Key Differences Between Regular and Advisory Shares

With the diversification of the marketplace, there are a wide variety of options available to investors. Corporations are constantly under pressure to develop new and innovative ways to fund their operations in this competitive environment. As such, companies may be required to issue multiple classes of equities in order to facilitate their operations. In this regard, regular and advisory shares are two such classes of equities.

Regular shares are common shares that may be traded on a stock exchange. While advisory shares are typically options with a vesting period, wherein the holder provides strategies, advice, and recommendations to the company. In this article, we will compare these two in order to gain a better understanding of their differences and similarities.

Regular shares and advisor shares

Basically, regular shares represent common stock in a company’s capital structure. This may refer to one share of equity that is typically available for sale to the public on a stock exchange. While in private companies, regular shares may be given to founders, executives, and other employees of the firm.

In contrast, advisory shares are stock options that are granted to the company advisors and consultants. They typically vest within a period of time, and in return, the holder gives the company advice that is used in formulating business strategies. Therefore, these shares differ in nature, rights, conditions, and other features.

What are regular shares?

Regular shares are essentially equity or ownership in a business. This is often the most traded form of equity on the market and the standard for other equity classes. In privately held companies, a number of shares are given to the firm’s founders, management, and other employees. Typically, regular shares come with voting rights, which give their holder the power to elect the board of directors. In publicly traded companies, regular shares are listed on a stock exchange.

What are advisory shares?

Advisory shares are a type of equity class that a corporation uses as a payoff for specialized consultants. These consultants are normally experts in a particular field who provide the company with expert advice, strategies, and recommendations. They are stock options with a vesting period and are used to incentivize and compensate the holder. These options vest upon the completion of a predetermined period of service. In exchange for these options, the holders agree to provide their expert advice and services to the firm during this time period.

How to determine a regular share’s price?

The fair market value of regular shares in public companies is determined by the market forces of supply and demand. However, share prices are influenced by news, events, market trends, and fluctuations. This may include the release of a quarterly earnings report and major announcements such as mergers and acquisitions. In addition, the price of the shares is also influenced by the economy’s overall state, the company’s operations, and its reputation.

In private companies, 409A valuation is conducted in order to determine the fair market value of these shares. The 409A valuation is required by the IRS as additional protection against fraud and other falsified valuations. Certain assumptions, projections, and mathematical models are used in the 409A valuation method. Thus, this provides a more accurate estimation of the fair market value of the private company.

How to determine an advisor’s share price?

Usually, startups issue advisory shares as a payoff for expert advice due to the fact that in the early days of development, startups require specialized expertise, as well as assistance in planning and managing their operations. In this regard, advisory shares (stock options) are issued instead of cash. Stock options are priced on the basis of the strike price or exercise price.

In other words, the strike price refers to the price at which the stock option can be bought or sold. The strike price is usually derived on the basis of the fair market value of the common share. Additionally, options pricing models such as the Black-Scholes-Merton (BSM) model can be used. This model can be used in order to determine the fair market value of an advisor’s share.

