.

In most cases, vesting periods tend to last for 3 to 5 years. One of the main advantages of stock options is the leverage they offer. That said, you should use employee stock options carefully, as they may prove to be a risky choice in some instances.

Restricted Stock

Restricted stock (also known as restricted securities or letter stocks) is company stock which you cannot fully transfer until after meeting some restrictions. The restrictions could be timing or performance related, which is quite similar to the restrictions you will find in stock options. It would be fair to consider restricted stock as an extra bonus reward rather than cash.

Restricted stock is a great alternative to other equity compensation types, especially stock options. This is especially true for executives because of their favorable income tax treatment and accounting rules. There are two main restricted stock types: Restricted Stock Units and Restricted Stock Awards, which you should know if you are considering using this form of equity compensation.

Employee stock Purchase Plans

When it comes to employee stock purchase plans, companies offer employees the chance to buy their shares for discounted rates. In addition to this, employee stock purchase plans are only restricted to a $25,000 limit per employee, per year. Generally, people buy the units or shares through payroll deductions.

At certain parts of the year, employers utilize the funds they accumulated to buy stock for their employees.

Pros and Cons of Equity Compensation

As mentioned before, equity compensation is an employee compensation type, giving them some share in the future profits of the company. They could be through performance shares or other forms of stock options. Ultimately, choosing the compensation type is up to the startup that provides it.

This is especially true for tech startups during their early stages, as they don’t have the money needed to offer high employee salaries. However, they are still well aware of the importance of encouraging and incentivizing motivated individuals to stay in or join the team. This is where most startups opt for equity compensation. Generally, they will offer it along with a lower salary offer. In some rare cases, they don’t offer any salary whatsoever.

Pros and Cons

Getting a part of your organization’s future profits is without a doubt an exciting opportunity as it gives employees an incentive to remain loyal to the company for several years. Depending on how successful the company becomes later on, there is a high chance that stock options may provide a massive payout compared to a regular salary.

That said, equity compensation has some risks as well, which is why employers should consider the risk to reward ratio before offering them. Compensation through stocks can be incredibly risky at times, leaving workers at the mercy of the company’s and market’s performance. Of course, everybody is aware of this risk when agreeing to their compensation terms, it is easy to forget that there are no guarantees.

These implications could significantly vary depending on the particulars and structure of the organization providing the compensation. In some cases however, cashing out the stock options could seem like a sizable payout initially, but upon a closer look, employees realize that taxes take out a massive chunk of the payout.

What is Salary Compensation?

When talking about equity compensation vs salary, salary compensation is simply the amount of monthly income the rest of the employees get. It is essentially a base pay that an employee receives depending on a pre-decided yearly, monthly, hourly, or weekly amount.

In most cases, employees know the exact amount of salary they will receive and when they will get it. Plus, unlike equity compensations, salary compensation does not fluctuate depending on the market or company’s performance.

Pros and Cons of Salary Compensation

Salary compensation is incredibly reliable compared to other forms of compensation. As mentioned earlier, employees know the amount of money they will get and the date they will receive it on. It is a major reason this type of compensation is a dependable, steady payment form that lets you plan for saving and spending in the future.

However, there are risks associated with salary compensation as well. Of course, it is dependable but some employees also see it as a disadvantage, and the reason is simple. With salary compensations, there aren’t any opportunities for higher payouts. You will only get the amount of money decided initially. Sure, there are higher salary structures and pay grades, but once you reach the highest level, you will not be able to earn a higher amount than what’s on the paygrade. In addition, there is also the risk of the organization going under or job layoffs.

When is Offering Equity a Good Idea for Startups?

Generally, employers tend to offer workers equity compensation as soon as they start their business. However, some companies even offer equity if they are experiencing cash flow shortage when paying salaries. Employee retention is another reason behind the provision of startup equity.

Whatever the case may be, it is important to make sure that the equity is favorable for employees as well as the employers. Offering equity means that the employee wants to form a culture that encourages employees to improve the quality of options with their accomplishments. It is a significantly better option than asking employees for variety once they complete a certain task.

You may come across a large number of cases where employers only offer equity after the employee completes a milestone. This could create a culture that focuses more on equity, subsequently suffering higher turnover loss. It is a major reason why a comprehensively designed equity allocation is ideal for both employers and employees.

