What does the SpaceX-xAI merger mean for ESOP-holders?

2026 is shaping up to be a blockbuster year for SpaceX. The recently announced merger with xAI values SpaceX’s pre-merger shares at 25% higher than December’s secondary market offering, and the current secondary market activity shows an additional 17.84% premium above the $1.25 trillion merger valuation. In just two months, SpaceX’s valuation has surged by 47.3%, setting the stage for what could be the world’s largest IPO in June 2026.

This rapid appreciation raises a critical question for ESOP-holders. Should they sell xAI shares or wait for the IPO?

That’s why, in this article, we will examine SpaceX’s valuation trajectory and what it means for employee shareholders navigating this pivotal moment.

SpaceX-xAI Merger in a Nutshell

- SpaceX was valued at $1 trillion, and xAI was valued at $250 billion

- xAI shareholders can receive 0.1433 SpaceX shares for each xAI share, and some can instead choose to receive $75.46 per share

- Merger doesn’t trigger the need to refinance xAI’s debt in the current high-interest-rate environment

- SpaceX remains insulated from xAI’s liabilities

- Premium on xAI’s bonds increased post-merger

- The companies have come together to develop orbital data centers (ODCs), which are speculated to be much more powerful, energy efficient, and cost-efficient than existing on-Earth data centers

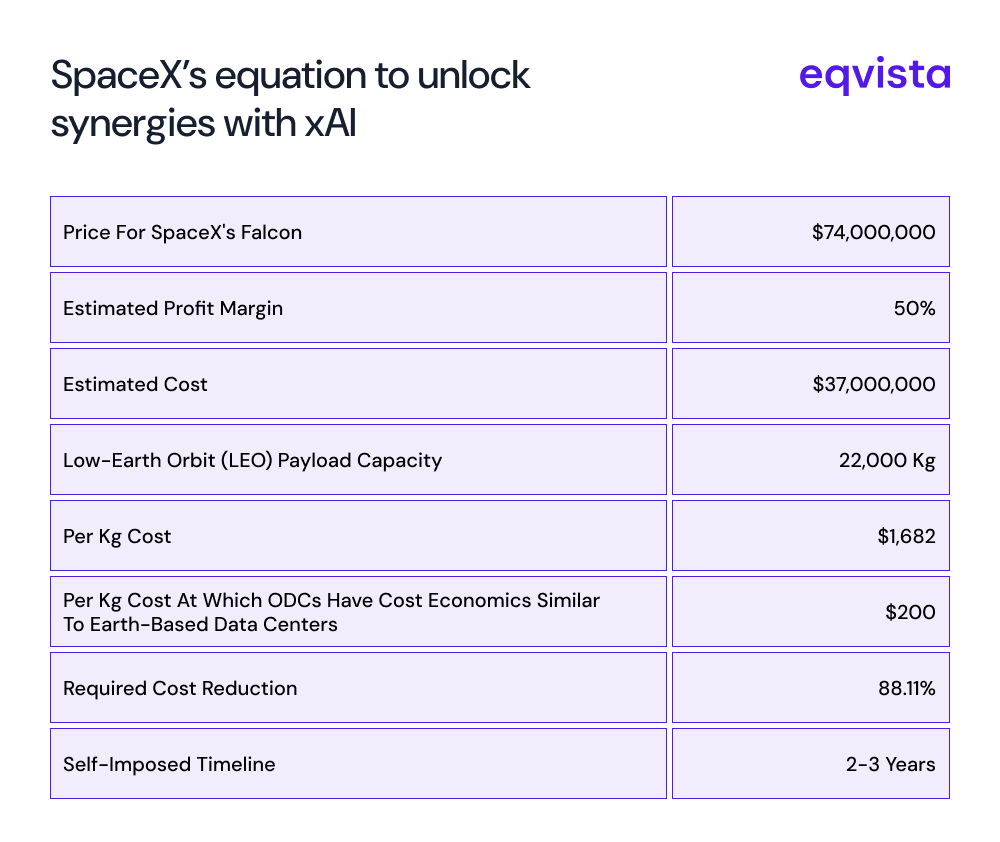

- SpaceX must reduce launch costs by an estimated 88.11% to realize its ODC vision

Understanding the SpaceX-xAI Merger Structure

The merger protects SpaceX’s financial position while unlocking potential synergies with xAI. Rather than combining operations into a single entity, xAI will operate as a wholly-owned subsidiary of SpaceX. The triangular merger structure, executed through two intermediary companies in Nevada, keeps SpaceX insulated from xAI’s debt obligations and legal liabilities.

Critically, because both companies were already controlled by Elon Musk before the merger, the transaction doesn’t qualify as a change-in-control event. This allowed xAI to avoid refinancing its debt in the current high-interest-rate environment. This is a significant advantage given that xAI inherited $12 billion in debt from X and took on at least another $5 billion since then.

That being said, the bondholders are not necessarily hard done by in this merger. They did miss an opportunity to earn a higher interest, but the premium on xAI’s bonds increased from 7% to 13.5%. This reflects an improvement in investor confidence in xAI, since the company is now supported by SpaceX, a larger and financially sound company.

