Pros and Cons of Pay to Play in Venture Capital

A pay-to-play clause in a venture capital term sheet mandates that current investors participate in any upcoming funding rounds. This will specify a company’s valuation reset (often at a significantly lower value) and require each participating venture capitalist to invest pro rata. This article highlights the alternative structures of pay-to-play, the pros and cons of pay-to-play provision, and the outcome of pay-to-play provision.

What is pay-to-play in venture capital?

Pay-to-play in venture capital is often discussed when things are catastrophic. These rules are becoming more prevalent as business entrepreneurs look for more funding. A typical pay-to-play strategy is to persuade existing investors to convert some or all of their prior investment into common shares or a newly created class of preferred shares with lower economic entitlements to retaliate against them for not taking up their pro rata share of a new financing round.

How does pay-to-play work?

Pay-to-play clauses aim to encourage investors to take part in upcoming financings strongly. Unless they invest proportionately in the following funding rounds, these clauses threaten to strip current investors of part or all of their preferential rights, such as anti-dilution protection, liquidation privileges, or specific voting rights.

Tough Times, Inc. is looking to raise more capital. It has raised earlier rounds of funding over the past three years at extremely favorable terms and values, generates double-digit revenue, and was anticipating a fantastic 2020 before the COVID-19 outbreak. Then, in March 2020, things began to go wrong for Tough Times. Some clients canceled, other prospects refused to sign contracts, their revenue projection had to be modified, some employees were forced to go, and pay had to be cut. Now, Tough Times needs an injection to keep alive. Hence they adopted a pay-to-play strategy. Then, Opportunity Ventures sent them a term sheet.

The outcome of pay-to-play provision

These clauses can also resolve financial problems, allowing the business to continue forward with a clear capitalization table and increase its chances of success. Pay-to-play provisions in venture capital can have both negative and positive outcomes.

On the negative side, these provisions can strain relationships between investors, especially when one party is unwilling or unable to contribute more funds. This tension can lead to conflicts in the boardroom and potentially harm business relationships or even the company itself.

On the positive side, pay-to-play provisions do serve a purpose by providing assurance of funding for the company in need. They can also help clean up funding issues, ensuring a cleaner capitalization table for the company’s success. In general, it’s advisable to use pay-to-play provisions sparingly and only when necessary to avoid potential negative consequences.

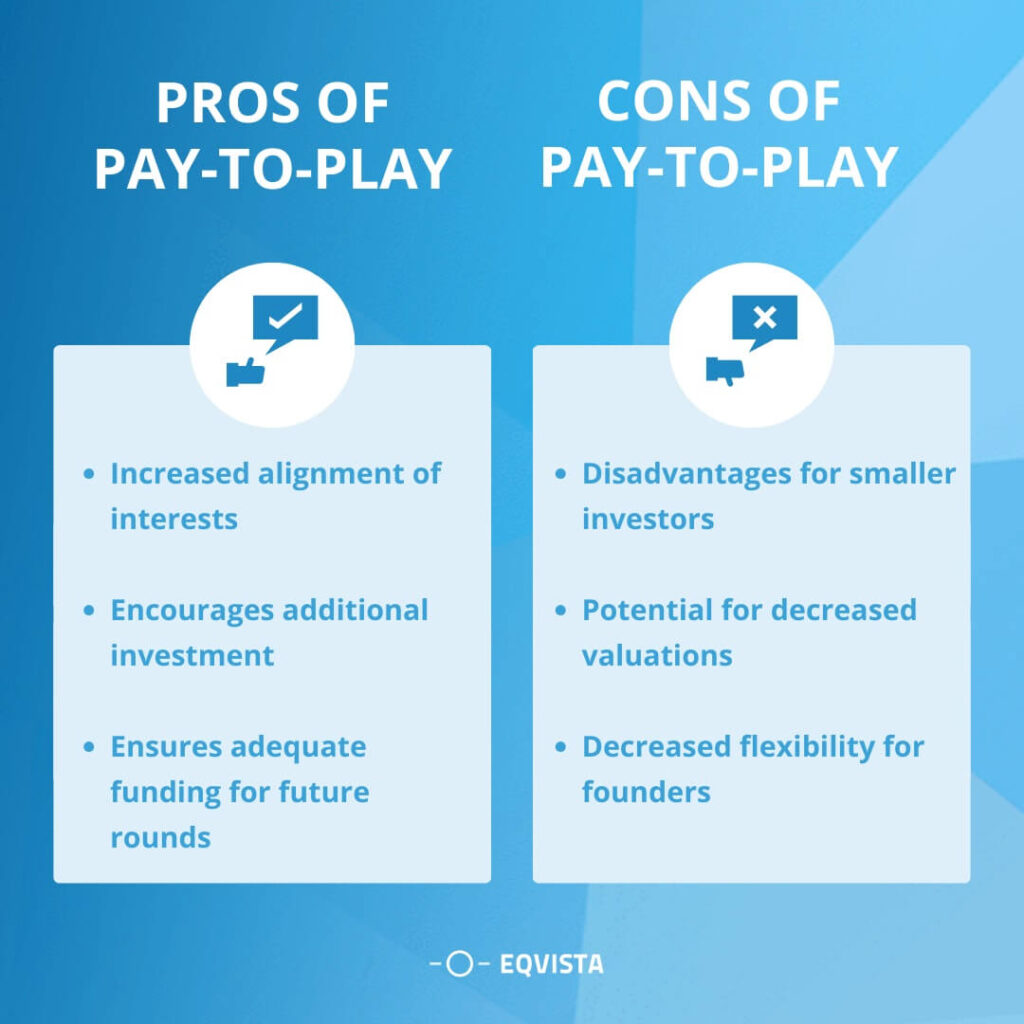

Pros of Pay-to-Play

There is little certainty when considering whether to incorporate a pay-to-play clause for possible investors because it all relies on the specifics of the firm seeking finance. It offers various advantages which are listed as follows.

