KISS or Keep It Simple Security Convertible Note Calculator

Have your company up and running but still need some capital to support and grow it? Don’t want to offer equity for the funding you raise? In this case, you can make use of convertible security instruments such as a KISS convertible note, otherwise known as a Keep It Simple Security.

Not sure what a KISS is and how can it help you? Keep reading to find out all about the KISS convertible notes.

What is a KISS or Keep It Simple Security?

During July 2014, 500Startups announced the birth of the KISS convertible note, which is an alternative investment vehicle to a SAFE instrument. It contains a lot of similarities with SAFE convertible notes. Its purpose is to allow startup companies to get financing within a short time and at a low cost while they avoid the long process of negotiations when creating a grant agreement by an investor.

In short, to keep convertible equity financings simple and quick, 500Startups created the KISS note template. The KISS convertible note is a short and sweet “open source” document that was drafted after discussions with many Silicon Valley law firms and early-stage investors. This KISS note template has been created to be flexible without being overly customizable. It’s simple while still including all of the necessary features that are both balanced from the investor’s and company’s standpoint.

Basic Concepts of KISS

Unlike SAFEs, a KISS is more like a convertible note and is very similar to the classical model of a convertible note. In short, it accrues interest at a rate of 5% and has a maturity date of 18 months after which the investor can convert the underlying investment amount along with the interest into a newly created series of preferred stock of the company. Moreover, unlike a SAFE, the KISS convertible note has an MFN clause. This lets the investor get better securities in the future if issued by the company.

KISS investors normally invest in a company in its early stages. And at this time, there is a huge amount of risk as the company hasn’t taken off yet and there is no way to know if the company will be successful or not. That is where the MFN term helps out. It offers downside protection in the event where the company does a “down round” or otherwise offers more favorable terms to the other investors in the future.

Basically, a KISS converts when the company raises at least $1 million in equity financing. The automatic conversion to preferred stock takes place when the company raises a qualifying priced round. The discount or valuation cap would have to be negotiated on a deal-by-deal basis. As mentioned above as well, a KISS convertible note has an 18-month maturity date, so if at least 1M equity financing does not take place by the maturity date, the KISS holder can easily elect to convert at the valuation cap by majority vote.

In fact, most investors are offered rights including financial information rights, 1x participation rights in the future rounds and a “Major Investor” right as defined in the next funding round in the company. Additionally, an investor can easily transfer its KISS convertible note to anyone at any time.

To understand the KISS convertible note better, let us talk about the clauses in the KISS note template (most of them are there in both kinds of KISS convertible note. Types explained below). The clauses include:

- maturity/expiration date (18 months)

- transfer rights: to anyone, at anytime

- cap/discount to be negotiated on a deal by deal basis

- minimum financing round: >$1 million

- interest rate (5%)

- conversion at, at least, $1million rise in an equity financing

- exit premium -> convert in 2x

- MFN

The KISS instrument does not easily permit high-resolution financing and all the KISSes in a given series have to have identical terms. The KISS note template is much more complex than the SAFE convertible note, but it is much more balanced.

However, it is dangerous for founders if they do not understand all the terms that they might be signing. So, it is always a better idea to know everything before you move ahead and sign the KISS convertible note. And once the founder is familiar with it, it can be a great option to offer the investors with, in exchange for funding. But due to the complexity and terms, this convertible security is most preferred by investors as compared to founders.

