Short Term Incentive Plan or STIP

Short term incentive plans can be complicated for those who are new to them, but serve as an important incentive for employees in a company.

Offering annual, quarterly, or in some cases, even monthly short term incentives to a company’s employees could be a great way to drive retention and engagement if done the right way. As companies set ambitious annual goals and seek to align individual efforts with broader strategic priorities, compensation strategies have evolved to keep pace. Among the various tools available, one approach stands out for its ability to link rewards directly to short-term achievements and organizational success.

Rather than relying solely on fixed salaries or long-term incentives, many firms have adopted programs that reward employees. Often structured to reflect company-wide and individual contributions, these programs have become a cornerstone of modern performance management and talent retention strategies.

What is Short Term Incentive Plan (STIP)?

A Short Term Incentive Plan (STIP) is a structured, performance-based compensation program designed to reward employees, often key staff or executives, for achieving specific short-term business objectives, typically over one year or less. STIPs are commonly known as annual bonus programs, but this can also be paid quarterly or monthly, depending on the company’s structure.

Key Features of STIP

- Performance Period: Usually one year or less, aligning with the company’s fiscal or calendar year.

- Purpose: To motivate employees to meet or exceed short-term business goals, align employee actions with company strategy, and drive profitability and growth.

- Eligibility: While originally focused on executives and key employees, many companies now extend STIPs to a broader range of staff as part of talent retention and attraction strategies.

- Payout Structure: Most STIPs pay out in cash, though some may include stock or other forms of compensation.

- Performance Metrics: Can be financial (e.g., profit, revenue growth, return on capital) or non-financial (e.g., quality, safety, innovation), and are often weighted based on their importance to the company strategy.

- Award Calculation: The actual bonus is typically a percentage of base salary, with a target award and a range (e.g., 0–1.5 times the target), depending on performance against set objectives

What are the Advantages of Short Term Incentive Plans?

- Straightforward: Short term incentive plans are incredibly useful as they offer employees a straightforward way to achieve and set their goals (often within a year). They are a significantly better option than other incentive strategies that take multiple years to complete.

- Easy to measure: What’s more, measuring the performance of employees and executives is remarkably simpler during shorter periods.

- Higher employee retention: In addition, there is also a high likelihood that most employees will remain in their current positions within a year. When it comes to long term incentives an employee’s position could change multiple times while the incentive is operational.

- STIP can link to profits: Companies can attach their employee’s compensations with profits. These plans often tie payouts to company performance, aligning employee rewards with organizational success.

- Allows to focus on specific results: STIPs are structured around clear, measurable objectives, which help focus employee efforts on key business priorities.

That being said, as with almost every type of reward programs, organizations should ensure their short term incentive plans blend intrinsic and extrinsic motivators to get the most out of their employee’s efforts. Of course, bonuses and cash awards can improve performances, but solely relying on them would not be a wise choice. Why? Because in most cases, they may not be sufficient for sustaining engagement in the long run.

Types of Short Term Incentive Plan or STIP

Short Term Incentive Plans (STIPs) come in several common structures, each designed to motivate employees and align their efforts with organizational goals over one year or less. The market’s most widely observed STIP structures include the Balanced Scorecard, Profit Sharing Program, and Discretionary Bonus Program. Many organizations also use hybrid approaches that combine features of these models. Each STIP type offers unique benefits, motivating employees to achieve their company’s business goals in shorter periods.

| Stip Type | Basis For Payout | Typical Metrics Used | Key Benefit |

|---|---|---|---|

| Balanced Scorecard | Weighted score of multiple objectives | Financial, operational, individual | Aligns with strategy, holistic view |

| Profit sharing program | Company Profitability | Financial results | Fosters Ownership,team focus |

| Discretionary Bonus | Management discretion | Qualitative/overall performance | Flexibility, recognizes exceptions |

Balanced Scorecard

A balanced scorecard evaluates employee performance based on pre-determined metrics reflecting key business success indicators, such as financial, operational, and individual objectives. Many organizations use performance management tools to track and analyze these metrics effectively. Each metric is assigned a specific weight according to its importance. The balanced scorecard typically measures performance across four perspectives:

- Financial

- Customer/Stakeholder

- Internal Process

- Organizational Capacity (Learning and growth)

Profit Sharing Program

Profit-sharing programs distribute a portion of the company’s profits to employees, typically as a cash bonus. The payout depends on overall company profitability, with the total bonus pool determined by financial results. Individual payouts may be equal or based on salary or position. This directly links employee rewards to the financial success of the organization, fostering a sense of ownership and shared purpose.

