How To Set Up a Cap Table For Free?

For early-stage startups, setting up a cap table might not feel as pressing as product development or fundraising. Yet it is one of the most critical documents you can create. According to the State of the Cap Table Industry 2024, almost 90% of startups use equity-based compensation and update their cap tables in real-time to reflect changing structures and dilution after each funding round, conversion, or transfer.

Done well, it ensures clarity, trust, and preparedness for the future. Done poorly—or worse, neglected—it can create disputes and roadblocks during critical moments like fundraising.

The good news is, you can set up and manage your cap table for free. By starting small with simple tools and making use of founder-friendly platforms, you can avoid unnecessary costs while keeping ownership records clear and scalable.

Why Every Startup Needs a Cap Table?

A cap table is more than a spreadsheet; it’s a map of your company’s ownership. Without a cap table, teams often rely on memory or loose agreements, which easily leads to disputes.

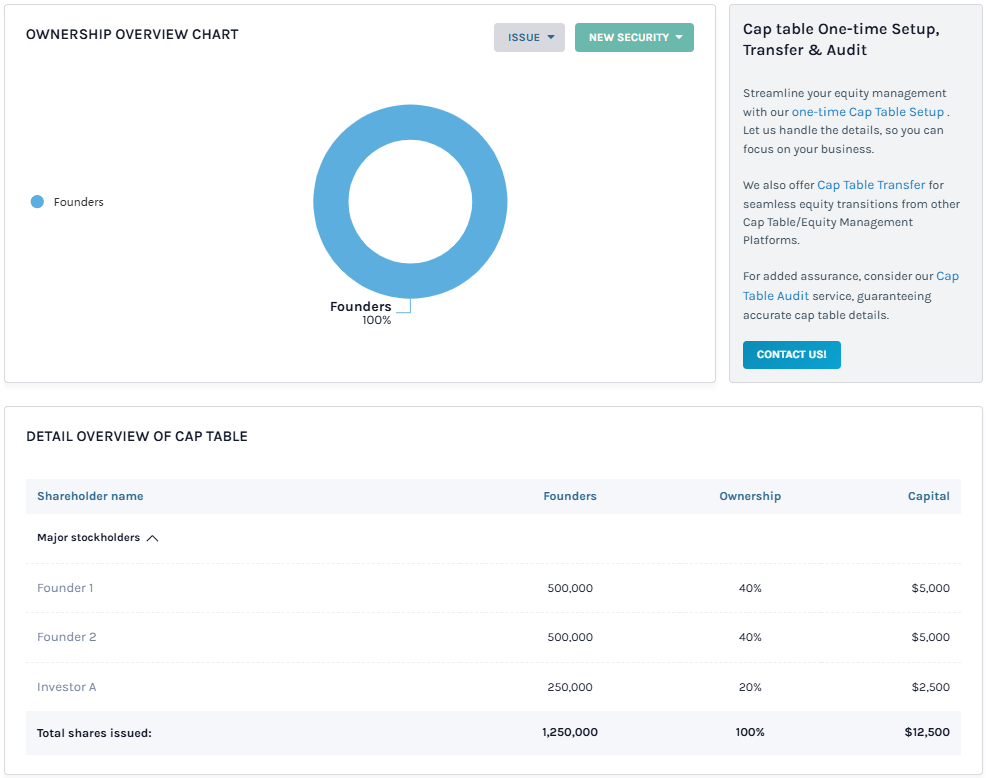

For instance, a simplified cap table after an initial funding round might look like this

An efficient cap table keeps track of:

- Founders’ ownership percentages.

- Investors and their stakes after fundraising.

- Stock option pools for employees.

- Advisors with equity grants.

- Equity changes over time.

Imagine co-founders disagreeing on their stakes during a Series A pitch—this type of confusion can scare off investors and complicate legal processes. A clean, transparent cap table signals professionalism and readiness.

Equity Management: What Can Go Wrong for Startups

Many early-stage founders share common frustrations around equity management:

- Hiring lawyers or subscribing to equity management software can feel out of reach when budgets are tight.

- Even simple ownership structures get messy when new employees, advisors, or investors enter the picture.

- Spreadsheets are cheap but error-prone, especially if maintained by multiple people.

- What works with two co-founders doesn’t scale once you introduce convertible notes, SAFEs, and multiple funding rounds.

This is where free solutions come in handy. They provide structure without adding extra costs, ensuring that as you grow, your equity records remain intact.

How To Set Up Your Cap Table for Free?

To set up your cap table for free, here are key steps and options that can guide you through the process.

1. Establish Ownership Among Founders

Clearly define how equity is split among co-founders. This is one of the most sensitive but important conversations you’ll have. Decide whether to split the shares equally or allocate them based on roles, contributions, or capital invested. Record these decisions immediately in your cap table.

2. Decide on a Share Structure

Instead of dividing ownership into percentages, many startups authorize a fixed number of shares, and this makes it easier to issue options or shares later without complex recalculations. For example, owning 1 million out of 10 million shares is clearer than saying you hold “10% of the company.”

3. Set Aside an Employee Option Pool

Investors almost always expect startups to have an Employee Stock Option Pool (ESOP) to attract and retain talent. Allocate this pool early—even if you don’t yet have employees to issue shares to. Including it in the initial cap table prepares you for negotiations with investors.

4) Record Equity Grants and Conversions Promptly

Early diligence issues often arise because founders fail to document grants that were agreed upon informally. Each equity event needs to be recorded as soon as it happens. Promised shares to advisors, SAFEs converting into equity, or stock option issuances should not be left to memory.

