Blue Sky Laws: Purpose, Variation and Exemptions Explained

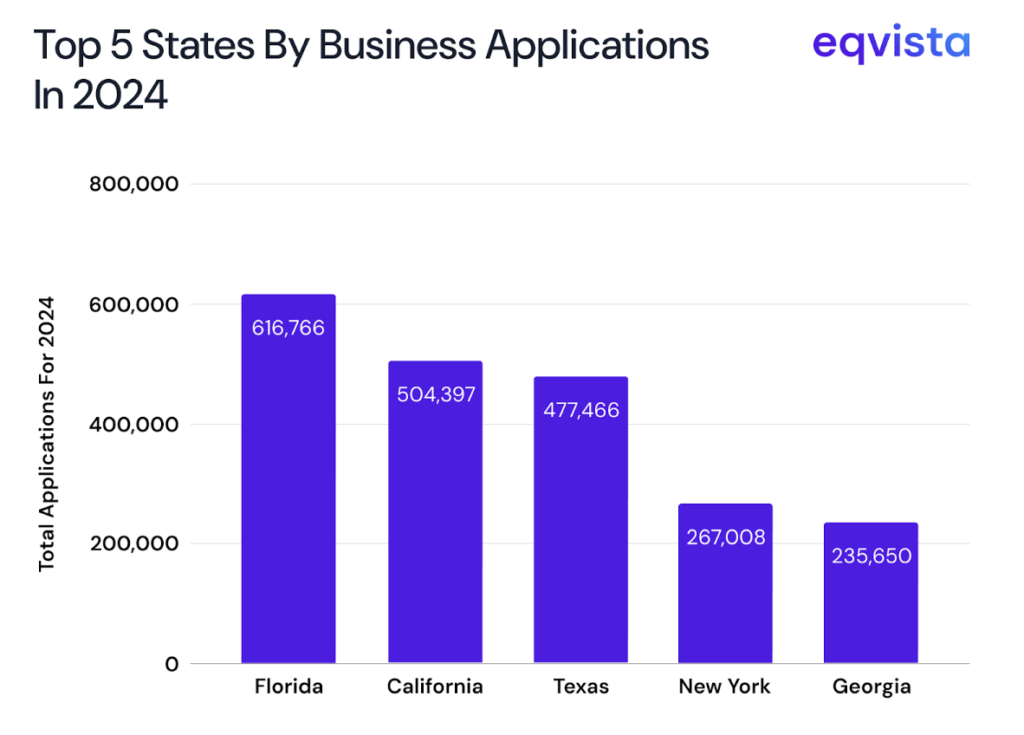

In this article, we will review the blue sky laws in states with the highest number of businesses formed in 2024 to help investors navigate these laws.

In the United States, in addition to federal laws, companies must ensure that their securities align with state-specific securities laws commonly referred to as blue sky laws.

The term ‘blue sky’ is a reference to a 1917 Supreme Court case where a judge described speculative schemes as having no more basis than arguing how many feet of blue sky exist. So, you can think of blue sky laws as state-specific laws meant to protect investors from fraudulent schemes or investment products.

The existence of blue sky laws adds another layer of protection for investors and creates a compliance consideration for entrepreneurs.

In this article, we will review the blue sky laws in states with the highest number of businesses formed in 2024 to help investors, as well as founders, navigate these laws.

Key takeaways

- Blue sky laws differ by state, with most states basing their rules on versions of the Uniform Securities Act of 1965, the Revised Uniform Securities Act (RUSA) of 1985, or the Uniform Securities Act of 2002.

- Common exemptions across these states include those for government-issued securities, financial institutions, highly regulated instruments like insurance contracts and publicly listed securities, public utilities, non-profits, commercial paper, and some employee benefit plans.

- Despite variation, the guiding principle remains consistent. Assume registration is required unless a clear exemption applies.

- Understanding these laws is crucial for businesses raising capital and investors navigating offerings across multiple states.

Purpose and scope of Blue Sky Laws

The purpose of blue sky laws is to protect investors from fraudulent or misleading securities offerings by ensuring transparency and accountability at the state level. These laws require issuers to register securities or qualify for exemptions, compelling them to disclose accurate and comprehensive information before soliciting investments.