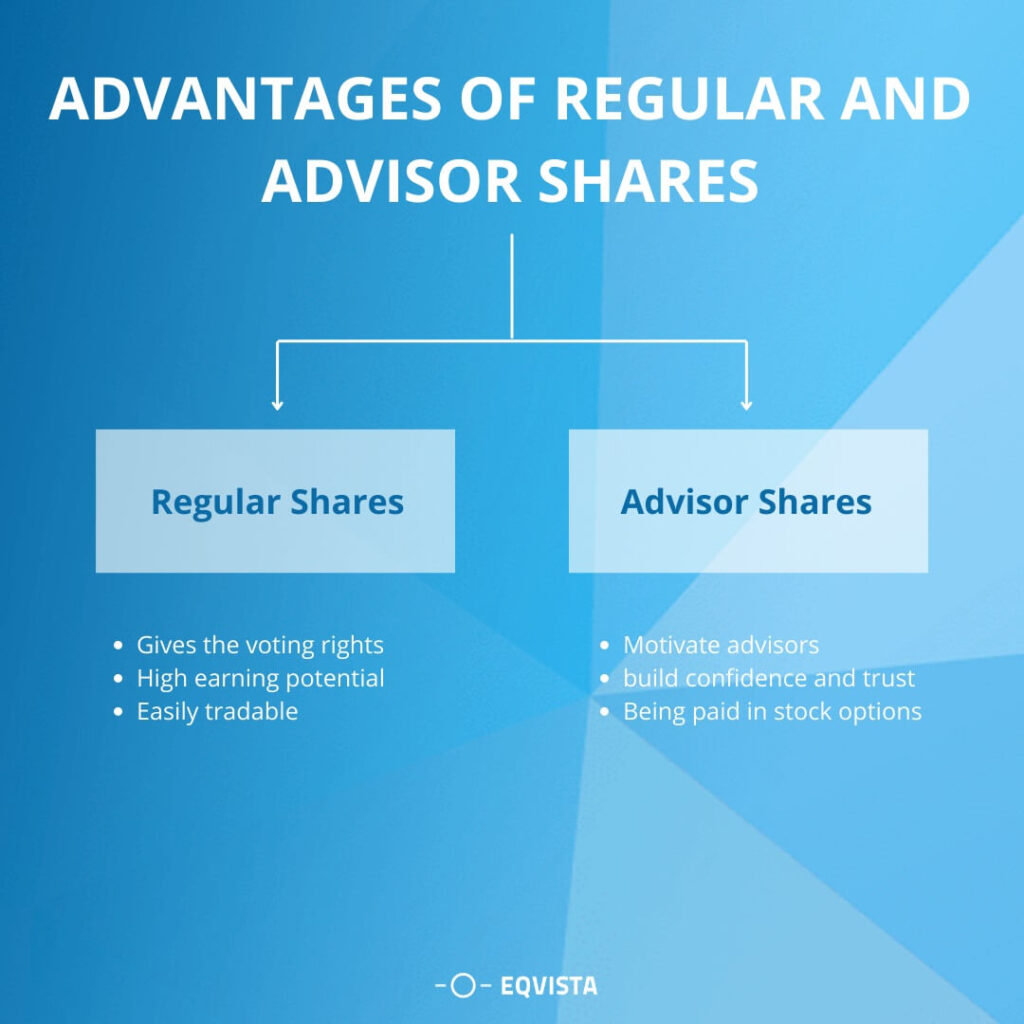

Advantages of regular and advisor shares

Regular, and advisor shares are two different types of equities that have a number of advantages. These include the following:

Advantages of regular shares

- Regular shares give the holder voting rights, allowing them to participate in major decisions, such as electing the board of directors. As a result, this gives them a sense of control over the direction of their firm.

- Regular shares offer high earning potential to the holder in a way that is more consistent and predictable. This may include the sale of shares on a stock exchange and/or the receipt of dividend payments from the company.

- This form of equity is typically easily tradable. In addition, it is relatively liquid, as there are several ways for an investor to trade their share, such as selling or transferring them to other investors.

Advantages of advisor shares

- Instead of paying advisors in the form of cash, startups can offer them stock options. This method helps increase the motivation of advisors to work harder for their firm. It also gives them a vested interest in the company.

- Building the confidence and trust of the advisor is important. In order to build this trust, advisors are given stock options; this helps in building a strong working relationship with the company’s management and founders.

- Being paid in stock options rather than cash also makes it easier to attract quality advisors, as well as retain good ones. As a result, advisor shares help attract the best talent to become part of the startup’s team.

Example of advisor shares

Now that you know what advisor shares are and how they work, you may be wondering how they can be applied to startups. Stock options are used in lieu of cash for certain services such as legal, accounting, and financial consulting services. Let us look at an advisor share example; when an advisor is hired for a startup, a part of the agreement, the advisor is supposed to provide insight at monthly meetings.

So how does this work? Well, this is where the advisor share comes into play. The advisor is granted stock options with a vesting period that is typically longer because the company wants to ensure that the advisor has a vested interest in the company. While assuming that the advisors are issued with 0.25% of the company’s equity. This mechanism allows the founders to motivate and incentivize their advisors while maintaining close ties with them.

Example of regular shares

Regular shares are best suited for companies that are fully established and mature. To better understand the implications of this, let us take a look at the regular share example. Suppose that the stock of Apple is trading at $150, and an investor or trader purchases 100 shares. This means that this individual owns a small chunk of Apple’s equity. As a matter of fact, these shares are considered a part of the overall equity structure of the company. Therefore, when the company profits, equity holders gain a percentage of these profits. In this regard, it is evident that the value of a company’s financial success is directly correlated to this form of equity.

