Why use Eqvista to issue and manage phantom stocks?

Phantom stocks, also known as phantom shares, simulated stock, or shadow stock, is a type of equity compensation in which corporate stock is issued to selected employees without any physical ownership. The phantom stock enables employees to have certain benefits of shares but with no actual ownership. The purpose of phantom stock is to eliminate the risks of dilution while increasing motivation and productivity within the workforce. In this article, we will briefly discuss the concept of phantom stocks and how Eqvista can help create and manage phantom stock plans easily.

Phantom Stock – Great Way to Motivate and Reward Employees

During the early stages of a company, retaining, incentivizing, and motivating employees is vital. To increase productivity and keep employees motivated, companies utilize several methods, such as providing access to cash rewards, drawing up annual and quarterly bonus plans, and organizing events to reward employees. However, with budget constraints and limited resources of startups make it difficult for them to create a suitable compensation strategy. Phantom stocks, in this context, are an excellent way of motivating and rewarding employees.

Phantom stock is a form of employee compensation that is designed to give an employee the benefits of owning stocks without actually holding any physical shares. A phantom stock plan allows the employee to earn money based on the value of company stocks. As a result, the employees are paid directly in the form of cash depending on the fair market value (FMV) of the stock. Here, it is essential to note that the FMV of private companies is determined with the help of 409A valuation.

What is phantom stock and how does it work?

A phantom stock plan is a deferred compensation plan that gives the employee benefits of owning stock in the company without actually holding the shares. This plan facilitates flexible payments and allows a company to reward employees without diluting ownership. In this regard, the phantom stock has no real effect on the employee’s actual shareholding rights in the company. Instead, it provides financial benefits which are determined according to the movement in the FMV of the shares. But, how does a phantom stock work? Well, phantom stocks work in two ways, appreciation approach and full value. Below is a brief description of each:

- Appreciation-based plan – In this type of plan, the employee will receive financial benefits based on the phantom stock value today in comparison to the original value. In practical terms, the value of the shares is not included, rather, the employees are paid according to the current value of the stock. Generally, the rise in the FMV of the phantom stock will be reflected in the remuneration that an employee receives.

- Full value plan – As the name suggests, this plan involves the payment of the entire value of the phantom stock to an employee along with the increased value of the stock. In other words, under the full value plan, the employee receives the underlying stock’s value and any appreciation. Therefore, the full-value plan provides the employee with a substantial amount of financial benefit.

