Startup Term Sheet Template

A startup term sheet is the first official yet non-binding business document that proposes the terms of a funding contract well before a legally binding one is created.

Term sheets are the base document that facilitates funding processes involving a venture capitalist and a startup founder. It is meant to ease the process of setting terms for the monetary exchange and manage the expectations rising from it. However, with the exception of a serial entrepreneur, venture capitalists have an upper hand in the knowledge and workings of this document. For most startup founders, the importance of a startup term sheet doesn’t dawn until served with one.

Startup Term Sheet

Startup founders often prepare for funding rounds with a myopic view of the money alone. Whom to ask? How to ask? How much to ask? How long will it sustain?… and the likes. It is a common lapse to forget the aspects they are required to trade in return for these funds. These are usually structures related to management control, dilution scenarios, and the VC’s involvement in the day-to-day activities of the startup. Discussing these verbally could be a vague process. This is why a startup term sheet is required.

What is the Startup term sheet?

A startup term sheet is the first official yet non-binding business document that proposes the terms of a funding contract well before a legally binding one is created. Usually, during a funding pitch, all negotiations take the verbal route. The next qualifying step involves sharing this document, usually initiated by the lead VC investor. In case many angel investors are involved, the startup may initiate the process.

The importance of a startup term sheet can be honestly appreciated when it ensures that the interests of both parties are aligned in the proposal. It outlines the terms and conditions discussed in the funding round and provides an opportunity for the investor and investee to review and suggest changes wherever necessary. This document is used as reference material for the final contract. In case not offered one, startup founders must insist before receiving the final contract. A typical term sheet has the following details:

- Basic information about the business, founders, registered office, etc.

- Details of existing shareholders and their equity holdings

- The proposed amount of funding and the duration of engagement

- Rights of founders and other common shareholders

- Rights of investors and restrictions

- Proposed use of funds (how and where the money will be spent)

- Liquidation scenarios and options pool

- Exit strategy

- Arbitration clauses

- Controlling authority structure

Salient Features of a Startup Term Sheet

A startup term sheet is a crisp and clear document. It is not just a formality. This document has a purpose and is designed in a specific way. Over the years, experienced VC and startup incubators have come up with simple templates readily usable by founders. However, before using a template, one must understand the design’s principles. To begin with, this document is intended to cover two basic aspects of any funding round:

- The Investment – This aspect covers terms and conditions regarding funds dissemination, liquidation scenarios, and exit formalities.

- The Ownership – This aspect governs the extent of ownership/participation shared by the startup founders and the investors.

Based on these two principles, a startup term sheet template follows the following structure:

- It is non-binding for all reasons and purposes – Startup founders need not feel obligated to commit to the transaction just because an investor shared this document. If the terms do not suit their interest, founders can feel free to walk out on the deal.

- All points must be listed in bullets – A term sheet should be a transparent document in terms of the conditions set forth as well as the formatting. Neither party should need to read between the lines.

- There should be room for flexibility – It is a primary document that precedes the actual contract. Its basic purpose is to open up a space for discussion between the investor and investee. Therefore, there must be room for negotiations and inclusion of ideas.

- It should be issued before the final contract – Founders must ensure that they don’t enter the final contract stage before seeing a term sheet. This is the basic purpose of it. To act as a precursor to a legal contract.

Further, to understand and appreciate the components of startup term sheets, one must know the flip side of it. What happens when these features are not included? Here are some scenarios:

- Startups don’t get an accurate picture of the investor’s intent beyond their verbal negotiations

- Founders don’t get an idea about the extent of their ownership. They might sign-up for more than they should

- Investors might end up funding the wrong people who won’t deliver what they promised during the pitch

- Parties, investors, and investees might leave some loose ends in the contract that will eventually land their relationship in a soup leading to heavy losses.

