ISO or Incentive Stock Option Taxation

When an employee exercises an ISO, they purchase the stock for a set rate, which could be lower than the actual market value.

Retaining and attracting employees, especially those with years of valuable experience and a high level of skills can be quite difficult. It can become challenging due to the competition most companies face. Startup companies especially have trouble with this issue, but luckily, there’s an effective solution called Incentive Stock Options.

Unlike other alternative modes of employee compensation, incentive stock options can qualify for special tax treatments by the federal government. You won’t need to pay taxes for buying or exercising ISOs. In addition, if you fulfill some essential requirements, you may qualify for paying lower tax rates.

Are you new to ISOs and incentive stock options taxation? If yes, this piece will discuss everything you need to know about them.

Incentive Stock Options or ISO

You may come across several online resources explaining incentive stock options. However, a lot of them are full of technical details, which may be hard to understand for beginners. Mentioned below is a simple, easy to understand breakdown of what incentive stock options are.

What is an Incentive Stock Option or ISO?

Also referred to as qualified stock options, companies offer incentive stock options to high-level employees in their compensation packages. Organizations can only give incentive stock options to its employees, and there are certain limits regarding the amount they can offer.

If you are an employee at a company that offers stock options, it essentially means that it is giving you the chance to purchase its stock shares at a set rate within a specific period. In order to get the stock’s shares in a stock option, you still have to buy the stock.

As an employee’s ISOs become available or vests, they can exercise or purchase a particular amount of shares at the exercise price. It would be best to wait instead of exercising your options right away. Why? Because the market price can go higher than the exercise price if you are patient enough. However, do not make the mistake of waiting for too long as your stock options could expire, leaving them worthless.

Advantages of Incentive Stock Option

Similar to non-qualified stock options, ISOs offer holders the opportunity to buy shares of stock at a lower price. For instance, your company provides you the option to buy 2,000 shares for an exercise price of $10 per share. However, the current market value of these shares is $20, which means you can purchase stock that is worth $40,000 for half the price.

Unlike RSUs or NSOs however, the main advantage of these is the incentive stock options tax treatment. Non-qualified stock options are considered as wages. Therefore, FICA and income taxes remain withheld when someone exercises their options. However, things are quite different with incentive stock options. Why? Because ISOs get preferential tax treatment, but are subject to a few rules.

ISO 100K Rule

The ISO 100K rule, which some people also refer to as the $100k limit, is a tried and tested way to hold employees back from treating exercisable options higher than $100K as ISOs in a single year. As opposed to NSOs, incentive stock options do qualify for preferential tax treatment. The ISO limit of $100K is an effort to steer clear from tax benefit abuse.

The IRS treats anything greater than $100k stock options worth as non-qualified stock options. To make sure you are complying with the ISO 100K rule, consider dividing option grants going over the $100k threshold into NSO and ISO portions. Companies often use the term “NSO/ISO split” when referring to this division.

Following the ISO 100K rule would be in every company’s best interest as it could impact the amount of taxes your organization has to withhold. The main reason for this is the different taxation methods used for incentive and non-qualified stock options. In addition, your organization can withstand tax deductions when its workers exercise non-qualified stock options. However, that is not the case with ISOs.

How Incentive Stock Option Works

Incentive stock options work in a relatively straightforward manner. All you need to know is that you can exercise your options as soon as they vest. This essentially means that you can purchase your company stock’s shares. Your options will not be of any value until you exercise them. So make sure you choose the right time for utilizing your ISOs, as not doing so could make the wait worthless.

You can find your options’ price inside your option contract. It would be best to go through it while signing the contract to steer clear from confusion. People often use the term “grant price” when referring to this price. Many employees consider stock options the best compensation alternative because the prices remain the same despite the company’s performance.

For instance, you spent 4 years in your company and you possess 20,000 stock options for an exercise price of $1. After exercising, you will own the entire stock and can sell it whenever you please. Some people often choose to hold it, hoping that stock prices will increase down the line.

Remember, ISOs come with an expiration date, which is present in your contract. Make sure you are aware of your particular option’s date, ensuring you can exercise it accordingly.

Incentive Stock Option or ISO Taxation

Incentive stock option taxation may seem a bit complicated to first timers. People especially have a difficult time determining the right time for exercising their incentive stock option, and that is precisely what we will discuss below.

When Can I Exercise ISO?

Contrary to popular belief, there is no particular time set for exercising your incentive stock options. Instead, you have to consider several factors to choose a time that would benefit you the most. First off, wait until your company goes public. Your shares could lose their worth or become completely worthless if you do not wait for your company to go public.

When your company receives its IPO consider exercising your ISOs only when the stock’s market price goes higher than the exercise price. That said, if the prices are increasing, waiting a bit more could prove to be more beneficial later on. There is no turning back once you exercise your shares. Therefore, waiting a few extra weeks may be a good idea and yield more profits.

If every indicator you see points towards an increasing stock price, exercising your options right away would be a wise choice, especially if you can hold the shares for a year minimum. This will ensure that you don’t have to pay an excessive amount of capital gains tax.