Difference between regular and advisor shares

| Parameters of Comparison | Regular Shares | Advisory Shares |

|---|---|---|

| Vesting schedule | Typically, there is no vesting schedule for regular shares because these are not linked to any services. As a result, the holder can sell their shares immediately. | Since advisors are hired for some specialized tasks, they will be given stock options with a vesting schedule. It is important to note that the longer the vesting schedule, the more likely that the advisor will have a vested interest in the company. |

| Shareholders' rights | Regular shares carry voting rights. In addition, they are subject to disclosure of financial information. | The holder of advisor shares can provide guidance, opinions, and feedback to a company. In addition, these can be used to vote on key decisions such as business strategy, executive appointments, and compensation levels. They also have voting rights. |

| Eligibility | Anyone who is over the age of 18 years, has a clean criminal record, is solvent and reliable can purchase regular shares. It is also important to note that the holder of these shares does not have to be an employee or manager of the company. | In order to qualify, the advisor should be an expert in their field, have relevant experience, and present a good reputation. In addition, they should have an interest in the company's growth and development. |

| Acquisition | Regular shares can be acquired by simply purchasing the stock on the stock exchange. It is important to consider that the price of regular shares changes from time to time. As a result, you should always be cautious when purchasing stock because there are several factors that determine its value. | Advisor shares are typically not publicly traded. Instead, they are given to the advisors on a case-by-case basis. As a result, there is no minimum or a maximum number of shares that can be given to an advisor. |

| Issued by | The companies that are matured and established usually issue regular shares. It is important to note that a public company usually issues its shares through an Initial Public Offering (IPO), while private companies issue regular shares through equity-based compensation. | Startups often choose not to issue regular shares because these are commonly associated with a large financial risk, dilution, and a lack of liquidity. In this regard, startups tend to issue stock options to advisors as part of their compensation strategy. |

| Issued to | Regular shares can be freely traded by anyone. Many investors and traders make money by buying and selling stocks on a daily basis. As such, it is important to understand the risks and rewards of owning stocks. | Senior executives, industry experts, and board members are usually the ones who are given advisor shares. They can best advise the company by providing their insight and guidance on a regular basis. |

Are there any similarities between advisor and regular shares?

Yes! There are some similarities between advisors and regular shares. Adequately, both types of shares can have the same value, which is determined by the market. In addition, they both have significant importance to the overall value of the company. Therefore, the decision to give one of the two types of shares depends on various factors, including the nature of the business, the status of the company, and many other factors.

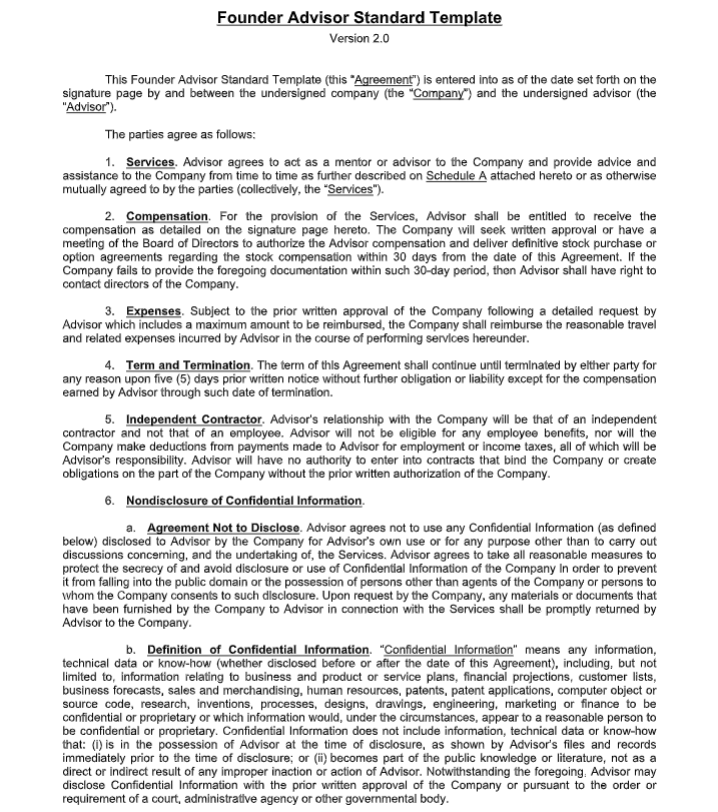

Advisor Share Agreement

Well, an advisor share agreement is a legal document that outlines the terms and conditions under which services are to be rendered and the payment due in exchange for such services. In other words, the terms defining the relation between the advisor and a business are laid out in an advisor share agreement. This agreement shows a clear picture of the services that have been agreed upon, what incentives are to be given in return for the same, and how the payments are to be made. Furthermore, the agreement can be modified to include clauses such as stock vesting conditions, compliance, termination, amendments, and other details.

