Qualified purchasers: Requirements & Benefits

In this article, we will explore who can be a qualified purchaser, how they are different from accredited investors, and what kinds of opportunities await them.

Due to the inherent risks of certain assets, only investors of a certain level of sophistication are allowed to invest in them. For beginners, investment options typically include stocks and government securities. As an investor matures, they can participate in more complex and risky instruments such as corporate bonds and derivatives.

The final stage of this evolution is becoming a qualified purchaser. They play an important role in the venture capital system in return for accepting greater risk, they can earn outsized or even supernormal returns.

What are the benefits of being a qualified purchaser?

A qualified purchaser can invest in virtually any opportunity available to them. These investors sit at the top of the investor hierarchy introduced by the Securities and Exchange Commission (SEC). The purpose of this hierarchy is to ensure that investors do not take risks they are not prepared to handle.

Qualified purchasers meet the highest level of asset ownership and financial sophistication criteria. Following them in the pyramid, we have accredited investors who must meet a lower level of asset ownership and financial sophistication criteria. At the bottom, we have the non-accredited investors who do not meet the criteria for accredited investors and qualified purchasers. A majority of the general public falls into this category. Such investors have comparatively limited investment opportunities.

For instance, the general public is not allowed to invest in hedge funds. You can overcome this hurdle by becoming an accredited investor. However, even accredited investors are not allowed to invest in 3C7 funds.

The SEC believes that meeting the asset ownership and financial sophistication criteria allows qualified purchasers to assess all investment opportunities with reasonable accuracy and equips them to face the risks.

Qualified purchasers VS Accredited investors VS General public

The key differences between the three categories of investors are summarized in the following table.

| Particulars | Qualified purchasers | Accredited investors | General public (Non-accredited investors) |

|---|---|---|---|

| Income requirement | Income is not a factor in becoming a qualified purchaser. | Those have an annual income of at least $200,000. | No specific income requirement |

| Asset requirement | $5 million in investments, excluding the primary residence or business property | If the individual does not meet the income requirement, they must have assets worth $1 million, excluding the primary residence. | No asset threshold |

| Where can they invest? | Public investments such as: Private placements Investment companies | Public investments such as: Private placements Investment companies | Public investments such as: |

Note: The income and asset ownership requirements mentioned in the table apply only to individuals. Trusts and other entities may need to clear a different set of requirements to qualify as accredited investors or qualified purchasers.

How does one become a qualified purchaser?

Individuals, family offices, trusts, and investment managers must meet different sets of requirements to be classified as qualified purchasers. These requirements are defined as follows:

- Individuals – A person can be a qualified purchaser if they own at least $5 million in investments, as defined by the SEC. The spouses can also be qualified purchasers if they share an ownership interest in a 3C7 fund.

- Investment managers – Individuals or entities that manage at least $25 million in investments, for themselves or qualified purchasers, are classified as qualified purchasers.

- Family offices – Any company that has assets of at least $5 million and is owned, directly or indirectly, by related individuals such as siblings, spouses, ex-spouses, direct descendants, or their estates, foundations, or charitable trusts is classified as a qualified purchaser.

- Trusts – A trust that is not established for the specific purpose of investing in 3C7 funds and whose trustees and settlers can itself be a qualified purchaser.

- Excepted investment company – A company that meets the requirements of paragraphs 1 or 7 of 15 U.S.C. Section 80a-3(c) can be excluded from treatment as an investment company under the Investment Company Act of 1940. If such a company wishes to act as a qualified purchaser, it will need the consent of all of its securities-holders (except owners of short-term papers). Trustees, directors, or general partners can give consent on behalf of the securities-holders.

You must note that the SEC has the power to update these requirements to protect investors or serve the public interest.

What are 3C1 and 3C7 funds?

3C1 and 3C7 funds are investment companies that do not need to comply with some of the requirements of the Investment Company Act of 1940 that regulates the activities and defines their disclosure requirements. The key requirements of this act are as follows:

- Registration – Investment companies should be registered with the SEC, also must file a registration statement and a prospectus with the SEC.

- Periodic disclosures – The investment company must disclose its financial condition and investment policies to investors at the time of stock issuance as well as regularly. The periodic disclosures must include the company’s risk exposure, historical performance, and investment strategy.

- Composition of directors – 40% of the investment company’s board must be composed of independent directors.