Taxation & Reporting of Qualifying Dispositions of Incentive Stock Options

The favorable tax treatments in incentive stock options make them a valuable form of compensation for most employees, and it is only because of something known as “qualifying disposition”. This occurs when someone waits before selling the shares they obtained at least a year after exercising their incentive stock options and two years after the company granted them.

Let’s say that an employee, Bill, was granted 5,000 options in a company on January 1st, 2017, with a strike price of $2. Now in June 2019, he decides to exercise his ISOs into shares for $10,000, and hold onto them. Once the stock price reaches $5 in October 2020, he decides to sell them for $25,000. Let’s see how this looks in a table:

| Detail | Price |

|---|---|

| Grant of 5,000 Options | $0 |

| Exercise of 5,000 Options | ($10,000) |

| Sale of 5,000 shares | $25,000 |

| Total Taxable Gain | $15,000 |

| Tax rate of 15% | ($2,250) |

| Total gain after taxes | $12,750 |

As the incentive stock options tax treatment is different for qualifying dispositions, Bill can enjoy long term tax rates on his gain from selling the shares, as the shares were sold one year after exercise, and two years after the original grant date.

Now let’s look at a disposition of shares that don’t meet this criteria.

Taxation & Reporting of Disqualifying Dispositions of Incentive Stock Options

Anyone who does not fulfill the requirements for qualified disposition or waiting period may encounter a disqualifying disposition, losing their tax advantage as a result. Once a disqualifying disposition triggers, the difference between the fair market value on exercise price and exercise date comes in the form of a tax for regular income (bargain element).

Let’s take the same example for Bill, but let’s say he sells his 5,000 shares in December 2019 when the stock price was at $4. In this case the fair market value of the shares on June 1st, 2019, was $3.

Here is how the disqualifying disposition would look like:

| Detail | Price |

|---|---|

| Grant of 5,000 Options | $0 |

| Exercise of 5,000 Options | ($10,000) |

| Sale of 5,000 shares | $20,000 |

| Total Taxable Gain | $10,000 |

| Bargain element | $5,000 |

| Income Tax (25%) | ($1,250) |

| Income tax on short term gains | ($1,250) |

| Total gain after taxes | $7,500 |

As far as capital gain goes, the price you pay will mostly depend on two things, whether the capital gain is for the short-term or long-term. If you hold it for a year, you may be entitled to favorable gain rates for the long run. However, if your capital gains will be short term if less than one year passes prior to the sale.

Interested to issue ISOs in your Company?

Incentive stock options can benefit the organization that provides it and the employees, as long as they know how to use it correctly. The information covered in this piece covers the fundamentals of incentive stock options taxation and how ISOs work, ensuring employers and employees can make the most of it. And with issuing your company’s ISOs, its essential to have a platform to track all the details.

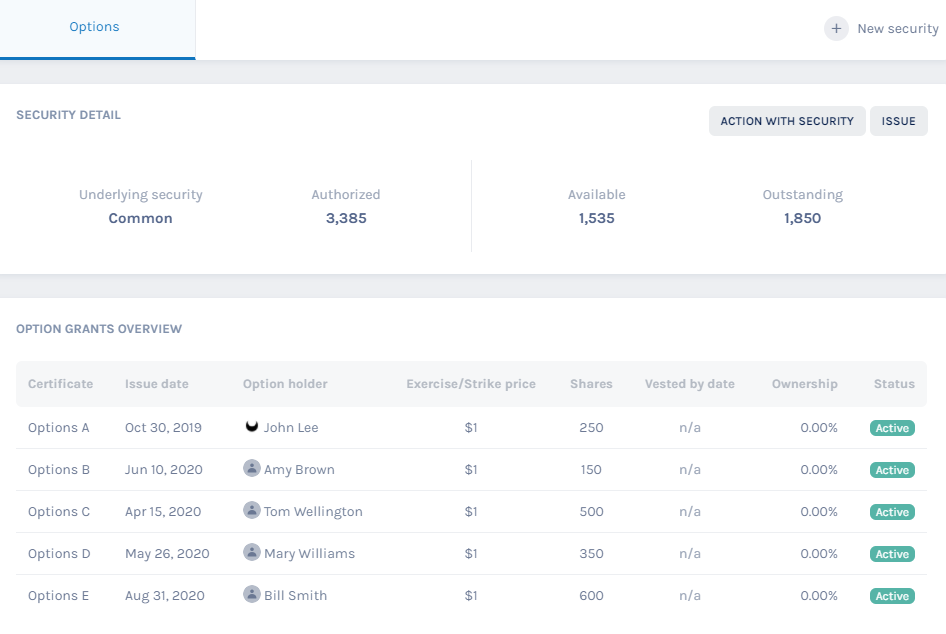

Eqvista is one such sophisticated software that can handle the options grants in your company. You can issue, exercise, repurchase options all from the Eqvista platform, and share the details with your employees. Here are some other important features of Eqvista. To know more about the Eqvista reach us today!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!