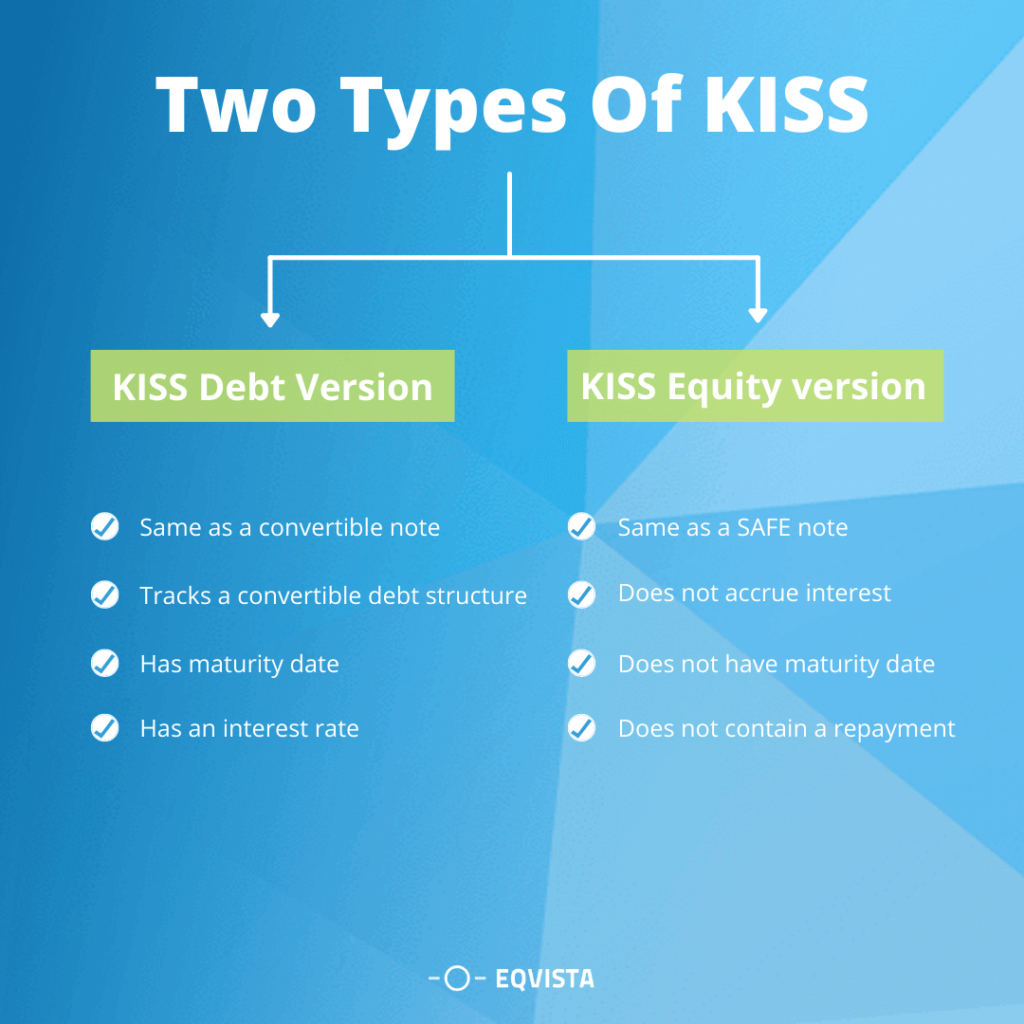

Two types of KISS

There are two kinds of KISS convertible notes that you can use based on the kind of agreement you have with the investor. These two are the debt version KISS note and the equity version KISS convertible note. To explain each:

- KISS Debt Version Template: Just like the convertible note, a debt version KISS convertible note has a maturity date and an interest rate. This convertible security more closely tracks a convertible debt structure.

- KISS Equity version Template: This KISS note template is just the same as a SAFE note. Basically, this KISS instrument does not accrue interest and does not contain a repayment clause as at maturity date.

With the KISS convertible note explained, let us talk about how it is calculated and converted.

Using a KISS convertible note calculator

Let us say that your company has moved forward and is entering the Series A financing round. In such a case, how would you calculate the price per share for your Series A financing knowing that there are some or just one KISS convertible note that has to convert? And this has to be converted into preferred stock, of course, in connection with the Series A financing.

Since the shares are issued upon the conversion of the notes, the noteholders will own some part of the company once it has been converted. And this will reduce the ownership of the existing shareholders, where they will own less than 80% of the company or the Series A investor will own less than 20% of the company.

To say this in another way; either the true pre-money valuation will be less than $8 million or the Series A investor would own less than 20% after the conversion has been made. This brings up some questions like:

- Whose ownership is diluted by the issuance of the shares on conversion of the KISS convertible note; and

- By how much is each party diluted?

And to resolve this, there are a few methods used to convert KISS convertible notes. We will use an example so that you understand the impact of these.