- Balance sheet requirement – Investment companies cannot fund their investing activities through debt beyond a certain threshold. Such companies also cannot buy securities on margin. Furthermore, an investment company’s ability to invest in other funds or financial firms is restricted.

Of the above-mentioned requirements, the Investment Company Act’s requirements regarding board composition, assets, and liabilities can impact the performance of a fund. Investment companies are restricted from relying heavily on debt. This limits their ability to engage in highly leveraged transactions.

Since an investment company’s investments into other such entities are restricted, they have limited access to high-performing funds. Furthermore, the board composition requirement prevents the investment managers from acting with a high degree of autonomy. Since 3C7 funds and 3C1 funds do not qualify as investment companies, their performance remains unimpeded by these requirements.

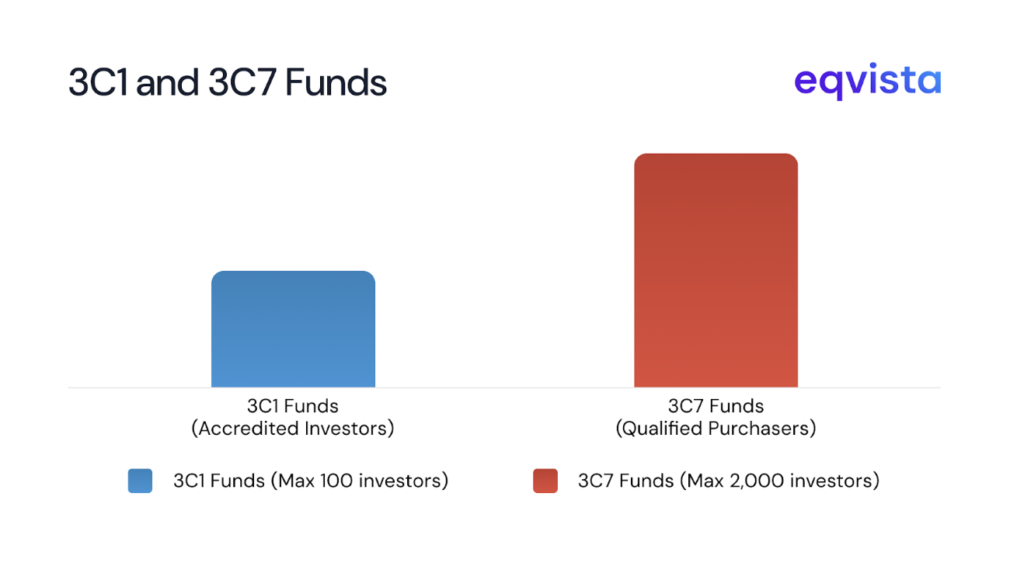

A conventional 3C1 fund can have a maximum of 100 investors, all of whom must be accredited investors. In case of 3C1 funds, which are qualifying venture capital funds, the maximum number of investors is increased to 250 accredited investors. Also, a qualifying venture capital fund must have a maximum fund size of $12 million.

In contrast, a 3C7 fund can have a maximum of 2,000 investors, all of whom must be qualified purchasers.

QSBS investments and qualified purchasers

Under Section 1202 of the IRC, qualified small business stocks (QSBS) may qualify for a 100% capital gains exclusion up to $10 million to 10 times the investment basis, whichever is greater.

This lucrative tax-saving opportunity can be surprisingly inaccessible. Firstly, only individuals, partnerships, and S corporations can own QSBS. Secondly, to qualify for the tax benefits, you must be directly issued QSBS in exchange for service, cash, or property other than shares.

For most people not employed by or directly contributing assets to a startup, QSBS is typically obtained through private placements. However, in the USA, only accredited investors and institutional investors can participate in private placements.

As a qualified purchaser, you would automatically meet the requirements of being an accredited investor, making you one of the few potential beneficiaries of this tax provision. To fully capitalize on QSBS opportunities, you must familiarize yourself with the key requirements of Section 1202.

Eqvista – Compliance through accuracy!

For investment companies that wish to qualify for 3C1 and 3C7 exemptions, verifying the asset ownership of investors is a critical compliance requirement. However, managing this process internally can divert valuable resources from core operations.

At Eqvista, we can help you overcome this challenge by providing unbiased and data-backed asset valuation reports tailored to meet regulatory standards. Contact us to know more about our services!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!