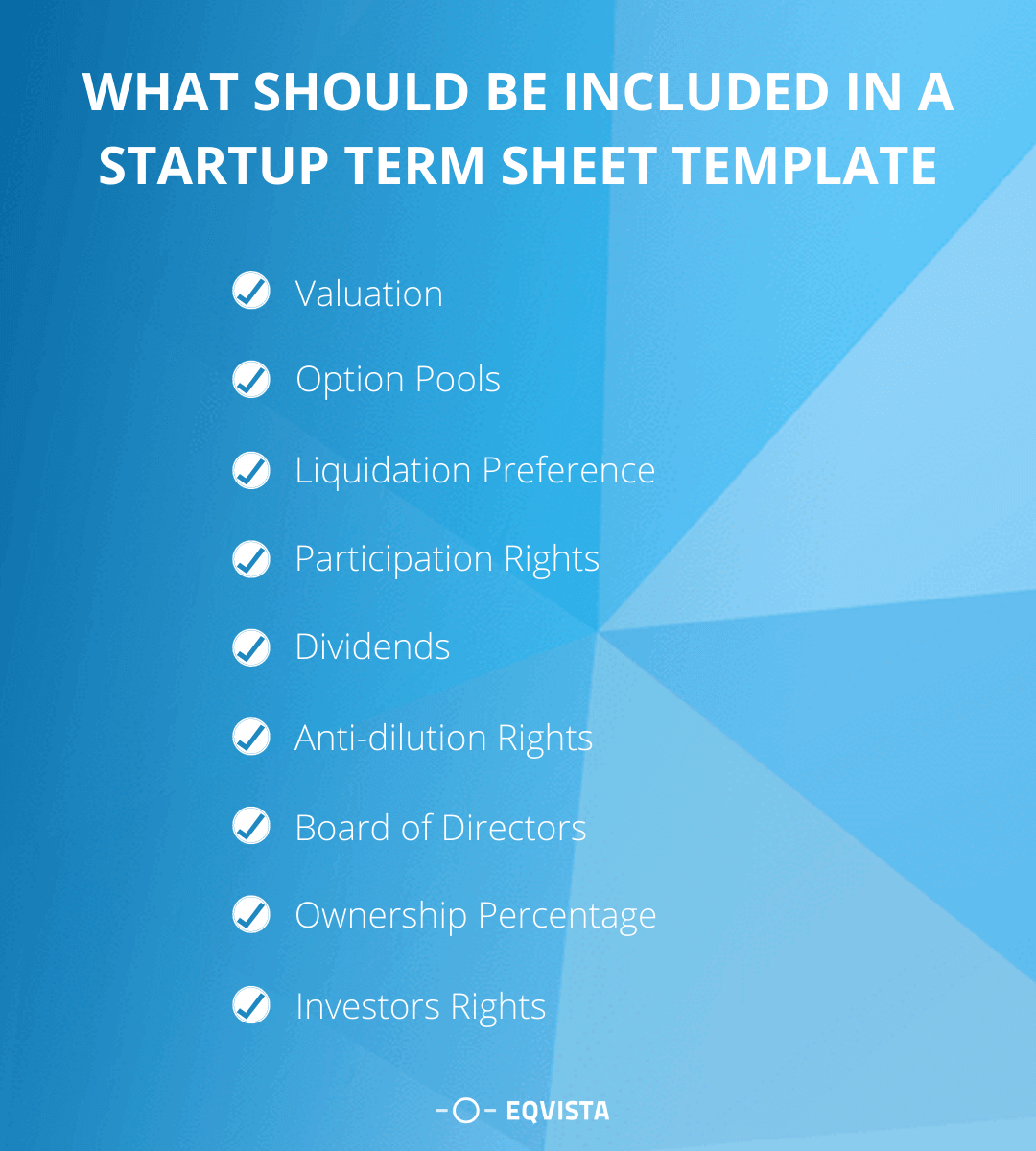

What Should be Included in a Startup Term Sheet Template?

Based on this reasoning, startup term sheet templates have evolved to follow a particular format. Certain aspects are a compulsory inclusion:

- Valuation – This point determines the perceived value of a startup. Since investors are parting with a substantial value of money, they perceive company valuation from two angles: pre-money (company valuation before funding) and post-money (company valuation post-funding). Leading from this is the inclusion of cap table terms. Cap tables provide clarity about shareholding and liquidation possibilities shared between investors and startup founders. Besides these, the information that ties all these aspects together is the price of each share.

- Option Pools – This is an important contributor to liquidation. As a result, it is a crucial component of every term sheet. Option pool is the segment of shares founders set aside for specific tasks such as employee compensation and incentives. Usually, an option pool is 10% of total equity. This works in favor of investors if the option pool is calculated pre-money, while founders benefit from it if it is done post-money.

- Liquidation Preference – This clause is directed towards investors who own preferred shares. The preference clause outlines the order in which shareholders would be paid in case of dilution. This is important for investors because it provides a security blanket for their investments. However, founders must not agree to more than 1x returns in a dilution scenario.

- Participation Rights – These rights are a way in which investors demand a premium for participating in shareholdings of preferred shares. But this is not mandatory. In fact, this clause can prove to be cumbersome for founders. Thus if unaffordable, founders must push back on including participation rights in the startup term sheet template. In case it is included, founders must place a cap on the multiple (eg. 2x, 3x,…). If the value crosses this cap value, investors must agree to convert their preferred shareholdings into common shares.

