What Is the Public Market Equivalent (PME)?

In this article, we will explore how PME can be calculated and interpreted using an example.

Public market equivalent (PME) is a method for evaluating the performance of private equity funds. Investments into public markets are comparable alternatives that investors pass up on to invest in private equity, a much riskier asset class. To understand whether this choice was worth the risk, investors must look at the opportunity cost through the PME framework.

This framework asks, ‘How much returns would I have generated if I simply invested in a comparable public market index?’

In this article, we will explore how PME can be calculated and interpreted using an example. Then, we will discuss some of its limitations and the solutions to these limitations.

How is PME Calculated?

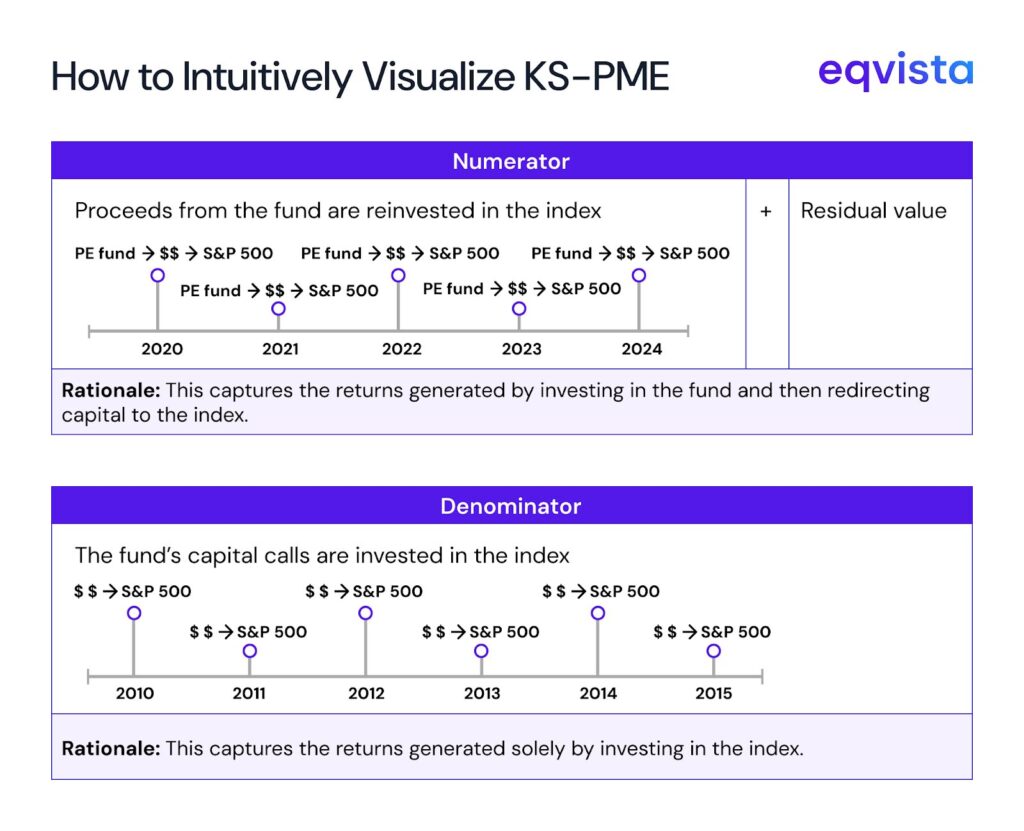

The Kaplar Schoar PME (KS-PME) methodology, a widely-used version of PME, takes a multiple-on-investment approach. This methodology is often represented by the following formula:

- KS-PME=Residual value + Sum of future values of distributions/Sum of future values of capital calls

Here, future values are calculated by multiplying each capital call and distribution by the respective index growth factor.

We can further simplify KS-PME into the following steps:

- Select a benchmark index.

- Calculate the number of units that could have been purchased if capital calls were actually investments into the index.

- Calculate the current value of such index units.

- Calculate the number of units that could have been purchased with the distributions on their respective dates.

- Calculate the current value of such index units.

- Divide the sum of residual value and current value of index units purchased with distributions by the current value of index units purchased with capital calls.

KS-PME is the multiple by which the private equity fund outperforms the benchmark index. For instance, if a fund’s KS-PME was 1.5, then the investors made 50% more money by investing in the fund instead of the index.