The assumptions we are taking include:

- Agreed Upon Pre-Money Valuation: $8 million

- Agreed Upon Post-Money Valuation: $10 million

- Amount Being Invested by New Series A Investors: $2 million

- Principal + Accrued Interest on Outstanding Promissory Notes: $1 million

- Discount Rate for Conversion of Notes: 30%

- Shares Outstanding on a Fully-Diluted Basis, Pre-Investment: 1 million

Pre-Money Method

The first method is the pre-money method where the pre-money valuation of the company is fixed and the conversion price of the notes is determined based on that. Using the set assumptions, the price per share for the new investors would be $8 per share and the conversion price for the note would be: $8 – 30% discount on one share = $5.60 per share. The equity ownership of the company pre- and post-investment would be as shown in the table below:

| Stockholder Group | Pre-investment | Post-investment | ||

|---|---|---|---|---|

| Shares | % Ownership | Share | % Ownership | |

| Founders | 1,000,000 | 100% | 1,000,000 | 70% |

| Noteholders | 0 | 0.00% | 178,571 | 12.50% |

| Series A Investors | 0 | 0.00% | 250,000 | 17.50% |

| Total: | 1,000,000 | 100% | 1,428,571 | 100% |

Using this method for the KISS note, both the Series A investors and the Founders would have their shares diluted upon conversion of the notes in proportion to their ownership percentage. And even though the pre-money valuation stays at $8 million, the post-investment percentage ownership of the Series A investors is 17.5% and the post-money valuation implied by this method is $11.43 million.

Percentage Ownership Method

The next method used for KISS notes is the percentage ownership method. In this method, the percentage ownership of the company the investor is buying is fixed and the other variables are computed based on that. In fact, the same result would be obtained if the post-money valuation was fixed. Using the assumptions above, the price per share for new investors would be $6.57 per share, which is the mathematical result to arrive at 20% ownership.

The conversion price of the notes would be $4.60 per share which is again $6.57 minus the 30% discount. With this, the equity ownership of the company post- and pre-investment would be as follows:

| Stockholder Group | Pre-investment | Post-investment | ||

|---|---|---|---|---|

| Shares | % Ownership | Share | % Ownership | |

| Founders | 1,000,000 | 100% | 1,000,000 | 65.71% |

| Noteholders | 0 | 0.00% | 217,391 | 14.29% |

| Series A Investors | 0 | 0.00% | 304,348 | 20% |

| Total: | 1,000,000 | 100% | 1,521,739 | 100% |

Dollars invested method

The last method used for KISS notes is the dollars invested method. The percentage-ownership method causes all of the dilutions that result from the shares issued upon conversion of the KISS convertible note to be borne by the founders. And even though the ownership of the Series A’s investors stays fixed at 20% and the post-money valuation also at $10 million, the pre-money valuation implied by this method is $6.57 million.

Due to this, the ownership percentage of the founders is also less than the results in the pre-money method. Unless it is expressly indicated in the term sheet, many entrepreneurs consider using this method to be a material deviation from the agreed-upon term sheet and object to its use. The dollar-invested method is normally used as a compromise between the percentage-ownership method and the pre-money method.

Now, using the same assumptions as shared above, the post-money valuation will be fixed at $11 million and each of the other variables would be calculated from that. Here, the price per share for the Series A investor would be $7.57 per share and the conversion price for the notes would be $5.30 per share, which is $7.57 minus the 30% discount. The equity ownership of the company post- and pre-investment would be as follows:

| Stockholder Group | Pre-investment | Post-investment | ||

|---|---|---|---|---|

| Shares | % Ownership | Share | % Ownership | |

| Founders | 1,000,000 | 100% | 1,000,000 | 68.83% |

| Noteholders | 0 | 0.00% | 188,679 | 12.99% |

| Series A Investors | 0 | 0.00% | 264,151 | 18.18% |

| Total: | 1,000,000 | 100% | 1,452,830 | 100% |

Basically, the dollar invested method offers the founders credit for accrued interest and principal on the KISS notes that are being converted into equity as if these were funds being newly invested into the company. But only the founders are diluted by the “extra” shares that the noteholders are receiving due to the conversion discount.

