How to Stay Compliant with HMRC?

Small and medium-sized business owners must ensure they are paying their fair share of taxes under HMRC regulations. Revenue collected from the United Kingdom in fiscal year 2022/23 was almost 786.6 billion Pounds. Compared to the previous fiscal year, 2000-01, this increased nearly 464.8 billion pounds.

HMRC (Her Majesty’s Revenue & Customs) is the organization tasked with enforcing laws in the United Kingdom.

This article will provide an in-depth overview of the tips for small businesses to stay VAT compliant with HMRC and guide you through the common challenges and pitfalls.

HMRC and Compliances

HMRC compliance refers to the adherence and conformity to the tax and regulatory obligations set forth by HMRC. It is crucial in the UK to understand regulations to ensure they meet their tax obligations and avoid penalties, fines, or legal consequences.

HMRC compliance statistics are published annually in the Annual Report and Accounts. The following are some key statistics from the 2022 to 2023 report:

- Compliance yield: £13.1 billion, up from £7.4 billion the previous year. This includes cash collected, revenue loss prevented, and future revenue benefits.

- Compliance rate: 94.9%, up from 94.3% in the previous year. This is the percentage of tax that is expected to be collected.

- Investigations: opened 12,000 new investigations in the 2022 to 2023 year and closed 11,000 investigations.

- Prosecutions: secured 1,000 criminal convictions in the 2022 to 2023 year.

- Compliance checks: The number of compliance checks that HMRC carries out each year varies depending on several factors, such as the risk profile of the taxpayer and the type of tax being checked. From 2022 to 2023, HMRC carried out over 1 million compliance checks.

- Voluntary disclosures: A voluntary disclosure is when a taxpayer comes forward to disclose that they have not paid correctly. HMRC receives around 250,000 voluntary disclosures each year.

- Penalties: HMRC penalizes taxpayers who do not comply with their obligations. The amount of penalties imposed varies depending on the severity of the offense. In the 2022 to 2023, imposed £3.2 billion in penalties.

What Is HMRC Compliance?

HMRC compliance is the practice of abiding by the tax laws, rules, and regulations imposed. These regulations cover various financial operations, such as payroll, excise and customs fees, income and corporation tax, VAT, and more.

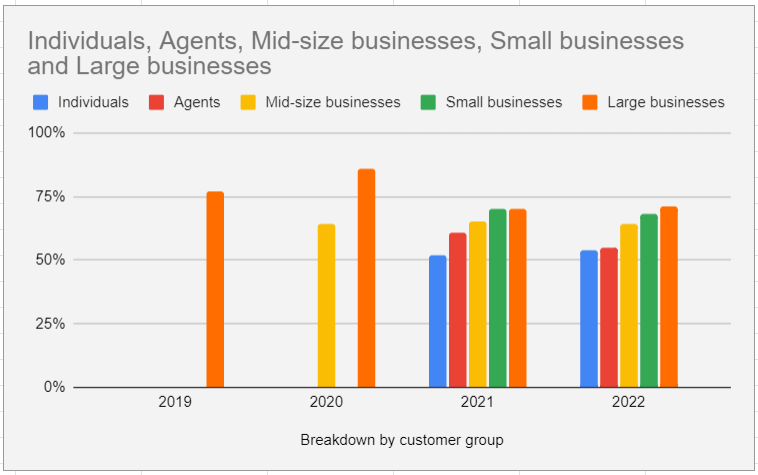

| Breakdown by customer group | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| Individuals | 52% | 54% | ||

| Agents | 61% | 55% | ||

| Mid-size businesses | 64% | 65% | 64% | |

| Small businesses | 70% | 68% | ||

| Large businesses | 77% | 86% | 70% | 71% |

Trust in HMRC

To stay on the right side of the law, you must file your returns on time and provide detailed accounts of your income, spending, and other financial dealings. It also necessitates maintaining accurate records and paperwork to back its monetary transactions.

Importance of HMRC Compliance

Your company can get a compliance notice at any moment. They’re on the lookout for problems to ensure that your company is paying its legal share of taxes. Ongoing compliance and checks are becoming more common, so you should always be ready for an audit!

The above graph illustrates the trust levels of small, mid-size, and large businesses, individuals, and agents in HMRC from 2019 to 2022.

But what happens if you’re not in compliance? The UK’s HMRC can impose fines and penalties on a firm even for a minor offense, such as filing a late return.

There are a few variables that will determine the total cost of fines and penalties:

- Revenue lost from taxes is the first consideration.

- The second consideration is how it was found .

HMRC Compliance: Common Challenges and Pitfalls

When it comes to taxation, Value Added Tax compliance, and keeping accurate records, both people and organizations confront several obstacles and pitfalls. These difficulties may lead to missed opportunities, legal problems, and financial repercussions.

Let’s learn more about these difficulties and possible risks.

Taxation Challenges

Staying on top of the constantly changing rules can be difficult and lead to costly mistakes and noncompliance. Finding legal and efficient planning methods, as failing to maximize tax methods, can result in higher bills. It’s important to claim all eligible deductions and credits to minimize your payment.

Self-employed individuals must separately calculate and budget the employee and employer shares of certain taxes, such as Social Security and Medicare.

