Mezzanine Debt: The Bridge Between Loans and Equity

Mezzanine debt, aka mezzanine financing, is a form of subordinated debt.

Imagine you need $100 million to acquire your competitor, but banks will only lend you $60 million, and you don’t want to give up half your company to raise the remaining $40 million. What do you do? This is where mezzanine debt comes in: a financing solution that’s been powering major deals for decades, yet remains surprisingly misunderstood outside finance circles.

If you’re a founder looking for your next acquisition, an investor seeking enhanced yields, or curious about how major deals get financed, knowing mezzanine debt gives insights into how modern business really works.

What is Mezzanine Debt?

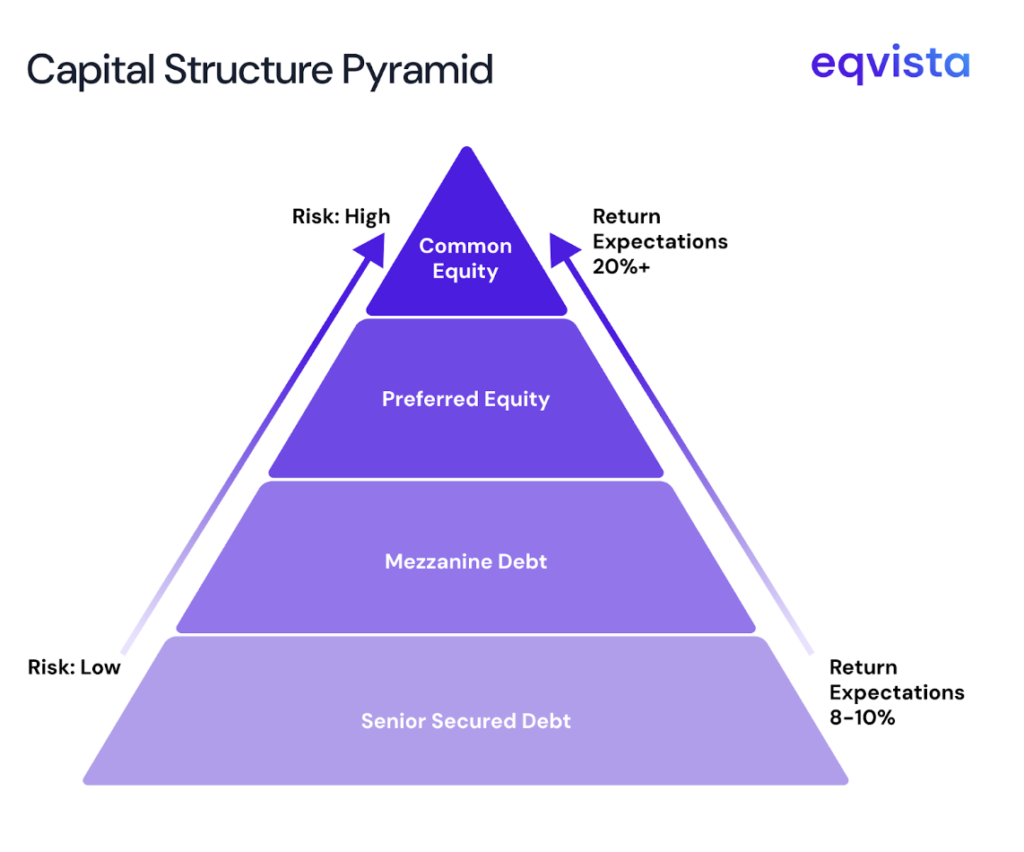

Mezzanine debt, aka mezzanine financing, is a form of subordinated debt. It sits strategically between senior debt, like bank loans, and equity in a company’s capital structure. You can call it the middle tier of the capital structure.

In a company’s capital structure, mezzanine debt sits between senior secured debt and equity. This subordinated debt carries higher risk than traditional bank loans but offers correspondingly higher returns, typically ranging from 12% to 20% annually.

Suppose you are acquiring a competitor at a price of $100 million. Your bank has agreed to lend you $60 million, and that is still short of a $40 million difference. You do not want to put all that on as equity because it will substantially dilute your ownership. You instead choose to partly resort to mezzanine debt, a middle way between equity and senior loans.

This arrangement enables us to finance the acquisition without relinquishing too much control. It also offers appealing returns to the investors who are willing to assume a greater degree of risk.

| Source of Capital | Type | Amount ($M) | % of Total | Annual Cost / Expected Return | Seniority (Repayment Order) | Notes |

|---|---|---|---|---|---|---|

| Bank Loan | Senior Secured Debt | 60 | 60% | 6% interest | 1st | Backed by assets, lowest risk |

| Mezzanine Debt | Subordinated Debt | 25 | 25% | 15% + small equity kicker | 2nd | Higher risk, sits between senior debt and equity |

| Equity (Owner) | Common Equity | 15 | 15% | Target 20%+ IRR | Last | Highest risk, highest upside |

5-Year Exit: The company is sold for $150 million.

| Investor Type | Principal Invested ($M) | Interest / Return ($M) | Total Repayment / Value ($M) | Priority in Repayment |

|---|---|---|---|---|

| Senior Lender | 60 | 18 (6% × 5 yrs) | 78 | 1st |

| Mezzanine Lender | 25 | 18.75 (15% × 5 yrs) + 7.5 (5% of 150 equity kicker) | 51.25 | 2nd |

| Equity Holder | 15 | Residual = 150 − (78 + 51.25) = 20.75 | 20.75 | Last |

In this case, mezzanine debt also enabled the firm to make a $100 million acquisition without surrendering too much equity. At the time of exit, the bank received a risk-free 6% yield, the mezzanine lender received an excellent blended yield of around 15% annualized return and the shareholders just got a 7% annualized return due to last repayment priority.