If it is Your Industry’s Norm

Adjusting in a marketplace can be quite difficult for startups. A great way to minimize inconvenience would be to offer equity startups if it is normal in your industry. More and more companies are coming to terms with the fact that providing equity packages is sometimes the only way to separate high level employees from the others. It can help determine the people the company should be relying on.

Considering the incredible competition among most startups, it’s no wonder why most of these companies attract highly skilled talent with the help of equity.

When Expanding Your Startup

If you are planning to take your startup to the next level, offering your skilled workers with employee compensation may be a great idea. It may also help you receive investment from angel investors, venture capitalists, and other types of investors. Since most investors intend to recoup their money in a short period, you will need a strong team to create your company around. You can only do this by attracting and retaining highly skilled workers, showing investors that your organization has the potential to evolve.

Incentivizing Senior Employees

Equity compensations are quite common among senior members of an organization. Why? Because people in senior roles are responsible for a massive part of their organization’s success. If an employer believes their workers have the ability to increase the company’s revenue by influencing and motivating others, offering them with equity compensation could prove to be instrumental for the future.

When there is Poor Cash Flow

If your startup is running out of money to conduct your business activities, taking advantage of equity compensation could be a tremendous way to reboot your business the right way. Besides helping you start a new, offering equity compensation could also resolve the problem of paying workers a massive sum of money each month.

Manage your Startup Equity on Eqvista

When it comes to issuing equity compensation to your employees, the Eqvista app is perfectly suited to fit your needs. You can manage all your equity needs from one platform, be it issuing share or option grants, exercising options into shares, or repurchasing shares in case an employee leaves the company.

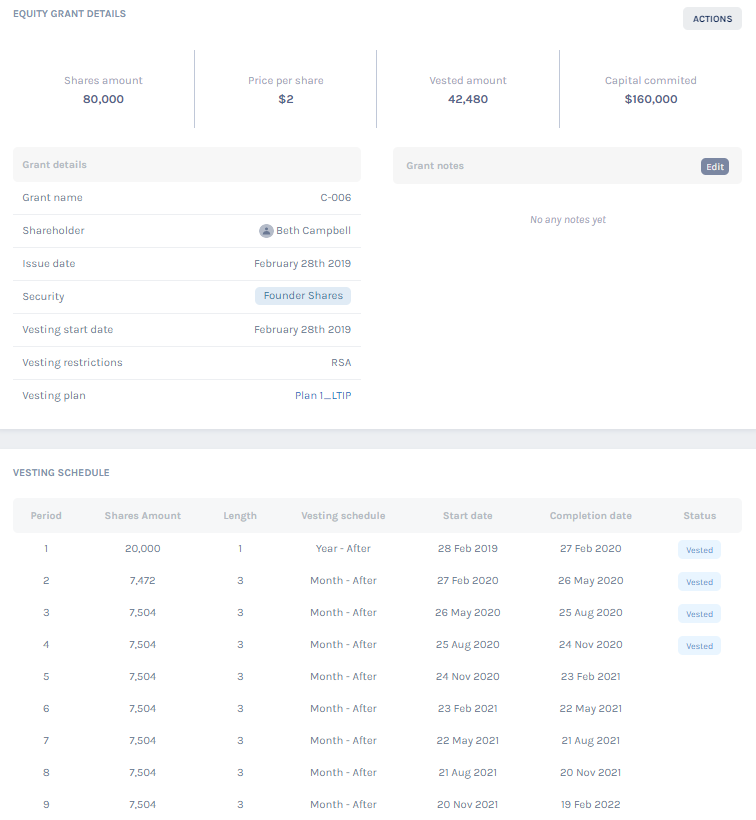

Here is a how an option grant with a vesting schedule would look on the Eqvista App:

The calculations for the vesting schedule is automatically handled on the platform, and you can easily track how many options have been vested for your startup equity. This makes managing your company equity compensation all the more easier.

Conclusion

While there are plenty of benefits of using equity compensation, it is important to do your research before distributing it. Doing so will help you analyze your startup’s worth and determine its future potential. It would also help if you discussed these things with your peers and co-founders to make a well-informed decision.

Eqvista is an easy to learn, state of the art platform perfectly suited to help manage your equity compensation in your company. Our app is highly scalable, both small and larger companies, and is free for companies of up to 20 shareholders.These articles will help you understand our services better. For further information, contact us today!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!