- Dividends (both Cumulative and Non-cumulative) – Dividends are the returns paid to shareholders. It is essentially the distribution of profits generated by the company. As expected, this should not be a concern for early stages startups. But founders must know about two types of dividends and ensure they are not misled:

- Cumulative dividends – Preferred shareholders are entitled to this type of dividend. But it comes at a heavy cost to common shareholders. In this arrangement, investor dividends accrue year on year in case the company fails to clear annual dues. As a result, this becomes a huge amount over time. Startups must never agree to this.

- Non-cumulative dividends – This is a much more flexible option. In case investors insist on dividends, it would be in the best interest of founders to choose this option. In this arrangement, the company’s board of directors must declare their claim over company profits or dividends annually. In this situation, preferred shareholders are paid only if common shareholders (founders and employees) agree to claim their right over dividends.

- Anti-dilution Rights – As the term suggests, this clause is one of the important components of startup term sheets and governs the changes in the ownership structure of investors and investees in scenarios of future investments. Founders must be careful neither to propose nor accept unreasonable terms in this section. Anti-dilution rights are broadly of two types:

- Full-ratchet – This works in favor of preferred shareholders. When new shares are issued, the full-ratchet clause entitles the shareholders to convert preferred shares at the price of the new ones no matter how many new shares are issued. But this does not favor common shareholders.

- Weighted Average – This is a much better option for common shareholders. The conversion price of preferred stocks is decided after considering the total number of new shares as well as the price per share.

- Board of Directors – The board of directors plays an important role in a company’s decision-making process. VCs, especially the ones lending capital investments at Series A funding rounds, will have suggestions about the board structure. The most favorable layout is one where investors and the founders have democratic control over company decisions. The two common types of board structures are:

- 2/1 – This proposes two seats for the founders and one for the investor. It is a founder-friendly structure.

- 2/2/1 – This proposes two seats for two founders, two for investors, and one for a third-party member. Here founders may run the risk of losing control.

- Ownership Percentage of the Share Class – This clause in a startup term sheet entitles the investors to choose the class of shares. In most cases, investors choose preferred shares as the privileges are exclusive and more compared to common stockholders.

- Investors Rights – This is an important section in term sheets. It is one of the aspects that require focused legal consultation. An investor right is a blanket term. In the context of startup funding, here are some specifics:

- Right to Exclusivity – This is a binding clause for a startup. It ensures that founders don’t look for new investors during the term of engagement of one VC. This clause also allows an investor the right to a thorough due diligence process before finalizing the contract.

- Right to Information – Once a VC is on board, they will represent the company board. This entitles them to receive updates about the business. They are also allowed regular access to important documents such as business plans, budget plans, financial reports, etc. In some cases, the investor might push for a right to visit the company in person as well.

- Right to Protective Provisions – This is an extension of the rights provided by the startup as a result of preferred shareholdings. VCs are entitled to veto powers in important business situations such as certificate of incorporation amendments.

- Right to Vote – Normally, the right to vote in company matters is reserved only for common shareholders (founders and employees). But exceptions are made for VC representations in the funded company. They are entitled to have a say/cast the deciding vote in all matters that concern allocation or distribution of their investment.

- Right to Affirmative Action – Apart from being part of the decision-making process, VCs have the right to be involved and participate in specific actions such as:

- Dividend payout structures

- Changes in corporate records

- Decisions of M&A, changes in management control, transfer of assets

- Changes in the structure of company equity such as issuance of new shares, creation/expansion of options pool, creation of a new class of shares, etc

- Liquidation or fragmentation of business units or the company as a whole

What Should Not be Included in a Startup Term Sheet Template?

All the varied components of startup term sheets make it a precise yet comprehensive document. Though many important aspects are covered that form the basis of contractual discussions, founders must also be aware of unnecessary components or will prove to be an imposition in the long run. Some of them are:

- Redemption Rights – This is a tricky one. It allows investors to demand the return of their money during startup operations. It does not pose a problem if the startup is clocking profits or has completely gone bankrupt. It becomes an issue when the startup is growing and expanding, and the investor (for whatever reasons) pulls back their funds. This is a catastrophe.

- Milestone-based Financing – This clause is gradually fading out. But as founders, it is good to know and ensure disagreement if proposed by an investor. Milestone-based financing is a model of investment where the funding is conditional. A certain amount is released at the start of a contract. But the rest is dependent on the achievement of milestones. In case founders fail to achieve these, funds are withheld.

- Unnecessary Fees – The two types of fees that fall under this category are – ‘board fees’ and ‘monitoring fees’. A board fee is what an investor would charge for being present in board meetings. While a monitoring fee is a demand for payment for monitoring the investments. These demands are unfair, and founders must never agree to them.

- Multiple Board Seats per Investor per Round – The usual practice at a funding round is to grant one board seat per investor. Founders can feel free to deny if any investor pushes for more than this.

