SAFE or Simple Agreement for Future Equity Template

When starting a new company, there comes a lot of excitement to get your business ideas off the ground and start running your company. But this will eventually bring in the realization that you will need to raise money to run the company and grow. And at this point, many founders struggle to find a nice middle ground between giving up a lot of ownership through issuing shares or incurring high interest from bank loans for the initial funding.

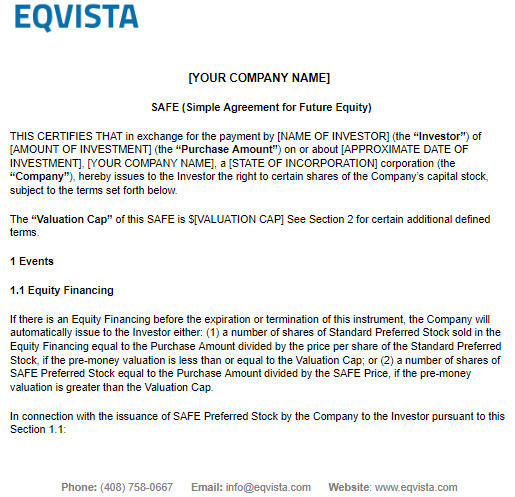

Keep reading to learn everything that you need to know about SAFE notes and the pre-money safe template.

What is a SAFE Note?

During 2013, the startup accelerator Y Combinator (a Silicon Valley accelerator) introduced an instrument known as a simple agreement for future equity (SAFE). It was created as a simpler alternative to traditional convertible notes. It allows startups to easily structure their seed investments without maturity dates or interest rates.

SAFEs streamline the early-stage fundraising and save both investors and startups time and money that they would otherwise spend in drafting one-off legal agreements. It is a short five-page document where all the details are outlined. The valuation caps are the only negotiable detail in a SAFE.

To explain better, a SAFE is a convertible note that allows investors to purchase shares in a future priced round. It addresses a lot of challenges and drawbacks that convertible notes have. Because of this, it is a great equitable option for founders and investors. This is also why a lot of startups prefer SAFE notes, as they do not accrue interest and are not debt, unlike convertible notes. But with all the positive points of SAFEs also comes uncertainty.

Overcoming uncertainty

As mentioned above, SAFEs bring money into a company in exchange for a promise to issue stock in an amount to be determined in subsequent rounds of funding. And even though they have gained huge acceptance in the industry, it has left founders without a way to know exactly how much of their company they have sold off to investors. Nor do the investors know how much percentage of ownership they have gained. Most of the time, investors do not get the amount of ownership they wanted after their investment.

To overcome this uncertainty, Y Combinator recently introduced a so-called post-money SAFE. And judging by its ubiquity, it’s seen as a game-changer as it enables a company and investors to instantly figure out how much ownership has been sold. This is done by treating the capital raised through a SAFE as its own round. A post-money SAFE reduces the burden on the founders in the company to calculate the dilution to their ownership that the investment will produce. The key changes in the post-money SAFE will be discussed further to help you understand more.

General Terms to Understand

SAFE notes are convertible securities, which means that they can eventually be converted into equity. To understand how they work and what to add in the agreement, you should be aware of the following terms and considerations:

- Discount and Valuation Caps: SAFE notes can include a discount that is applied to a future valuation when it is time to convert. It can also have a valuation cap that sets the highest price that can be used to set the conversion rate. During the conversion, the investor can take advantage of either of them, whichever is more favorable. Although in SAFE notes, both can be used or not based on the agreement.

- Early Exit Payback: This means that the notes can be paid out to the buyer if a change of control or acquisition should occur before the expected conversion. Usually, if there is a change in control, the convertible note templates give a 2x payout option and an equity conversion. And if they stay with the acquisition, they can have a 1x payout or equity according to the valuation cap.

- Company Type: At times, a startup is a limited liability company and not a C-corporation. A limited liability company can use a convertible note as it is a debt instrument. But SAFE notes need the C-corporation status since the investment is noted on a capitalization table just like stock options. Although some people find ways to use SAFE notes in an LLC, it is not so simple.

- Conversion: It’s possible for a note to change into equity during a future financing round. And SAFE notes can convert with any dollar amount in a preferred cycle, unlike a convertible note that has a minimum amount to be raised before it can be converted. Going without a qualifying transaction obligation can help as this would prevent the conversion to real equity.

