Dilutive Vs Non-Dilutive Funding

This article will decode the complexities of both funding, providing you with the knowledge and framework needed to make informed decisions.

Most founders want the same thing—capital to grow, but without giving up too much control.

Raising money isn’t just about getting a cheque. According to recent data, H1 2025 posted the strongest half year for VCs since that of 2022. Startups raised a total of $205B through the mid-year, up 32% from H1 2024.

The choice between giving up equity or maintaining control isn’t just a financial decision; it’s a strategic one that will influence every aspect of your business.

This article will decode the complexities of both funding, providing you with the knowledge and framework needed to make informed decisions that align with your company’s stage.

What is Dilutive Funding?

In dilutive funding investors become partial owners of your business. They don’t just lend you money—they buy a piece of your future success. When you accept dilutive funding, you’re essentially trading pieces of your company for money, which reduces—or “dilutes”—your ownership percentage.

Here’s how it works in practice: If you own 100% of your company and sell 25% to an investor for $1 million, you now own 75% while the investor owns 25%. Your slice of the pie got smaller, but the entire pie became more valuable with the influx of capital.

Current Market Context and Conditions Of Dilutive Funding

The venture capital landscape in 2024-2025 demonstrates resilience amid macroeconomic uncertainty. Global VC investment reached $109 billion in Q2 2025, with the US capturing 64% of global funding. Pre-seed valuations show slight recovery from 2023 lows, with median valuations reaching $3.95 million in H1 2025, though remaining below 2021 peaks.

This reflects investor focus on sustainable growth and profitability rather than growth-at-any-cost strategies.

Dilutive funding qualification involves rigorous multi-stage evaluation processes covering financial, legal, operational, and strategic dimensions. Securing dilutive funding is not just about having a pitch deck.

Investors typically look for:

- Team quality – Proven execution capability

- Market size – A large, defensible opportunity

- Traction – Revenue or strong user growth

- Unit economics -Early signs of sustainability

VCs spend an average of 4 minutes reviewing a startup pitch deck. That means founders have very little room to make a strong impression. And rejection is the norm, not the exception.

Sector-Specific Guidance of Dilutive Funding

Not all sectors attract equal investor appetite:

- SaaS and Fintech – Still strong magnets for venture funding due to scalability and recurring revenue models.

- Biotech and Deep Tech – Require larger, longer-term bets. Founders often need to pair VC money with grants or academic partnerships.

- Consumer Goods (D2C) – Investors are cautious unless the brand shows unique defensibility and strong unit economics.

- Climate Tech and AI – Among the hottest categories in 2024–25, but also crowded, meaning differentiation is critical.

Failed Funding & Reality Check

Even with strong teams and products, many startups fail to close rounds. Common reasons include:

- Overvaluation that scares investors away

- Poor storytelling or unclear business model

- Weak unit economics

- Entering a crowded space without differentiation

Not every pitch leads to a term sheet. In fact, most don’t. For early-stage founders especially, rejection is part of the process, not a final verdict. But a failed funding attempt has very real consequences—and how you respond can determine your company’s trajectory.

Pros and Cons of Dilutive Funding

| Pros | Cons |

|---|---|

| Larger capital infusions for high-growth needs: Dilutive funding, especially through venture capital, can inject millions of dollars in a single round. | Loss of ownership and control: Each round of equity funding chips away at your share. Multiple rounds can leave early founders with a minority stake. |

| Access to expertise and networks: Investors don’t just bring money. The right VC or angel can open doors, make key introductions, and help you avoid rookie mistakes. | Investor pressure for exit: Most institutional investors are focused on 5- to 10-year exits. That could mean pressure to scale faster than you’re ready for, or to sell when you’d rather keep building. |

| No fixed repayment pressure :There’s no monthly repayment or interest rate. Investors only win if your company grows in value. | Potential for misalignment: If the investor’s goals diverge from yours, it can create friction. |

What is Non-Dilutive Funding?

Non-dilutive funding allows you to raise capital without giving up any ownership in your company. Instead of selling equity, you’re either borrowing money that must be repaid, earning grants that don’t require repayment, or generating revenue that funds growth organically.

Slower venture capital activity and higher equity dilution have driven startups toward non-dilutive solutions like revenue-based finance, venture debt, and specialty credit. Funding costs have risen as interest rates remain elevated, impacting borrowing costs and prompting founders to seek more flexible alternatives to VC equity. Economic uncertainty from policy changes and global volatility has further accelerated demand for less founder-diluting capital.

Founders can now mix and match non-dilutive funding solutions for runway extension, lower cost of capital, and faster, milestone-driven growth.

Qualification Challenges of Non-Dilutive Funding

Non-dilutive funding isn’t a free pass. Each source comes with its own hurdles:

- Grants & subsidies – Require competitive applications, progress reporting, and compliance. Success rates are low—for example, only about 15–20% of SBIR Phase I grant applications in the U.S. are approved.