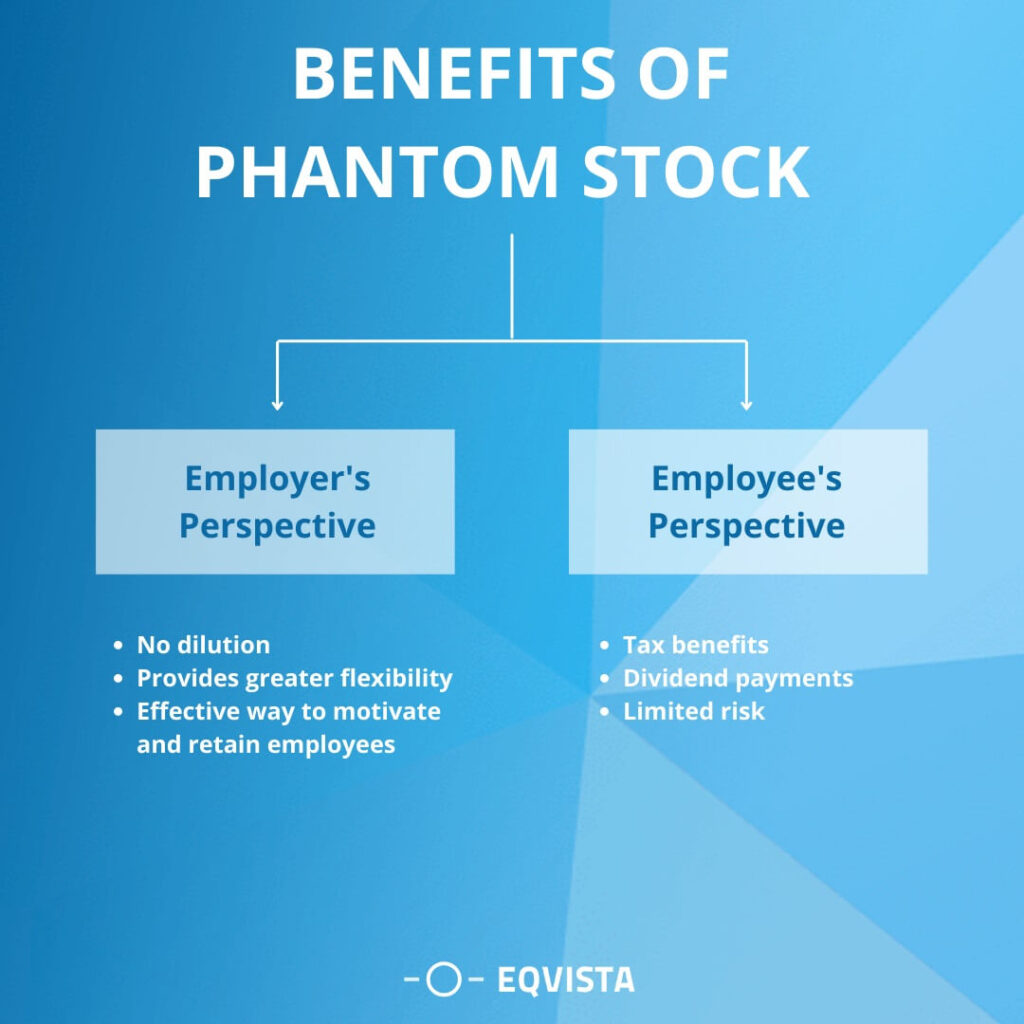

Benefits of phantom stock for both employers and employees

Now that we understand the concept of phantom stock, it’s time to discuss its benefits from the perspective of employers and employees. From the employer’s perspective, the phantom stock benefits are as follows:

- No dilution – Phantom stocks do not involve a physical transfer of shares to employees, which, in turn, prevents the dilution of ownership. Dilution is the reduction in the percentage of the shares held by current shareholders due to the issuance of new shares.

- Provides greater flexibility – Unlike other equity compensation plans, the phantom stock plan offers a considerable degree of flexibility. In this way, private companies can reward employees with minimal rules and regulations.

- Effective way to motivate and retain employees – Phantom stocks are cost-effective, making them an excellent way for companies to motivate and retain employees. It ensures that employees are offered financial perks while increasing long-term association.

From the employee’s perspective, the benefits of using a phantom stock plan are:

- Tax benefits – Employees receiving phantom stock are not required to pay taxes till the time the stock matures. As a result, the phantom stock plan acts as an ideal compensation plan for employees.

- Dividend payments – Although phantom stocks are hypothetical, employees may receive a dividend payment from the company similar to real shares. Dividend payments can serve as an added benefit for employees.

- Limited risk – Unlike real shares, phantom stock is not subject to any internal or external risks. However, it is important to note that the financial benefit or loss of phantom stock will be directly related to the performance or FMV of the stock.

Phantom Stock vs Stock Option

Phantom shares and stock options are often confused as both of them are deferred compensation plans. The purpose of phantom stocks and stock options is the same; they are meant to motivate and encourage employees. However, they are quite different from each other in terms of the benefits they offer to employees. To begin with, stock options are stock-based compensation plans that offer selected employees the right to purchase shares at a specific price within a specific time frame.

On the other hand, phantom stock acts as an employee benefit plan and does not obligate the company to issue stock. Instead, a phantom stock allows employees to earn financial benefits through hypothetical ownership. The following lists the key differences between phantom shares and stock options:

- Under stock options, at the time of expiry or after the vesting period is completed, employees can purchase the shares, while under phantom stocks employees can receive money without actually possessing the shares.

- In the case of stock options, employees are required to sell the acquired shares to receive the cash remuneration, but under phantom stocks, this restriction does not exist. Phantom shares allow employees to receive cash without even possessing the shares.

- Employees using stock options can become the shareholders of the company, while under a phantom stock plan, this is not the case. In other words, employees under a phantom stock plan cannot become shareholders.

Probably now you have a clear understanding of phantom shares vs stock options, but even though they are different, we can say that both stock options and phantom stocks work to increase the financial benefits of employees which in turn, helps to build a stronger relationship between employers and employees.

Eqvista makes it easy to issue and manage phantom stocks

You might have noticed that phantom stock plays an important role in company incentive plans and employee compensation packages, however, companies may find it difficult to implement such plans. This is because there are certain steps involved in implementing a phantom stock plan. To make things easier, you can use Eqvista to help you issue phantom stocks as well as manage phantom stocks. But, why should you hire Eqvista for managing your phantom stock?

With Eqvista, you can easily issue, manage and track phantom stocks in a matter of minutes. Eqvista is equipped with an online dashboard that offers complete transparency, reporting and access to the data associated with phantom shares of your organization. With real-time data, you can easily monitor the overall performance of your phantom stock plan. Isn’t it amazing how easy and simple phantom stock planning can become with Eqvista’s support?

How can you issue phantom stock on Eqvista?

So, how to issue phantom stock? The process of issuing phantom stocks on Eqvista is quite simple. All you need to do is, register for an account on Eqvista and enter the basic details of your company. Once you have registered for an account, you need to enter the specific details of the phantom stock plan into the system for issuance. That’s it! You can now issue the phantom stock plan and start managing your stocks with Eqvista. If you want to know more about the process, you can check our support article.

Manage Phantom Stocks with Eqvista!

You don’t need to struggle with the implementation of phantom stock plans when you can easily issue and manage phantom stocks on Eqvista in an efficient manner. With Eqvista, it is now possible to set up and manage the plan within minutes. Along with the ease of issuing phantom stock, Eqvista comes with an extensive set of other features that you can use to make your management of stocks more efficient. The team at Eqvista is well-equipped to offer you with the best possible solution for setting and managing your phantom stock plan. To learn more about the services that Eqvista offers, you can contact our team!