When Does the Startup Term Sheet Come into Play while Fundraising?

Startup term sheets play a specific role in the fundraising process. It would work in favor of a founder to understand where to present or expect this document. Here is the process flow:

- Decide to fundraise – The first step is the decision to enter the fundraising process. Once a founder has bootstrapped into the market and engaged a few angel investors for the seed money, the next step involves venture capitalists.

- Finding investors – There are many active players in the market. Founders must choose the ones which suit their business interests. VCs not only bring in the money but years of industry experience as well. With the right strategies, a startup stands to benefit from this arrangement.

- Pitching investors – VC investment is a highly competitive space. They receive hundreds of applications each day, and just about 1% to 3% of them receive the funds. Therefore, founders must work on network-driven, reliable introductions, design an appealing pitch deck, and have the patience to follow through. The run between the first pitch and the final agreement could take several months.

- Due diligence and final steps – After the investor has agreed to fund a startup, before proceeding further, they will conduct a thorough due diligence process to verify credentials.

- Term sheet – Only after a convincing due diligence process, this document is issued by the VC. After both parties have agreed to the terms listed in this document, they proceed towards formalizing the deal in a final contract.

Importance of a Startup Term Sheet

When the startup culture began with limited investors (mostly on word-of-mouth references), it was possible to handle business over informal chats before committing to the final contract. As the industry grew and more players came into the picture, certain checks and balances were introduced to protect the interests of the founders and investors. These documents are one of them. They are important because:

- They establish a relationship -This is the first and foremost function of such a document. It binds all parties together in a financial transaction. It assigns roles such as founders, investors, or VC firms.

- They clarify intent – Investors could engage with a startup in many ways. It could be an acquisition, a regular equity funding round, or any other financial agreement. It helps clarify the intent behind these connections.

- They provide a base draft – This document is a basic outline that forms the basis of a final funding contract. It lays out all the proposed terms and conditions on paper. This automatically leads to possibilities of mutual negotiations.

- They facilitate negotiations – The engagement term between a startup and a VC can range between 5 to 10 years. A contract, once signed, binds both parties in a long-term engagement. Thus term sheets are an important precursor as they open channels of equitable communications between both parties before finalizing a long-term binding contract.

- They enable due diligence – They form the basis of the due diligence process. Investors and founders can mutually agree or disagree over the proposed terms and walk out of the arrangement without any liabilities. Considering the early nature of this document, it saves cost as well in case the engagement needs to be dissolved.

Important Provisions of Startup Term Sheet

A startup term sheet template includes many features, as discussed so far. By nature, they are not legal documents, yet they are considered official communications and command a certain level of integrity and commitment from both parties. Specifically, two provisions are binding in nature:

- Provision of Confidentiality – The moment an investor issues this document, it binds both parties in a confidentiality clause. Though this document is not the final agreement, it lists many sensitive terms of the contract which are classified as ‘eyes only for the parties involved.

- Provision of ‘no-shop’ – This clause is intended for founders. Once this document is issued to a startup, it must not engage with any other investors until this deal is closed or dissolved. This is a way of protecting the interests of investors.

Startup term sheet example and template

Over the years, term sheet templates have reached a standardized format. This eases the burden on founders as they know what to expect from a VC once the deal moves towards maturity. Standard formats are beneficial to the investor as well because they don’t have to reinvent the wheel every time they work with a startup. With this extensive brief, here are two popular examples of startup term sheet templates:

- Y Combinator startup term sheet template – Y Combinator is one of the earliest startup accelerators. They have nurtured thousands of founders in their startup journey. Based on these experiences, they have created a standard template. This is a single-page document and the most popular one. It works well for any Silicon Valley based VC. This particular template is directed towards Series A funding.

- NVCA startup term sheet template – The National Venture Capitalists Association (NVCA) provides an advanced version of a term sheet template. The NVCA has a database of 100,000 plus transaction histories. It is the most reliable network of VCs with more than 40,000 active investors. The combined value of all these investors in terms of assets they manage is over $1 trillion. The NVCA template is sought after because it allows an investor to create a draft while comparing the ones trending in the market. This is very helpful as investors can compare their proposals with the ones floated by various NVCA database members.

Store your Agreements and Startup Term Sheet with Eqvista!

For startups, managing important documents can be a hassle since there is so much to keep track of, especially a startup term sheet. With Eqvista, you don’t have to worry about getting lost with your paperwork. Eqvista is the pioneer in startup cap table management and company valuations. We provide a comprehensive range of services that enable and support growing startups. Sign-up with Eqvista today and receive expert consultation about your startup journey, including storage of startup terms sheets and company agreements. Reach us today!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!