From a valuation perspective, the merger itself doesn’t negatively impact SpaceX since xAI’s liabilities and exposures remain separate.

Dilution impact for SpaceX

The SpaceX-xAI merger is essentially a share swap. SpaceX issued new shares worth $250 billion to gain control of xAI. Let’s understand the dilution impact of these new shares.

Dilution = (New shares issued ÷ Total outstanding shares after new issue) × 100

= [(Share price × New shares issues) ÷ (Share price × Total outstanding shares after new issue)] × 100

= (Value of new share ÷ Post-merger valuation) × 100

= ($250 billion ÷ $1.25 trillion) × 100

= 20%

This simply means that each pre-merger SpaceX shareholder had their ownership percentage reduced by 20%. Let’s understand what this means with a few examples.

SpaceX-xAI merger dilution projections

| Pre-merger ownership percentage (A) | Reduction in ownership percentage (B = 20% of A) | Post-merger ownership percentage (C = A-B) |

|---|---|---|

| 100% | 20% | 80% |

| 80% | 16% | 64% |

| 60% | 12% | 48% |

| 40% | 8% | 32% |

| 10% | 2% | 8% |

| 5% | 1% | 4% |

| 1% | 0.20% | 0.80% |

Post-Merger SpaceX Valuation Analysis for ESOP Holders

The merger values SpaceX at $1 trillion and xAI at $250 billion, with each xAI share converting to 0.1433 SpaceX shares at prices of $75.46 and $526.59, respectively. The all-stock transaction structure and Musk’s control of both entities suggest valuations are fair rather than inflated to sweeten the deal.

SpaceX’s 2025 financial performance provides a solid foundation for these valuations. The company generated $15-16 billion in revenue and $8 billion in profit, indicating a healthy 50% profit margin. These results reportedly led bankers to estimate a possible IPO valuation of $1.5 trillion or more, and the possibility to raise $50 billion.

Assuming the current $1.25 trillion post-merger valuation is fair, and banking estimates for the pre-merger SpaceX entity were accurate, we can project an adjusted post-merger IPO valuation of approximately $1.75 trillion. This suggests potential share price growth of 40% by June. However, if banks were already aware of the merger when providing their estimates, the expected growth moderates to 16.67% ($1.25 trillion to $1.5 trillion).

The higher estimate comfortably exceeds the typical discounts for risks and lack of marketability, making it attractive for ESOP holders to wait for the IPO. However, we cannot say the same if the lower estimate represents reality.

For xAI shareholders with the option to receive $75.46 per share in cash instead of SpaceX stock, the analysis favors holding until IPO unless extraordinary personal circumstances exist.

The Orbital Data Center Opportunity

Musk has declared orbital data center (ODC) development as the primary merger rationale. He aims to position SpaceX such that it can capture the need for space infrastructure to keep up with AI’s computational needs.

The economics are compelling in theory. Solar panels in space generate 8 times the energy of Earth-based panels, with 24/7 generation possible due to orbital positioning. ODCs can employ radiative cooling to eliminate water consumption and environmental impact.

SpaceX estimates that it could eventually add 1 terawatt of AI compute capacity annually, which carries no operational or maintenance cost.

However, there are significant hurdles to this vision. Firstly, the equipment must withstand space radiation without Earth’s magnetic shield protection. Secondly, Google’s Project Suncatcher research suggests launch and operating costs will only become comparable to on-Earth data centers by the mid-2030s if the launch cost drops to $200 per kilogram for low-Earth orbit (LEO).

For SpaceX to realize Musk’s 2–3-year timeline for cost-competitive ODCs, the company must reduce its current Falcon 9 costs dramatically.

The Falcon 9 has a price of $74 million per launch, and at an estimated profit margin of 50%, we can estimate the launch cost as $37 million. This vehicle has a LEO payload capacity of 22,000 kg and thus, its per-kg cost is approximately $1,682.

Achieving $200 per kilogram requires an 88.11% cost reduction. This is an extremely aggressive target.

While technological breakthroughs shouldn’t be dismissed in light of SpaceX’s track record, ODC economics remain steep and largely seem unachievable. ESOP holders should view this as potential long-term upside rather than near-term value generation.

Eqvista – Navigate Complex Valuations with Confidence!

The SpaceX-xAI merger creates a compelling but complex situation for ESOP holders. The shares have appreciated 47.3% in two months, and a blockbuster IPO is approaching. This was possible because the triangular merger structure protects value while positioning SpaceX to capture the AI-in-space opportunity.

Near-term growth projections of 16-40% by June favor holding through the IPO for most shareholders. But ultimately, you must make a decision while also considering your personal liquidity needs and tax planning.

Accurate and timely valuations are essential for ESOP-holders who must navigate high-stakes decisions like in the case of SpaceX.Whether you need 409A valuations, fairness opinions for acquisitions, or strategic guidance on equity compensation decisions, Eqvista provides data-backed insights that empower confident decision-making.

Contact Eqvista today to ensure your equity valuation supports your financial objectives!