Stock Dilution: Everything You Need to Know

One of the most important things that any startup executive will come across when discussing about the company shares is stock dilution. Stock dilution in a company decreases the equity ownership of the existing shareholders when new shares are issued, be it to investors, employees, advisors, and others. There are also other ways equity dilution occurs other than the issuance of shares.

Stock Dilution

Stock dilution takes place when a company issues additional shares to new individuals joining the company in exchange for capital, services or even professional advice. This, in turn, reduces the ownership of current shareholders.

Common Situations for Stock Dilution

Now that you know what equity dilution is all about, let us talk about the several situations in which shares become diluted. These include:

- Conversion by optionable security holders: Stock options granted to individuals, including board members or employees, may be converted into common shares that eventually increases the total share count.

- Offering new shares in exchange for services or acquisitions: A company may offer new shares to the shareholders of a firm that it is acquiring. Small businesses can also provide new shares to people in exchange for the services they offer. This is usually offered to consultants, advisors, key employees and others who offer services to the company.

- Secondary offerings to raise additional capital: When a company is acquiring capital for growth opportunities, it offers the investors equity in exchange for funding.

The Effects of Stock Dilution

A lot of existing shareholders do not consider equity dilution as something good. After all, by adding more shareholders in the company, they are having their ownership cut down. This can lead to shareholders thinking that the value of the company is reduced. There are even cases where investors who have a large piece of ownership in the company can easily take advantage of those minority shareholders.

But it is not always that bad. The company may be issuing new shares for boosting revenue, raising money for new business ventures, buying out a competitor or for investing in a strategic partnership. These all can bring value to the company and increase its share price in the end.

How Does Stock Dilution Affect Startups, Founders and Investors?

When additional capital is raised by a company, the pre-existing shareholders – which include the investors, founders and even the employees who own shares – are diluted. This stock dilution is directly proportional to the amount of funding that the company gets. And the dilution is also inversely proportional to the company valuation obtained. Moreover, all the options offered to the employees in the company are also diluted.

Even though this may seem bad for the current shareholders, in the end its a positive thing for the company. This is because it increases the valuation of the company as it grows, and attracts further funding and a higher valuation. This growth increases the price of the shares that the shareholders hold even if they are diluted. It is much more valuable than when the company doesn’t scale at all.

Example of Equity Dilution

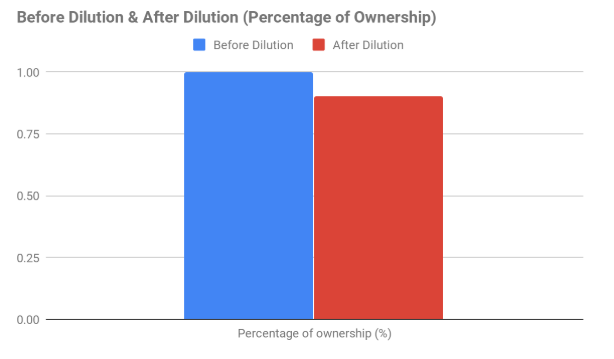

Let us understand this better with an example. Assume a company called Best Services Inc. started with 1,000,0000 shares owned by 100 individual shareholders, with each owning 1% of the company. To get more capital into the company, the business issued 100,000 additional shares to ten new shareholders. With this, there are now 110 shareholders in the company who owns approximately 0.9% of the company each.

Here is a breakdown of the share ownership:

Before dilution:

- Number of common shares = 1,000,000

- Number of shareholders = 100

- Number of shares per shareholder = 10,000

- Percentage ownership = 10,000 / 1,000,000 = 1%

After dilution:

- Number of common shares = 1,100,000

- Number of shareholders = 110

- Number of shares per shareholder = 10,000

- Percentage of ownership = 10,000 / 1,100,000 = 0.9%

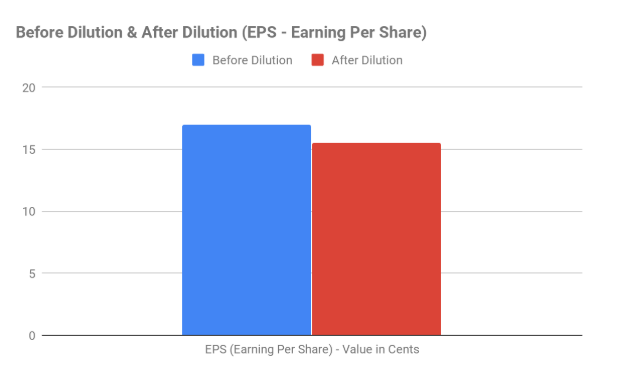

If Best Services Inc.’s available earnings after tax for common shares are $17,000, the equity dilution would have the following impact on the earnings of each shareholder:

Before dilution:

- EPS (Earning Per Share) = 17 cents per share

After dilution:

- EPS (Earning Per Share) = 15.5 cents per share

As you can see, the effect of the stock dilution has decreased the EPS of the shareholders of the company. Let’s dive further into the EPS formula and understand it in detail.