What are the key terms included?

A formal advisor share agreement should outline the following basic terms:

- The area of expertise of the advisor – The first step in drafting an advisor share agreement is to identify the subject matter on which the advisor shall provide services on. Therefore, it is important to precisely define the job scope for which you are hiring the advisor. This will help you establish a clear expectation of the services that will be provided by an advisor and thus, save both parties from any future misunderstandings.

- Services to be offered – Once the advisor has been hired, the next step is to define the overall scope of services that they will be offering to the company. This includes determining the exact nature of services that are to be rendered, as well as the frequency and duration of these services. For example, if it is a long-term relationship, then this agreement can prescribe an agreement on how often these services will be rendered in future.

- Duration of the agreement – In the world of business, it is necessary to clearly define the time period during which an advisor will be providing services to the company. Basically, the agreement should incorporate the expected time duration for which the services will be rendered. This can be in the form of a fixed agreement or an agreement which is dependent on certain milestones achieved by the company.

- Equity compensation-related details – The last thing that you need to include in your advisor share agreement framework is the compensation details. Typically, the number of shares to be granted, the price at which the shares can be acquired, and the vesting conditions are all included in this section. Thus, all the equity-related details should be clearly laid out in this section.

Example of an advisor share agreement

The usual advisor share agreement that is used is the FAST agreement. Below is a sample of a FAST agreement that you can refer to. You can check out the full template here.

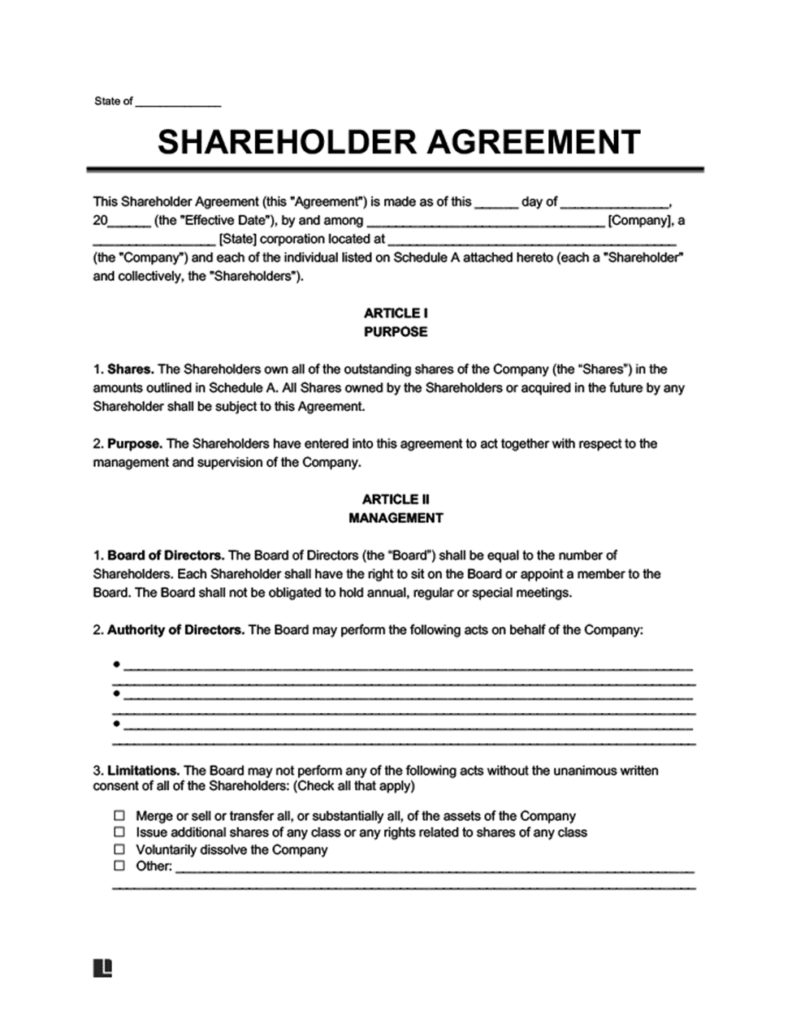

Regular Share Agreement

As the name implies, a regular share agreement is a formal and legal agreement between the company and the investor. It outlines all the terms and conditions upon which the investor is acquiring the shares of the company. In addition, it includes details such as the rights of both parties, liabilities and restrictions that are to be followed by both parties while they are servicing their obligations under this agreement. It serves as the basis of the relationship between the investor and the company which helps to protect the interest of both parties. As a result, regular share agreement plays a vital role in defining the relationship between the company and its investors.

