QSBS for Investors

Angel investors, venture capitalists, and family offices that frequently invest in high-growth businesses have an extraordinary tax-saving opportunity under Section 1202 of the IRC. Such investors can potentially exclude 100% of their gains from QSBS investments. However, as with any great opportunity, this one comes with its own challenges.

Since these tax benefits are meant to support small businesses, you must adhere to a holding period of 5 years. Additionally, only businesses with gross assets of up to $50 million can issue QSBS.

In this article, we will explore various other caveats of QSBS investments and how investors can fully leverage the potential tax benefits.

Why does QSBS matter for investors?

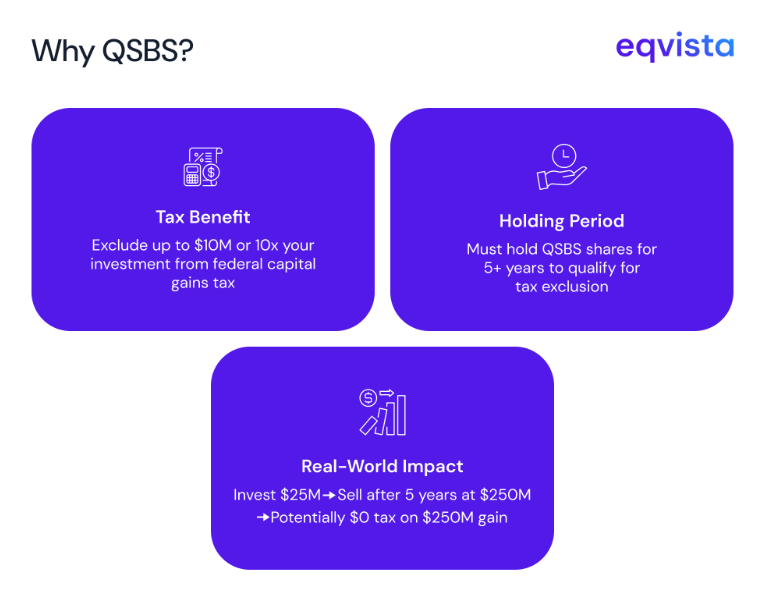

Under Section 1202, when you invest through the QSBS route, you can potentially exclude taxes on gains up to $10 million or 10 times the initial investment basis. The best part is that the greater of the two values is considered. The only catch is that you must hold your QSBS investments for at least five years to avail of these tax benefits.

Suppose that you were issued QSBS in exchange for an investment of $25 million. A little over five years later, the value of these shares reached $250 million. At this point, if you sold your stake, the entire proceeds of $250 million would not be subject to long-term capital gains tax.

This means if you invested $25 million (your basis), 10 times that is $250 million, which exceeds the $10 million minimum cap. Therefore, your potential exclusion can be up to $250 million of gains, assuming all other requirements are met.

Key Benefits for Investors

Here are some reasons why you should evaluate your investment targets for QSBS eligibility:

- 100% capital gains exclusion – Section 1202 allows investors to exclude capital gains up to 100%, provided the stock was acquired after September 27, 2010, and all other requirements are met.

- Exclusion limit – The exclusion amount in QSBS is limited to the greater of $10 million or 10 times the investor’s adjusted basis (initial investment).

- AMT exclusion – For any QSBS investments made after 27th September 2010 can qualify for alternative minimum tax (AMT) exclusion.

How can investors identify QSBS-eligible opportunities?

While looking for QSBS investment opportunities, you must be mindful of the following requirements:

Original Issuance

You cannot avail yourself of QSBS tax exclusion benefits from shares bought from founders, employee investors, or other investors. Only freshly-issued shares can qualify for QSBS treatment.

Qualified Small Business

Only businesses with gross assets worth up to $50 million that are engaged in qualified businesses can issue QSBS. Certain types of businesses that are excluded from QSBS treatment are as follows:

- Banking

- Insurance

- Financing

- Leasing

- Farming

- Hospitality

- A business where the skill or reputation of one or more employees is the principal asset

Active Business Requirement

Under Section 1202, an eligible corporation can issue QSBS only if 80% of its assets by value are engaged in a qualified business. Any domestic corporation except domestic international sales corporations (DISCs) or former DISCs, cooperatives, regulated investment companies or is an eligible corporation.