Diluted Earning Per Share Formula

New investors of the company would want to know the possible effect on the share price for all the company’s convertible securities, such as options, warrants and convertible notes. These all would reduce the earning per share for the common shareholders.

The value of earnings per share in case all the convertible securities, including convertible notes, equity warrants, and stock options, are converted to common shares is known as diluted earnings per share (EPS). This value is calculated and reported in the company’s financial statements.

The simplified formula for calculating diluted earnings per share is:

- Diluted EPS = Net Income − Preferred Dividends/WA + DS

Where:

- WA = Weighted average shares outstanding

- DS = Conversion of dilutive securities

Diluted Earnings Per Share Methods

Now that you know about the diluted EPS formula, you should know that there are other methods used to calculate the diluted EPS based on various conditions in the company. These include the If-Converted Method Diluted EPS, If-Converted & Convertible Debt and Treasury Stock Method, Diluted EPS.

If-Converted Method Diluted EPS

The if-converted method is utilized to calculate the diluted EPS in case the company has potentially dilutive preferred stock. To utilize this method, subtract the preferred dividend payments from net income in the numerator and add the number of new common shares that would be issued if it is converted, to the weighted average number of shares outstanding in the denominator.

For instance, if the net income is $10,000,000, and there are 500,000 weighted average common shares, then the basic EPS would be $20 per share ($10,000,000 + 500,000). If the company issued 10,000 convertible preferred shares that pay a $5 dividend, then each preferred share is convertible into five common shares.

With this, the diluted EPS would be equal to $18.27 as per the calculation: [$10,000,000 + $50,000] / [500,000 + 50,000]. We add the $50,000 to net income with the assumption that the conversion will occur at the beginning of the period, so it would not pay out dividends.

If-Converted & Convertible Debt

Now, let us take the if-converted method and apply it to the convertible debt as well. In this case, the after-tax interest on the convertible debt would be added to the net income in the numerator. Along with this, the new common shares that would be issued at the conversion are added to the denominator.

Let us take again a company that has a net income of $10,000,000 and 500,000 weighted average common shares outstanding, with a basic EPS equal to $20 per share ($10,000,000 + 500,000). Now, assume that the company also has $100,000 of 5% bonds that are convertible into 15,000 shares. Let us say that the tax rate is 30%. Using the if-converted method, the diluted EPS would be equal to $19.42 as per the calculation: [10,000,000 + ($100,000 x .05 x 0.7)] / [500,000 + 15,000].

Note: The after-tax interest on the convertible debt added to the net income in the numerator is calculated as the value of the interest on the convertible bonds ($100,000 x 5%), multiplied by the tax rate (1 – 0.30).

Treasury Stock Method, Diluted EPS

In such a case, the numerator stays the same. For the denominator, subtract the shares that could have been purchased with cash received from the exercised options or warrants from the number of new shares that would be issued upon a warrant or option exercise. After that, add it to the weighted average number of shares outstanding.

Now taking our example again, with the net income of $10,000,000 and 500,000 weighted average common shares outstanding, and basic EPS equal to $20 per share ($10,000,000/500,000). And if 10,000 options were outstanding with an exercise price of $30, and the average market price of the stock is $50, the diluted EPS would equal to $19.84 ($10,000,000 / [500,000 + 10,000 – 6,000]).

Note the 6,000 shares is the number that the firm could repurchase after receiving $300,000 for the exercise of the options. The calculation for this is: [10,000 options x $30 exercise price] / $50 average market price. Here, the share count would increase by 4,000 (10,000 – 6,000) because after the 6,000 shares are repurchased, there is still a 4,000 share shortfall that needs to be created.

Also be aware that securities can be anti-dilutive. This means that if converted, the diluted EPS would be higher than the company’s basic EPS. Anti-dilutive securities don’t affect shareholder value and are not factored into the diluted EPS calculation.

Financial Statements, Diluted EPS

Nowadays, it is very easy to get the diluted EPS as it is presented in financial statements. Companies report key line items that can be used to analyze the effects of dilution. These line items are basic EPS, diluted EPS, weighted average shares outstanding, and diluted weighted average shares. Many companies also report basic EPS excluding extraordinary items, basic EPS including extraordinary items, dilution adjustment, diluted EPS excluding extraordinary items and diluted EPS including extraordinary items.

Companies also provide important details in the footnotes. In addition to information about significant accounting practices and tax rates, footnotes usually describe what factored into the diluted EPS calculation. The company may provide specific details regarding stock options granted to officers and employees and their effects on reported results.

Understand how Stock Dilution can affect your Company?

Stock dilution can dramatically impact the value of your ownership in the company. A company must make adjustments to its earnings per share and ratios for its valuation when equity dilution occurs. Additionally, investors should lookout for signs of potential stock dilution and understand how it could affect the value of their shares and their investment overall.

If you have just become a founder of your company, it might be time for you to start working on your cap table. To help you out in managing and tracking your shares properly, Eqvista is your best bet. Check it out here and begin to track your shares today and avoid making bad decisions that would dilute your ownership in the company!