Discretionary Bonus Program

Discretionary bonus programs provide management with the flexibility to award bonuses on overall performance. Management determines the size and recipients of bonuses, often using subjective criteria or overall company performance as a guide.

This structure allows organizations to recognize exceptional contributions or adapt to changing business conditions, though it may lack the transparency and predictability of more formulaic plans.

Performance Based Short Term Incentive Plan

A Performance-Based Short-Term Incentive Plan (STIP) is a compensation strategy to reward employees for achieving specific, measurable performance goals over one year or less. These plans are widely used to align employee efforts with immediate business objectives and to drive results that matter most to the organization.

Example Structure of Performance-based STIP

| Performance Metric | Weighting | Threshold | Target | Stretch | Actual Performance | Payout % of Target |

|---|---|---|---|---|---|---|

| Profit Margin Improvement | 50% | 85% | 95% | 110% | 100% | 107% |

| Revenue Growth | 25% | 70% | 80% | 90% | 85% | 110% |

| Process Efficiency | 25% | 80% | 90% | 100% | 90% | 100% |

| Final Payout | 106% | |||||

For instance, if a company rewards groups according to customer satisfaction, it would be fair to assume that the customer service team had a direct impact for reaching that goal. Therefore, companies should measure teams according to their exact roles and contributions.

If everyone from the team fails to meet their objectives, it could give rise to a toxic atmosphere within the company because of employee resentment. On the other hand, if everyone reaches their targets, it could significantly boost the organization’s morale, but tough on the company’s budget.

All performance-based STIPs are STIPs, but not all STIPs are performance-based. Some STIPs may rely on discretionary or profit-sharing models that are not strictly tied to individual or team performance metrics. Performance-based STIPs are a subset of STIPs, focused specifically on rewarding measurable achievements.

Benefits of Performance-Based STIP

Key benefits of performance-based STIP are:

- Ensures that individual and team efforts are directed toward the organization’s most critical short-term objectives.

- Provides timely motivation for employees to achieve key business outcomes within a set period.

- Employees have a clear line of sight to the metrics that determine their rewards, fostering ownership and responsibility.

- Helps attract, retain, and motivate talent by offering rewards for measurable contributions to success

Performance-based STIPs are structured bonus plans that reward employees for meeting or exceeding short-term, clearly defined goals. When designed with the right metrics and transparency, they are powerful tools for driving business results and employee engagement.

Short Term Incentive Plan on Eqvista

You can create and implement short term incentive plans on the Eqvista app, and manage all of your STIP plans for your shareholders on one platform. After setting up these vesting plans, you can even apply them to many shareholders at one time.

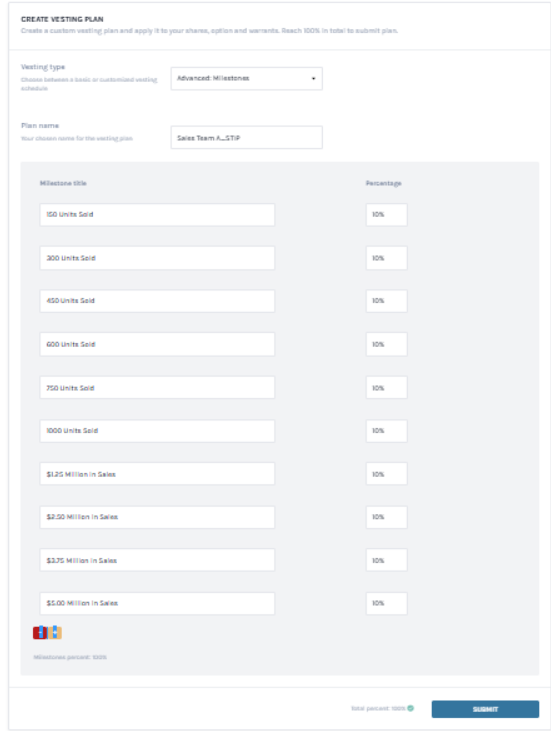

Here is how to set up an LTIP plan on the Eqvista App:

From the dashboard go to “Cap Table” on the sidebar, and click on “Vesting and Plans”. From this page click on the button “Create Vesting Plan” which will bring you to the following page:

In this example, Let’s say the company sets up a 1 year Stock Appreciation Rights (SAR) plan, which the employee will gain the difference between the initial share price and ending share price of the STIP plan. They receive 10,000 SARs on a 1 year plan, with 70% individual based milestones and 30% company based(Sales Team) milestones. Here this scenario was set up accordingly in the vesting schedule.

