Non Qualified and Qualified Deferred Compensation Plans (With Case Studies)

Let’s imagine you’re at a point in your career where you’re earning more than enough to cover your current expenses, and you start thinking about the future. How can you make your money work for you, especially when it comes to retirement? Deferred compensation could be the key. It’s like allowing you to delay receiving part of your income until later, like retirement.

Understanding the differences between the deferred compensation- qualified and non-qualified– is essential whether aiming for tax-efficient savings or seeking flexibility in retirement planning. Let’s discuss how to set up a non-qualified compensation plan. Or even how to set up a qualified compensation plan.

Non-qualified and qualified deferred compensation plan

Before deciding on the plan you need, you must know both qualified and non-qualified deferred compensation and their types. This section will deal with all of that in detail.

What is a non-qualified deferred compensation plan?

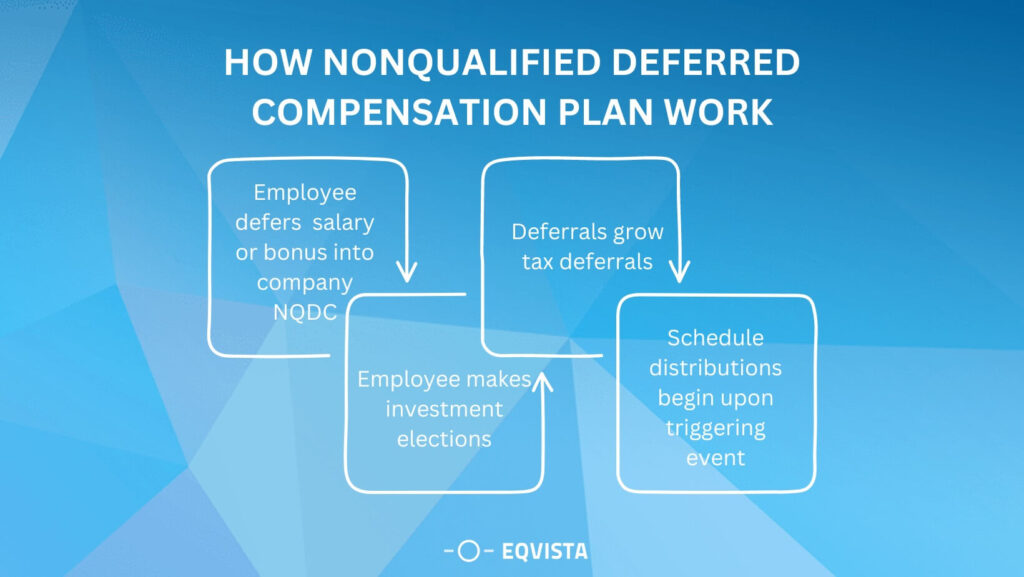

A non-qualified deferred compensation plan (NQDC) allows employees, especially those in high-earning positions, to defer a portion of their income to a future date beyond the current tax year. This deferral can include salaries, bonuses, and other forms of compensation.

NQDCs are not bound by contribution limits or the same strict regulations set by the Employee Retirement Income Security Act (ERISA), offering flexibility regarding how much and when to defer income. These highly flexible, allow deferred compensation tailored to individual financial goals and tax strategies.

These highly flexible plans allow deferred compensation tailored to individual financial goals and tax planning strategies. For example, employees might defer some of their income until retirement, potentially reducing their taxable income in high-earning years and managing taxes more efficiently.