What are the key terms included?

A regular share agreement is generally a simple document. However, it is important to include certain provisions in it so that it can be legally binding. These provisions serve as the legal basis for all agreements and obligations between the company and its investors. Here are some of the commonly-included terms in a regular share agreement:

- Basic details of the company and the shareholder – Firstly, the name of the company along with its address should be clearly mentioned in this section. In addition, the name of the shareholder should also be highlighted.

- Dividends – Secondly, it is very important to include the terms and conditions upon which the shareholder is entitled to receive dividends in this section. In this regard, the exact frequency of the dividend payment can be clearly prescribed.

- Limitations on parties and default events – Another important provision that should be included in a regular share agreement is the limitations of obligations, as well as the events which can lead to its termination.

- Procedures for resolving disputes – In the event of any disputes between the two parties, it is important to include the procedures involved in resolving these issues. For example, if a dispute arises over the payment of dividends, a provision should be included which specifies the manner in which this issue can be resolved.

- Rights and restrictions on share transfers – The last legal provision that needs to be included in a regular share agreement is the details of the rights and restrictions on the transfer of shares. In other words, it defines any restrictions on selling, trading, or transferring all or part of the shareholding.

Example of a regular share agreement

The image below shows the sample format of a regular share agreement:

Choose Eqvista to manage your shareholder’s data efficiently!

It is important for corporations to choose the correct form of equity in order to ensure the success of their business. As such, it is necessary to thoroughly examine the pros and cons of both forms to find the best option. Are you looking for an expert to help you manage the shareholder’s data? Eqvista is here to support you! With Eqvista, you will be able to monitor the shareholders of your company in an efficient and transparent manner. Contact us for more information.

FAQ

1. How do advisory shares differ from regular shares?

Unlike advisory shares, which are not publicly traded, regular shares may be bought and sold on the stock exchange. Advisor stock options, on the other hand, are stock grants made to experts in return for their strategic knowledge on how to best run a company. Common stock options granted to advisors are always NSOs, which is a significant distinction. Nonqualified stock options (NSOs) are not limited to being awarded to workers like incentive stock options (ISOs).

2. How are advisor shares diluted?

Advisor shares are dilutive in the same way that other stock types are. Existing shareholders’ ownership in a corporation is eroded if new shares are issued. Dilution happens if additional shares are issued without a corresponding increase in the holders’ voting power. It follows significant events like a capital raising or the establishment of an employee stock option pool. When a company issues or reserves new shares, current shareholders’ ownership proportion drops.

3. What does 5% advisor shares mean?

When a firm is still in its infancy, it may choose to reward its advisory board members with a portion of the company’s stock. There is a possibility that advisers might get a maximum of 5% of the entire shares in the firm. Advisor equity grants are quite variable. The decision to award advisory shares to a consultant depends on the consultant’s experience and status. The advisor’s and the business’s expectations for the duration of their relationship might also have a role.

4. Why are advisory shares different from equity?

In a company’s capital structure, common stock is represented by equity. Founders, top management, and other staff in private corporations may get equity as compensation. Advisory shares, on the other hand, are stock options awarded to advisers and consultants of a corporation. They usually vest over time in exchange for the holder’s input into the company’s strategic planning process. Therefore, the characteristics, privileges, and conditions of each of these shares are unique.

5. Do advisory shares expire?

A conventional employee stock option has a vesting schedule of four years or more, whereas an NSO awarded to an adviser may have a vesting schedule of just one to two years, with no cliff or a cliff of only a few months. This is due to the fact that the majority of an advisor’s contributions to a business occur early on. Advisors may also be permitted to sell their shares of stock at any time before or after the expiry date specified in the agreement.

6. How do advisory shares affect valuation?

The insight of a business adviser will eventually result in business practices and tactics that will ultimately raise the value of a company and increase the likelihood of the firm’s long-term success. However, there is no hard and fast rule against bringing in advisers and issuing advice shares, even at a later stage of development, by any company.

7. How much equity should you give an advisor?

The amount of ownership that is often offered to longer-term advisors by startups is 1%. These advisors typically put in less than two days of labor per month and are exclusively compensated in the form of equity. When evaluating the equity remuneration that general advisers are entitled to, this is a smart place to begin. However, the number of shares of stock that startups distribute to advisers varies depending on the experience, function, and stage of the firm that the advisor is involved in.