- Business loans – Depend on creditworthiness, collateral, and financial history. Many early-stage startups fail to qualify.

- Revenue-based financing (RBF) – Works only if you have consistent, predictable revenue streams. Margins must be strong enough to support repayments.

- Competitions/accelerator prizes – Highly competitive, often rewarding only a handful of startups out of hundreds of applicants.

The “cost” here isn’t equity, but time, effort, or repayment obligations that can stretch cash flow.

Sector-Specific Guidance

Not every industry is equally suited for non-dilutive funding:

- SaaS & E-commerce – Strong fits for RBF because of recurring revenues and predictable cash flows.

- Biotech & Deep Tech – Better aligned with government grants, R&D tax credits, and institutional funding since revenue comes late.

- Clean Energy & Climate Tech – Often supported by subsidies, green innovation grants, and public funding programs worldwide.

- Consumer & Retail – Typically rely on short-term working capital loans or trade financing rather than grants.

The right fit depends on your business model, margins, and growth horizon.

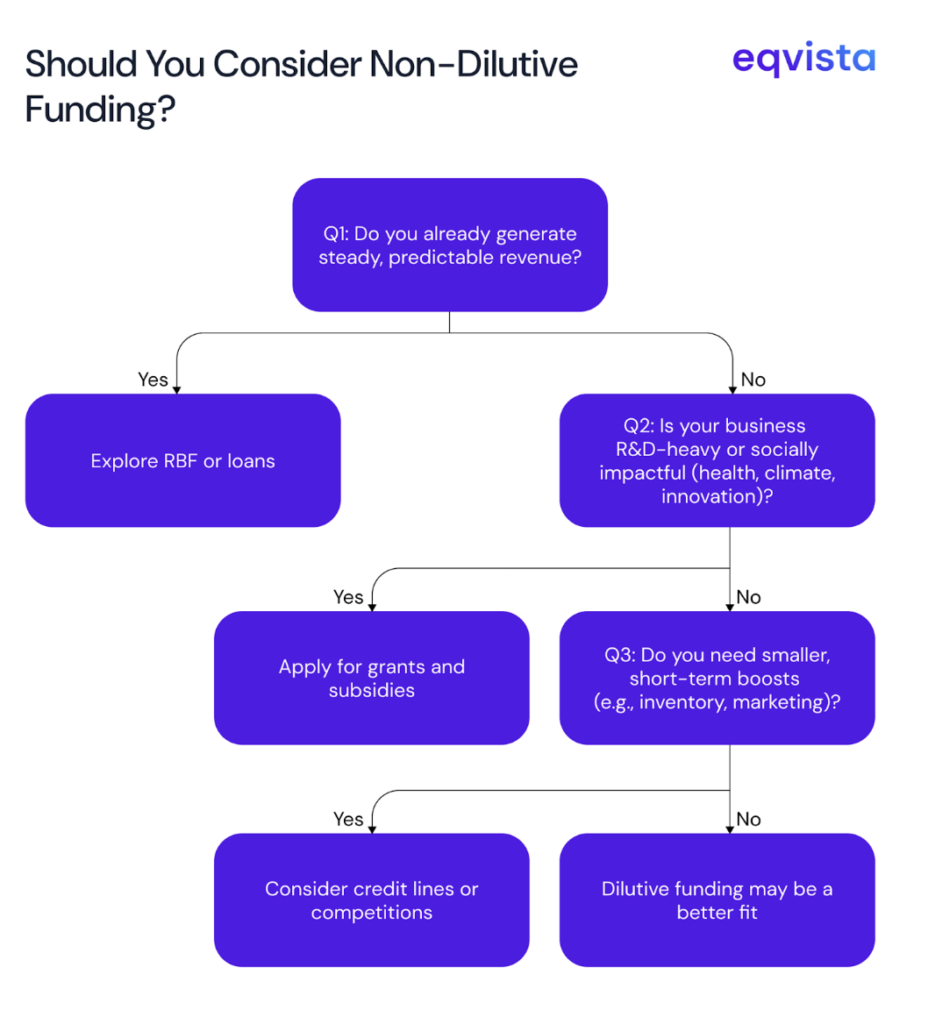

We have added a decision tree below that helps you to decide about Non-Dilutive Funding,

Should You Consider Non-Dilutive Funding?

Q1: Do you already generate steady, predictable revenue?

- Yes → Explore RBF or loans

- No → Go to Q2

Q2: Is your business R&D-heavy or socially impactful (health, climate, innovation)?

- Yes → Apply for grants and subsidies

- No → Go to Q3

Q3: Do you need smaller, short-term boosts (e.g., inventory, marketing)?

- Yes → Consider credit lines or competitions

- No → Dilutive funding may be a better fit

Many founders underestimate the difficulty of winning grants or qualifying for loans. Even when approved, funds may take months to disburse. On the debt side, repayment pressure can sink startups with weak cash flow. So while you preserve equity, you assume other types of risk—cash flow strain, time delays, or compliance burdens.