Types of non-qualified deferred compensation plans

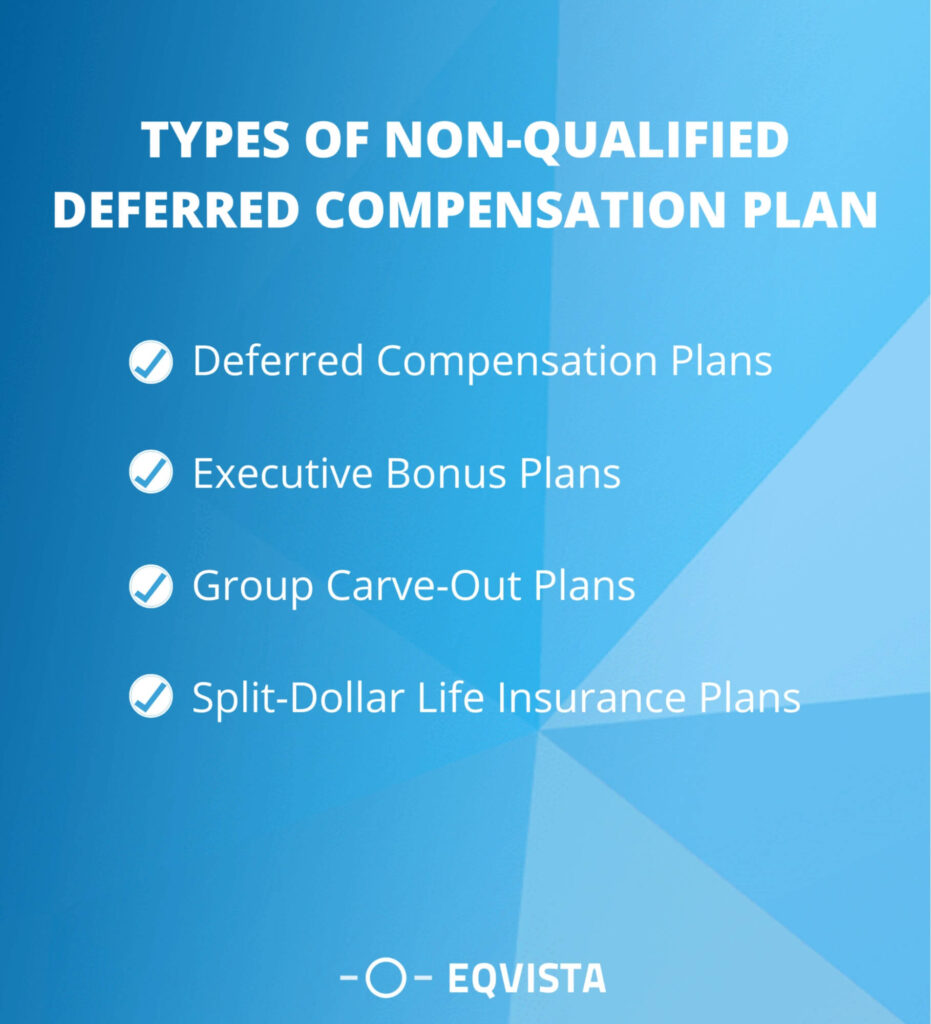

Non-qualified deferred compensation plans (NQDC) are versatile tools employers use to reward and retain key employees. Here’s a breakdown of the four major types of non-qualified compensation:

- Deferred Compensation Plans: These plans let employees defer a portion of their income to a future date, typically retirement, allowing them to benefit from a lower tax bracket later in life. It can include both true deferred compensation and salary-continuation, where the former defers salary earned to a future period, and the latter continues to pay a portion of the salary during retirement.

- Executive Bonus Plans: Under these, employers provide select executives with additional benefits, most commonly life insurance policies, with premiums paid by the employer. This additional compensation is tax-deductible for the employer and adds to the employee’s taxable income, although they can defer taxes until a more advantageous time.

- Group Carve-Out Plans: These are specialized life insurance arrangements where an employer replaces a key executive’s group life insurance with an individual policy. It helps the employee avoid the higher costs associated with the group, offering a more tailored benefit.

- Split-Dollar Life Insurance Plans: In this arrangement, an employer purchases a life insurance policy for an employee, and both parties share the policy’s ownership. It’s a less regulated form of compensation and can be customized based on the employer and employee contract.