The final result is that converting the KISS convertible note into equity without a discount does not change the percentage ownership of the Series A investor. This means that they are still getting the deal they bargained for. Additionally, the founders will have to compromise and accept the additional dilution. But it is way less than what they were suffering in the previous method.

Creating & Issuing KISS convertible notes on Eqvista

With all that said and explained about the KISS convertible note, it is time to learn how to create and use it on the Eqvista application. Below are the steps to add a KISS convertible note to your cap table on Eqvista:

Step 1: Log into your Eqvista account and select your company profile for which you want to issue the KISS convertible note. From the home page, click on “Securities”, and then on “convertible instruments”.

Step 2: From here, click on “Issue Instrument”.

Step 3: You will reach the next page where you can work to set up and issue the convertible note (KISS).

All the details have been added as seen in the image. Some fields will not be visible initially. But as you add the details as per the agreement, the fields will appear. You will have to fill in the following details:

- Name of the shareholder – Select the shareholder name from the list available. If you have not yet added the shareholder, check out the support article here to help you in adding a shareholder to your cap table.

- Convertible note name – Give a name to the convertible note. Here, we named it KISS Note 1.

- Issue Date – This is the date on when the issuance was made.

- Note Type – Since we are talking about KISS, the type to select is “500 startups KISS”.

Another field appears after this. Here, you need to add the principal amount. Add it and then some additional fields appear again where you will have to add the following details in it:

- Converts to – This tells us what the convertible note will convert to from the option of common shares or preferred shares.

- Conversion trigger amount – This is the minimum equity financing amount that will trigger the conversion of the note.

- Valuation Cap – This is the minimum company valuation when the note will then be converted into shares.

- Early Exit Multiple – This is the guaranteed multiplier of the principal paid out. We did not add any value to this to make things easier.

- Conversion Discount – Discount of share purchase applied to the valuation of the company. (Also explained above.)

Once you have filled in all these details, click on “Submit”.

Step 4: After doing this, you will reach the page where you can see the details of the note as shared below.

Step 5: To see how this affects the cap table, you will have to visit the detailed cap table. Click on “Cap table” and then “Detail” on the left side menu to reach the following page.

From here, you can see how the note has affected the company’s committed capital and the cap table of the company. Basically, using these steps, you can easily create a KISS note on Eqvista.

KISS Calculator using Round Modeling on Eqvista

Before we can talk about how the KISS note is converted into shares, we should cover what round modeling is. Round modeling is a financial tool that helps investors and the management in the company view the dilution of the company’s cap table with the introduction of new investments. So when a new investment is made and the KISS convertible note is converted, the round modeling chart will help in understanding how much of the ownership has been diluted.

Here are the steps to view the KISS note’s effect on the round modeling of the company through Eqvista:

Step 1: For you to be able to see the effect of the convertible note on the cap table through the round modeling tool on Eqvista, you will have to click on “Modeling” from the left-side menu and then on “Round Modeling”. After doing this, you will reach the next page as below.

In this round modeling scenario, the company valuation before the new investments (pre-money) is equal to $100,000, causing the price per share in the pre-money stages to be $0.1 (1,000,000 shares / $100,000). Then in the round modeling scenario, a new investment amount of $10,000 is introduced together with a post-money option pool of 10%, causing the post-money breakdown of the different parts of the distributions as seen in the graph.

With the new financial instruments added to the round modeling, the KISS Note created before makes up 9.09% of the total net worth of the company, causing the Founders stock to become diluted if the KISS note was converted.

And this simple example shows how the round modeling can help you see the effect of the KISS convertible note on the ownership of the company when converted. This financial stool becomes more useful in complex shareholding scenarios with multiple KISS and SAFE convertible notes together with common shares, preferences shares and options & warrants.

Conclusion

All-in-all, note-alternatives like the KISS convertible note can offer additional financing options for investors and founders hoping to raise or contribute early-stage capital. The simplicity of the notes is what makes them highly popular amongst companies and investors. Now that you know all about KISS convertible notes, you can easily use it to take up initial funding for your company.

In fact, creating them on Eqvista is very easy as shared above. You can easily convert it as well using our advanced financial tools. To know more about how to use the Eqvista platform, check out the support articles and knowledge center here. You can also contact us and our representatives will do their best to guide you where needed.