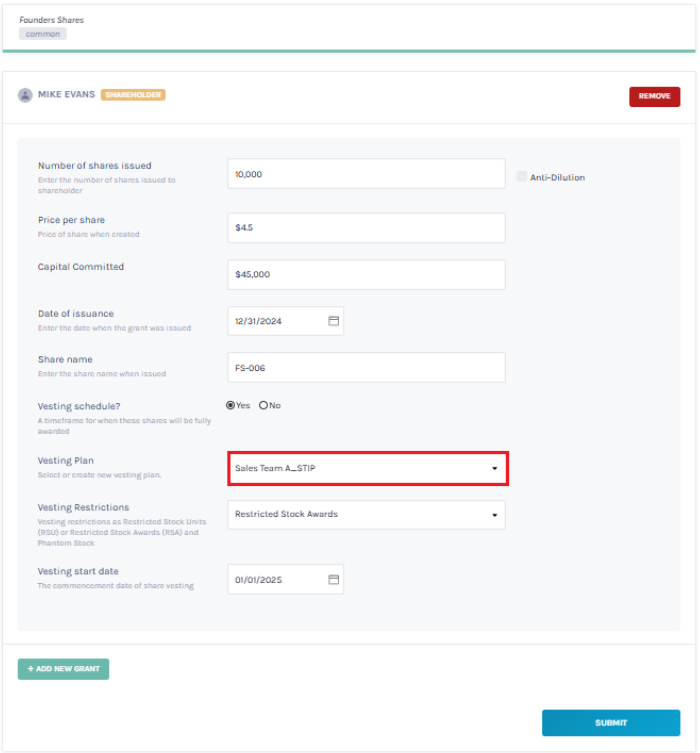

After setting up the STIP, you can apply these to different grants.

Here we can see this plan can be applied to different grants under the share class “Founder Shares”. Once this is complete, the vesting plan will be applied and the share will start vesting according to the start date.

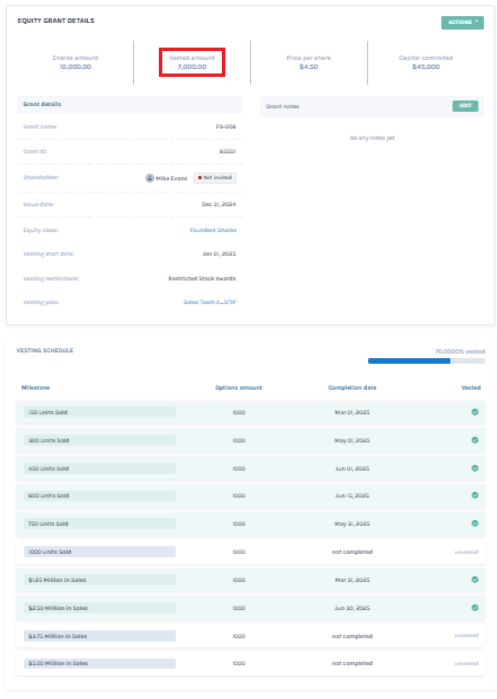

Once in the share grant page, you can see how each STIP milestone will be shown, and how many shares have vested. In this case most of the milestones were completed according to the completion dates inputted, with 7000 shares of the 10,000 shares vested.

Let’s say the employee Mike Evans plans to exercise his SARs, with the difference of the company’s share price over the 1 year being $1.25. In this case, Mike would receive $10,312.50 for his hard work completed over the year. This resulted in a nice bonus and great incentive for him, as well as the desired results of higher profitability of increased sales for the company.

Simplify Your STIP with Eqvista

STIPs are powerful tools for motivating employees, aligning their efforts with organizational goals, and driving measurable. Whether structured as performance-based, profit-sharing, or discretionary bonus programs, STIPs can be tailored to fit your company’s needs and culture.

To ensure your incentive plans are effective and compliant, it’s essential to have accurate, up-to-date equity and compensation data. Eqvista offers comprehensive solutions for managing equity, tracking performance metrics, and streamlining your STIP. Ready to elevate your compensation strategy? Contact us Today! Eqvista can help you design and manage your STIP today.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!