Advantages and disadvantages of non qualified deferred compensation plan

Non-qualified deferred compensation plans (NQDCs) offer a mix of advantages and disadvantages, making them an attractive yet complex tool for compensation strategies, particularly for highly compensated employees and executives in the U.S. Let’s explore these aspects in simpler terms.

| Advantages | Disadvantages |

|---|---|

| Tax Deferral: NQDC plans allow deferred compensation taxes until distribution, potentially reducing the immediate tax burden and future tax bracket. | Credit Risk: Deferred compensation is at risk if the employer faces financial issues, as ERISA does not protect it. |

| No Contribution Limits: Unlike qualified plans, NQDC have no IRS-imposed contribution limits, benefiting high earners seeking additional retirement savings avenues. | Lack of Early Access: Accessing funds before the distribution date can result in penalties, limiting flexibility for unforeseen financial needs. |

| Customizable Plans: These plans offer customization to align with specific financial goals and needs, including deferred amount, duration, and payout conditions. | Complexity and Costs: NQDC require complex administration and incur setup and management costs that employers must consider. |

| Enhanced Retirement Savings: Provides an avenue for additional retirement savings for those who have maximized contributions to qualified plans, helping to meet retirement income goals. | Taxation Upon Vesting: The IRS may tax-deferred amounts when they vest, potentially impacting deferral strategies and timing. |

What is a qualified deferred compensation plan?

A qualified deferred compensation is a type of retirement plan that meets the requirements of the Employee Retirement Income Security Act (ERISA) and the Internal Revenue Code. These offer tax benefits to employers and employees, such as tax-deferred growth on investments within the plan until withdrawal, and employee contributions are typically pre-tax, reducing their taxable income.

The IRS sets annual limits on how much can go to these from employees and employers. These limits ensure that the tax-advantaged savings are used primarily for retirement purposes.

Types of Qualified Compensation Plans

Qualified deferred compensation are essential retirement savings tools, offering employees tax benefits and financial security. Here’s a brief overview of the different types of qualified compensation plans:

- 401(k) Plans: These are some of employers’ most common retirement savings. Employees can contribute a portion of their salary on a pre-tax basis, which lowers their taxable income. Many employers also match a portion of the employee’s contributions, further boosting the savings. Funds grow tax-deferred until withdrawn in retirement.

- 403(b) Plans: Similar to 401(k) plans, but specifically designed for employees of public schools, certain non-profit organizations, and churches. These also allow employees to save pre-tax, with contributions and earnings growing tax-deferred until withdrawal.

- Pension Plans: Also known as defined benefit, these provide employees with a guaranteed payout at retirement. The payout usually relies on years of service and salary history. The employer primarily funds pensions, and the benefits are predetermined, offering a stable income in retirement.

- Employee Stock Ownership Plans (ESOPs): These give employees ownership interest in the company through stocks. ESOPs are often used as a corporate finance strategy and also to align the interests of employees and shareholders. The benefits for employees depend on the performance of the company’s stock.

Advantages and disadvantages of qualified deferred compensation plan

Qualified deferred compensation plans, like 401(k)s and pensions, offer a structured way to save for retirement with various tax advantages. However, they come with benefits and constraints that can impact financial planning.

| Advantages | Disadvantages |

|---|---|

| Tax Benefits: Pre-tax contributions lower taxable income, offering immediate tax savings and potentially reducing overall tax liability. | Contribution Limits: IRS-imposed annual limits may restrict desired retirement savings. |

| Employer Match: Employers often match contributions, enhancing retirement savings | Early Withdrawal Penalties: Taxes and withdrawal penalties before age 59½ limit emergency fund access. |

| Tax-Deferred Growth: Earnings grow tax-deferred, postponing taxes on investment gains until withdrawal. | Required Minimum Distributions (RMDs): Mandatory distributions starting at age 72 could increase taxable income in retirement. |

| Legal Protections: ERISA protects from creditors and legal judgments. | Investment Risk: Exposure to market risk with potential impacts on retirement savings. |

| Diverse Investment Options: Offers various investment choices to suit different risk tolerances and goals. | Complexity and Fees: Account management complexity and potentially high fees can reduce investment returns. |

Case study for Qualified Deferred Compensation Plan

Case Study: Mid-Sized Manufacturer’s Deferred Compensation Implementation

Alzo Inc., a 200-employee company, faced the challenge of securing its aging workforce’s financial future. In response, the company implemented a Supplemental Employee Retirement Plan (SERP). SERPs are often used with existing retirement plans like 401(k)s to provide a comprehensive retirement benefit package.