Non-dilutive funding works best when paired with discipline. If you have predictable revenue or a strong R&D case, it can extend your runway, improve valuation, and help you negotiate equity rounds from a position of strength

Pros and Cons Of Non- Dilutive Funding

| Pros | Cons |

|---|---|

| You keep full ownership: No equity exchange means you retain complete control over your company’s vision, strategy, and direction. | Qualification barriers: Many non-dilutive options require specific eligibility. These options can be competitive and time-consuming. |

| Less external pressure: It usually doesn’t come with a board seat, performance milestones, or an investor looking over your shoulder. | Limited capital amounts: While helpful, most non-dilutive funding sources don’t match the scale of equity funding. They are great for early milestones, but not enough for aggressive growth. |

| Can strengthen valuation: Clever use of non-dilutive funding in early stages can help you prove traction before raising equity, resulting in better terms down the line. | Cash flow implications: If your revenue is still lumpy or unpredictable, repayment obligations can strain your operations. |

Key Differences of Dilutive and Non-Dilutive Funding

Once you understand how each funding type works, the trade-offs become clearer. Below is a quick side-by-side comparison:

| Factor | Dilutive Funding | Non-Dilutive Funding |

|---|---|---|

| Equity Ownership | You give up a portion of your company’s equity | You retain 100% of your equity |

| Control & Governance | May lose some decision-making power or board seats | Founders retain full control |

| Repayment Obligations | No repayment; investors profit only if your company grows in value | Usually requires repayment or has conditional usage terms |

| Eligibility | Based on the company's potential, pitch, and growth vision | Often based on revenue, industry, or government-defined criteria |

| Speed of Access | Often faster with strong investor interest | Can be slower; involves application processes or credit checks |

| Capital Amounts | Potentially large sums, especially in VC rounds | Usually smaller or staged over time |

| When to Purchase | Best suited for high-growth startups looking to scale rapidly, especially in tech, biotech, or sectors with long R&D cycles. | More suited for early-stage or capital-efficient businesses, service-based firms, or those in regulated sectors (healthcare, clean energy) where grants are common. |

| Investor Involvement | High; investors may mentor, advise, or demand performance | Low; funding sources are typically hands-off |

| Risk to Founders | Low financial risk but high on control dilution | Financially riskier, especially with debt or revenue commitments |

| Timelines to Access Fund | Lengthy—can take 6–9 months (or more) for venture rounds; multiple pitching and due diligence cycles. | Typically faster—bank loans in weeks to 2 months, grants vary from 3–6 months, and revenue-based financing can be almost immediate. |

| Failure / Rejection Risk | Very high. Most startups face multiple rejections before closing a round. Funding winter cycles can worsen the odds. | Moderate. While rejection is possible, the criteria are clearer, and companies can often reapply or adjust to meet conditions. |

When to Choose Dilutive and Non-Dilutive Funding?

There’s no one-size-fits-all answer when it comes to funding. The right choice depends on where your company is today, what you’re trying to build, and how comfortable you are with giving up equity, taking on risk, or moving at different speeds.

Let’s look at how to align your funding choice with your business context.

Early-Stage Startups with Limited Revenue

If you’re pre-revenue or just starting, it’s often easier to raise dilutive capital. Angel investors and pre-seed funds are willing to bet on the team and the vision. You’re trading equity for belief and backing. For most new startups, equity funding is the more realistic path.

When it fits:

- You need quick capital to build your MVP or hire key team members

- You’re okay giving up 10–20% equity to get moving

- You have strong storytelling, traction, or founding experience

Post-Revenue Companies with Traction

If your product is live, you’re generating consistent revenue, and you can show real customer interest, non-dilutive funding becomes more accessible and strategic. Revenue-based financing, small business loans, or government-backed programs (like SBA loans in the U.S.) allow you to grow without diluting ownership.

Founders at this stage often underestimate how much leverage they have. If you can show the right metrics, you may be able to secure flexible funding on founder-friendly terms.

When it fits:

- You want to avoid giving up more equity at a low valuation

- You’re growing steadily and want to fund operations or expansion

- You have predictable revenue to support repayment

Choosing the Right Funding Path with Confidence – And Clarity from Eqvista

Capital can unlock growth, but the wrong kind can compromise ownership, control, or long-term vision. The decision between funding should never be guesswork.

The most successful founders don’t just ask, “Where can I get the money?” They ask:

- What am I giving up in return?

- How will this affect my cap table in 12, 24, or 36 months?

- What funding mix fits the company I’m trying to build—not just the stage I’m in now?

That’s where connecting with Eqvista becomes essential. Eqvista helps startups model the impact of equity dilution, manage their cap table accurately, and plan smarter fundraising strategies from day one.

If you’re weighing funding options, don’t make assumptions. Make informed decisions.

Use Eqvista to:

- Visualize how equity shifts across funding rounds

- Prepare for investor conversations with clarity

- Retain control as you scale

Because capital should grow your business—not cost you more than it’s worth.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!