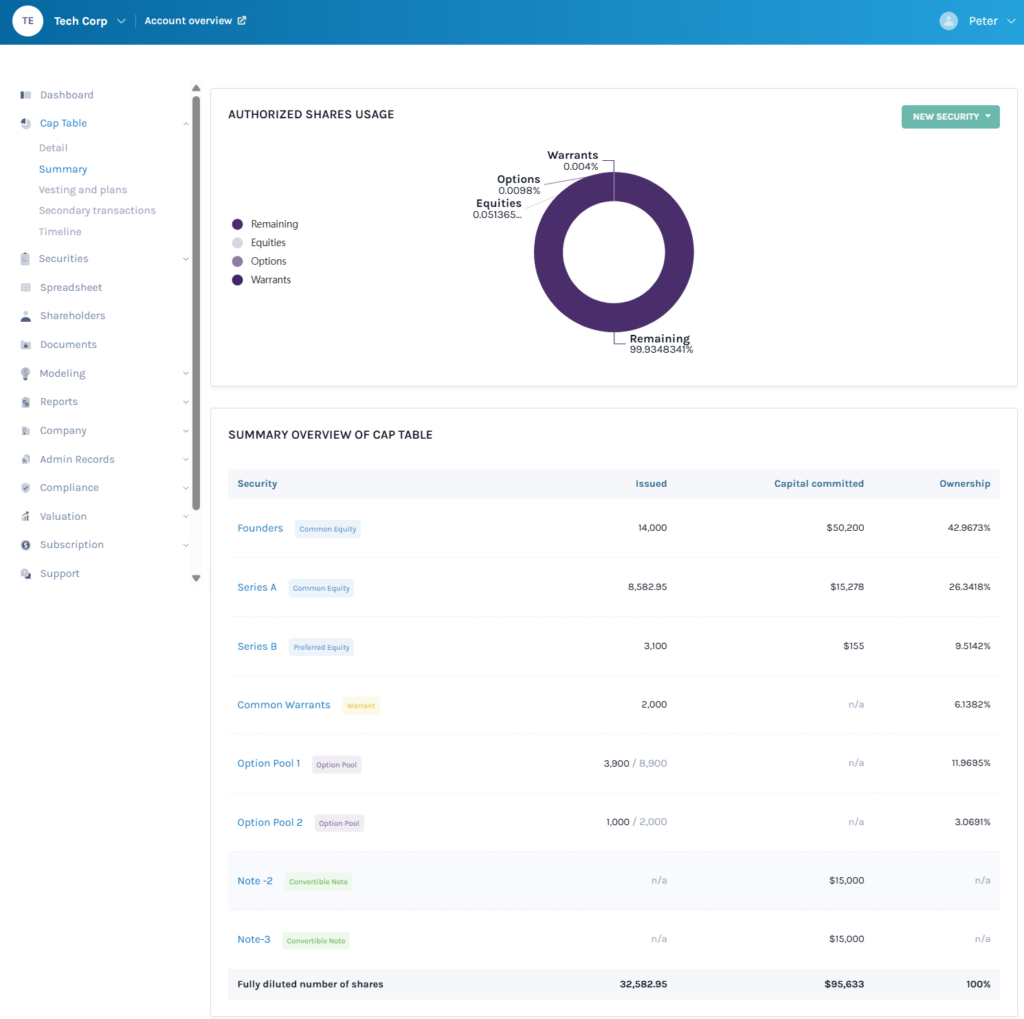

5) Move to Free Cap Table Software

While spreadsheets are useful in the first few months, they quickly become difficult to manage. This is where free cap table management platforms offer real value.

- Eqvista provides a free plan for startups, allowing you to issue shares, record stock options, and invite shareholders to view their holdings—all at no cost. This reduces errors and improves transparency as your company grows.

- Other platforms offer free tiers as well, but many limit the number of stakeholders or require upgrades earlier in your growth. Eqvista is particularly founder-friendly because its free plan covers most needs at the pre-seed and seed stages.

Using a dedicated tool early also helps you avoid the pain of migrating messy spreadsheets later.

Share and Stay Transparent

Early investors, advisors, and employees appreciate clarity. Don’t let your cap table become a document that only the founders understand. Transparency creates trust and minimizes conflict.

Whether you’re using a spreadsheet or a free platform, share regular updates or allow stakeholders to view their equity positions.

Knowing When Free Isn’t Enough

Free solutions are an excellent starting point, but as your startup matures, you may need to upgrade. Consider moving beyond free options if:

- You begin raising significant outside capital from angels or venture funds.

- You expand your team and start issuing large option pools.

- You grow internationally by holding companies or subsidiaries.

- Legal compliance and reporting become more complex.

At that point, platforms like Eqvista can support advanced features—such as compliance filings, complex reporting, and managing multi-stage financing rounds. By starting on a free version early, you’ll make upgrading later seamless.

Why is Eqvista the Smart Choice?

For founders, equity is everything. Your cap table is more than paperwork; it is the foundation of ownership and a reflection of your company’s credibility. Setting up a cap table correctly from the start—without needing to spend extra—ensures transparency among peers and signals professionalism to investors.

While spreadsheets can work temporarily, free digital solutions like Eqvista offer better scalability and reduced risk. For early-stage teams strapped for cash, these platforms are a cost-effective way to grow without losing track of who owns what.

By investing a little time upfront in building a clean cap table, founders save themselves countless headaches in the future. Equity disputes, investor confusion, and administrative chaos can all be avoided with one simple step: setting up your cap table properly—and doing so for free. Sign up for free today.