This case study explores the strategic deployment of the SERP over five years, showcasing how Alzo Inc. addressed the dual objectives of employee well-being and organizational competitiveness.

Details:

- Eligible employees: All employees within 10 years of retirement age (55 and above).

- Employer contribution: 5% of eligible employees’ salaries, capped at $10,000 annually.

- Investment options: A conservative portfolio focused on income generation and capital preservation.

- Distribution schedule: Paid out as a monthly annuity upon retirement.

- Tax benefits: Employees pay income tax on the annuity income, but employer contributions are tax-deductible for the company.

- Employee benefits: Enhanced retirement savings, increased sense of security and loyalty, the potential to attract and retain older workers.

- Company benefits: Improved employee morale and engagement, reduced risk of future pension liabilities, competitive edge in attracting talent.

Results:

- Employee participation: 90% of eligible employees enrolled in the plan.

- Increased retirement savings: Average retirement account balance for eligible employees increased by 20% in 5 years.

- Improved employee engagement: Employee satisfaction surveys showed increased confidence in the company’s commitment to their long-term well-being.

- Enhanced recruitment: Alzo Inc. attracted skilled older workers seeking secure retirement benefits.

Numbers:

- Total employer contribution in Year 1: $100,000 ($10,000 x 10 eligible employees).

- Estimated tax savings for Alzo Inc.: $30,000 (30% corporate tax rate).

- Increased average retirement savings per employee in 5 years: $12,500.

Case study for Non-Qualified Deferred Compensation Plan

Alzo Inc., a $200 million company, offers a non-qualified deferred compensation (NQDC) plan to retain Sarah, a key software engineer earning $150,000 annually. This case study explores this plan’s potential benefits and considerations for Sarah and Alzo Inc.

- Deferral: Sarah chooses to defer 10% of her salary, which translates to $15,000 annually, up to a maximum deferral of $50,000.

- Investment options: Sarah selects a balanced mutual fund with an average annual annual return of 7%.

- Distribution: Sarah can access the deferred funds upon retirement at age 65 or if she leaves the company involuntarily (e.g., layoffs).

Benefits for Sarah:

- Tax savings: $3,750 annually (assuming a 25% tax bracket in retirement).

- Potential investment growth: $234,000 in 10 years (excluding taxes and additional contributions).

Benefits for Alzo Inc.:

- Retention tool: The NQDC plan incentivizes Nara to stay for at least 10 years to access the full deferred amount and potential investment growth.

- Cost-effective: Alzo Inc. doesn’t need to fund the deferred amount, offering some financial flexibility immediately.

Considerations:

- Company risk: Nara may not receive the full amount if Alzo faces financial difficulties.

- Market risk: actual investment return may differ from the historical average.

- Tax implications: Nara will pay taxes on the entire amount upon distribution, potentially at a 25% tax rate.

Key difference between qualified and non-qualified deferred compensation plans

Qualified deferred compensation plans come with broad employee eligibility in mind and certain protections and limits to ensure retirement readiness for a wide workforce. In contrast, non-qualified offer more flexibility and are often used to attract and retain key talent, albeit with fewer protections under federal law.

Both types of plans can be crucial components of a comprehensive retirement strategy, but they serve different purposes and are under different sets of rules. Here’s a simple table summarizing the key differences between qualified and non-qualified deferred compensation:

| Feature | Qualified Plans | Non-Qualified Plans |

|---|---|---|

| Tax Regulations | Subject to ERISA guidelines and IRS rules | Not subject to ERISA guidelines |

| Eligibility | Available to all employees | Typically offered to executives and high-earning employees |

| Contribution Limits | Yes, limits set annually by the IRS | No, allows for greater flexibility in contribution amounts |

| Tax Benefits | Contributions are tax-deductible, earnings grow tax-deferred | Taxes on contributions are deferred, earnings grow tax-deferred |

| Withdrawal Penalties | Penalties for early withdrawal before age 59½ | Specific plan rules apply, generally more flexible |

| Protection from Creditors | Protected under ERISA | Not protected under ERISA, subject to employer's credit risk |

| Investment Risk | Borne by the employee | Borne by the employer or employee, depending on the plan |

| Reporting Requirements | Stringent reporting and disclosure requirements | Less stringent reporting requirements |

What are the tax implications of qualified deferred compensation plans?