VAT Compliance Issues

VAT compliance can be extremely demanding, especially for enterprises involved in international trade. Goods and services are subject to value-added tax or VAT. The current VAT registration limit is £85,000.

Invoices must have very particular information to conform with VAT regulations. Invoicing mistakes might cause problems with the rules.

Record-Keeping Challenges

Good personal and company financial management begins with accurate record-keeping of all financial transactions also required by law. This is especially important during audits. These documents serve as the basis of tax reporting and sound financial decision-making.

HMRC Legal Obligations and Requirements

HMRC presumes that all taxpayers are forthright in their dealings with the agency. It conducts random audits to ensure compliance with laws and to avoid tax evasion or the investigation of individual returns.

Tax Return Filing

To fulfill one’s legal responsibilities in this area, individuals and businesses alike must abide by the need to file returns. To do this, you must submit a tax return to HMRC detailing your financial dealings for the previous tax year.

Let’s take a look at the tax return submission procedure :

- Individuals: If you have self-employment, rental, dividend, or capital gains income, you must file a self-assessment return. Typically, the online filing date in the UK is January 31st, and the tax year runs from April 6th to April 5th. The deadline for paper returns is October 31st.

- Business: Incorporated businesses must file a Company Tax Return. It entails disclosing the company’s profits and spending. Sole proprietorships, partnerships, and other unincorporated business structures must be included in annual Self-assessment reports. Generally, a business must file its return 12 months after closing its accounting period.

VAT Registration

Businesses that fall under the VAT’s scope must register for the tax. In the UK, a firm must register for VAT if its taxable turnover (sales of VAT-liable products and services) surpasses the threshold, which is subject to yearly revision.

The steps necessary to register for VAT are as follows:

- HMRC Application: Businesses with a turnover over the threshold must apply for VAT registration with HMRC. You may complete this online by visiting the website.

- VAT Registration: Following registration, a company must collect VAT from customers on all products and services sold and may recover VAT paid on purchases. The company must file quarterly reports and send remaining funds on a monthly or quarterly basis.

- Compliance: A company that has obtained a VAT number has a legal obligation to issue invoices under the law, maintain accurate financial records, and file its VAT returns on time.

HMRC Legal Responsibilities

Legal requirements include following the several laws, rules, and guidelines that HMRC has established. Some examples of these duties are as follows:

- Maintaining precise accounting records to back up returns and accommodate HMRC audits.

- Ensuring complete and timely payment of such as income tax, VAT, and National Insurance contributions.

- Paying the right amount of tax based on one’s work, self-employment, rental, and investment income.

- Satisfying the requirements of registering for VAT or Self Assessment and filing proper returns by the due date.

- Protecting companies who deal in international trade by making sure they pay their customs and excise taxes.

Tips for Ensuring HMRC Compliance

Individuals and organizations must ensure HMRC compliance to fulfill tax responsibilities and prevent legal complications.

To help you reach and keep your compliance goals, consider the following:

- Maintain Accurate Records: Maintaining precise financial records is essential for becoming tax-compliant. Each monetary transaction might appear with a debit and a credit.

- Document Verification: Maintain thorough records of every financial transaction, including bank statements, expenditure reports, invoices, and receipts.

- Seek Professional Assistance : Professional accountants and tax preparers are important to the success of individuals and businesses in achieving and maintaining HMRC compliance. They are well-versed in the intricacies of policy and regulation.

- Stay Informed:In order to stay in compliance with the law, your company must be adaptable. Whether it’s modifications to VAT, pensions, or auto-enrollment, a good accounting system will ensure that you’re always compliant.

It is possible to avoid unintended noncompliance by keeping up with policy shifts, tax filing deadlines, and new incentives.

Consequences of Non-Compliance from HMRC

Penalties and Fines

HMRC may be forgiving if you quickly reported the inaccuracy to them after discovering it. It falls under the label of “unprompted disclosure”. HMRC may file criminal charges in appropriate instances.

- According to the penalty guidelines, inspectors can levy a fine of 10%-30% of the revenue lost.

- It’s entirely different if you find the problem while you fail to. This is an enforced disclosure with a potential penalty of at least 30%.

- If HMRC has reason to suspect the mistakes were intentional, the consequences might be dire. A penalty of 30–100% of lost income may result from such errors.

Legal Actions

As it places a greater emphasis on compliance and works to make those who don’t follow the laws accountable. It may bring criminal charges, which include a potential sentence of fines, jail time, or both, in circumstances of significant tax evasion or fraud. Realizing that noncompliance might have severe repercussions on one’s financial security and legal status is crucial.

Get professional help for HMRC compliance from Eqvista!

One of the hardest parts of running a business is keeping up with all the paperwork. However, maintaining compliance with HMRC regulations is crucial for any organization hoping to succeed. To ensure you have the information you need on hand, make sure you set aside time to keep up with your taxes and maintain accurate records.

Eqvista can help you with all of the HMRC valuation requirements and guarantee that the report you provide is accurate and precise. Eqvista offers a team of professional valuation specialists with valued forms of varying sizes and phases. One expert analyst oversees every part of the appraisal, such as gathering information, updating you on changes, and answering your questions. In addition, you will receive an audit-ready, fast, and accurate HMRC valuation report. For a share or business valuation that complies with HMRC, get in touch with us straight away.