- Term (Maturity Date): As SAFEs are not a debt instrument, there is no end or maturity date. This means that investors can be waiting endlessly for maturity even when the business is earning profits.

- Interest Rate: SAFE notes also do not have any interest rates that are typically seen in convertible notes.

Benefits of Using Safe Notes

With all clear on what SAFE notes are, it is time to decide if SAFE notes are for you. For this, take a look at the benefits that the SAFE has to offer:

- Simplicity: SAFE notes are simpler than convertible notes, with no maturity date and interest rate. It is a straightforward five-page document that can be understood easily without the need of a lawyer.

- Less to negotiate: SAFE notes do not need a lot of negotiations like other investments. At times, valuation caps are talked about, but that is all.

- Accounting: Just like every other convertible security, SAFE notes also end up on a company’s cap table.

- Similar provisions: SAFE notes still offer the provision for change of control, early exits, or even the dissolution of a company. There are provisions for investors, such as discounts and valuation caps.

- Conversion to equity: Investors have the choice to change their investment into equity later on. And even though the date of conversion is not fixed initially, it can be done when an equity round is raised and the preferred shares are distributed.

- Flexibility for startups: The lack of a maturity date and pre-defined terms offer the startup with complete freedom with no particular expectation or destination.

- Proportional benefits: The moment the SAFE notes convert, you might be entitled to better benefits in proportion to your original investment. They can offer preferred stock called “sub-series” or “shadow” stock. And this can turn out to be a much better deal than convertible notes. However, this can also make for a more complicated mix of shares. Also, watch out for legal costs during the equity rounds and remember to take help from a lawyer at all times.

Pro-Rata Rights

Another new feature of SAFE notes relates to pro-rata rights. The original SAFE notes obligated the company to allow SAFE-holders to participate in the round of funding following the round the SAFE is converted. For instance, if a SAFE note is converted during the Series A Preferred Stock financing round, the SAFE-holder who is now a holder of a sub-series of Series A Preferred Stock would be permitted to buy a pro-rata portion of the Series B Preferred Stock.

Nonetheless, while this concept was consistent with the original concept of SAFE notes, it made less sense in the world where SAFEs became independent financing rounds. So, the old pro-rata right was removed from the new SAFE notes. But there is a new template side letter that offers investors with a pro-rata right in the Series A Preferred Stock financing based on the investor’s as-converted safe ownership, which is also now much more transparent.

This means that the investor and the company have the choice to enter into the side letter with the SAFE notes, which is also based on many factors. The factors here include the purchase amount of the SAFE and the amount of future dilution that the pro-rata right would cause for the founders in the company. And this amount can easily be forecasted with much more accuracy, thanks to post-money SAFE notes.

Just so you know, the new SAFE does not change the significant features that are important for startups, which are:

- It permits high-resolution fundraising. Instead of trying to coordinate a single close with all investors simultaneously, startups can now close the deal when the investor is ready to wire the money and both parties are ready to sign. Basically, high-resolution fundraising would be much easier now that both parties have more transparency and certainty into what is being given and what they are getting.

- Being a one-document and flexible security without numerous terms to negotiate, SAFE notes save both the investor and startups a lot of money in legal fees and reduce the time spent in negotiating the terms of the investment. The only thing that the parties would have to negotiate is the valuation cap. And since SAFE notes have no maturity date, there’s no need to extend the dates or revise the interest rates.

Regardless of if you are using the SAFE for the first time or have already used it before, it is always a good idea to check out the main Safe User Guide by Y Combinator.

Different types of SAFES

With that said, let us talk about the various kinds of SAFE notes. From the above explanation, you now know that there are two variants that are in SAFE notes, which include the valuation cap and the discount. However, these two variants are not mandatory for SAFE notes to have. This gives us four versions of the new post-money SAFE along with the optional pro-rata side letter. And keep in mind, these are not the pre-money SAFE template but the post-money SAFE templates.

- SAFE: Valuation Cap, no Discount – This post-money SAFE note would include a valuation cap as the name implies. But it would not have any discount mentioned in the terms.

- SAFE: Discount, no Valuation Cap – In this post-money SAFE note, there would not include a valuation cap. Instead, it would include a discount that would be used during the conversion of the note.

- SAFE: Valuation Cap and Discount – In this post-money SAFE note, both the valuation cap and discount terms would be included in the template.

- SAFE: MFN, No valuation cap, no Discount – This post-money SAFE note has no valuation cap and discount terms in it.