Qualified deferred compensation plans, such as 401(k)s and pension plans, come with specific tax implications crucial for retirement planning. Understanding these can help you make informed decisions about saving for your future.

- Tax Deferral: Contributions to these plans are typically made with pre-tax dollars, meaning the money you put into the plan is deducted from your taxable income for the year you contribute. This can lower your income tax bill by reducing the income subject to taxation.

- Tax-Deferred Growth: The money in your retirement plan grows tax-free until you withdraw it. Any interest, dividends, or capital gains your investments earn do not get taxed as long as they remain in the account. This tax-deferred growth can significantly increase the size of your retirement fund over time.

- Taxation upon Withdrawal: When you start taking distributions from your qualified plan in retirement, those distributions are treated as ordinary income and subject to income taxes at your current tax rate. If you withdraw funds before reaching age 59½, you may also face a 10% early withdrawal penalty, although there are exceptions to this rule.

- Required Minimum Distributions (RMDs): Once you reach age 72, you must start taking minimum distributions from your qualified retirement accounts each year based on a formula that considers your account balance and life expectancy. RMDs are also subject to ordinary income taxes.

- State Tax Considerations: While the federal tax advantages of qualified plans are consistent across the U.S., state tax treatment of retirement plan contributions and distributions can vary. Some states offer tax deductions or credits for contributions, and taxation of distributions in retirement can also differ.

What are the tax implications of non-qualified deferred compensation plans?

Now, let’s look at a few tax implications of non-qualified deferred compensation plans.

- Tax Deferral: In non-qualified deferred compensation plans, you can postpone receiving part of your income until a future date, typically retirement. This deferral means you don’t pay income taxes on this portion of your income until you receive it. High earners often use it to manage their tax liabilities effectively by deferring income — and its taxation — to years when their tax rates may be lower.

- Taxation upon Receipt: When you finally receive distributions from your non-qualified deferred compensation plan, this income is subject to federal (and possibly state) income taxes at your current tax rate. Since these distributions are considered ordinary income, they could significantly increase your taxable income in the years you receive them.

- Social Security and Medicare Taxes: Unlike income taxes, FICA taxes (which fund Social Security and Medicare) are typically due in the year the compensation is deferred, not when it’s paid out. This means that even though you’re deferring income to a future date for income tax purposes, you’re still responsible for paying Social Security and Medicare taxes on this income as you earn it.

- No Contribution Limits: One of the notable features of non-qualified deferred compensation plans is the absence of contribution limits. This lack of limits allows participants to defer large amounts of their income, a feature particularly beneficial for high earners looking to minimize their taxable income.

- No ERISA Protection: Non-qualified deferred compensation do not come with the protections afforded to qualify for the Employee Retirement Income Security Act (ERISA). This means that deferred amounts could be at risk if the employer faces financial difficulties, as these assets may not be protected from creditors in bankruptcy situations.

Optimize Your Compensation Strategies With Eqvista!

Both non-qualified and qualified deferred compensation plans offer unique advantages and considerations. The choice between them depends on individual financial goals, tax situations, and the specific benefits an employer offers.

With expertise in equity management and financial planning, Eqvista helps businesses and individuals optimize compensation strategies in alignment with evolving regulations. Our services extend beyond traditional offerings, incorporating cutting-edge technology and personalized consulting to address each client’s unique needs.

Whether you’re looking to manage equity for a startup or seeking advanced strategies for deferred compensation, Eqvista offers the tools and insights necessary to make informed decisions. Discover how Eqvista can enhance your financial planning by visiting our website or calling us to explore our services!