These figures demonstrate the effectiveness of mezzanine financing in terms of bridging the gap between loans and equity, offering greater rates of returns to the investors without sacrificing the ownership to the founders of the company.

Features That Set Mezzanine Apart

What makes mezzanine debt different from a regular bank loan or a simple equity investment? It’s all in the creative structuring. Mezzanine lenders have developed several mechanisms that make this financing flexible enough for borrowers while still protecting their investment.

Here are the features that define how mezzanine deals actually work:

Payment in Kind (PIK) Options

Unlike traditional loans requiring monthly payments, mezzanine debt often allows PIK interest—interest is added to the principal rather than paid in cash. This protects the cash flow during the growth stages.

Equity Kickers

The equity component differentiates mezzanine from pure debt. Lenders receive warrants or conversion rights, allowing them to participate in the company’s upside.

Minimal Covenants

While senior lenders take advantage of strict financial contacts, mezzanine lenders offer more flexibility, focusing on asset sales or additional borrowing rather than quarterly metrics.

Advantages of Mezzanine Debt for Borrowers and for Lenders

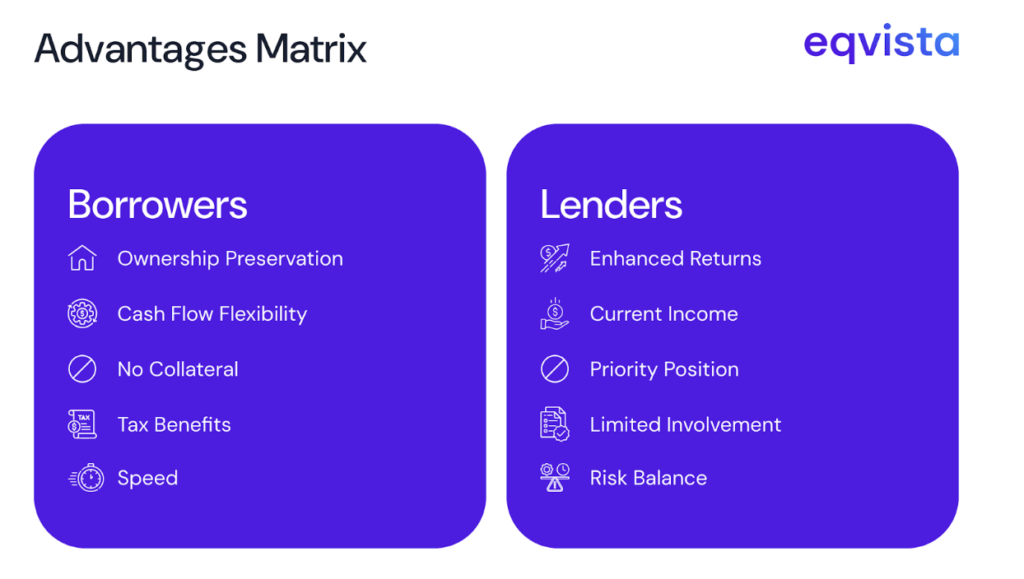

Mezzanine debt offers compelling benefits for companies seeking capital:

- Unlike equity financing, mezzanine debt doesn’t immediately dilute ownership. Even with warrants attached, founders retain more control than they would by raising pure equity.

- PIK interest options mean companies can defer cash payments during growth phases, using capital for operations rather than debt service. This is invaluable for businesses reinvesting in expansion.

- Mezzanine debt is typically unsecured, meaning companies don’t need to pledge additional collateral—especially valuable for service businesses or tech companies with limited hard assets.

- Interest payments on mezzanine debt are tax-deductible, reducing the effective cost of capital compared to equity dividends paid with after-tax dollars.

- Mezzanine deals close faster than equity rounds, with fewer investors to coordinate and less dilution to negotiate.

From the lender’s perspective, mezzanine debt presents unique opportunities:

- With interest rates of 12-20% plus equity upside, mezzanine lenders can achieve private equity while maintaining the senior position of debt holders.

- Unlike pure equity investors who wait for exits, mezzanine lenders receive regular interest payments while participating in company growth through warrants.

- While subordinated to senior debt, mezzanine lenders sit ahead of equity holders. In a sale or refinancing, they get paid before equity receives anything.

- Mezzanine lenders typically don’t require board seats or daily oversight, yet they benefit from both debt protections and equity appreciation.

- For institutional investors, mezzanine debt offers a middle-ground risk profile between conservative bonds and aggressive equity investments.

The Bottom Line: Strategic Financing for Growth

Mezzanine debt represents the art of financial engineering at its finest. While more expensive than traditional debt, it provides a bridge for companies at inflection points, enabling growth, acquisitions, and transitions that might otherwise require surrendering ownership.

For savvy business owners and investors, understanding mezzanine debt opens new strategic possibilities.

Managing complex capital structures with multiple layers of financing?

Eqvista’s cap table management platform helps you track debt instruments, equity positions, warrants, and conversion rights all in one place. Learn how Eqvista can simplify your equity management.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!