- Pro-Rata Side Letter – As mentioned before, this is an optional pro-rata right letter that you can add in the terms if you wish to do so.

Pre-money and Post-money SAFEs

As mentioned earlier, SAFE notes have been changed to overcome some of the challenges at the beginning. Below are some of the key changes that were made to pre-money SAFE notes:

Easier to Track Ownership and Dilution

As discussed earlier, old SAFE notes did not allow investors to learn about how much ownership they were getting and the founders to know how much of their ownership was being diluted. Basically, with pre-money SAFE notes, for the parties to evaluate the dilution and ownership, it was important to take into consideration the theoretical increase of shares to the company option pool during a subsequent equity round.

Dilution and ownership values were more of an informed decision instead of a sure calculation. That is why the post-money SAFE notes were created. With this, in order to evaluate the dilution and ownership, you will have to remove the theoretical increase of shares, and instead consider the convertible securities that have been issued. Basically, what you are doing here is that you are calculating the price per share at which the SAFE investor’s money converts. This is a simple division problem where the Valuation Cap is divided by the Company Capitalization.

By adding the convertible securities in the definition of the Post-Money Company Capitalization, the denominator in that simple division problem is made larger. And with a larger denominator, the lower the quotient, that is, the price per share. With the low price per share, the SAFE investor gets more shares for their money. And the more shares they get, the more dilution is caused to the ownership of the other shareholders.

However, a major drawback is that the holders of the post-money SAFEs would not participate in any dilution of the next financing rounds until the Post-money SAFE notes convert at a priced equity round. Because that dilution must go somewhere, it is borne by the founders and early employees. And with this, it would seem that any post-money SAFE investor would get a better deal than most of the non-post-money SAFE holders on the cap table.

Nonetheless, the proposed tradeoff is the increased clarity of ownership and future dilution would promote the confidence of the investor and give the founders a much better idea of how diluted their ownership would become. This can eventually help in setting themselves up in a favorable position for subsequent rounds. Here are some more considerations of the share dilution breakdown:

Pre-investment shareholders (founders, early employees, advisors, etc.)

- Pre-Money SAFE notes: Bear dilution from all the next investors.

- Post-Money SAFE notes: Bear dilution from all the next investors AND the dilution that would normally be borne by the early investors if the company raises a convertible round following a Post-Money SAFE round.

Early-stage investors

- Pre-Money SAFE notes: Bear dilution from all the next investment rounds regardless of format, that is, SAFEs, convertible notes, or a priced round.

- Post-Money SAFE notes: Bear NO dilution by the next investment rounds until it is an equity round. A lot of companies are performing many convertible rounds before their priced round, which can create an issue for the early team members if the company starts with a Post-money SAFE round and does another convertible round at any time before the priced equity round.

Equity round investors

Pre and Post-Money SAFEs: In both cases, it rarely takes dilution from prior investors.

Creating & Issue SAFE convertible notes on Eqvista

With all this clear, you now need to ensure that the SAFE notes you are giving out are being recorded in your company’s capitalization table. And if you have not yet started using Eqvista, then try it out now. You can easily create a SAFE note in Eqvista that would record all the details for you and keep your cap table up to date. Here is the step by step form on how you can do this:

Step 1: Create an account on Eqvista (and make your company profile, if you are new here) or log into your account (if you have one and select the company profile in question). From here, click on “Securities” and then on “Convertible instruments”.

Step 2: With this done, you will be taken to the next page where you can begin the issuance of the convertible note by clicking on the button “Issue Instrument”.

Step 3: From here, select the person who you are offering the instrument to from the drop-down list and add the details to set up and issue the SAFE note here.

Note: In this example, we have used the SAFE: Valuation Cap, No Discount.

All the details have been added as seen in the image. Some fields will not be visible initially. But as you add the details as per the agreement, the fields will appear. Once you have filled in all the details, click on “Submit”.

Step 4: After this, you will be directed to the page showing the details of this SAFE you just issued. You can also edit the SAFE notes here by clicking on “Actions” and select the action you want for the note.

And just like this, you can easily create and issue SAFE notes on Eqvista.

Conclusion

Finally, you now have an idea of what the SAFE notes are about and how they work. You can easily create them using Eqvista and keep track of all the shares in your company just in one place. If you need more help to understand how to use the Eqvista platform or need some more details on the convertible securities, check out the support articles here. You can also contact us and our representatives will do their best to guide you where needed.