Let us explore this methodology with an example. Suppose a private equity fund’s capital calls and distributions are as follows:

| Capital calls | Distributions | ||

|---|---|---|---|

| Date | Amount | Date | Amount |

| September 30th, 2015 | $80 million | October 30th, 2023 | $428 million |

| March 30th, 2016 | $120 million | October 30th, 2024 | $642 million |

| September 30th, 2016 | $240 million | April 30th, 2025 | $1,284 million |

| March 30th, 2017 | $160 million |

We will assume that the fund’s residual value is $100 million.

The private equity fund would amass the following number of units if it invested the capital calls into the S&P 500:

| Date | Amount | Price | Units |

|---|---|---|---|

| September 30th, 2015 | $80,000,000 | 1,920.03 | 41,666.02 |

| March 30th, 2016 | $120,000,000 | 2,063.95 | 58,140.94 |

| September 30th, 2016 | $240,000,000 | 2,168.27 | 110,687.32 |

| March 30th, 2017 | $160,000,000 | 2,368.06 | 67,565.86 |

| Total units bought with capital calls | 278,060.14 |

Similarly, we can calculate the number of index units that can be bought by directly investing the fund’s distributions.

| Date | Amount | Price | Units |

|---|---|---|---|

| October 30th, 2023 | $428,000,000 | 4,166.82 | 102,716.22 |

| October 30th, 2024 | $642,000,000 | 5,813.67 | 110,429.38 |

| April 30th, 2025 | $1,284,000,000 | 5,569.06 | 230,559.56 |

| Total units bought with distributions | 443,705.16 |

At the time of writing (October 16th, 2025), the S&P 500 closed at $6,629.07. So, the KS-PME in this case can be calculated as:

- KS-PME=$100,000,000+ $6,629.07 × 443,705.16/278,060.14×$6,629.07≅$3,041,352,565$1,843,280,132.27≅1.65

So, this private equity fund outperformed the S&P 500 by a factor of 1.65.

What Are the Limitations of PME?

The four key limitations seen in all versions of PME are as follows:

High Dependence on Index Selection

The calculated PME can vary greatly depending on which index is used as a benchmark. To overstate the fund’s performance, a fund manager can choose an index wherein the growth from distribution dates to the current date is greater than that from capital call dates to the current date.

Chances of such manipulation are greater when the benchmark index has been trading at similar levels for an extended period.

Also, fund managers can choose the most favorable benchmark if there’s no standard choice.

Solution: Evaluate PME in conjunction with absolute returns and TVPI, and cross-check against multiple benchmark indices.

No Adjustment for Risk or Leverage

Private equity investments are much riskier than public market investments and may sometimes be made using borrowed funds for greater leverage. Additionally, this asset class is extremely illiquid, which makes exits uncertain. Most PME variants do not account for these factors and focus only on raw returns.

Solution: Complement PME with risk-adjusted metrics such as the Sharpe ratio.

Not Directly Comparable Across Funds

PME values are highly dependent on cash flow timing. Even if two funds operate on the same investment strategy, they may not have comparable cash flow timings. Capital call timing may depend greatly on the fund manager’s reputation. Similarly, the fund manager’s negotiation skills, ability to anticipate liquidity trends, and network depth can influence distribution timings. Thus, PME values cannot always be comparable across funds.

Solution: Compare funds with similar vintages and investment horizons so that, at the very least, liquidity conditions and investor appetite remain common for all funds being considered.

Potential Misinterpretation

In this article, we explore PME from a multiple-on-investment perspective. But, PME can also be calculated on an IRR basis. Investors unfamiliar with the distinction may misread the results. For example, a KS-PME of 1.3 means 30% higher terminal wealth versus the index, not 30% higher annualized returns.

Solution: Always check the PME basis (IRR or multiple) and verify its interpretation with the fund manager.

Eqvista – Accurate Insights for Informed Decisions!

The Public Market Equivalent (PME) helps investors gauge whether a private equity fund truly outperformed public markets. While insightful, PME works best when paired with other performance metrics that account for risk, leverage, and liquidity. To gain a comprehensive, data-driven view of your portfolio’s true performance, explore Eqvista’s professional portfolio valuation services today. Click here to contact us!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!