By doing so, blue sky laws create a safeguard against deceptive practices, promote fair markets, and help maintain investor confidence.

While federal regulations set broad standards, state-level blue sky laws provide an additional layer of oversight tailored to local markets.

How Blue Sky Laws Vary by State

In response to the challenges created by contrasting securities laws across states, the US government has attempted to standardize securities laws on various occasions. As a result, in most states, blue sky laws are an iteration of three laws, which are the Uniform Securities Act of 1965, the Revised Uniform Securities Act (RUSA) of 1985, or the Uniform Securities Act of 2002.

So, let’s explore blue sky laws in the top 5 states by new business applications in 2024.

Florida’s Blue Sky Laws

In Florida, all securities must be registered before they can be sold or offered for sale in the state, unless an exemption applies or they are classified as federal covered securities. This registration process ensures that potential investors receive a prospectus meeting the state’s regulatory standards, providing transparency about the investment opportunity.

California’s Blue Sky Laws

California has strict securities regulations that make it unlawful to offer or sell any security in an issuer transaction within the state without proper qualification. The state also prohibits the offer or sale of any security in non-issuer transactions unless it is qualified under relevant chapters or exempted. The state’s fee structure includes $200 for filing an application for the sale of securities, plus additional charges based on the value of the securities up to a maximum of $2,500.

Texas’s Blue Sky Laws

Bonds issued for employment, industrial development, and affordable housing are exempt from state taxation and securities registration requirements in Texas. Hospital and health facility bonds are classified as exempt securities under the Securities Act, simplifying their issuance process. Financial institutions receive substantial exemptions in Texas.

New York’s Blue Sky Laws

In New York, no individual or entity can engage in a public offering and sale of securities without first filing a detailed offering prospectus with the New York Department of Law. Certain transactions where all parties and assets involved are located in the state, undivided whole bond and mortgage, and certain real estate offerings have exemptions.

Georgia’s Blue Sky Laws

Georgia streamlines the registration process for securities that already have federal registration under the Securities Act of 1933, allowing them to be registered in Georgia simultaneously through additional documentation. This coordination approach reduces duplicative efforts for issuers.

Common Blue Sky Law Exemptions Across States

While each state maintains its own blue sky laws, certain exemptions appear consistently across Florida, California, Texas, New York, and Georgia. Understanding the following common exemptions helps both issuers and investors navigate multi-state offerings more efficiently:

- Governments – Governmental entities consistently receive exemptions, including securities issued by the US government, states, political subdivisions, and certain foreign governments like Canada. In Georgia, this exemption is extended to governments with which the US maintains diplomatic relations.

- Financial institutions – Certain financial institutions, including savings banks, farm loan associations, and land banks, are exempt in most states mentioned in the article.

- Highly-regulated securities – Insurance-related securities and contracts receive exemptions since they are already heavily regulated by other government agencies. Similarly, publicly-listed securities receive exemptions because they are subject to the scrutiny of the Securities and Exchange Commission (SEC) and their respective exchanges.

- Public utilities and non-profits – To ensure that blue sky laws do not impede the development of critical services, securities issued by railroads, public utilities, and their holding companies also get exemptions. For similar reasons, exemptions are extended to non-profit organizations dedicated to charitable, educational, religious, or other socially beneficial purposes.

- Commercial paper – Commercial paper used in current transactions receives exemptions across most of these states.

- Employee benefits – In California and New York, employee benefit plans receive exemptions for two reasons. Firstly, they are an important source of financial security for the employees. Secondly, these plans are already heavily regulated at the federal level, leaving very little need for state-specific legislation.

Eqvista – Demystifying State Securities Compliance!

Understanding blue sky laws is essential for entrepreneurs raising capital and investors evaluating opportunities across state lines.

Florida, California, Texas, New York, and Georgia each maintain unique registration requirements and enforcement mechanisms. But common exemptions for governmental entities, financial institutions, non-profits, and listed securities provide some consistency.

The key takeaway is simple. Assume registration is required unless you can clearly demonstrate an exemption applies.

If you are experiencing difficulty in navigating multi-state offerings, consider consulting with Eqvista. Our team of in-house tax and equity experts can provide valuable guidance. Contact us to know more!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!