Five-Year Holding Period

You must hold your QSBS investments for at least five years to avail of the tax exclusion benefits.

Restrictions

Any gains exceeding $10 million or 10x the investment basis, whichever is greater, will be subject to taxation.

How Can Investors Build a QSBS-Optimized Portfolio?

To fully leverage QSBS provisions, you must take the following steps.

- Diversify across QSBS-eligible companies – QSBS investments are typically small businesses that may have a high growth potential but also carry a high risk. So, if you hold QSBS investments, you must diversify across sectors to protect against risks specific to a certain industry.

- Right balance between QSBS and non-QSBS investments – You must hold your QSBS investments for at least 5 years to avail of the tax benefits. So, you may need to diversify into more liquid assets. Also consider investing in stocks, bonds, and money market instruments.

- Family members should be included in QSBS planning – You can avail an additional tax exclusion of $10 million per beneficiary by gifting QSBS to non-grantor trusts meant for family members. So, to maximize your QSBS benefits, you must involve your family members in your tax planning.

How Do Investors Report QSBS Gains on Tax Returns?

Reporting QSBS gains on tax returns requires you to file various forms. It is mandatory to file Form 8949, Schedule D, and Form 1045. To identify which other forms must be filed, you can refer to the following table.

| Form | Instance |

|---|---|

| Form 1099-B | Your broker must file this form if they facilitated the sale. |

| Form 1099-CAP | You must file this form if you received cash, stocks, or other property due to a change in control or capital structure. |

| Schedule K-1 | You must file this form when you receive QSBS through a partnership or S-corporation. |

| Form 6251 | This form is used to determine AMT when the original investment was made before 27th September 2010. |

| Form 8960 | This form is used to declare the portion of the gain that is not eligible for QSBS treatment as part of net investment income. |

Under Section 1202, if your gains are under $10 million or 10x your QSBS investment, you can exclude your entire gains. Any gains exceeding the greater of these values would be subject to taxes.

Potential Pitfalls

Certain risks relating to QSBS that an investor must be aware of are as follows:

- Loss of QSBS Status – A business may lose its QSB status depending on its ownership of stocks and securities and real estate engaged in non-qualified businesses. To prevent such outcomes, you must communicate your needs to the founders and help them understand these restrictions.

- State Tax Treatment – Although most states offer tax benefits comparable to those provided at the federal level, California, Pennsylvania, New Jersey, Mississippi, Alabama, and Puerto Rico do not extend such benefits at the state level. Furthermore, Hawaii and Massachusetts only extend partial benefits.

- Legislative Risk – Rules regarding QSBS treatment may change due to legislative actions. This may mean changes in the asset value requirements, holding period, or any other key restrictions. As a result, you may lose the benefits you expected from QSBS provisions.

Frequently Asked Questions for QSBS Investors

Some queries relating to QSBS that investors often have are as follows.

What businesses do not qualify for QSBS?

Certain businesses, such as those whose principal asset is the reputation of one or more employees, banking, and hospitality, do not qualify for QSBS.

What is the 80% rule for QSBS?

To qualify for QSBS tax benefits, 80% of the business’s assets must be engaged in a qualified business.

How does QSBS rollover work?

Under Section 1045, by investing the proceeds of your QSBS investments into a new QSB, you can preserve the original holding period. This provision is valid as long as your original investment period was at least 6 months and the reinvestment was made within 60 days of the sale.

What are the industries that are not excluded from QSBS eligibility?

Manufacturing, Technology (including software development), Research and Development, Retail, Wholesale, Transportation, Educational Services and Telecommunications.

Eqvista- Empowering investors through tax savings!

Section 1202 of the IRC allows investors to make considerable tax savings by supporting small businesses crucial for the functioning and growth of the economy. However, you must abide by various requirements to actually avail these benefits. The two key requirements in the case of QSBS relate to the value of assets and the percentage of assets engaged in qualified businesses.

Eqvista can help you gauge whether you qualify for these benefits through QSBS attestations. Our accurate valuation reports determine if your invested company meets the necessary QSBS asset requirements. Contact us to learn more about our services!