- Increased alignment of interests – In venture capital, a pay-to-play agreement is one in which all participants stand to gain from a single outcome.

- Encourages additional investment – A pay-to-play clause commits investors to take part equally in subsequent investment rounds. If the investor decides not to take part in this way, their stock will be adjusted into ordinary or shadow-preferred stock. These investors often also give up any preferential rights they may have previously acquired, such as anti-dilution safeguards or unique voting privileges. As a result, the pay-to-play clause expressly encourages investors to stick to their commitment to participate in such future funding to avoid such unfavorable outcomes. Thus pay- to -play in venture capital encourages additional investment.

- Ensures adequate funding for future rounds – The goal of this investment approach is to incentivize investors and ensure that at least some of the pay-to-play investors would take part in future financings when necessary.

Cons of Pay-to-Play

The pay-to-play clause offers a number of benefits and drawbacks, just like other potential stock options. The cons are as follows

- Disadvantages for smaller investors – Naturally, this provision does not excite or inspire confidence in small investors, given that it effectively coerces investors into agreeing to participate in future fundraising efforts, which frequently happens because the company is experiencing financial difficulty or even taking a down round. Some circumstances could considerably restrict the pay-to-play provision, but it remains a dangerous investment from the perspective of any small investor.

- Potential for decreased valuations – The mere suggestion of the intention to incorporate this clause may dissuade otherwise interested investors from making a first investment. The investors might attempt to reduce their losses and sell their remaining stakes at even lower prices, thus decreasing the company’s value and undermining the pay-to-play clause’s goal and advantage.

- Decreased flexibility for founders – Founders should concentrate on a number of challenges. They must first realize that pay-to-play clauses are not normally included in a Series A term sheet. They must bring this up and properly debate it with the investors. The founders of a company are the people who have contributed to the startup’s success. They will experience it as an affront. They might need more resources to participate in the pay-to-play, but they have a longer history with the firm than new investors.

Overview of Real-life examples of pay-to-play in venture capital

The pay-to-play strategy of Tough Times Inc. was executed as follows;

- All outstanding preferred stock was exchanged at a 1:1 ratio for common shares.

- Following the imposed conversion, opportunity ventures suggest that they will set up a preferred stock fundraising at a value that is around 25% lower than the previous deal.

- The firm will conduct a rights offering, in which any preferred stock that has recently been converted to common stock will be offered the option to participate in the financing managed by option ventures.

- Opportunity Ventures will backstop the rights sales by paying the pro rata investment of any previous investors.

- To compensate for the dilution and maintain their incentive, certain members of management will receive stock in the form of options following the financing’s closure at the revised post-closing 409A price.

- There will be a reprice for all active options.

Positive and negative outcomes of each example

- Although venture financing will flow, the conditions could shift.

- Founders should rely on board members, and investor board members should seek advice when making choices since there are certain significant corporate governance elements to these financings that require special attention.

- Many VC funds have just obtained fresh cash, and since they are in the business of investing, they must use that money.

- Strong and seasoned firms will be less stringent with their criteria than newer, less experienced funds.

- Deals could take longer to complete because investors might adopt a wait-and-see attitude at critical turning moments, such as the end of a quarter.

Alternative Structures of pay-to-play

Expecting angel and certain non-lead investors, especially strategic investors, to participate in future funding rounds could be unreasonable. Hence, alternative structures of pay-to-play arrangements should be considered.

Companies should adopt a procedure that assists in limiting the possibility of adverse claims by opposing minority shareholders when considering and implementing any pay-to-play transaction (especially when the proposed transaction is not provided for in the company’s governance papers and share terms). This obstacle could be handled by utilizing different pay-to-play mechanisms such as ;

- Weighted average anti-dilution protection – It is an anti-dilution mechanism that ensures investors are not punished when corporations issue new shares. The new weighted average price for the old shares is solely based on the total number of outstanding preferred shares. Usually, the narrow-based weighted average excludes options, warrants, and shares that are issuable as a component of stock incentive pools. As additional shares are issued, and valuations rise, the weighted average could be included in the agreed conditions for a company’s following fundraising rounds.

- Ratchet anti-dilution protection – A ratchet is a clause that allows the venture capitalist who purchased the startup’s shares earlier with the ratchet protection to get a price adjustment to the lower price if another venture capitalist later pays a lower price for those shares.

- Full ratchet anti-dilution protection – A full ratchet is an anti-dilution provision that uses the lowest available selling price as the modified option price or conversion ratio for existing shareholders. It safeguards early investors by ensuring they receive compensation for any ownership dilution brought on by subsequent funding rounds. Full ratchet clauses may be expensive for entrepreneurs and impede their ability to acquire money in the next funding rounds.

Get a valuation from Eqvista!

Every successful startup firm needs venture capital to survive. How a company collaborates with VCs and forges a positive connection will establish its standing as a professional in the field. Documentation is one of the most critical parts of this. Startups should ensure all guiding papers are in place, especially those dealing with stock management. Eqvista is a pathfinder in this field. The experienced team at Eqvista is proficient at all of these tasks, starting with business incorporation and moving on through company valuation, issuing shares, and cap table administration. Contact us right now for further details. Sign up to stay updated!